Summer Homework

According to various web searches and large language models (LLMs) such as ChatGPT, the three most frequently asked questions about the economy and markets tend to involve some form of the following topics:

- Can the economy avoid recession?

- What will the Fed do next?

- Has AI created a stock market bubble?

In sympathy with students returning to school, we have prepared a brief essay response to each of the three most important questions related to the economy and markets.

Can the economy avoid recession?

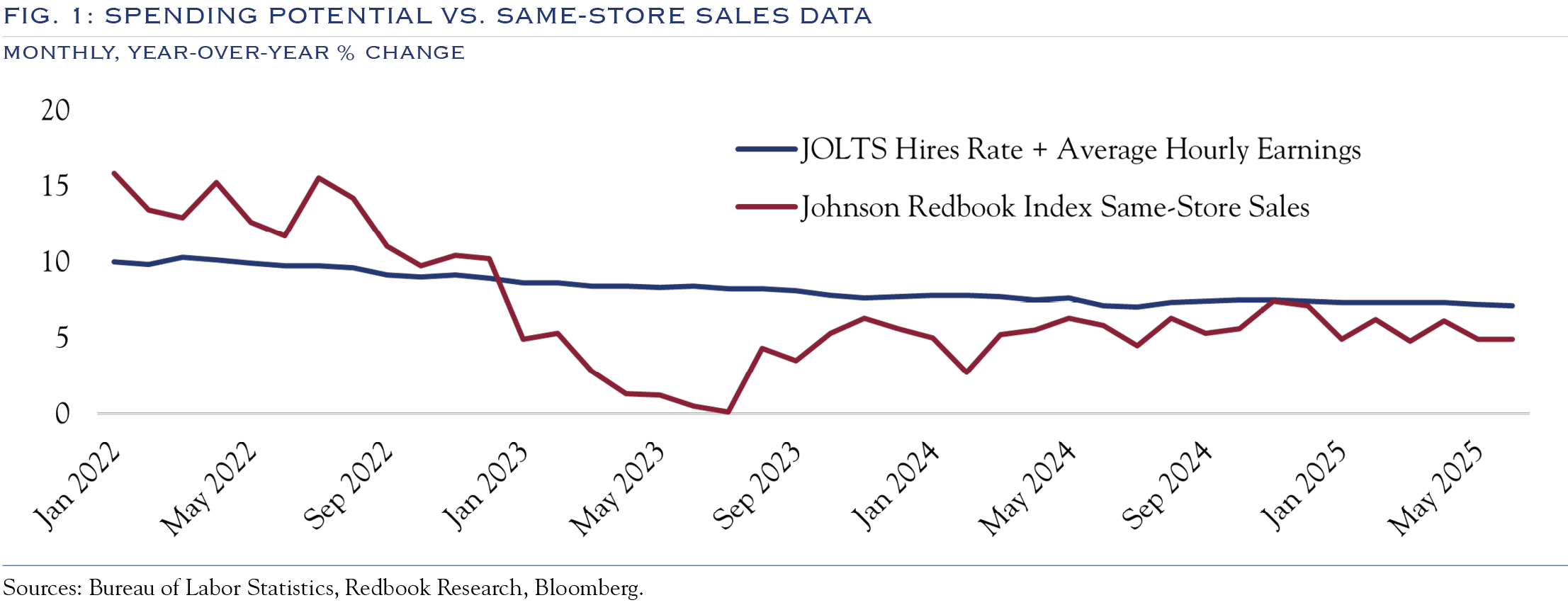

Yes, the economy can avoid recession. Although the policy backdrop has varied throughout the year, the rules of engagement are now largely established. While there will be a drag on growth from tariffs, it will remain manageable through a combination of shifting geographies, substitutions, changing buying patterns (from goods to services), a sharing of burden between importer and exporter, and a sharing of burden between the seller and consumer. According to our calculations, we anticipate a 0.7% drag. With some of the adjustments already having occurred and the economy expanding at a 3.5% rate, according to the Atlanta Fed’s GDPNow metric, we don’t see an imminent recession. At the same time, other policies such as depreciation of capital expenditures will also support growth. With the consumer being the linchpin for economic growth in the United States, we closely monitor a “back of the envelope” metric derived from the JOLTS Hires rate (are there more or fewer people working?) plus change in average hourly earnings (are they being paid more or less?), and comparing that to various “real-time” consumer spending metrics. One long-lived data set is the Johnson Redbook, which pulls weekly retail same-store sales data. Figure 1 is a simple chart showing the spending potential (payroll expansion plus wage expansion) and Johnson Redbook same-store sales data. Recent earnings reports from retail companies are consistent with the trends in the chart.

What will the Fed do next? Extra Credit—How will markets interpret it?

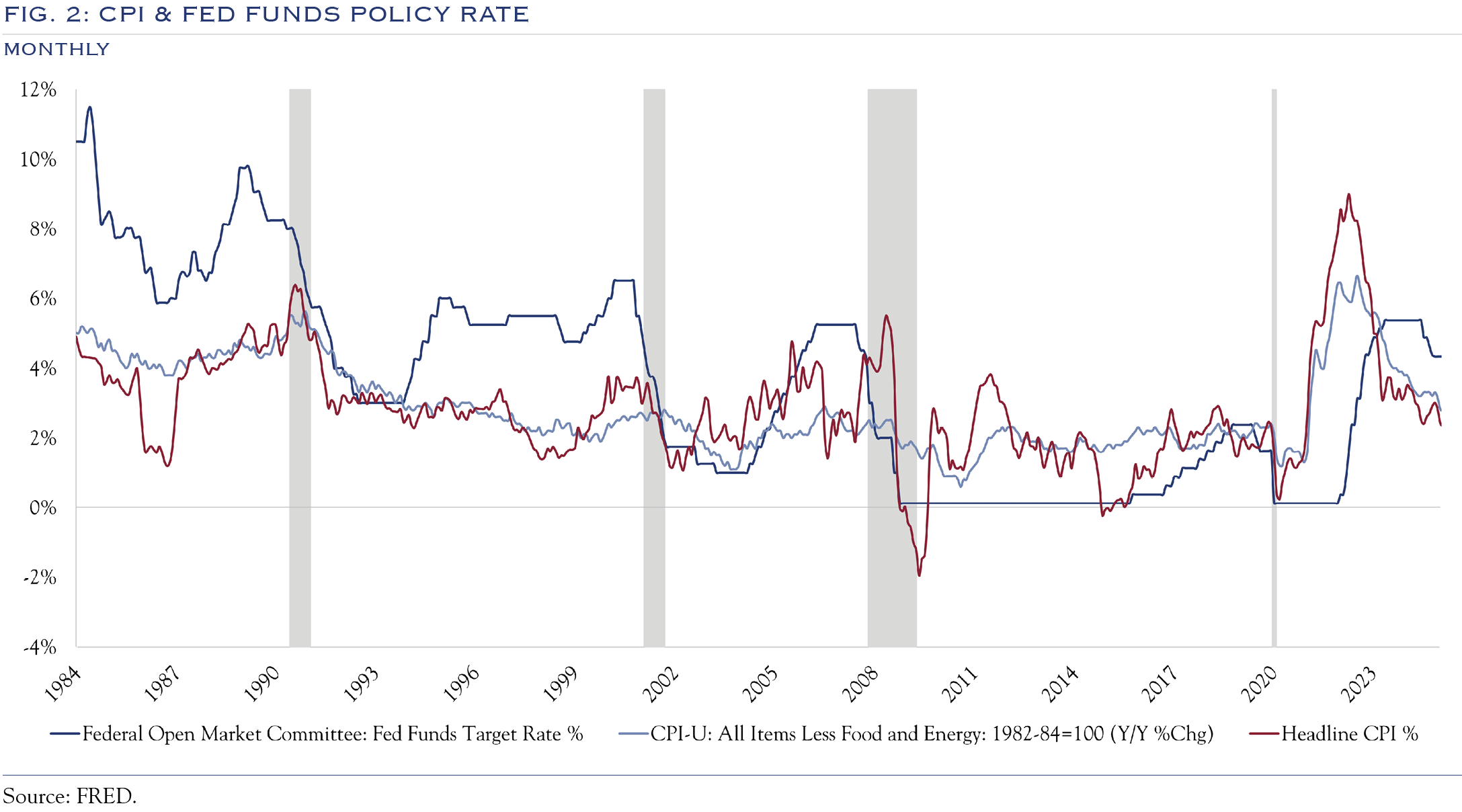

We expect the Fed to cut the Fed Funds rate by 25 basis points in September and then begin a slow process of normalizing policy, ultimately to a rate of 3.00–3.50% over the next 12–18 months.

The Fed delivered its signal from Jackson Hole at the right time. Had they opted to wait longer to signal pending cuts, future policy actions would be deemed reactionary.

Although the labor market is somewhat less robust, the economy is still expanding at a solid rate. Despite a likely tick up in inflation from tariffs, inflation readings have been much more tame than most estimates predicted.

This balanced profile means the window is open for a rate cut to be seen as positive and anticipatory, alleviating restrictiveness and extending the business cycle.

It has been a full 20 years since the Fed had this much ammunition in the form of potential future rate cuts. They needed every basis point to combat the financial crisis. Today, the circumstances are different, and a return to a neutral rate—say 3.0–3.5%—would still provide fuel to extend the current cycle, leaving ample flexibility to deal with future crises. Recall that the Fed had “only” 175 basis points in the tank on the eve of the pandemic.

We anticipate a 100-basis-point reduction over the next 12 months. The most recent example of cuts that were not in the midst of a crisis was the rate cut in 2019, and while it was a minimal data set, it saw 50 basis points of cuts and a subsequent move higher in economic growth.

The signaling of a willingness to act preemptively brings the Fed in sync with markets and sets the stage for a longer positive run for both the economy and equities. We look for stable valuation metrics, continued earnings gains, and a broader market that is willing to consider smaller companies, which require lower financing costs and more robust growth to attract investor attention.

Has AI created a stock market bubble?

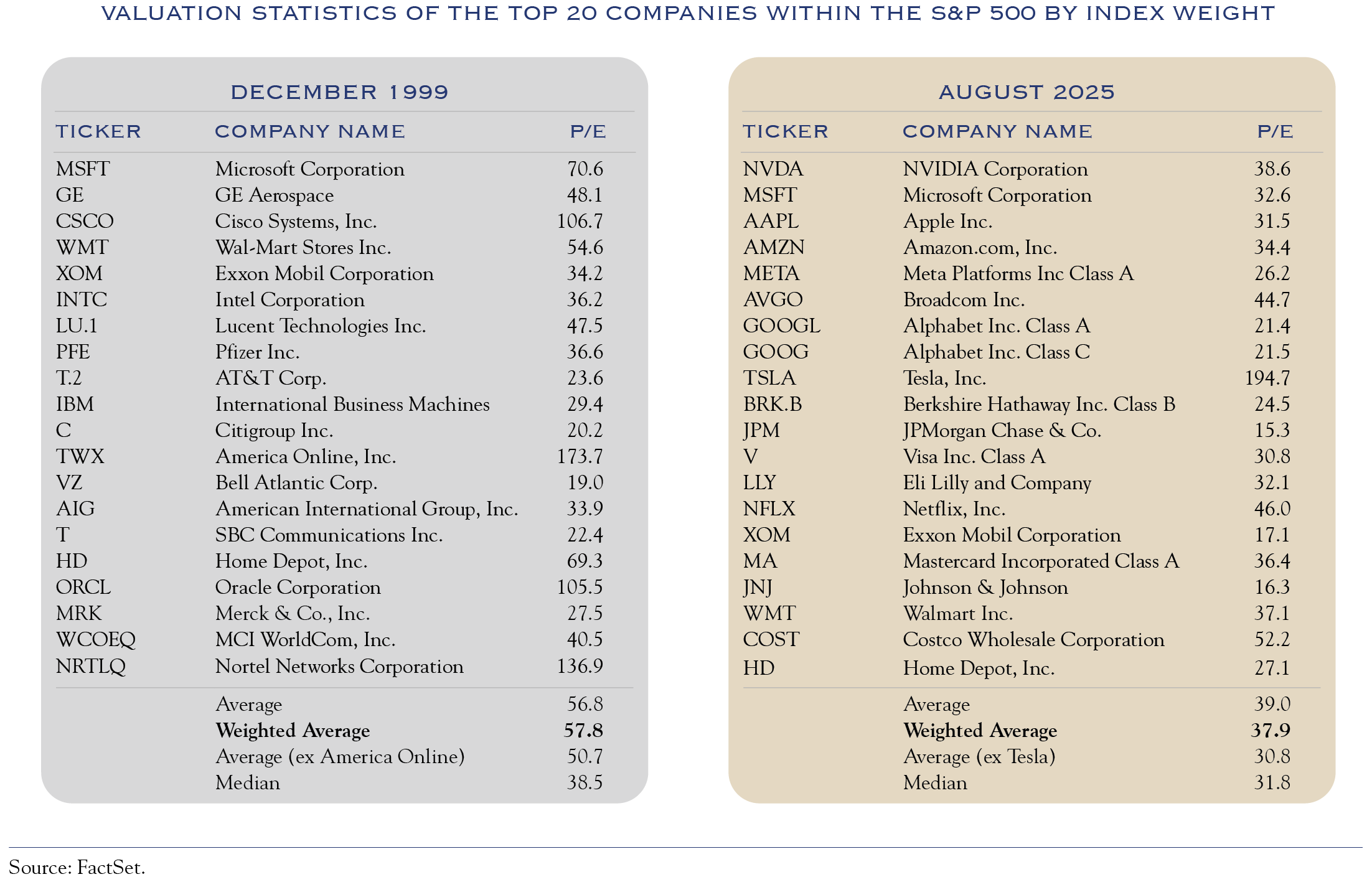

No. While AI has led to an enthusiastic embrace of companies related to the trend, overall market valuations, while elevated, are not excessive, particularly given the current and expected interest rate outlook. In 1999, the P/E ratio on the S&P 500 was 30.2x, while the interest rate on the U.S. Ten-Year Note ranged from 3.8% to 4.3%. Currently, the P/E ratio on the S&P 500 is 24.7x. In 1999, numerous S&P 500 stocks achieved returns exceeding 100%, and three stocks saw returns exceeding 1,000%. The stocks contributing most to the S&P 500’s return in 1999 traded at far higher valuations compared to the top stocks today.

Enthusiasm over productivity and profit margin improvements, a consistently growing economy, and expectations of declining interest rates are boosting valuation enthusiasm to high levels (top 8% vs. the past 30 years). However, these levels are not excessive given the current state of fundamentals. Furthermore, a true bubble is marked by excessive enthusiasm, more similar to metrics seen in 1999. While current valuations are mostly justified, we do observe a juxtaposition of elevated valuations and suppressed volatility. This configuration rewards rebalancing or hedging, even though current market characteristics do not represent a bubble.

Regarding the general enthusiasm for AI and some questioning of its importance, we continue to emphasize that the changes are profound. However, they will play out incrementally in three phases: 1) Chips/Hardware, 2) Scaling/Models, 3) Usage/Implementation. While Phase I is still growing quickly (as per earnings report views on capex), Phase II might be slowing a bit—and that’s okay. AI is already highly capable of many things. Phase III has been slow to unfold, meaning organizations and individuals are only scratching the surface of what can be done.

Outlook

Looking further ahead, we see the primary market narrative being driven by earnings gains. Despite a slowing economy and policy disruptions, second-quarter earnings increased by +11% and were well above expectations. Once again, earnings surprised by a larger magnitude than sales, implying that analysts are underestimating margin expansion. Margin expansion is the key to further earnings gains and stock price appreciation.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC