Recently, I met with two prospective clients who shared the same reason for looking for a new wealth manager. Both had received calls from their existing brokerage house advisors explaining that they were leaving their firms and were calling in hopes the clients would follow them to their new employer. One explained that this was the third time he had received such a call from his broker and that he had grown fed up with the process and the associated pains of moving. The other explained that he had stayed with his brokerage firm but had transitioned through three different broker teams as he was hesitant to leave a branded industry name. He was not willing to be shuffled to a fourth team this time around.

When Your Broker Calls

As long as Wall Street has an insatiable appetite for growth, lucrative deals will continue to entice advisors to port their clients to new firms.

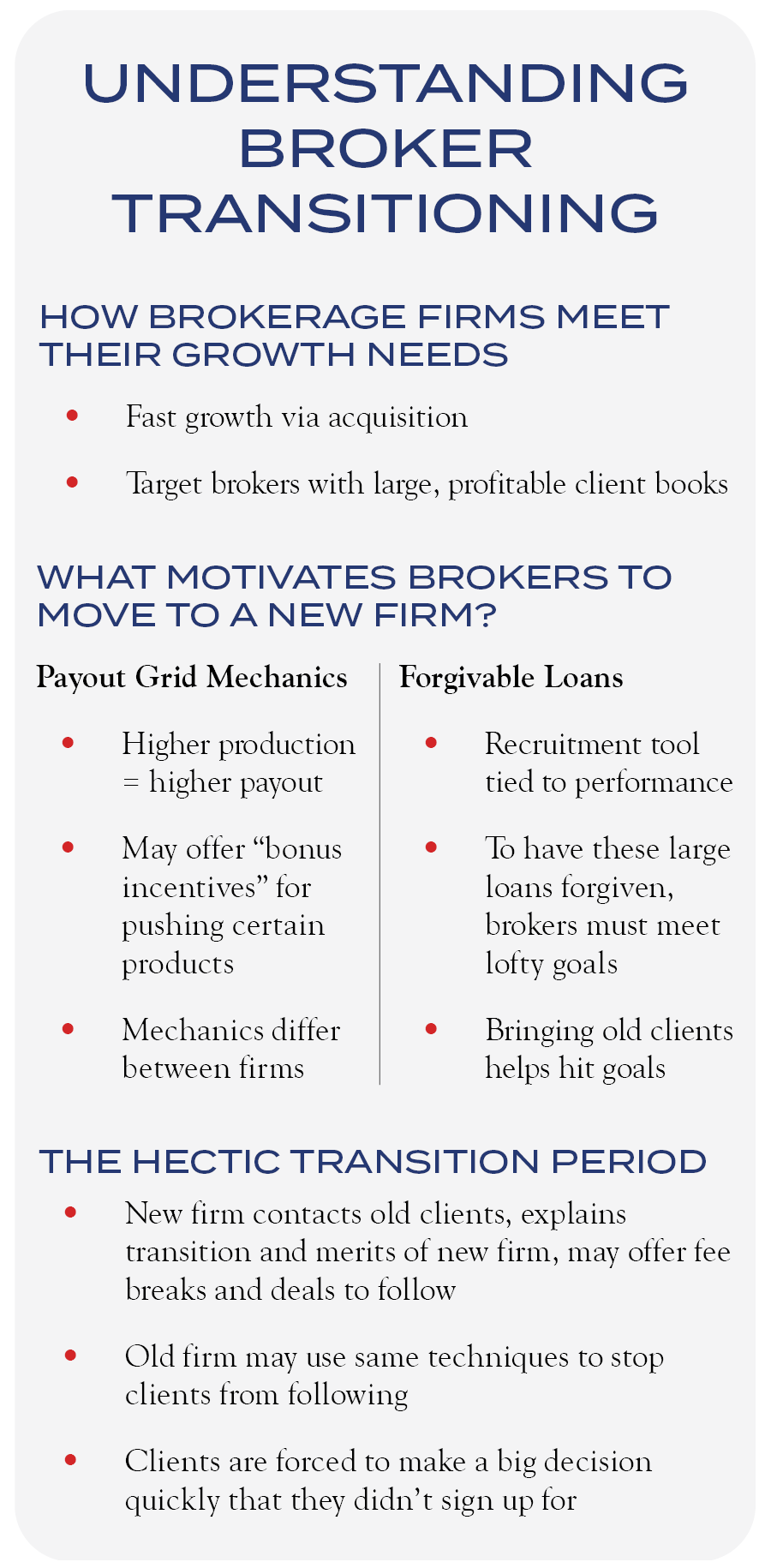

Broker transition is a common practice, and it is not unusual for a successful brokerage team to work for several firms over the course of a career. As long as Wall Street has an insatiable appetite for growth, lucrative deals will continue to entice advisors to port their clients to new firms.

Receiving a call from your broker about a change like this can be daunting for clients who may have grown comfortable with the status quo of their relationship. The team or advisor may have provided excellent service and counsel over the years, and the firm may have promoted a culture and offering that the client had come to appreciate. With everything up in the air, a client is tasked with a big decision: do I stay, or do I go?

When clients agree to follow their advisor to a new firm, they may be offered fee discounts for a time or promised a more robust product offering. But change comes with other considerations. Historical transaction and performance reporting may be lost, new technology may need to be adapted, existing portfolio positions may not be portable, and service quality may be affected. In addition, the new firm may have differing views of markets and recommendations that have the potential for portfolio turnover.

Advisors at brokerage firms earn commissions on product sales, and commissions may vary at different firms. Compensation dictates behavior, and deciding to move firms may influence the composition of a portfolio. Regardless of any fee discounts a client may receive, investment providers pay brokerage houses to sell their products. There are no free lunches on Wall Street.

Broker counsel is often helpful, particularly when clients understand that they are being offered securities to buy and not necessarily objective recommendations.

Sales concessions paid to brokerage houses influence the products offered to clients. New investment opportunities are the topic of morning calls, and advisors contact clients who may have an appetite to buy them. Without proper diligence, it is not unusual for a brokerage investment account to appear more like a collection of investments rather than a thoughtfully constructed portfolio.

Brokerage firms work well for clients who have the wherewithal to select their own investments. Broker counsel is often helpful, particularly when clients understand that they are being offered securities to buy and not necessarily objective recommendations.

Understanding the Difference: Brokerages vs. RIAs

Portfolio construction involves not only asset allocation and security selection but also careful analysis of cost and how underlying investments interact. Each piece of a portfolio must serve a purpose and be constantly reviewed.

Registered investment advisors may be more suitable for clients looking for someone to build and manage portfolios on their behalf and for clients who prefer to pay a fee for the work rather than commissions for services and investments.

Registered investment advisors may be more suitable for clients looking for someone to build and manage portfolios on their behalf and for clients who prefer to pay a fee for the work rather than commissions for services and investments.

When an investor receives a call from a broker explaining the transition, it may be a suitable time to reassess their financial needs. Choosing not only the right individual but also the right firm is one of the most important decisions an investor can make. Among the considerations are the provider’s track record and process, personality fit, level of service they can provide, and how they are compensated for their services.

The playing field in wealth management has broadened and evolved over the years, and the distinctions between firms have become murky. When selecting a provider, be sure to understand the offering and decide if that offering is the best fit for your financial needs. Your money is important; make sure your provider puts your needs before their own.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Brown. No part of Mr. Brown’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC