This February, athletes from more than 20 countries will compete for gold in bobsled, or bobsleigh, as it is officially known in the Olympics. The race consists of two phases: the start, or push phase, which demands raw power to generate launch speed and create early differentiation, and the drive or glide phase. A fast start is crucial for a podium finish—research published in 2006 by Sara L. Smith and collaborators found that “almost 40% of the variance of final time was accounted for by start time.” However, success depends not only on speed at the start; on a technical track, the drive or glide phase is equally critical, requiring clean, precise driving to achieve separation between top competitors.

The U.S. economy has received a strong initial push from policy stimulus, interest rate cuts, and deregulation, all of which are highly visible—similar to the explosive start in a bobsled race. In response, markets anticipate a strong finish. Cyclical sectors, commodities, and smaller companies have built a massive lead in the first few weeks of the year, analogous to gaining speed early in a race. Still, just as the outcome in bobsled depends on technical skill in the later phase, the economic track is complex, and the final result will depend greatly on the actions of companies, consumers, and policymakers, as a bobsled driver navigates turns to affect final standings.

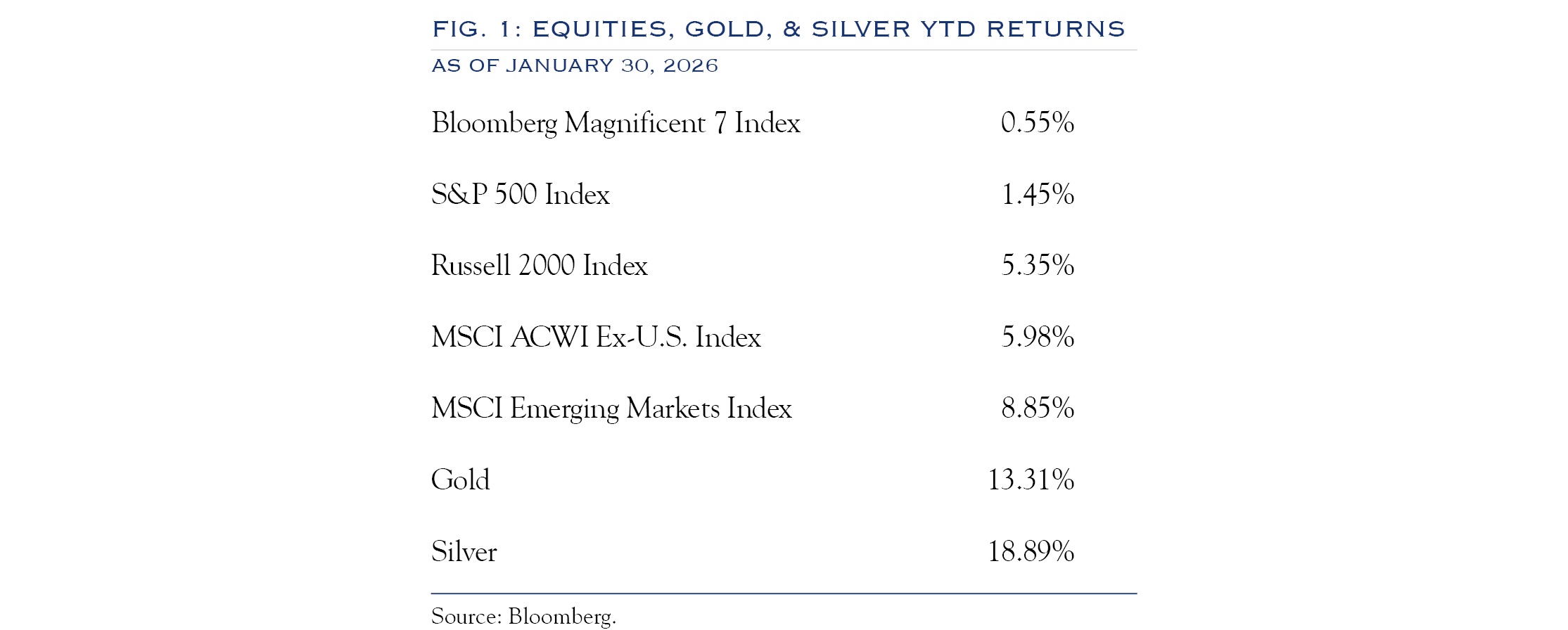

The year is off to a positive start with a return of 1.45% for the S&P 500 Index.

Reflecting this, within the index, Energy, Materials, and Industrials occupy three of the top four spots for sector returns on a year-to-date basis. Simultaneously, across all U.S. equities, small-cap stocks lead on a market-cap-ranked table of year-to-date returns. Non-U.S. and emerging-market equities have also delivered solid results, while in the commodity space, metals—especially silver, tin, platinum, nickel, and gold—posted blistering returns.

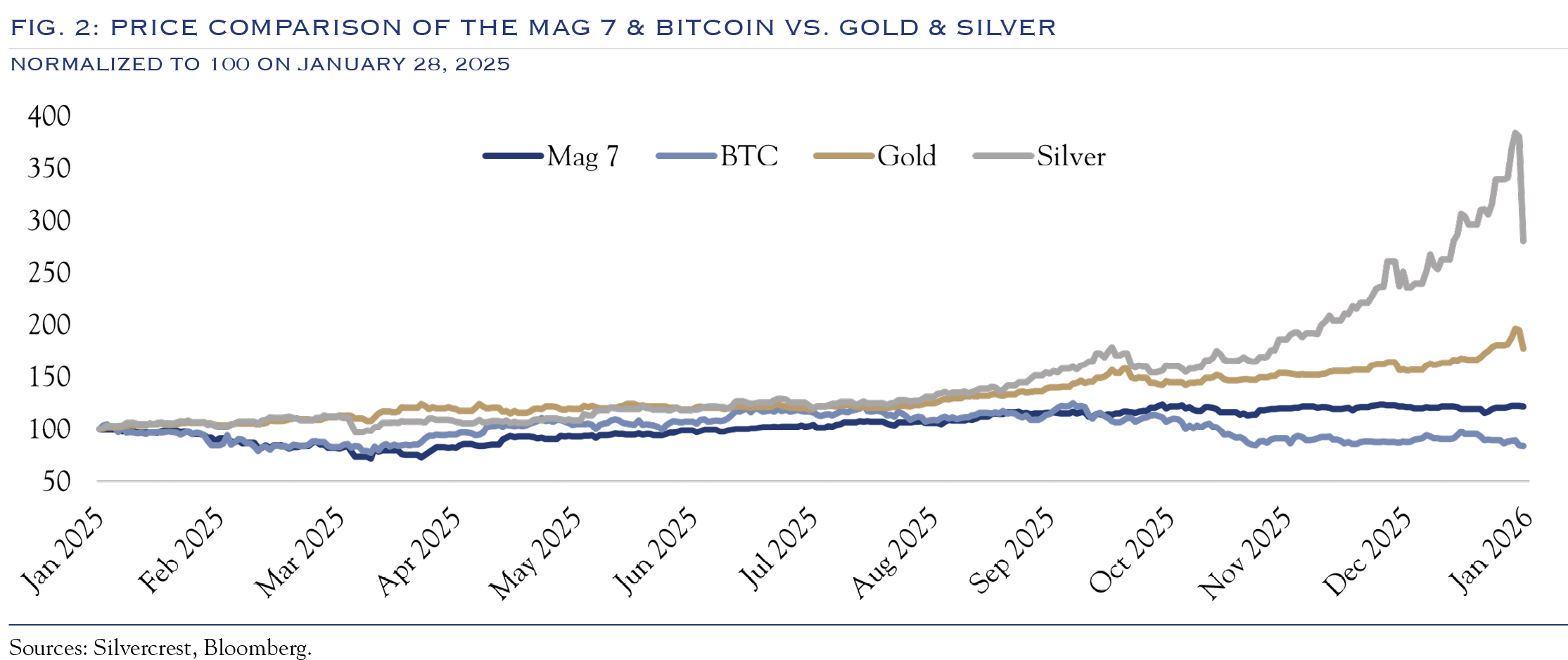

Some of the more notable moves in the market are reminiscent of previous price actions seen in meme/YOLO trades, technology leaders, or emerging areas of focus such as bitcoin. As depicted in Figure 2, over the past 12 months, gold and silver have become prominent performers, surpassing mega-cap tech (Mag 7) and crypto (bitcoin).

Looking more broadly, January’s price action highlights the presence of three key factors spanning all asset classes:

- The unpredictable role of the United States in global affairs has likely prompted incremental allocation adjustments and helps explain some of the notable moves in gold, the U.S. dollar, and non-U.S. equities.

- Sharp moves higher in select areas may signal a partial return of meme/YOLO trading, and there is evidence of increased retail trading activity in both gold and silver, as well as low-priced stocks and more speculative holdings.

- Sector results and the emergence of small-cap returns indicate that expectations are running high for the “run it hot” economy.

All policy levers are currently contributing to economic momentum. The key question is how much sustained growth this support will yield, especially given the divergence between the GDPNow and WEI models, which is central to the “run it hot” theme in current market behavior. GDPNow indicates 4.23% economic growth, while WEI is 2.49%. Sustained growth above 3% would likely prolong current market trends. However, if the growth surge is temporary, recent trends may reverse rapidly. GDPNow numbers fluctuate widely, and strong net exports accounted for a large share of its 2026 growth forecast. WEI focuses more on growth in the U.S. Both have limits, but the gap between them suggests markets are betting on faster growth that isn’t yet reflected in the data, except in GDPNow.

Adding more detail, the ISM numbers point to a mixed view on the economy. Manufacturing is below 50 and just below its year-average. ISM services are slightly higher than their average. Neither signals the kind of fast growth seen in markets lately.

The “run it hot” trade started quickly in 2026. But the outlook still needs support from earnings and better data. Often, markets look ahead of the data. If this is right, signs of faster growth should appear by summer. Until then, most economic news may already be in prices, and markets are likely to remain volatile.

Outlook

We expect a steady U.S. economy, as the strong policy push helps boost growth and the wealth effect. As Team USA’s bobsled navigates the track in 2026, it may be difficult to produce more than a small change in the size of the workforce or wages. The rise of AI brings significant potential productivity gains and is causing companies to place headcount under intense scrutiny. U.S. companies will keep working to improve efficiency and drive profit growth, helping earnings and modest stock gains. More types of stocks should participate in these gains, which is our base case outlook. However, with high valuations, stubborn inflation, and rates over 4% on the U.S. 10-Year note, more churn is expected as each new data point is judged against the high hopes embedded in most economic and earnings forecasts. The U.S. economy is receiving a strong push start, but needs to navigate a very tricky track to reach the podium.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC