Beside the broken bridge and outside the post-hall,

A flower is blooming forlorn.

Saddened by her solitude at night-fall,

By wind and rain she’s further torn.

Let other flowers their envy pour.

To Spring she lays no claim.

Fallen in mud and ground to dust, she seems no more,

But her fragrance is still the same.

—Lu You, Ode to the Plum Blossom*

April showers of politics rained down in recent weeks, leaving the economy and markets a bit forlorn. But much like the fragrance of the battered flower, the essence of the economy—a desire for growth—remains. Throughout extensive recent travel, we have consistently heard a clear message of what businesses are seeking: less politics and more focus on growth. (See Author’s Note below for more detail.)

*From a book of poetry translations by Xu Yuanchong, gifted by a faithful Economic Update reader and a great friend in China. Thank you!

A Disruptive Time

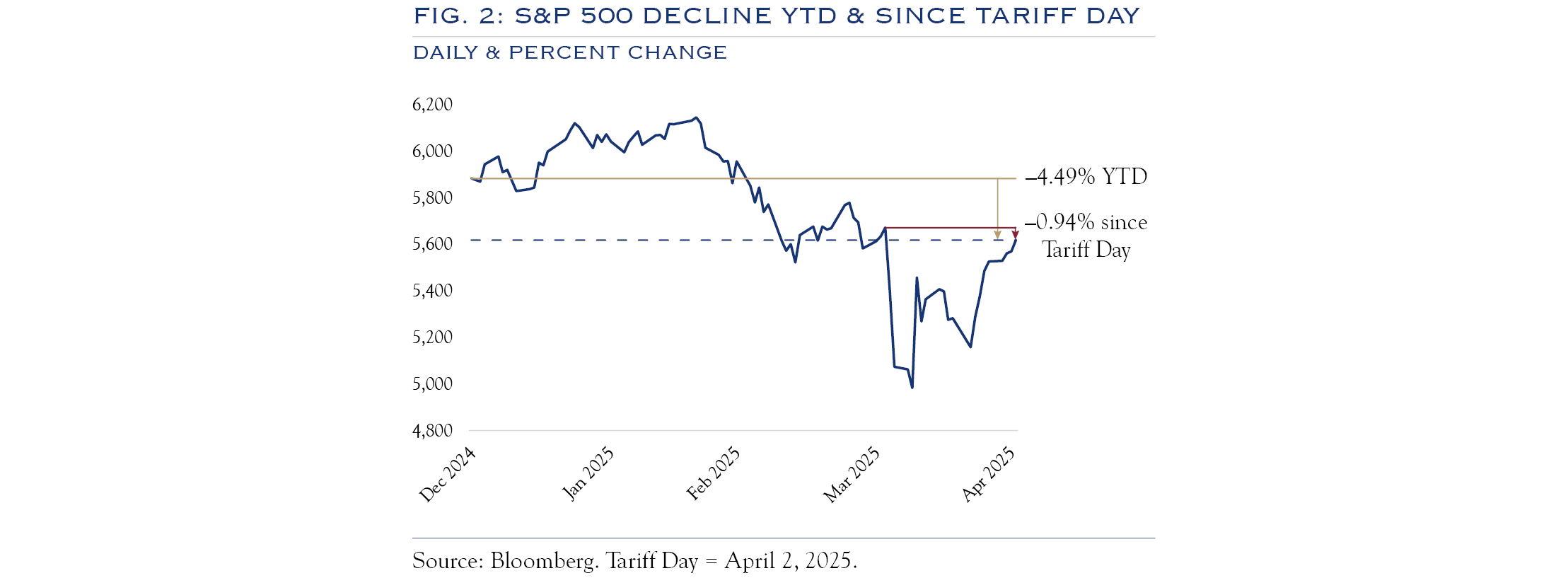

Much of the recent market volatility can be traced to initial tariff announcements on April 2, followed by near-daily policy changes. In a period of rapid disruption, it can be tempting to interpret each new development as a permanent change. Our approach has been to evaluate conditions as they unfold while maintaining perspective on time horizons, recognizing that tariffs in place today may not retain the same configuration in the months ahead.

The end goals for restructuring trade are admirable and aimed primarily at boosting domestic economic activity, particularly in manufacturing and strategically important industries. None of these objectives are easy to achieve, nor can they be enacted quickly. At the outset, two schools of thought are emanating from the White House, one advocating for full-scale trade rebalancing and the other promoting negotiation and improved terms of trade. As negotiations continue, a narrowing of trade imbalances is expected to be tackled via increased purchases of U.S. defense goods, energy, and agriculture. The 90-day pause on the more restrictive tariffs indicates that the plans announced on April 2 represented “peak tariffs”—and that negotiation from this point forward will bring down tariff rates. In other words, tariffs are expected to fall below current levels, and trade will become more balanced, though it won’t be a smooth process.

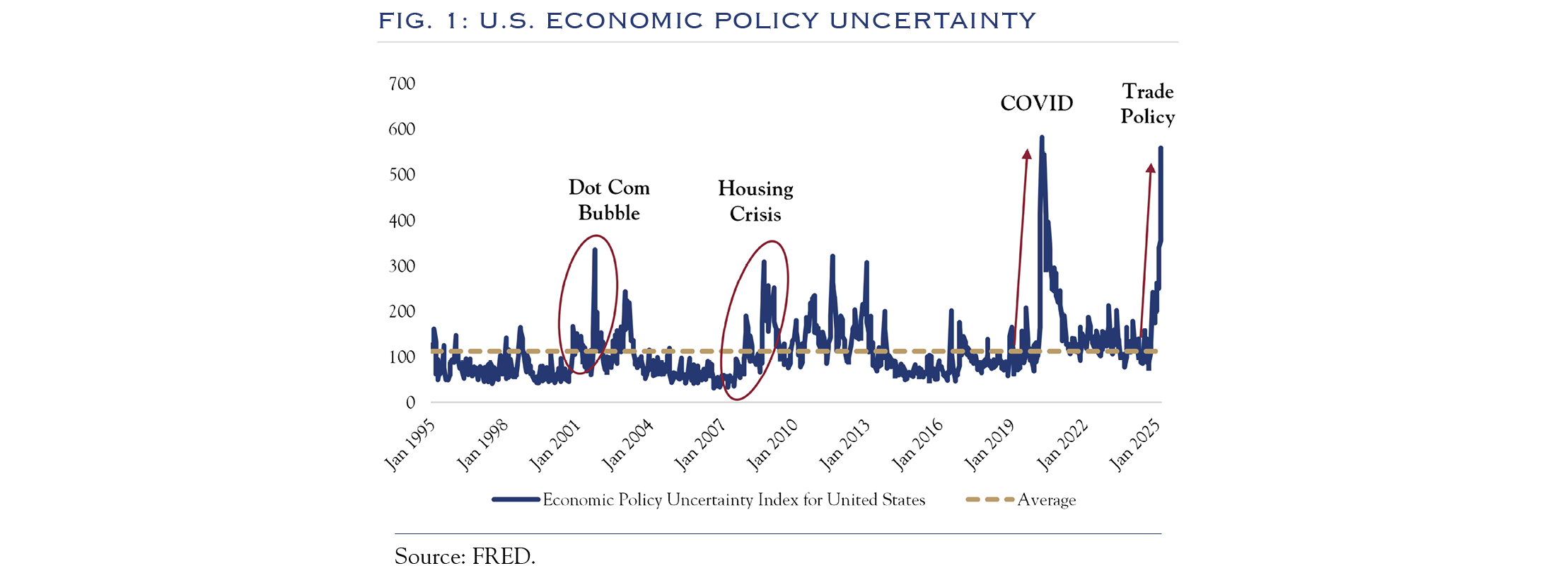

The current policies will likely exert a significant drag on growth while simultaneously boosting inflation, approximately a 1.75% decrease in growth and a 1.75% increase in inflation. Figure 1. shows the dramatic elevation of policy uncertainty in recent weeks.

Unsurprisingly, volatility, as measured by the VIX index, jumped significantly. Normally, higher volatility translates directly into lower valuations and stock prices. A rise in volatility also typically results in a flight to safety, with both bonds and the U.S. Dollar rallying. This most recent bout of turbulence has not followed the standard playbook.

While equity prices dropped rapidly, as much as –18.9% from the peak on February 19, they have mostly recovered lost ground as the tariff backdrop continues to evolve towards something less menacing. Bond yields, meanwhile, have traded in a range of 4.79% on January 14 to 3.99% in April. The U.S. dollar has declined –10.62% from its high on January 13 and on a trade-weighted basis –5.79% in April.

Against this atypical backdrop, assets like gold have rallied, partly due to wavering confidence in traditional U.S. investments. The faltering confidence largely stems from rapidly changing and often unclear communications around tariffs. The first step in rebuilding confidence will come from initial announcements of deals. Market confidence will improve if these revised trade arrangements reveal improved configurations and are announced with clarity of purpose and a sense of durability.

Nonetheless, expectations derived from financial indicators point to continued volatility. The VIX futures curve shows that volatility expectations have increased significantly since tariff day and are expected to remain elevated for the next few months. For now, equity market pricing seems to embed some measure of progress on tariffs, while volatility metrics point to continued unpredictability.

Given the timeline of the announced tariff pause and the recent signaling of urgency for negotiation, the second quarter will represent a reset on three fronts—trade policy, the economy, and corporate activity—and each will cycle through various phases in response to the complex backdrop. Given the intense pressure and strong incentives for progress, we anticipate significant change throughout the second quarter.

Before tariff announcements, consumer spending was growing at about a 2.0% rate, boosted somewhat by demand that was pulled forward to avoid tariffs. While some companies can operate from those elevated stocks of inventory, the clock is ticking.

Our model factors in current tariff rates and projects a drag of 1.75% economic growth and a similar uptick in inflation. Thus, growth in the second quarter may be flat or even negative. A lot depends on timing.

We take an incremental approach to assessing tariffs, recognizing that the effects will vary over time. While first-quarter GDP results showed negative growth, much of this resulted from a very unusual configuration with very high levels of imports and inventory building. Underlying spending remained on solid ground. Real-time spending data from credit card vendors and aggregators of retail sales data such as Johnson Redbook and Bloomberg Second Measure are consistent with a modest expansion in consumer spending at least through the third week of April.

For the time being, the employment picture remains favorable. Yet, with all the uncertainty surrounding the economic outlook, savings rates have increased, spending is slowing, and tariffs are expected to suppress growth further.

The U.S. labor market has remained healthy, helping the economy avoid recession. Payrolls expanded by 228,000 new jobs in March.

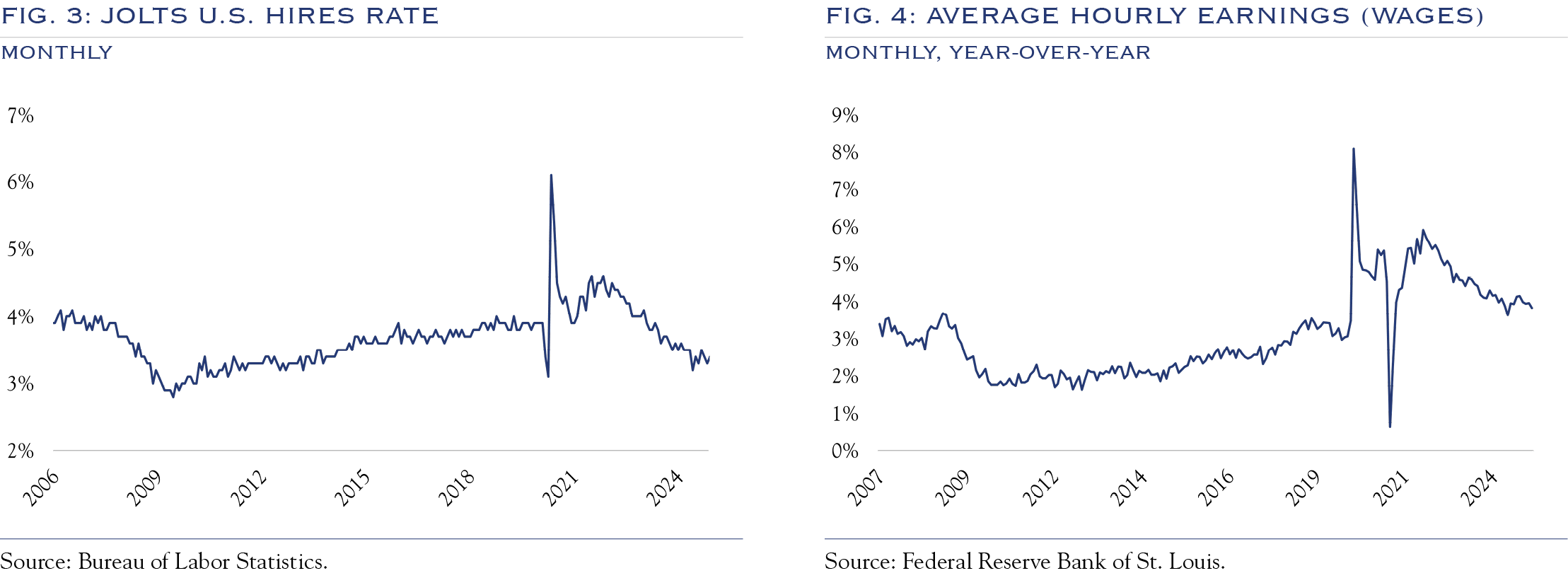

There are signs of gradual cooling in the labor market.

- The unemployment rate rose to 4.2% in March, driven in part by new entrants to the workforce rather than layoffs.

- The number of job openings was 7.6 million in February, down from a peak of 12 million in March 2022.

- The BLS Hires Rate has declined to 3.4% in February, reflecting a slower pace of expansion of payrolls.

- Wages increased at 3.8% year-over-year in March, down from 4.2% one year ago.

Outlook

Given the lack of economic growth, earnings will likely suffer, particularly if companies use the second quarter as a reset. Later in the summer, when second-quarter earnings are announced, an uptick is expected in one-time charges and business restructurings and a lowering of the earnings bar. There are some tentative signs that AI is allowing companies to lag employment cost vs. revenue growth. The disruptions of the second quarter could encourage more of this activity.

This coming summer, second-quarter earnings announcements could unfold alongside progress on tariffs. At the same time, economic activity will weaken within the second quarter. This could present an interesting dichotomy between weak economic and earnings news and positive macro news on tariffs, leading to an improved growth outlook. If so, it would set the stage for a better back-half of the year for the economy and earnings. Clarity on tariffs would also help to boost M&A activity and capital expenditures.

In the meantime, expect a plethora of news, plenty of posturing, and continued volatility in stocks and bonds. As we look further ahead, the trade backdrop will improve, helping to stabilize growth and ultimately getting back on track for expansion. Although the economy may remain disrupted for a few quarters, markets generally look ahead, and we maintain our longer-term favorable view of the U.S. economy and equities. For now, the Fed will likely remain on hold, with bonds remaining range-bound but volatile.

Author’s Note

I began writing this Economic Update on a high-speed train traversing China amid a ten-day whirlwind of planes, trains, and automobiles (mostly EVs) through Beijing, Shanghai, Shenzhen, Hong Kong, and Singapore. My colleagues and I met with many talented investors and innovative companies throughout these cities.

The trip was a great reminder of the importance of travel. Having not been to mainland China since 2019 and visiting amid a massive trade war, I expected more tension. As it turned out, everyone we met, from businesspeople to service workers, was unfailingly friendly and professional. News reports often overstate the vitriol, while face-to-face encounters reveal a more nuanced tone. The same can be said for politicians’ public and private demeanors in the United States.

As technology leaders, specifically in AI, and with large domestic markets, both the United States and China are critical engines of growth for the global economy. Despite the recent global turmoil, the mindset of businesspeople seems to be the same on both sides of the Pacific. They’d like politicians to remove the uncertainty, set the rules, and let activity and competition flourish. It is true that, nearly 25 years after China’s admission to the World Trade Organization, the rules may need to be updated for the current landscape. Any final resolution to the current trade war will take some time.

Recent announcements from Washington and Beijing show that the temperature may be cooling, and the negotiation phase seems to be starting. As a committed cheerleader for economic growth, I find this encouraging.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC