In this latest issue of Insights, our authors turn to topics central to wealth preservation, financial transitions, portfolio construction, and building enduring legacies.

Introduction

Richard R. Hough III

Chairman and CEOIn this latest issue of Insights, our authors turn to topics central to wealth preservation, financial transitions, portfolio construction, and building enduring legacies.

Managing Director Chip Kelleher’s “Family Leadership: Moving Beyond Management to Legacy” lays out how strong family leadership rooted in culture, communication, and shared responsibility can transmit a mission across generations.

In “The Ownership Mindset: Investing for the Long Term,” Jay Dunn, Managing Director and Senior Equity Analyst, explores how the principles of private business owners—such as patience, capital discipline, and a focus on intrinsic value—can lead public market investors through short-term volatility toward long-term success.

Scott Brown, Managing Director and Portfolio Manager, discusses brokerage transitions in “Is My Portfolio for Sale?” From his experiences with clients, he details the costs, risks, and questions that investors must consider when facing advisor movement and sales-driven portfolio structures.

In “Fixed Income: One Size Doesn’t Fit All,” Ernie Cruikshank, Senior Advisor at Silvercrest, discusses the changing role of bonds in portfolio construction. He outlines income and volatility management strategies across tax brackets and market cycles, with guidance on structure, liquidity, and duration.

Finally, in “Beyond Asset Allocation: The Importance of Asset Location,” Portfolio Manager Brandon Sim presents a framework for optimizing investment placement. Brandon looks into why tax efficiency, liquidity needs, and time horizon must guide where assets are held, not just what assets are owned.

Thank you for joining us for another edition of Insights. We are grateful to be able to share our thinking with you.

Economic & Market Overview

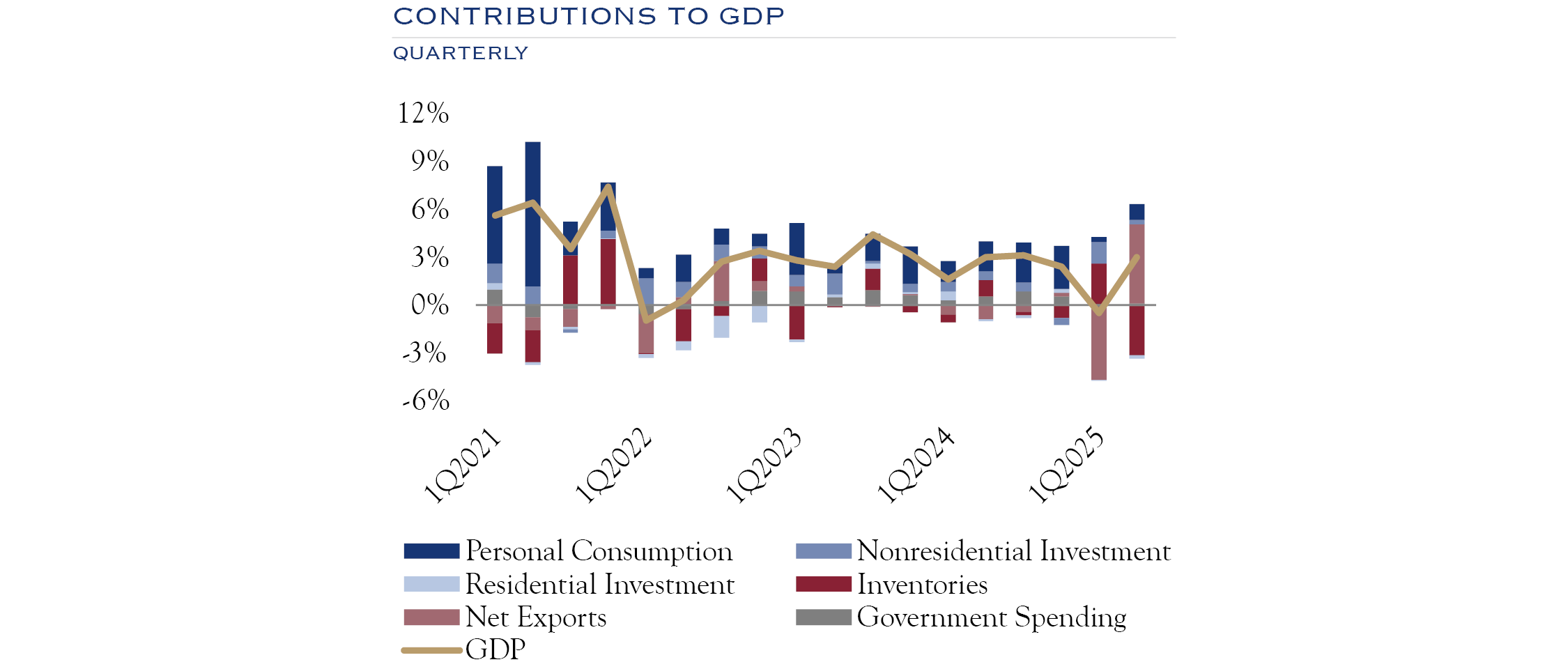

Sources: Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

- The economy remains solid, with growth averaging 3.0% since the beginning of 2021, though the expansion rate is slowing a bit.

- While consumption slowed in 1Q 2025, it continues to drive the majority of economic growth and is powered by a solid labor market.

- Inventories rebounded (likely due to tariff worries) while Net Exports dragged on economic growth in 1Q 2025. This will likely reverse somewhat in future quarters.

- Overall, turbulence should settle down as the year progresses. While growth has slowed, the economy continues to expand.

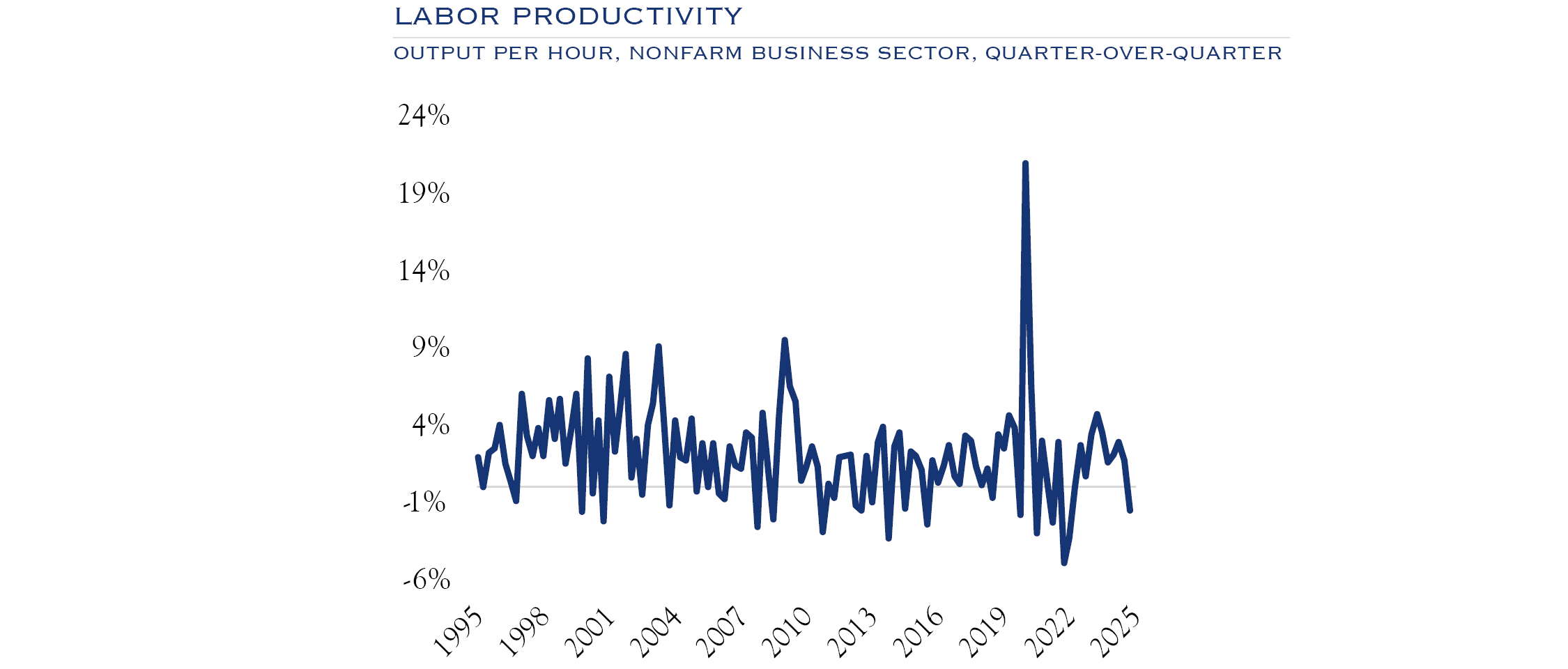

Source: Bureau of Labor Statistics.

- The data over the past 30 years show a stable productivity backdrop, with volatility around recessions. In the 1990s, there was a burst of non-recession productivity. Productivity trends should trend higher in the years ahead.

- The catalysts for better productivity are threefold: 1) a slower growth economy requires productivity to boost profits, and dynamic companies will seek out these gains; 2) the pandemic triggered a long-overdue work process review at many organizations; and 3) developments in AI and robotics have the potential to produce significant and widespread gains.

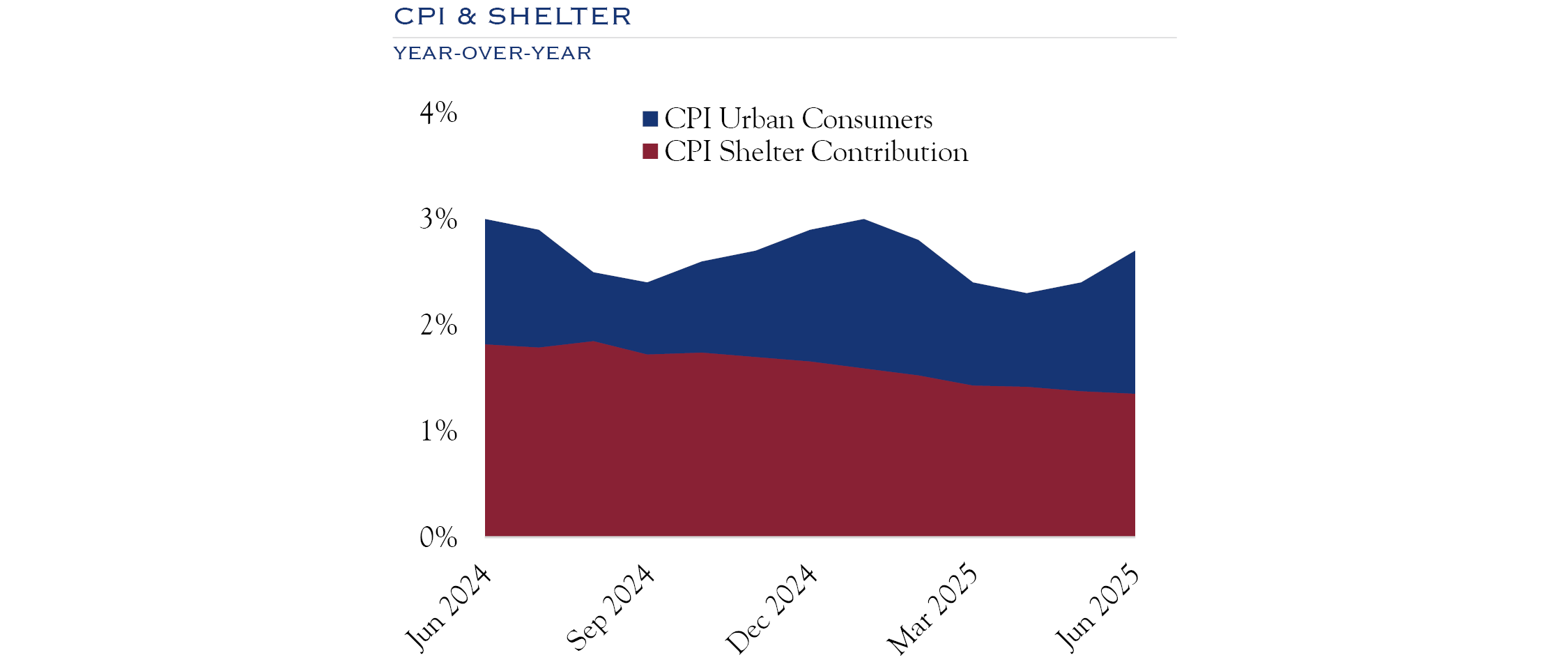

Source: Bureau of Labor Statistics.

- CPI is currently at 2.7%. Shelter, a 36% weighting, continues to be the primary driver of inflation over the last 12 months.

- The Shelter component of CPI is made up of two items. First, Rent of Primary Residence, which, simply put, is the cost of renting a residence. This metric accounts for around 7.6% of Shelter’s weighting in CPI. The second is Owners’ Equivalent Rent, which refers to the amount of rent that a homeowner would be paid if they rented out their home in the market. This metric accounts for around 26.8% of Shelter’s weight.

- With homeowners and renters staying put for various reasons, the specific methodology of calculating shelter CPI has kept inflation above the Fed target of 2.0%.

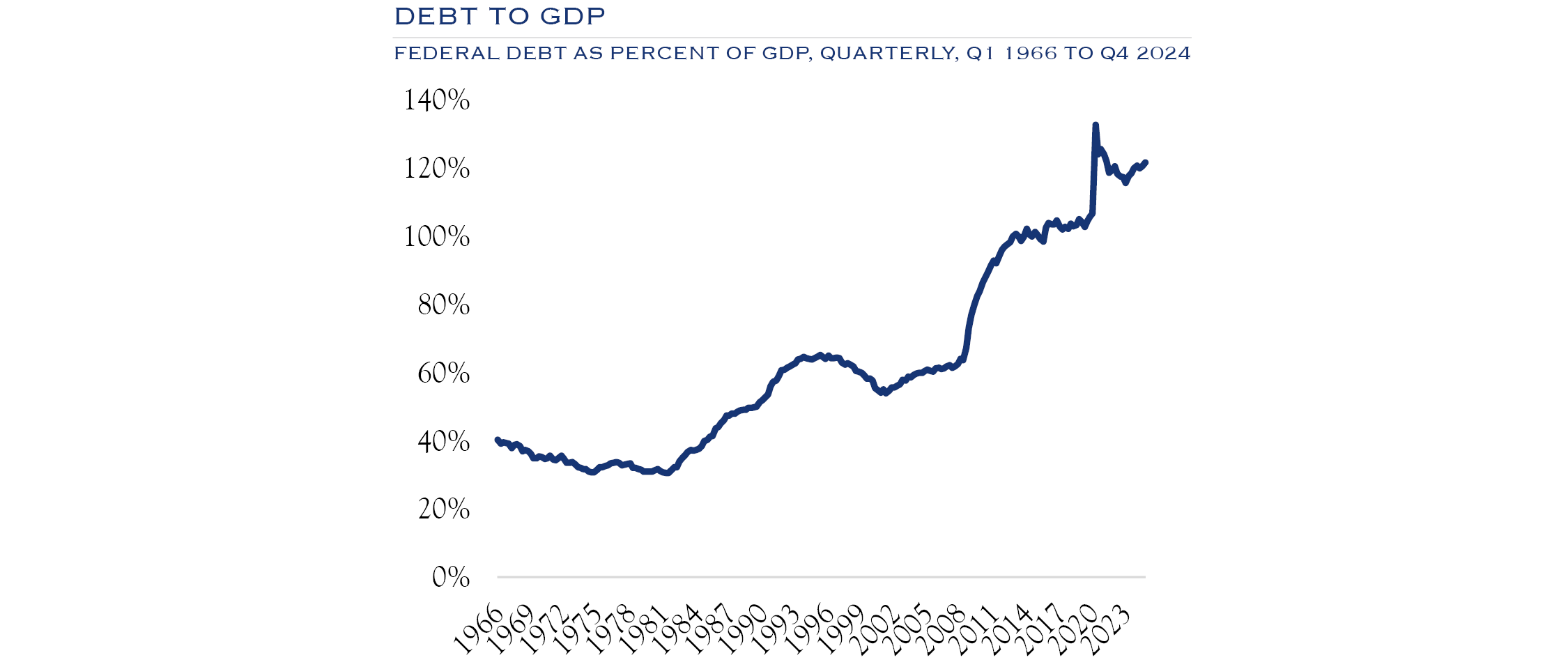

Source: White House Office of Management and Budget.

- The debt-to-GDP level has risen over time as each new crisis has added to aggregate debt levels.

- With a high proportion of spending coming from areas that are politically difficult to reduce, deficit spending continues to add to debt levels.

- While the debt level continues to expand, continued economic growth will help keep this metric tolerable. The administration seems to be seeking to increase growth rates as one tool to help manage the level of debt/GDP.

- While it would likely only come to fruition with the pressure of a crisis, bipartisan action could also temper the debt growth rate.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC

Chip Kelleher

Managing DirectorFamily Leadership: Moving Beyond Management to Legacy

A true legacy requires moving beyond management and tending to a culture of family leadership that transfers not just assets but also purpose, responsibility, and vision.

read the insight

James A. Dunn, Jr.

Managing Director, Senior Equity AnalystThe Ownership Mindset: Investing for the Long Term

Adopting the perspective of purchasing an entire business, rather than a ticker symbol, allows you to see beyond short-term noise and focus on underlying business fundamentals.

read the insight

Scott Brown, Jr.

Managing Director, Portfolio ManagerIs My Portfolio For Sale? Understanding Broker Transitions

Broker transition is a common practice, and it is not unusual for a successful brokerage team to work for several firms over the course of a career. As long as Wall Street has an insatiable appetite for growth, lucrative deals will continue to entice advisors to port their clients to new firms.

read the insight

Ernest Cruikshank

Senior AdvisorFixed Income: One Size Doesn’t Fit All

The role of bonds in a balanced portfolio is especially important during the current period of heightened headline risk and market volatility.

read the insight

Brandon C. W. Sim

Portfolio ManagerBeyond Asset Allocation: The Importance of Asset Location

While each client’s goals are unique, three factors consistently guide effective asset location decisions: tax efficiency, liquidity requirements, and the investment time horizon.

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Equities

While valuation levels are elevated, equities are expected to generate returns of 7.5% annualized over the next three years and maintain a slight +5% overweight vs. the benchmark.

Growth & Value

We generally recommend a balanced allocation to both growth and value-oriented investments. Growth stocks, while expensive, provide earnings growth in a low-growth environment. Value stocks are exposed to areas that should benefit from stable employment, expansion in domestic manufacturing, and strong fiscal spending.

Given the powerful wave of technological change, company-specific factors will be more determinative of results than “growth” or “value” designations. Each category offers a robust opportunity set, and stock selection will be more determinative than a particular style bias.

Small Cap & Large Cap

We recommend overweighting small-cap equities relative to their benchmarks, as they stand to benefit from increased M&A activity, the eventual easing of interest rates, onshoring, and the potential productivity gains from new technology.

U.S. & Non-U.S.

We favor a small allocation to non-U.S. stocks for U.S.-focused clients given the weaker growth in other developed markets, inconsistent emerging economies, and continued geopolitical uncertainty. However, international markets offer good opportunities for active managers to outperform compared to U.S. large-cap managers, and in international equities, the valuation discount remains compelling, justifying a broadly neutral weighting.

Fixed Income

We expect a slow path to lower rates. Things have been slowing down slightly, but in a barely noticeable way. The inflation environment is manageable at the moment. The jobs and consumer data we track are around normal, although more recently they have been slightly decelerating. There has been some volatility for bonds, with rates trading in a wide range. The Fed and the market continue to be heavily data-dependent. Markets have reacted quickly, although companies are starting to push forward with plans rather than waiting for clarity. Overall, this is a good scenario as rate pressure will eventually be alleviated, with the economy still on solid ground.

Market Monitor

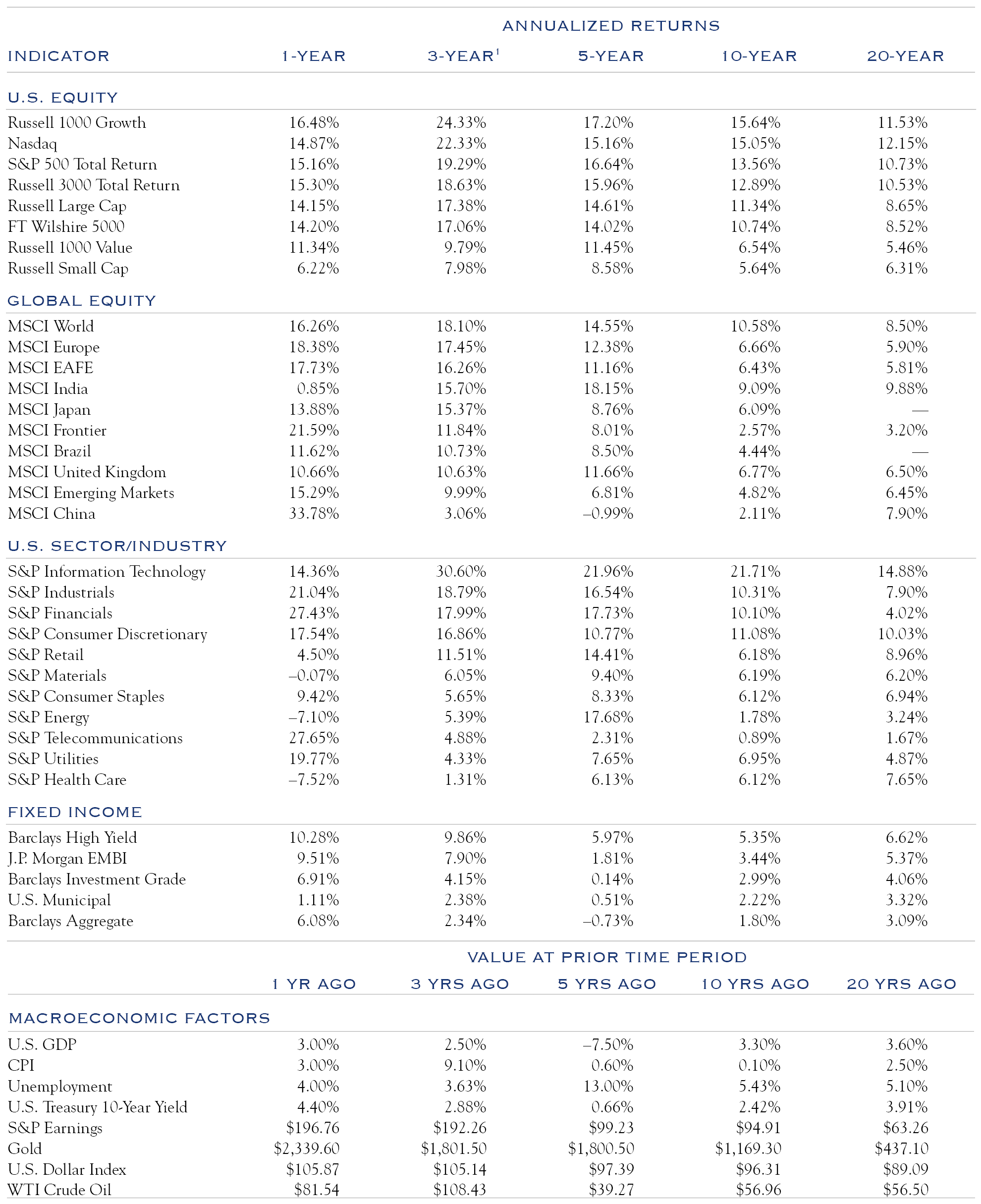

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 6/30/2025.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by the Investment Policy & Strategy Group. No part of the members of the Investment Policy & Strategy Group’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC