Are small caps stuck in the discard bin forever?

Following ten years of dominance by large caps and private equity, the portfolio role of small-cap public equities is being questioned today more than ever. Large-cap stocks and private investments have had a clear (albeit backward-looking) appeal, driven by strong earnings and favorable flows from allocators. The appeal of small caps is more complex due to the wide range in the quality of the Russell 2000 Index’s underlying components. Historically, small caps have held a strong advantage, and while this has dissipated in recent years, several tailwinds are emerging to support smaller companies. Using active stock selection to navigate the small-cap index, there is the potential for compelling returns.

Why small caps?

1. Valuation Advantage

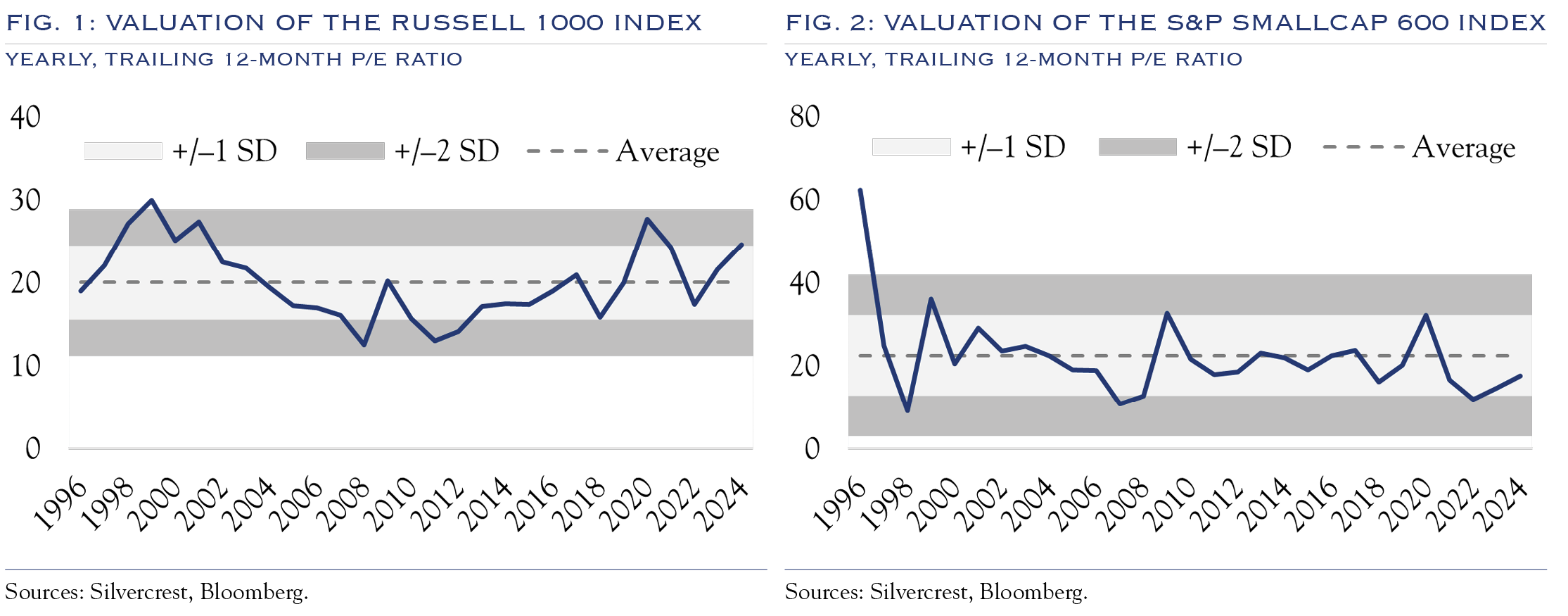

Unlike their large-cap brethren, small caps are trading at valuation levels below their own long-term average. To compare valuations, we review the trailing 12-month P/E ratio for the large-cap Russell 1000 Index and the S&P SmallCap 600 Index. We use the S&P 600 because it has a higher-quality profile than the Russell 2000, thereby avoiding excessive valuation noise from unprofitable companies in the Russell 2000. As shown in Figures 1 and 2, small caps are trading at historically “cheap” levels, while large caps are “expensive” relative to their own history.

Long Cycles of Underperformance Precede Long Cycles of Outperformance

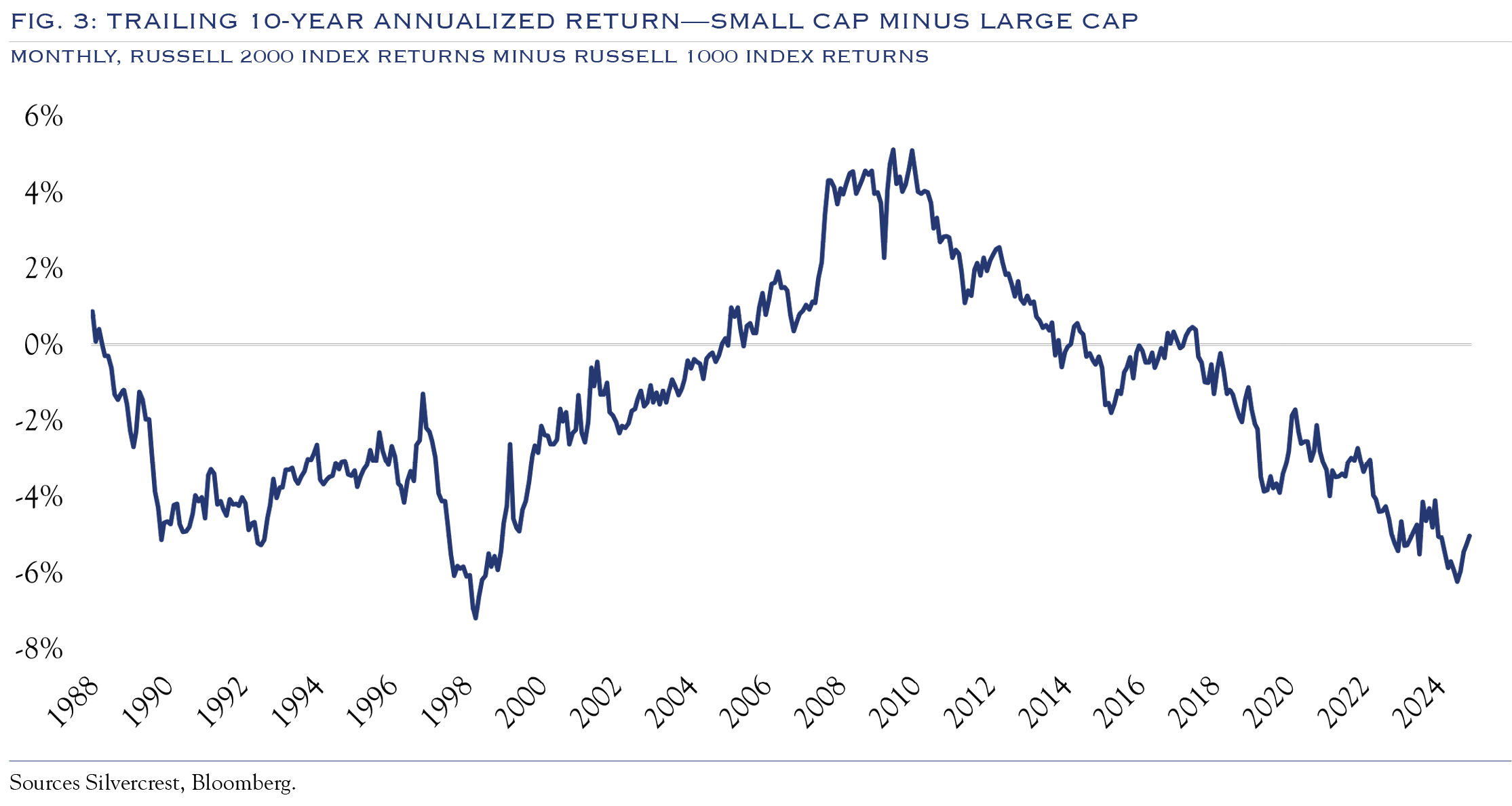

As shown in Figure 3, small caps hit a significant turning point in the late ’90s when reaching a ten-year, –7% annualized performance lag. Additionally, long-term studies from Furey Research Partners show major inflections at similar levels in the 1930s and 1950s. Historically, the first phase of a turnaround sees more speculative corners of the small-cap universe rally first. Often, this is manifest in covering short positions, and indeed, heavily shorted stocks have rallied, dragging unprofitable and speculative corners of the index to significant gains in recent weeks. Ultimately, for the recent surge in small caps to be sustainable, leadership must extend to more durable corners of the small-cap universe and be fueled by factors that are sustainable over the long term, such as earnings. This broadening of earnings growth is on the cusp of unfolding. Investor attention has begun to scrutinize the valuation of larger participants building the AI infrastructure and tools.

Meanwhile, evidence is mounting that small companies of all stripes are becoming increasingly active users of AI, potentially leading to boosts in productivity, profit margins, and earnings. This trend can be observed via earnings transcripts, news reports, and, for very small companies, in a U.S. Chamber of Commerce study. As of November 2025, the rally has been running for eight months, placing the market squarely within the window when the transition to quality-driven leadership has historically occurred.

Small Caps & Privates

The deal size for some private investments overlaps with the market caps of small companies, and many excellent companies have elected to remain private and/or go public at levels comparable to those of large-cap companies. These trends are likely to continue; however, investors do not need to choose between private investments and small caps. In fact, several key differences highlight the appeal of small caps for portfolio construction. Prudent portfolio construction should emphasize diversification of general characteristics.

2. Diversification—Small Caps Protect During a Change in Mega Cycles

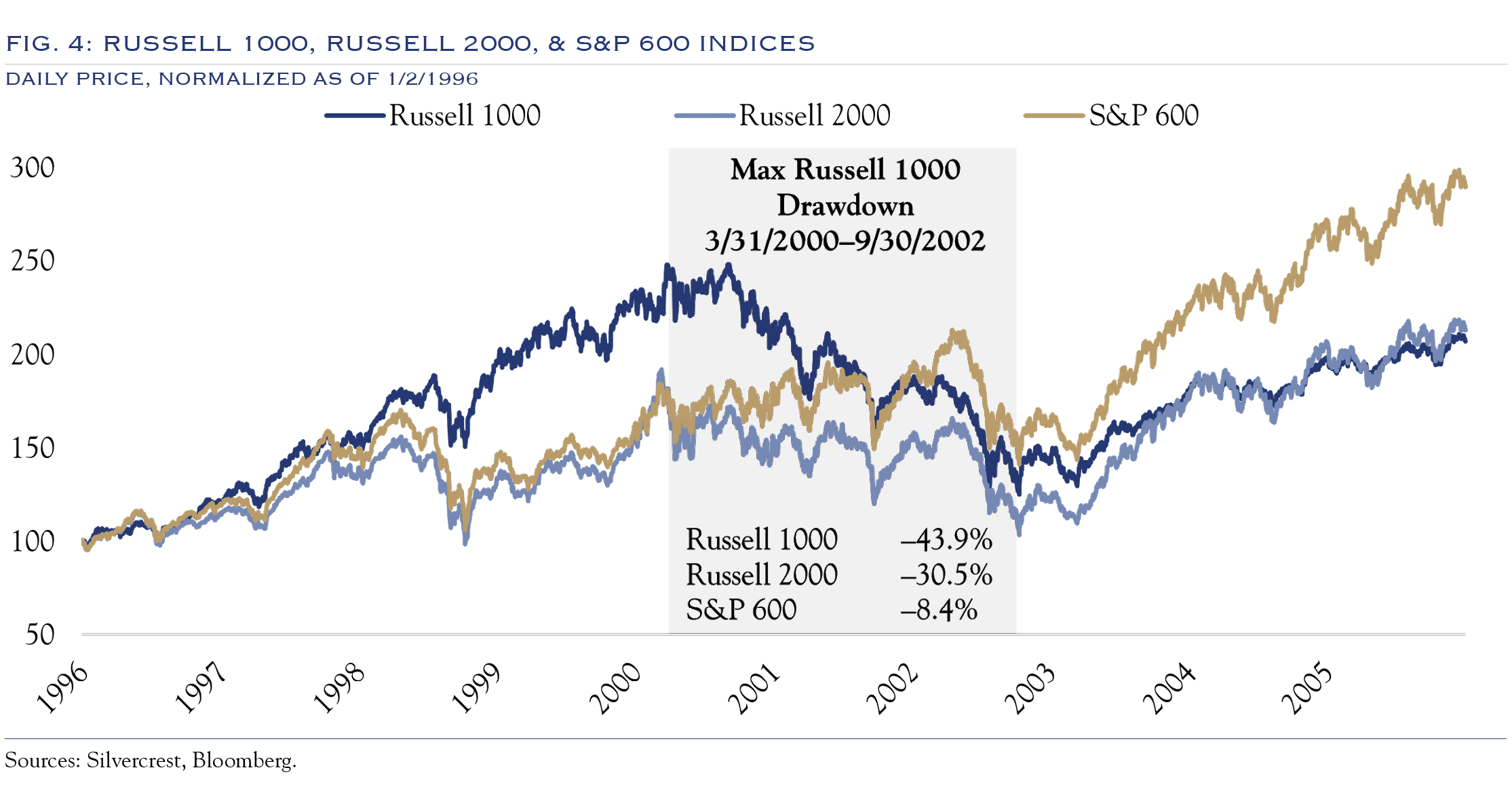

In the aftermath of the most notorious instance of valuation dispersion during the 1999 Internet Bubble, high-quality small-cap companies provided portfolios with significantly greater diversification benefits.

As shown in Figure 4, small caps performed significantly better during the 1999–2000 cycle shift. From March 2000 to September 2002, the small-cap S&P 600 experienced a modest –8.4% decline, compared with the –43.9% decline in the large-cap Russell 1000. At a 10% portfolio weight, this would provide 355 basis points of additional portfolio return. Small caps outperformed handily over the ten years from 1995 to 2005. The key is to add the allocation before the change in the cycle. While the current large-cap technology cycle may not have an imminent end, it will eventually come to a close. Increasing small-cap exposure now could bring significant diversification benefits.

The Nifty Fifty era experienced a similar outcome: what was working best and most popular suffered the most when the environment changed. Small caps also provide fundamental diversification through a mix of companies across sectors and geographies. Small caps offer greater exposure to Health Care and Industrials, and have a much more domestically focused revenue base.

3. Timing: Why Now?

We see several catalysts for small-cap performance:

- First, recently enacted legislation and the upcoming mid-term election cycle make it likely that ample resources will be deployed in the domestic economy. Historically, domestic activity has benefited small caps.

- Second, after several false starts, M&A activity seems to be on the rise once more. With ample “dry powder” from private firms and an increased appetite for processing a deal backlog, M&A activity should continue rising. Typically, this activity benefits small-cap companies, as they are often the acquisition targets. There is a growing list of small and solid companies that haven’t seen a valuation boost by being acquired or landing on lists of potential acquisitions from private equity or large strategic acquirers.

- Third, an improved interest rate backdrop brings two benefits to small caps. Smaller companies often have a higher proportion of floating-rate bank debt and generally longer-maturity bond issuance from large caps. In these situations, lower rates bring a disproportionate potential benefit. The decline in rates alleviates the financing stress (real or perceived) that is often a concern for smaller companies. Further, an extended cycle of interest rate declines, such as the one we are likely to see over the next 18 months, typically boosts investor interest in smaller companies, partly because they are more economically sensitive.

Smaller companies will be the ultimate beneficiaries of the AI revolution. For now, the focus is on the technology’s builders, who are often large-cap companies. Eventually, the focus should shift to technology users, with margin gains spread across all market-cap segments, thereby leveling the playing field as small companies adopt new AI use cases.

Small Caps—One Size Does Not Fit All

Recent rallies in small-cap stocks have been either very short-lived or populated with a burst of activity from lower-quality companies. For example, Citadel Securities has been tracking activity in lower-priced shares, which tend to be driven by retail investors and focused on momentum. For a more durable rally, we look to the catalysts above to provide a rich opportunity set for classic stock selection.

Specifically, we are looking for:

- Under-appreciated success stories

There is a sizeable opportunity set for active managers to operate within a less-covered segment of the capital markets. A typical large-cap company has 30 analysts covering the stock, while the average Russell 2000 company has fewer than six analysts on average. The same situation exists at scale outside the U.S., where there are over 4,100 companies in the MSCI ACWI ex USA Small Cap Index, with many of them receiving little or no analyst coverage. - Quality (as defined by the situation)

In the small-cap arena, quality is somewhat in the eye of the beholder. Companies that are perceived as low quality today can become the high-quality names of tomorrow. Disciplined active managers can distinguish those from the truly low-quality businesses that are destined to remain small forever. Balance sheets that are strong relative to peers, bringing staying power in a challenging economic backdrop. There is no lack of high-quality companies in public markets. - Ability to Execute in an Environment of Rapid Change

A management team that is aligned with shareholders and has a demonstrated history of executing to its stated goals.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC