To borrow from Alice in Wonderland—“If you don’t know where you going, any bond will take you there.”

The role of bonds in a balanced portfolio is especially important during the current period of heightened headline risk and market volatility.

For individual client accounts, there are two primary roles for bonds: generating income and reducing portfolio volatility.

For individual client accounts, there are two primary roles for bonds: generating income and reducing portfolio volatility.

While there is no single prescribed model for the stock/bond mix, historical research has viewed the 60/40 allocation as a conventional asset mix. Clearly, if bonds are to have an impact on dampening the portfolio’s volatility, the allocation should be in a range of 20% to 40% fixed—especially if current income is an important consideration. The recent environment was particularly significant: bonds rallied with interest rates coming down, and equities—most notably technology names—suffered from a repricing of risk.

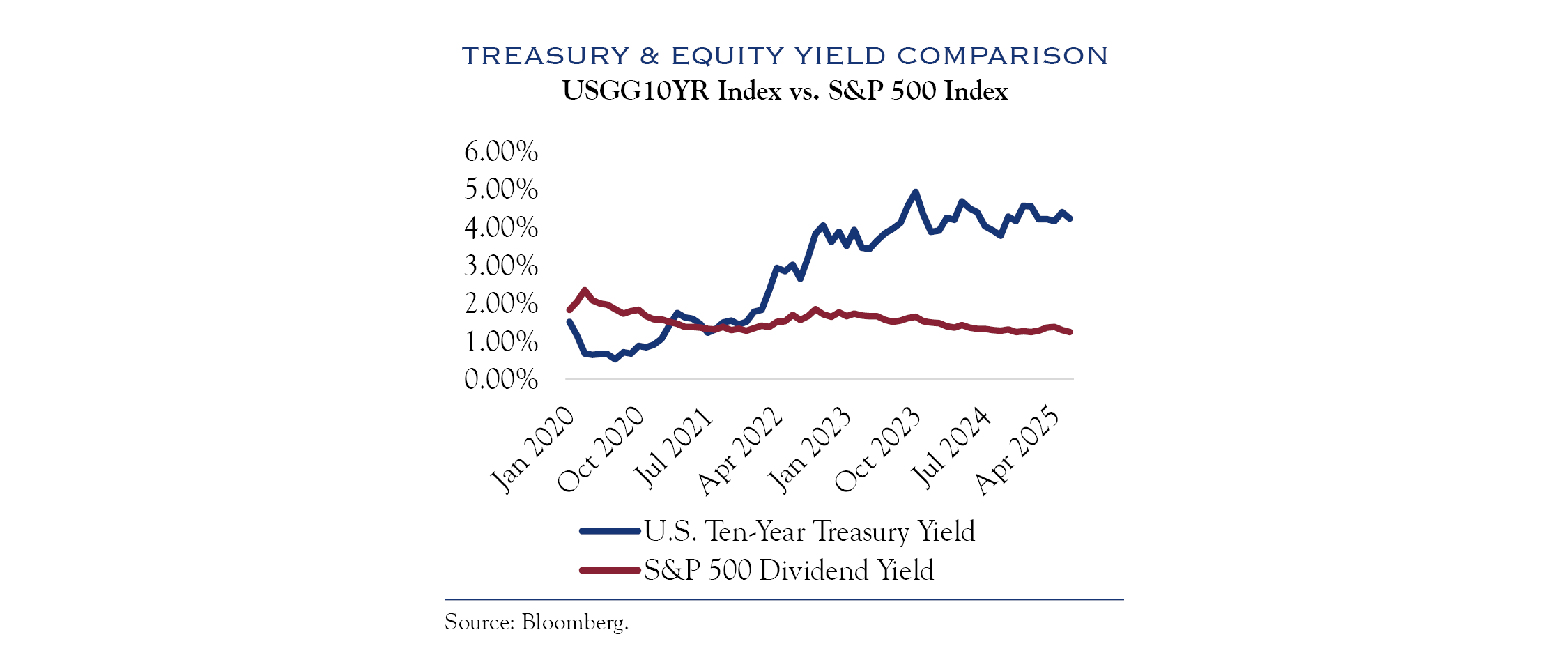

Generating current income is an important objective for most conservative investors, particularly those at or approaching retirement. At the time of this writing, the current yield on a Ten-Year U.S. Treasury is 4.22%, which compares favorably to the 1.24% equity dividend yield on the S&P 500.

At the start of the pandemic, not so long ago, market turmoil drove Ten-Year Treasury yields briefly below 0.60%. Throughout 2021, yields were generally contained in a range between 1 and 2%. This was an unprecedented era of negative “real” yields where the inflation rate exceeded the yield of Treasuries. In other words, Treasury yields were not keeping pace with inflation. This was not a time to lock in yields. A turning point arrived in 2022, as a result of accommodative fiscal and monetary stimulus, when Treasury yields moved to strongly positive levels of real inflation-adjusted rates.

Determining the appropriate asset mix of taxable and tax-exempt requires a careful assessment of client-specific objectives and the balance between risk and reward.

By reinvesting maturing bonds and/or investing cash, it was possible for portfolios to book intermediate-term Treasuries yielding between 4% and 5% or invest in comparable maturity corporate bonds yielding 5% to 6%. Such periods of bond market weakness continue to provide opportunities to fine-tune client portfolios in order to capture attractive real Treasury yields and incremental corporate bond yields.

Clients in higher tax brackets may find that tax-exempt municipal securities provide an after-tax yield advantage compared to U.S. Treasuries and corporate bonds. Determining the appropriate asset mix of taxable and tax-exempt requires a careful assessment of client-specific objectives and the balance between risk and reward.

Liquidity needs should begin with money market funds, followed by Treasury bills and notes, and then extend to corporates and municipals.

Liquidity varies considerably among U.S. Treasuries, corporate bonds, and municipal securities. Liquidity needs should begin with money market funds, followed by Treasury bills and notes, and then extend to corporates and municipals. Smaller denominations of corporate or municipal bond issues tend to be less liquid for secondary holders. Treasuries, by contrast, exhibit substantially greater liquidity compared to corporates and municipals. The absolute size of an issue outstanding and the credit rating of the issuer also contribute to liquidity in the marketplace.

The maturity decision for a portfolio should involve several factors, primary among them being short-term cash needs, such as tax payments and contract closing dates. These near-term obligations can be easily covered with money funds—preferably all U.S. Government funds—and Treasury bills that closely match settlement needs.

Another factor in the maturity decision relates to the “duration” of the portfolio overall. The duration metric measures the sensitivity of the value of a bond to changes in interest rates. The longer the duration of the portfolio, the more susceptible to volatility its bond holdings are to changes in interest rates.

In some instances, there can be value in constructing a portfolio using a “laddered” approach, which provides income as well as a structured set of maturities of individual holdings over time.

A “barbell” approach to fixed income portfolio construction to provides shorter maturities in combination with opportunistic selections at maturity dates further out on the yield curve. Such strategies seek to capitalize on economic developments based on credit, sector, structure, and/or relative value merits.

The appropriate identification of objectives and portfolio construction is paramount to ensuring that a fixed income portfolio is configured to meet client needs for liquidity, portfolio diversification, and income. The intersection of market opportunities and client needs will determine the best approach. Unfolding political and economic developments, both here and overseas, present a timely opportunity to incorporate a well-structured fixed-income allocation into a balanced account.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Cruikshank. No part of Mr. Cruikshank’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC