Adopting the perspective of purchasing an entire business, rather than a ticker symbol, allows you to see beyond short-term noise and focus on underlying business fundamentals.

Investing in publicly traded businesses can be a highly emotional endeavor. The stock market is rife with volatility and short-term noise that have little impact on what truly matters—the intrinsic value of your stake in a business. News headlines, quarterly earnings surprises, and constant market gyrations can lead the mind in many directions, often not the correct one. A time-tested approach to investing in public companies is to think and act like a private business owner. An ownership mindset suggests that shareholders do not just “rent” shares but own a stake in the enterprise, aligning with the business’s long-term prospects. Adopting the perspective of purchasing an entire business, rather than a ticker symbol, allows you to see beyond short-term noise and focus on underlying business fundamentals.

How Owners Create Long-Term Value

A private business owner measures success in years rather than days or months. Patience and long-term commitment are essential. The same applies to shareholders of publicly traded companies. An astute owner focuses on the long-term growth of intrinsic business value rather than daily fluctuations in perceived value. Maintaining a long-term investment perspective promotes rational decision-making and prevents impulsive reactions that can lead to detrimental results.

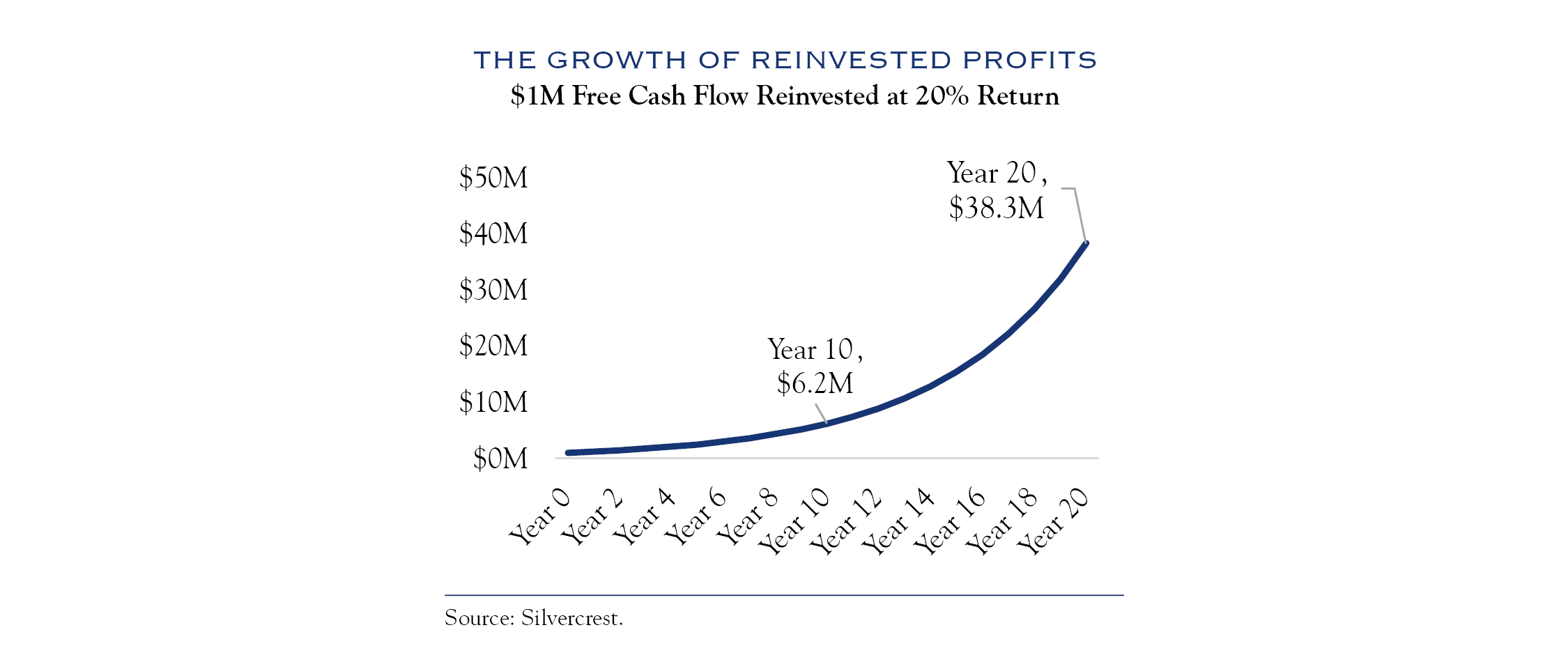

This mindset naturally aligns with harnessing the power of compounding. Compounding becomes exponentially more powerful over time as perpetually reinvested profits generate additional returns on top of the preceding period’s capital. Private business owners typically reinvest profits into improving products, expanding market share, or developing new revenue streams, gradually creating a flywheel effect that drives exponential growth. When companies reinvest cash profits at high rates of return, the intrinsic value of your investment can grow substantially over many years, illustrating the remarkable impact of compounding. The math is simple: if a company generates $1 million in free cash flow (FCF) and repeatedly reinvests 100% at a 20% return on that incremental investment, its FCF reaches approximately $6.2 million after ten years. In twenty years, it will become $38.3 million. Intrinsic value tends to follow along; over the long term, price and value will eventually meet at the same destination. This reinforces the discipline to stay focused on business fundamentals. Ultimately, companies that compound in value year after year will reward the patient investor.

If you owned a private bakery or a software startup, you would carefully track the drivers of business value—sales growth, operating margins, customer satisfaction, and operational efficiency. Likewise, if you are a public market investor with an ownership mindset, your focus would be on your holdings’ long-term prospects and economic health. Metrics like return on invested capital, reinvestment opportunities, and durability of the economic moat become more relevant performance measures than daily stock quotes.

Spending discipline is second nature to private business owners. From reinvesting for growth to distributing profits or repurchasing shares, each decision matters. An owner mindset in the stock market similarly demands a thorough understanding of capital allocation. Does management reinvest cash profits into promising projects that generate high returns on the capital deployed? Are they wisely returning excess capital to shareholders? A company’s allocation strategy offers valuable insight into its long-term potential.

Private companies often develop shareholder-oriented cultures. They reinvest profits thoughtfully, avoid wasteful spending, and maintain a long-term outlook. Public company investors should prioritize businesses with similar characteristics: cost discipline, willingness to reinvest to widen their moat, and treating shareholders as partners. Shareholder letters and conference calls can reveal much about the company’s orientation. Executives who speak candidly about challenges, focus on long-term value creation, and hold themselves accountable signal a culture that benefits long-term shareholders.

Safeguards of the Owner Mindset

Thinking like an owner naturally encourages you to be conservative with your assumptions and disciplined before committing capital.

Private owners usually maintain buffers—financial and otherwise—to handle the unexpected. This translates into maintaining a “margin of safety” when buying publicly traded stocks: purchasing shares at a price significantly below your estimate of the business’s intrinsic value. That cushion helps shield you from misjudgments and unforeseen troubles. When setbacks occur, a margin of safety can help mitigate your downside risk. Thinking like an owner naturally encourages you to be conservative with your assumptions and disciplined before committing capital.

Paying attention to a company’s debt is likewise essential. Private businesses rarely succeed by repeatedly overextending themselves with debt to pursue growth. Sustainable enterprises keep debt levels conservative and maintain ample liquidity. Public investors should likewise examine a company’s balance sheet before buying shares. High leverage can amplify returns in good times and magnify losses in bad times. When financial calamity strikes unexpectedly, such as during the great financial crisis of 2008 and the recent COVID-19 pandemic, the owner stands last in line.

Volatility as Opportunity

One of the biggest challenges for any investor is managing their emotions. Private owners make rational decisions because they experience the mileposts and pitfalls of their business firsthand and make decisions based on real results rather than speculation or rumor. Mimicking this level-headed, rational mindset in the public markets will steer an investor away from ruinous errors like panic selling as prices decline or fear-based speculation. A structured mind steeped in fundamentals and long-term goals leads to sounder and steadier decision-making.

Unlike public companies, which have their valuations reassessed every second in the market, private businesses are appraised infrequently, perhaps during annual reviews or when a new round of investment is sought. Private owners are less likely to panic when stock prices temporarily fall because they recognize that price does not necessarily reflect intrinsic business value. In fact, price fluctuations may present the chance to acquire more shares at an attractive price or to initiate a position in a high-quality business that was previously too expensive.

This mindset is especially helpful during extreme market conditions. Euphoric markets can lead to prices that are detached from fundamental values. Private owners might recognize the overvaluation and channel their resources toward more reasonably priced investments. In distressed markets, where fear reigns and prices plummet, the private owner focuses on underlying business value and may seize opportunities to purchase shares of great companies at significant discounts. This contrarian thinking is core to the strategies of the many successful investors who emphasize buying when others are fearful.

Focus on the Long View

Public market investors are often overwhelmed by short-term noise, but adopting a business owner’s mindset can provide focus on what matters. By concentrating on profitability, reinvestment opportunities, and competitive positioning, you can gain an edge over time. The owner-oriented approach does not guarantee immediate success or insulation from temporary downturns, but it does foster rational decision-making, emotional discipline, and a steadfast commitment to compounding value over the long term.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Dunn. No part of Mr. Dunn’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC