In this issue of Insights, our team examines key forces shaping today’s investment landscape. We explore evolving portfolio styles, valuation trends, technological innovation, and the outlook for global energy.

Introduction

Richard R. Hough III

Chairman and CEOIn this issue of Insights, our team examines key forces shaping today’s investment landscape. We explore evolving portfolio styles, valuation trends, technological innovation, and the outlook for global energy.

Elinor Ouyang, who leads Silvercrest’s portfolio analytics, writes “When the Map Changes: Style Labels in a Shifting Market Landscape.” She explains how shifts in market structure, index methods, and company fundamentals have blurred the lines between value and growth investing. In the end, a strong investment philosophy and disciplined process remain the best guides for choosing managers.

Our chief investment strategist, Robert Teeter, contributes “Evaluating Valuation: Historical Context & Modern Factors.” He reviews valuation’s role in equity markets, noting that it is an imprecise but vital tool. He concludes current valuations appear reasonably supported, and he expects future stock returns to rely more on earnings growth than rising multiples.

Senior analyst Marcus Viscichini addresses technology’s effects in “AI & The Labor Market: The Slow & Uneven Process Already Underway.” Drawing on academic studies and recent labor data, he shows how artificial intelligence is reshaping tasks and careers—without causing widespread job loss.

Finally, Roger Rama, portfolio manager for several of our U.S. Growth strategies, covers “The Nuclear Renaissance: Producing Clean Energy and Powering the Digital Age.” Roger highlights nuclear energy’s comeback, driven by rising global power needs and artificial intelligence’s growth. Advances in reactor design, greater safety, and supportive policies position nuclear as a vital source of reliable, low-carbon energy.’

Thank you for reading this edition of Insights. We appreciate the opportunity to share our views with you.

Economic & Market Overview

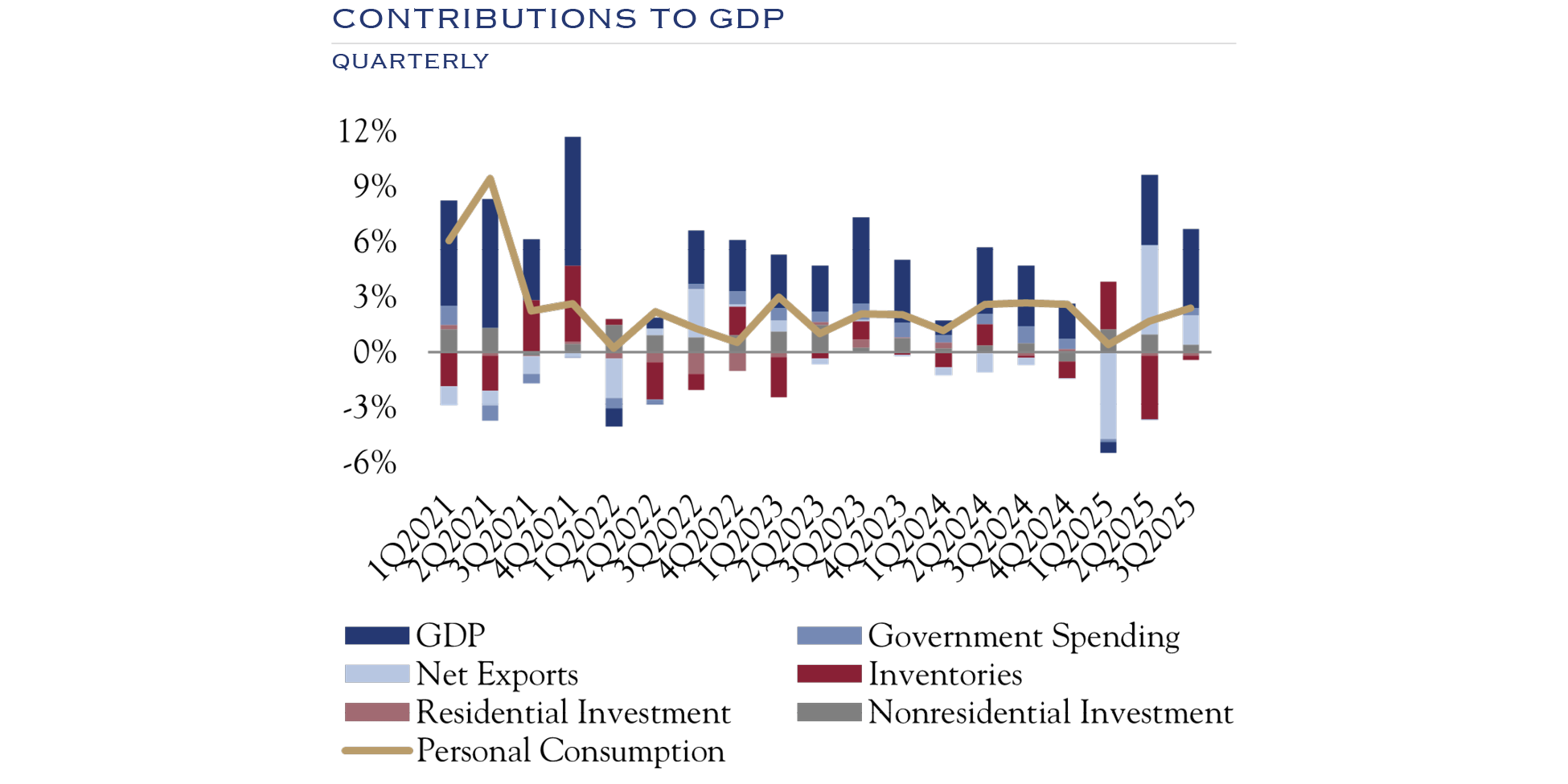

Sources: Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

- The economy remains solid, with growth averaging 3.0% since the beginning of 2021, though the expansion rate is slowing a bit.

- While some labor market data have been interrupted by the government shutdown, it appears that hiring has continued at a modest rate while layoffs have not accelerated.

- Inventories have come down while Net Exports have accelerated on economic growth in 3Q 2025.

- Overall, turbulence should settle down as 2026 progresses. While growth has slowed, the economy continues to expand.

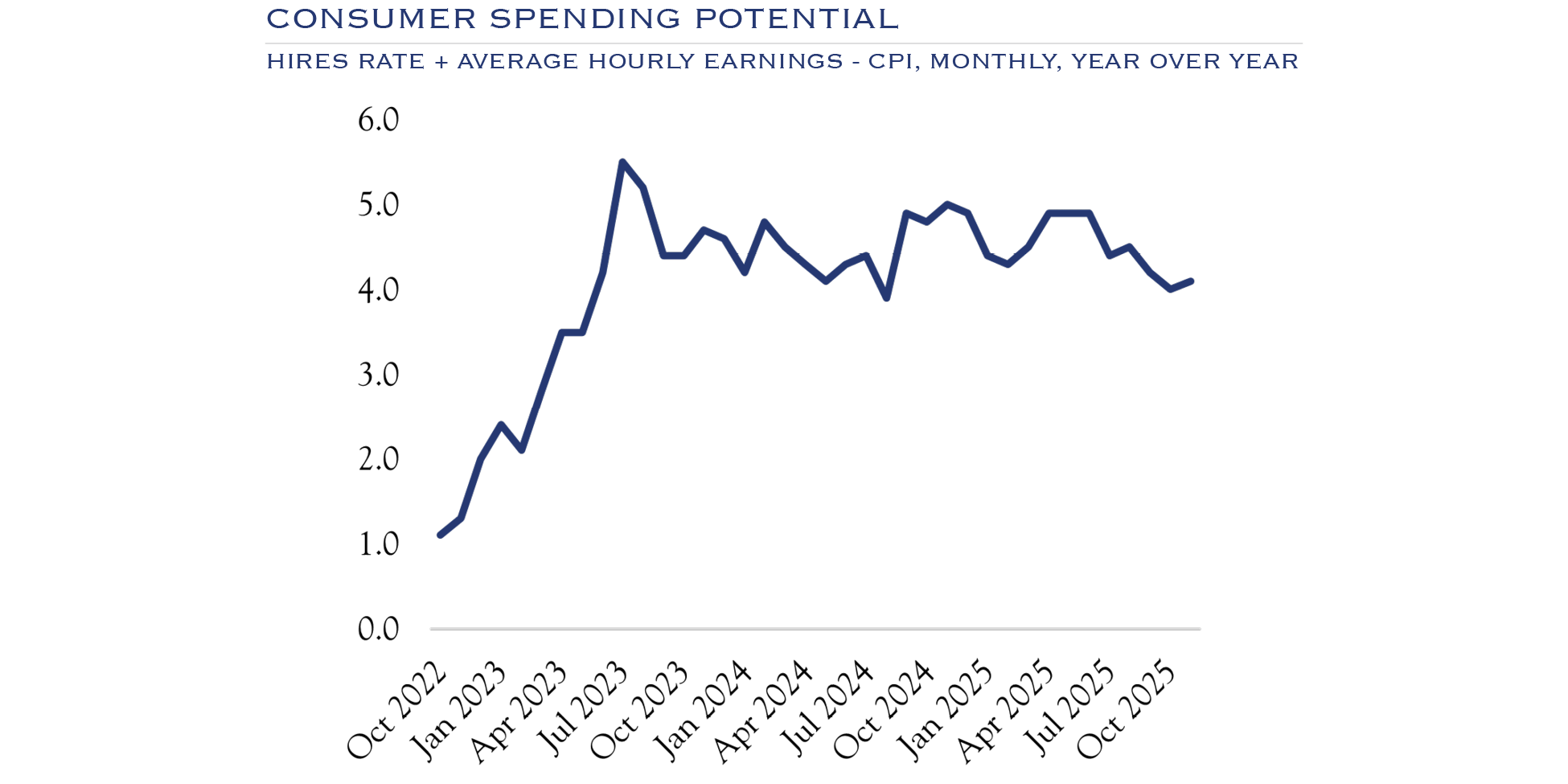

Sources: Silvercrest, Bureau of Labor Statistics.

- Our simple model combines the rate of payroll expansion, change in wages, and inflation as an estimate of the potential to spend for the U.S. consumer. Consumers have an additional 4% of spending potential compared to the prior year.

- Another way of describing the current drivers of economic growth comes from Gregory Daco, Chief Economist at EY Parthenon and President of the NABE, who says the economy is running on “three A’s”: affluent consumers, AI enthusiasm, and asset price gains. Since those three elements are tightly linked, broader-based job and wage gains would provide additional support to the economy. Conversely, an equity market decline could create a drag on economic growth.

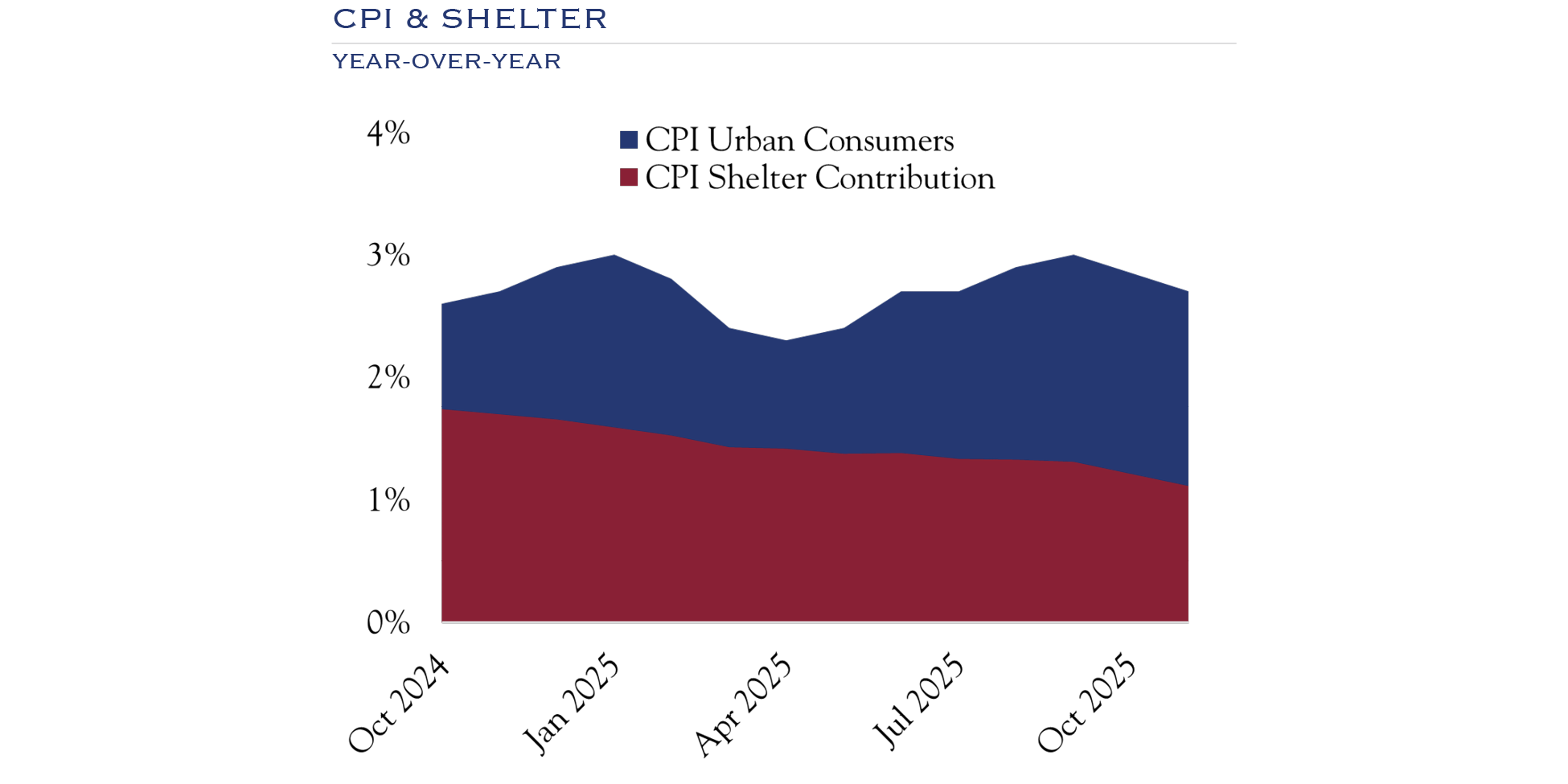

Source: Bureau of Labor Statistics.

- CPI is currently at 2.7%. Shelter, which carries a 36.7% weighting, remains the primary driver of inflation over the last 12 months.

- The Shelter component of CPI is made up of two items. First, Rent of Primary Residence, which, simply put, is the cost of renting a residence. This metric accounts for around 7.75% of Shelter’s weighting in CPI. The second is Owners’ Equivalent Rent, which refers to the amount of rent that a homeowner would receive if they rented out their home at market rates. This metric accounts for around 27.1% of Shelter’s weight.

- With both homeowners and renters staying put for various reasons, the specific methodology of calculating shelter CPI has kept inflation above the Fed target of 2.0%.

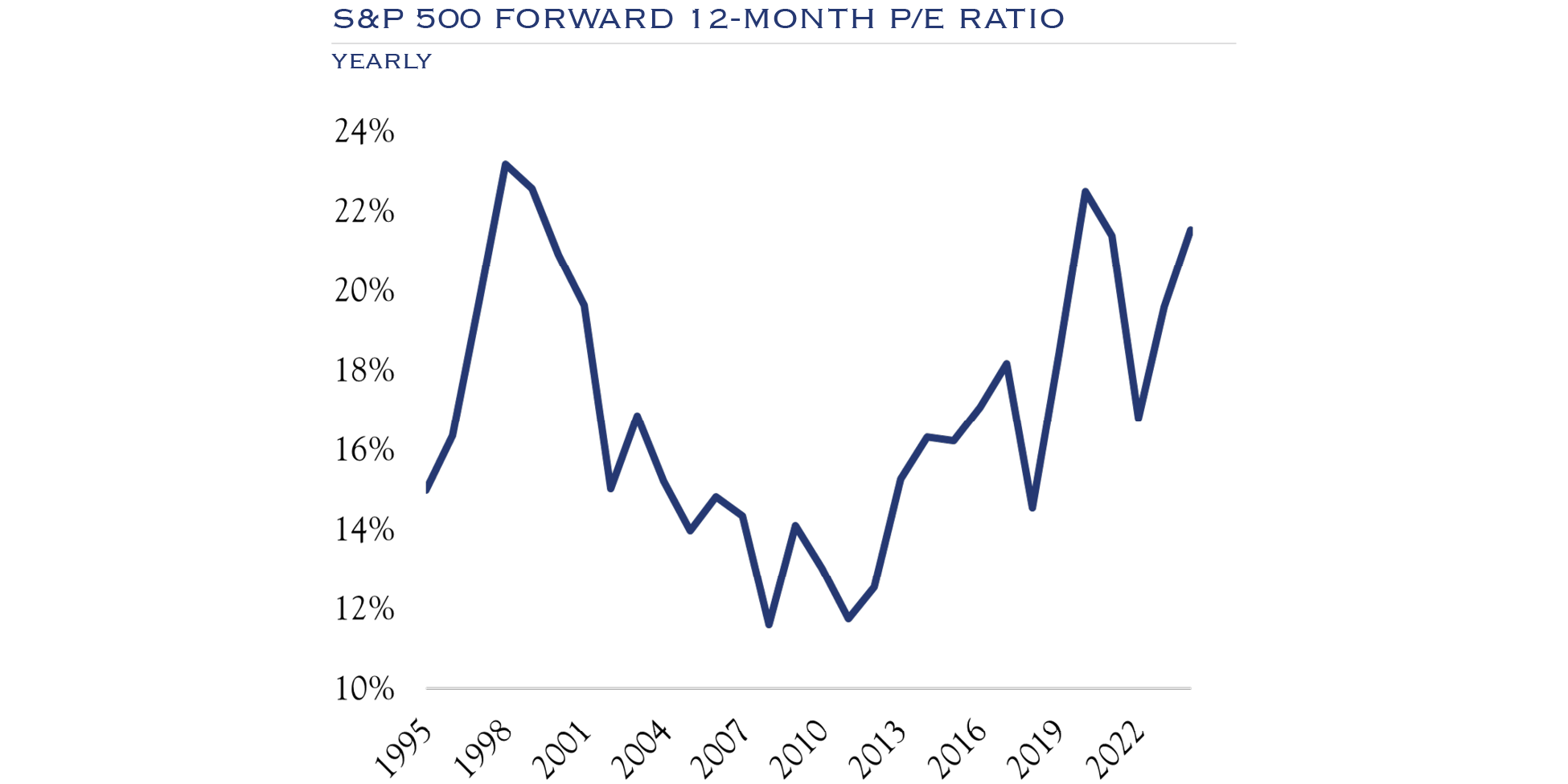

Source: Bloomberg.

- In the short term, an important constraint for further equity appreciation is valuation levels. The forward P/E ratio on the S&P 500 has rarely been higher. While valuations are likely to remain supported by a stable economy and a gradual easing of the Fed Funds rate, the P/E ratio embeds a fair amount of good news. This situation sets up the risk of disappointment, as good news might not be good enough. It is possible that valuations could stretch even higher, though this would require enthusiasm matched only by the greatest market peaks of all time.

- While valuations are a constraining factor, earnings growth will continue to power stocks higher.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC

Elinor Ouyang, CFA, FRM

Head of Portfolio Analytics, Portfolio ManagerWhen the Map Changes: Style Labels in a Shifting Market Landscape

Labels such as value, growth, and core offer a convenient asset allocation framework, but they are simplifications, not a full representation of what managers actually own.

read the insight

Robert R. Teeter

Managing Director, Chief Investment StrategistEvaluating Valuation: Historical Context & Modern Factors

The common expression, “valuation is a terrible timing tool,” is a great way to describe how valuation metrics are informative but not predictive.

read the insight

Marcus Viscichini

Senior AnalystAI & The Labor Market: The Slow & Uneven Process Already Underway

How is artificial intelligence affecting the labor market? By linking theory, transition, and observed outcomes, three research papers help shed light on this question.

read the insight

Roger Rama, CFA

Managing Director, Portfolio ManagerThe Nuclear Renaissance: Producing Clean Energy & Powering The Digital Age

As the demand for clean, reliable power intensifies, nuclear energy—long viewed with skepticism—is being reborn as a cornerstone of the global transition.

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Equities

Continued gains in equities are expected, driven primarily by earnings growth, which will be powered by profit margin expansion. Over the past several years, corporate America has been especially dynamic in adapting to massive change. This dynamism, along with advances in technology, should drive higher profits, with stocks following suit. However, given the elevated state of valuation, risk and reward have become more balanced, and we recommend a posture that is near target ranges for exposure.

Growth & Value

We continue to advocate for a balanced approach between growth and value. The degree to which individual companies can adapt to a rapidly changing environment is more likely to determine success than their designation within benchmark indices. The economy should remain on solid ground, neither accelerating nor falling into recession, so a balance between cyclical and less cyclical components is warranted. Additionally, the degree of exposure to the AI theme has emerged as a new and powerful factor that cuts across value and growth.

Small Cap & Large Cap

Large-cap companies will continue to benefit from their scale, including access to capital markets, the ability to invest in new technologies, and the recipients of index flows. We have maintained and will continue to maintain an outsized allocation to smaller companies. As noted above, the valuation gap, diversification benefit, opportunity for profit expansion as the AI wave unfolds, M&A environment, and tailwinds from eventual rate cuts present a compelling mix.

U.S. & Non-U.S.

We maintain our diversified posture across geographies. Valuation and growth opportunities exist across a broad range of industries, regions, and countries, and we rely on active management to identify these opportunities. Currency should be largely neutral, with a stable to slightly declining U.S. dollar, although the U.S. has an edge over most developed markets due to better demographics and expected growth. Pockets of emerging markets also offer solid growth prospects.

Fixed Income

Credit

We emphasize extreme selectivity with credit risk. Security selection is paramount, with active management as a critical component of avoiding potential problems. We favor more liquidity and higher quality within the credit space. A recent Bloomberg story highlighted the range of prices used by various market participants for the same loan. Given the massive growth in private funding markets against a mostly benign backdrop and with interest rates remaining stubbornly high, it is no surprise that some situations have gone haywire. Our work has consistently emphasized the importance of diligent credit underwriting and security selection, rather than generic and broad exposure.

Rates

Interest rates for the U.S. 10-Year Note will generally follow the path of Fed policy for the foreseeable future. This means that rates will decline, but slowly. Fed policy is constrained by stubborn inflation and a steady but weakening job market. So long as inflation and employment remain mostly stable, rate pressure will ease slowly.

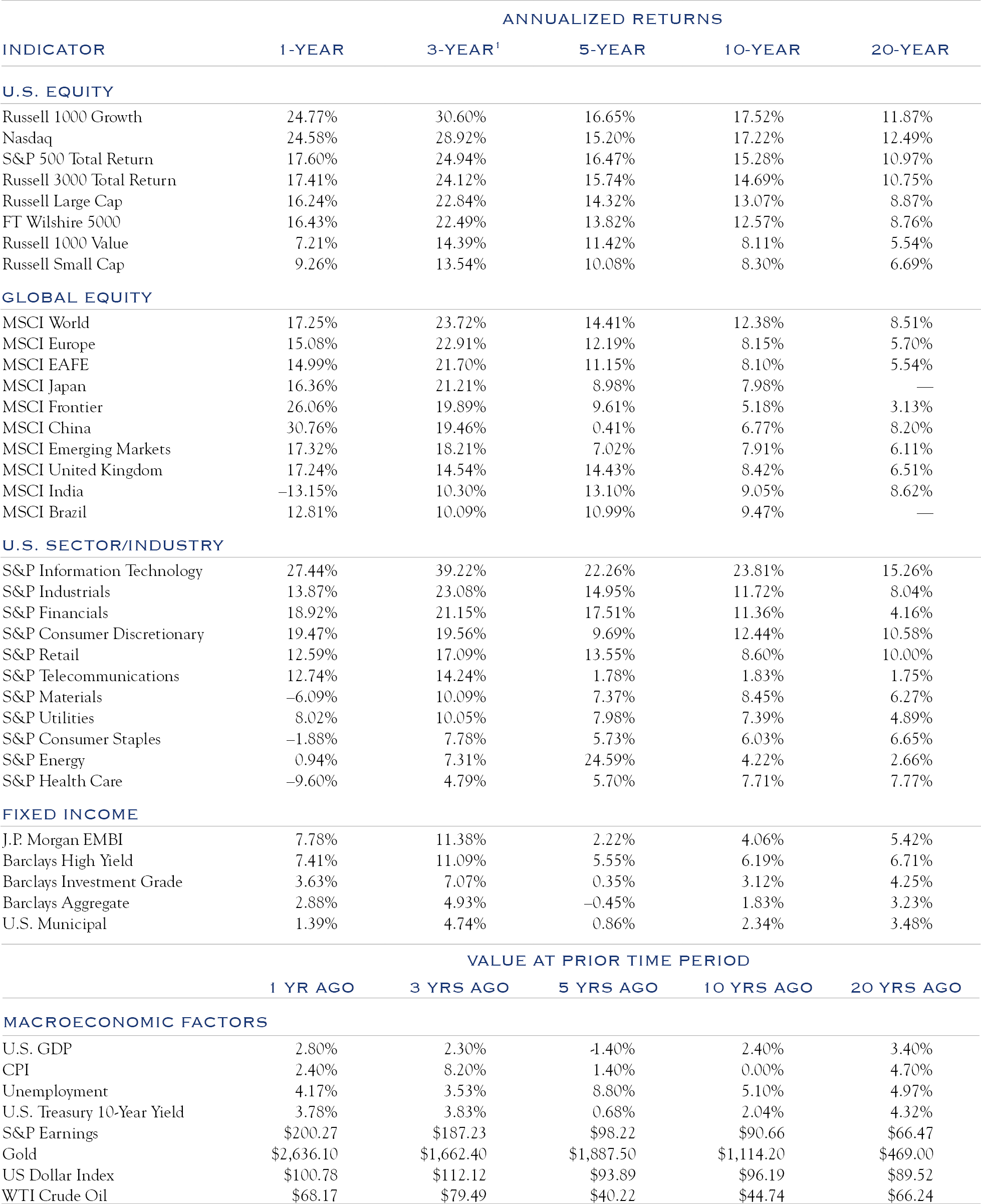

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 9/30/2025.

This document has been prepared without consideration of the investment needs, objectives or financial circumstances of any investor. Before making an investment decision, investors need to consider, with or without the assistance of an investment advisor, whether the investments and strategies described or provided by Silvercrest, are appropriate, in light of their particular investment needs, objectives and financial circumstances. Furthermore, this document is for information/discussion purposes only and does not and is not intended to constitute an offer, recommendation or solicitation to conclude a transaction or the basis for any contract to purchase or sell any security, or other instrument, or for Silvercrest to enter into or arrange any type of transaction as a consequence of any information contained herein and should not be treated as giving investment advice.

This communication was not intended or written to be used, and cannot be relied upon, by any taxpayer for the purposes of avoiding any U.S. federal tax penalties. The recipient of this communication should seek advice from an independent tax advisor regarding any tax matters addressed herein based on its particular circumstances. Investments with Silvercrest are not guaranteed. Although information in this document has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness, and it should not be relied upon as such. All opinions and estimates herein, including forecast returns, reflect our judgment on the date of this report, are subject to change without notice and involve a number of assumptions which may not prove valid.Investments are subject to various risks, including market fluctuations, regulatory changes, counterparty risk, possible delays in repayment and loss of income and principal invested. The value of investments can fall as well as rise and you may not recover the amount originally invested at any point in time. Furthermore, substantial fluctuations of the value of the investment are possible even over short periods of time. Further, investment in international markets can be affected by a host of factors, including political or social conditions, diplomatic relations, limitations or removal of funds or assets or imposition of (or change in) exchange control or tax regulations in such markets. Additionally, investments denominated in an alternative currency will be subject to currency risk, changes in exchange rates which may have an adverse effect on the value, price or income of the investment. This document does not identify all the risks (direct and indirect) or other considerations which might be material to you when entering into a transaction. For certain investments, the terms will be exclusively subject to the detailed provisions, including risk considerations, contained in the Offering Documents. Review carefully before investing.

This publication contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. The forward-looking statements expressed constitute the author’s judgment as of the date of this material. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Therefore, actual results may vary, perhaps materially, from the results contained herein. No representation or warranty is made by Silvercrest as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. We assume no responsibility to advise the recipients of this document with regard to changes in our views.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by the Investment Policy & Strategy Group. No part of the members of the Investment Policy & Strategy Group’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed.

© Silvercrest Asset Management Group LLC