More Uncertainty—Good for Stocks?

Despite a significant increase in economic policy uncertainty metrics, frequent predictions of recession, and increased equity market volatility, stocks are currently in positive territory +0.12% through May 28 and up +3.84% since the announcement of tariffs on April 2nd.

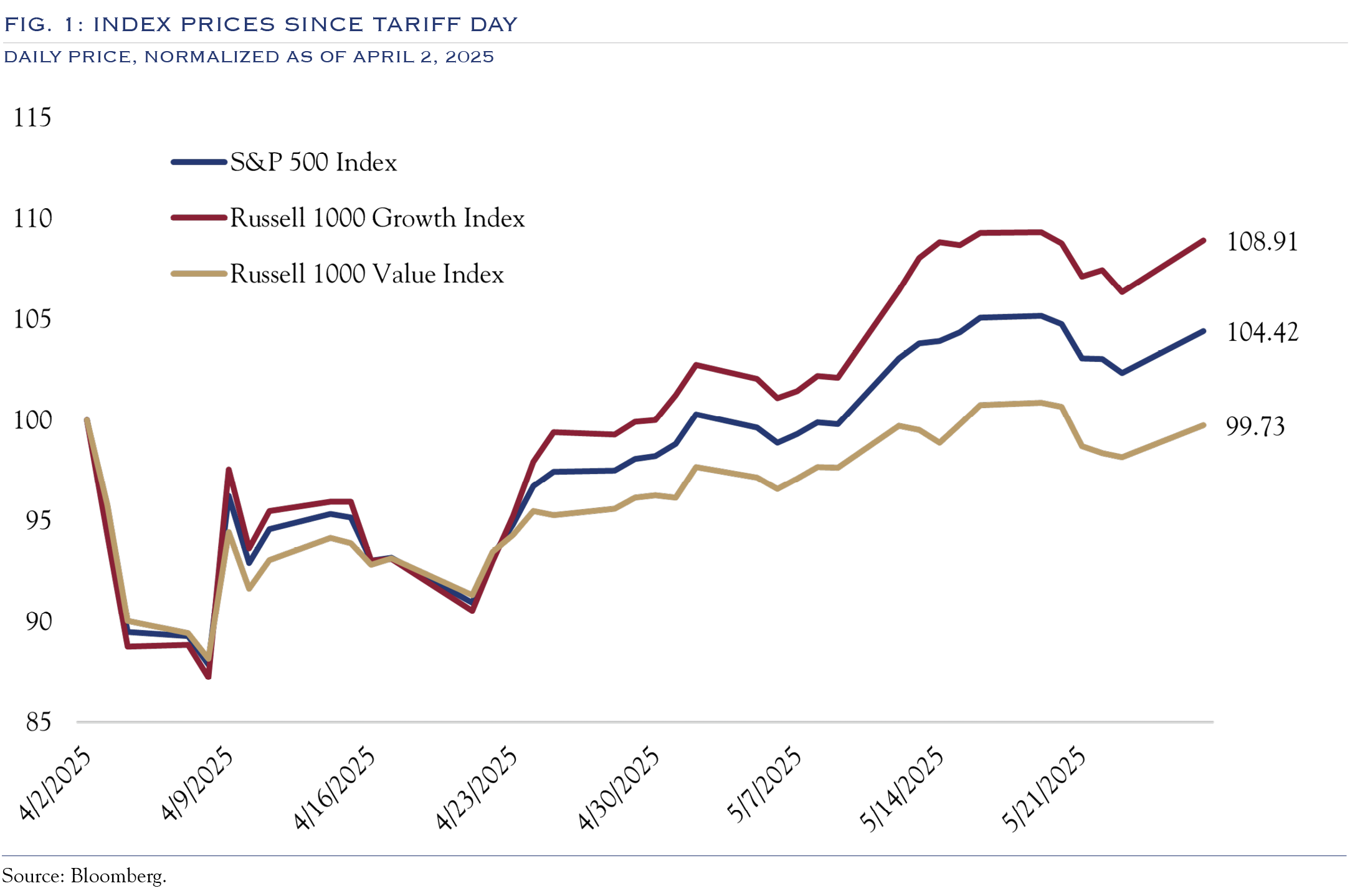

Figure 1 shows the S&P 500, Russell 1000 Growth, and Russell 1000 Value indices, normalized to a starting point at the market close before the announcement of tariffs. Large-cap growth leads the way, while all indices are at, near, or above levels achieved before the tariff announcements.

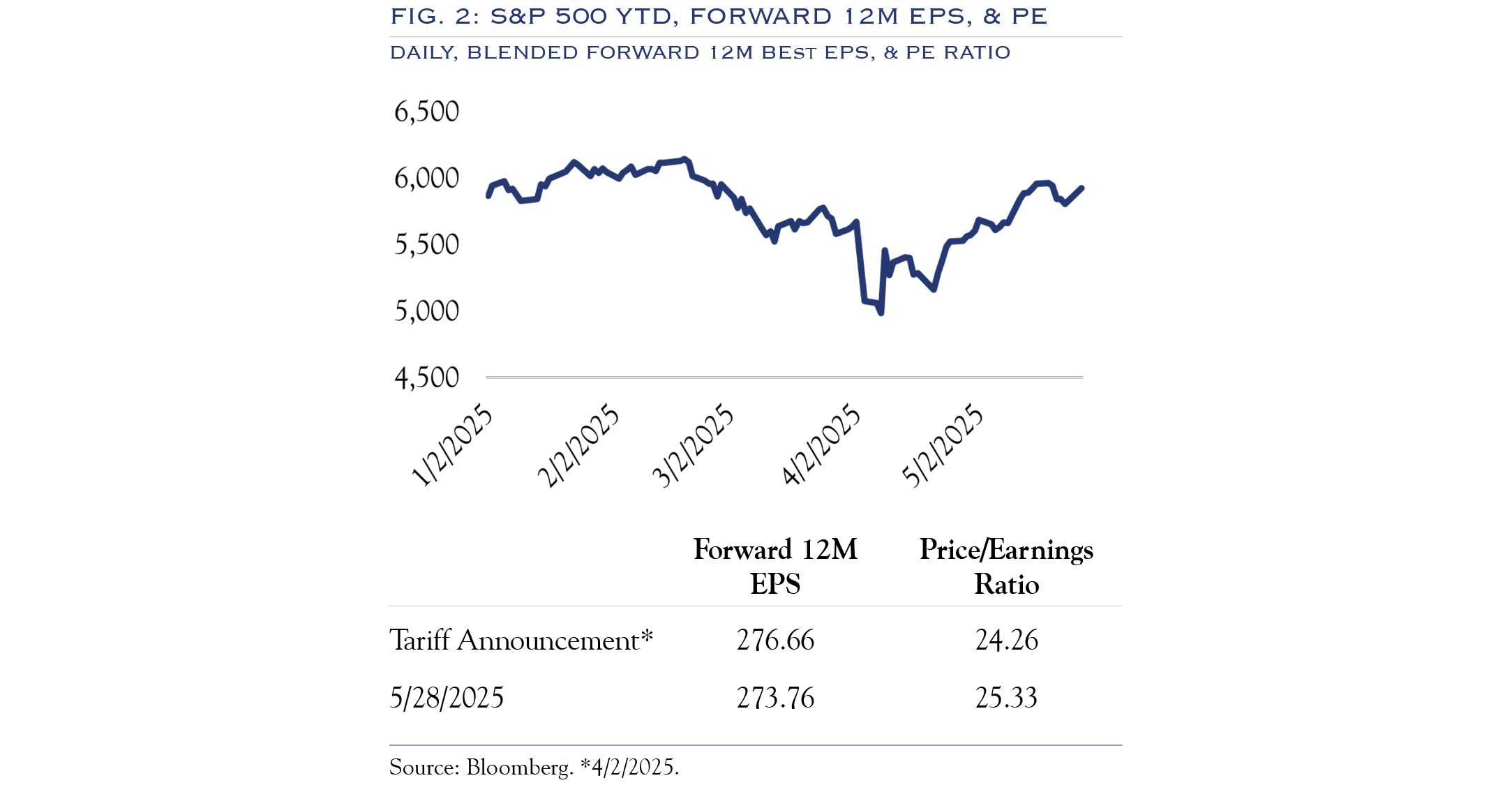

Following the announced tariffs, stocks have moved by an average of +/– 1.5% on a daily basis, roughly 2x the long-term average. The most significant decline was –6.0%, and the most considerable advance was +9.5%. These large moves up or down were often linked to specific policy announcements. Overall, 58% of days have posted a positive return since the announcement of tariffs. As stocks have recovered, they have done so with a slight uptick in valuation, as shown in Figure 2.

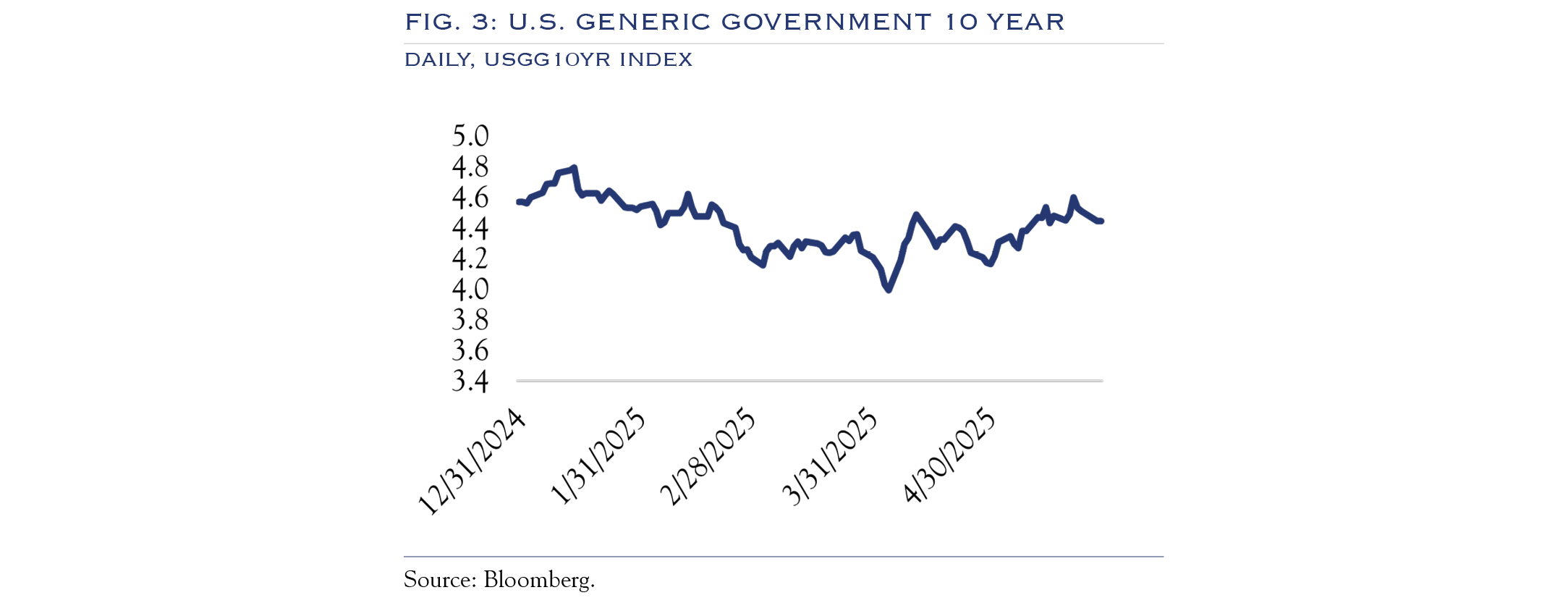

As shown in Figure 3, yields on the U.S. Ten-Year Note remain quite volatile, which we expect to continue. Given the slow progress toward the Fed’s inflation target of 2.0% and ongoing global concerns over budget deficits and debt issuance, Treasury prices are expected to remain choppy. Nonetheless, the long-term path is towards lower yields, as inflation will reach lower levels after a tariff adjustment, eventually allowing the Fed to resume some rate cuts. For now, we anticipate the Fed to remain on hold with a 4.5% Fed Funds rate, effectively setting a floor for interest rates in the near term.

Given the prevailing political uncertainty, interest rate backdrop, inflation picture, and other factors, our model suggests that valuations are perhaps elevated by approximately 8% above fair value.

Several reasons sit as root causes for this degree of optimism:

Earnings

The earnings situation in the first quarter, inclusive of guidance, was better than expected. One reason is that profit margins remained near peak levels, showing that companies continue to find ways to generate earnings despite a modest and uncertain growth backdrop.

Economy

Despite persistent calls for a recession, up-to-date metrics on the job market, such as weekly claims and real-time spending data, align with Fed models from Atlanta and Dallas, pointing to growth of +2.1% and +1.9%, respectively.

Outlook

We see two paths through the noise:

- Path 1 (more likely)—A continued volatile mix of policy changes with ample pauses and course corrections along the way.

- Path 2 (less likely)—A policy mistake that remains unchecked for an extended period.

If the tariffs in effect today under the pause scenario represent the peak tariff levels, this will be sufficient to prevent the economy from falling into recession. While growth may slow to a “stall speed” of below 1.5%, pushing earnings lower, the backdrop will be seen as a reset, with longer-term results being powered by modest earnings resulting from productivity and margin gains.

To date, each new policy that has been tested through an adverse market reaction has resulted in a change or pause. This pattern of course correction suggests that the administration is sensitive to market conditions, particularly seeking to maintain a backdrop that can support domestic economic expansion.

Overall, higher-than-normal volatility in fixed income and equity markets will stem from volatility in economic and policy news. Nonetheless, the economic backdrop is such that earnings gains can continue. The net result over the next twelve months should be higher equity prices and lower bond yields.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC