The month of October has a well-earned Jekyll-and-Hyde reputation. It is simultaneously the scene of some of the worst stock market declines in history, yet it is also a month with positive average returns, and marks the starting point for a well-documented period of seasonal strength.

The economy and markets are showing some duality as well. The labor market is seeing minimal hiring but few layoffs. Interest rates are being influenced by “hot” inflation and easing policy. The stock market is making new highs, but with fewer stocks participating.

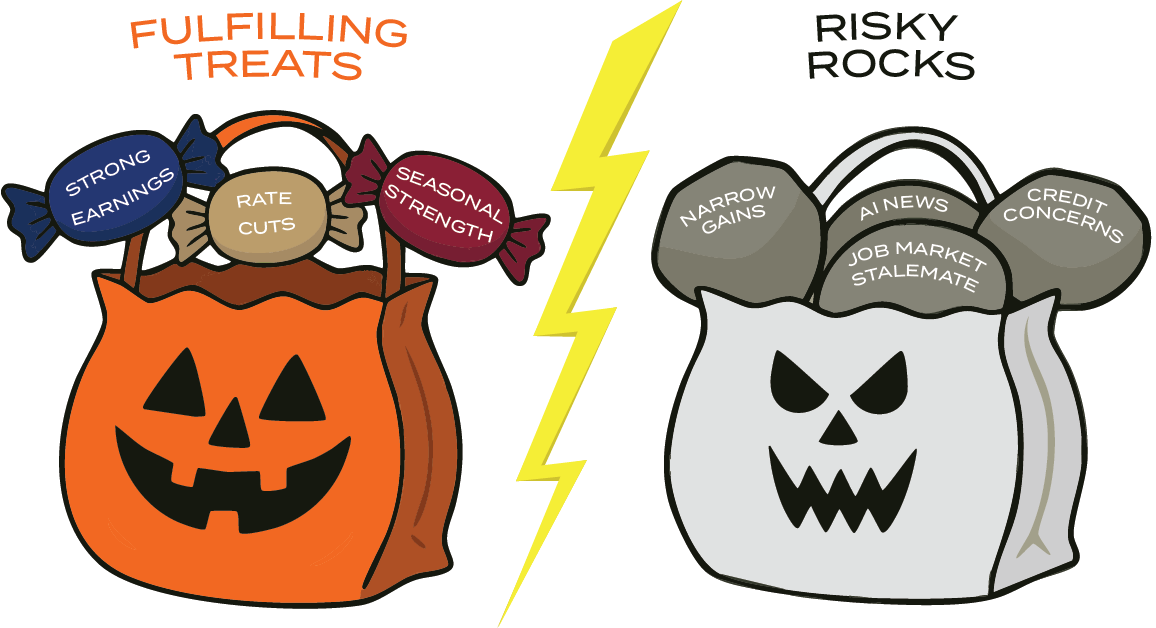

The big-picture backdrop remains mostly a bag of Halloween treats, such as earnings and rate cuts, though some recent developments are delivering a vibe like Charlie Brown on a trick-or-treat outing when he said, “I got a rock.”

A Sampling of Risky Rocks

Narrow Gains

Market breadth has been deteriorating, with the market-cap-weighted S&P 500 starting to outperform the equal-weighted S&P 500 more aggressively in recent days. The advance/decline ratio within the index has similarly been weak. Noted market technician Tom McClellan commented in a recent letter, “What we can say, though, is that the numbers of NH [New Highs] have been waning as this uptrend has been getting more mature. … It is not a bullish factor to see the SP500 and other indices continue to make higher highs with waning numbers of NH being made.”

- While this pursuit of winners may continue through year-end, there should be a healthy broadening, fueled by lower rates and the ongoing improvement in M&A.

Credit Concerns

Although major banks reported no significant credit issues, there has been a continued trickle of idiosyncratic credit problems.

- Several prominent bankruptcies were declared in recent weeks, alongside a slow-moving trend of delinquency rates creeping higher for auto loans and credit cards. Bankruptcies are expected to remain episodic and idiosyncratic.

AI news—Is it good enough?

The news on AI has been largely favorable and is likely to have a long runway for positive fundamental developments. Yet, with lofty valuations and vigorous enthusiasm, the expectations game will come into play at some point, where announcements of good news won’t be enough.

- Since most major players have mapped out clear and robust spending plans, and there are some capacity constraints, this is not an imminent risk.

Job Market Stalemate

Employers seem to be neither adding nor reducing headcount. The effect of AI on hiring has been relatively modest to date. Segments of the market, such as recent graduates, are also seeing some weakness. Recent layoff announcements at Target, Amazon, and UPS are not yet indicative of broader weakness. Other high-profile companies have announced plans to maintain their headcount while utilizing AI to expand capacity.

- For now, a continuation of sideways action in the job market is expected.

A Bag of Fulfilling Treats

- Corporate earnings have been quite strong and are likely to benefit from continued margin expansion. To date, with about half of the S&P 500 reporting, earnings have surprised by 7.5% above analyst consensus estimates.

- At the Federal Open Market Committee meeting, the Fed Funds Rate was reduced by another 25 basis points to an upper bound of 4.0%, down from 5.5% in 2024. While the Fed outlined a meeting-by-meeting approach, it seems likely that rates will experience a long, slow glide lower, providing support for valuations.

This combination of strong earnings growth and lower interest rates is a potent elixir for capital appreciation.

Overall

So long as the risk factor “rocks” above don’t turn into a landslide, we expect earnings and interest rates to drive positive results for equities. However, lofty valuations and a slew of potential risks require discipline in rebalancing and careful attention to risk levels.

STAY TUNED FOR OUR FORTHCOMING PUBLICATION:

OUTLOOK 2026 & BEYOND

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC