The Summer 2025 Equity Market Weather Report

With the trade picture slowly coming into focus and early signals from earnings season showing decent profit growth and a still resilient consumer, the focus should shift from macro concerns to microeconomic issues.

The big macro storms are passing, and the clearing summer sky is revealing a critical landmark (earnings) for navigating the equity market.

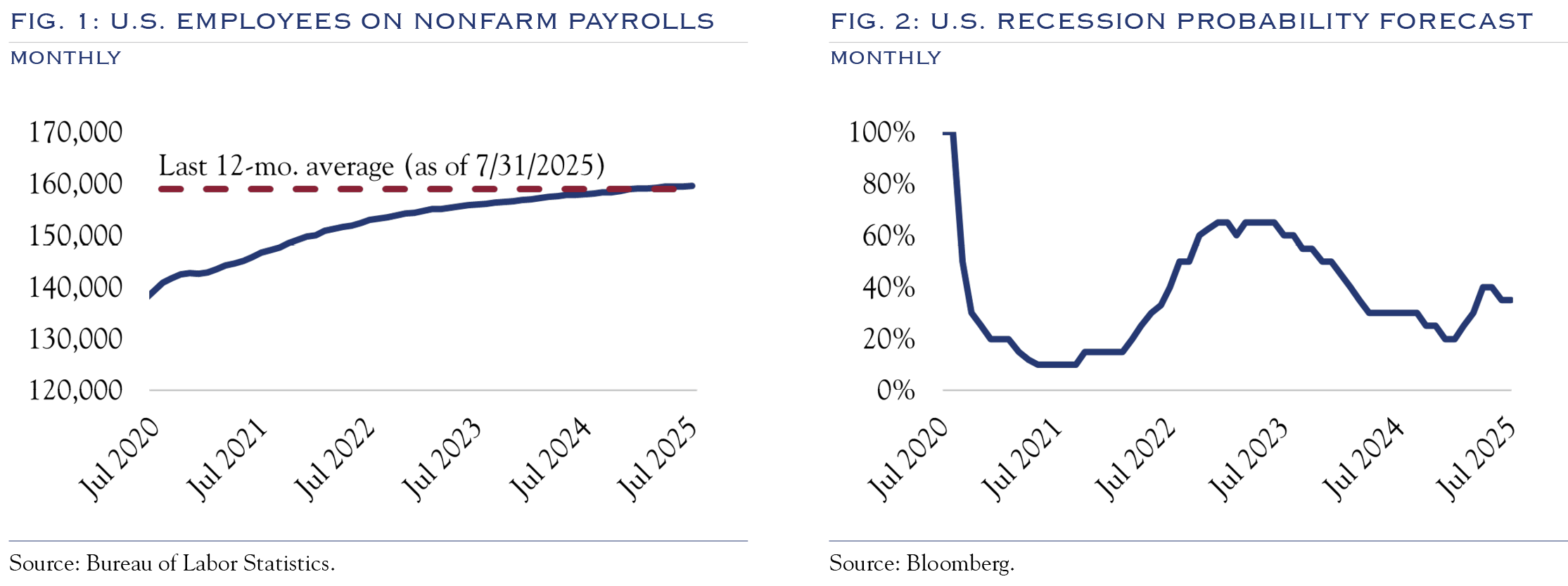

Macro Storm 1: Recession risk is easing

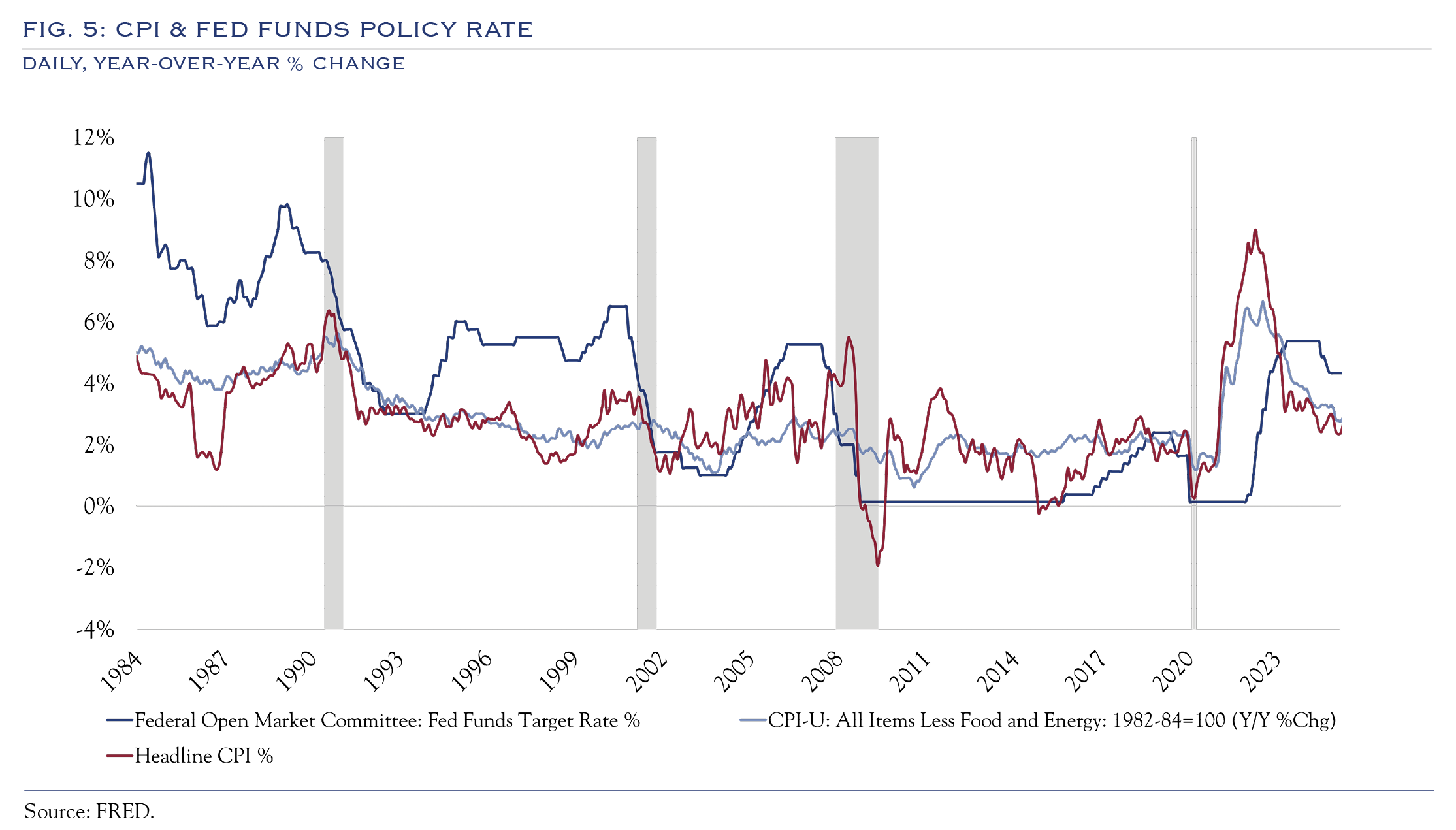

The Fed has retained a large arsenal of potential rate cuts to offset any economic weakness by remaining resolute in its vigilance on inflation. Despite the construction site tour at the Fed, it appears increasingly likely that Chair Powell will finish his term. We eagerly await clues on the path to rate cuts from the Jackson Hole event in August. Meanwhile, hiring and wage gains have remained steady, and the wealth effect from higher equity prices means that recession risks have continued to decline. While the mechanical adjustment of tariffs may cause a dip in real economic growth, it will be modest.

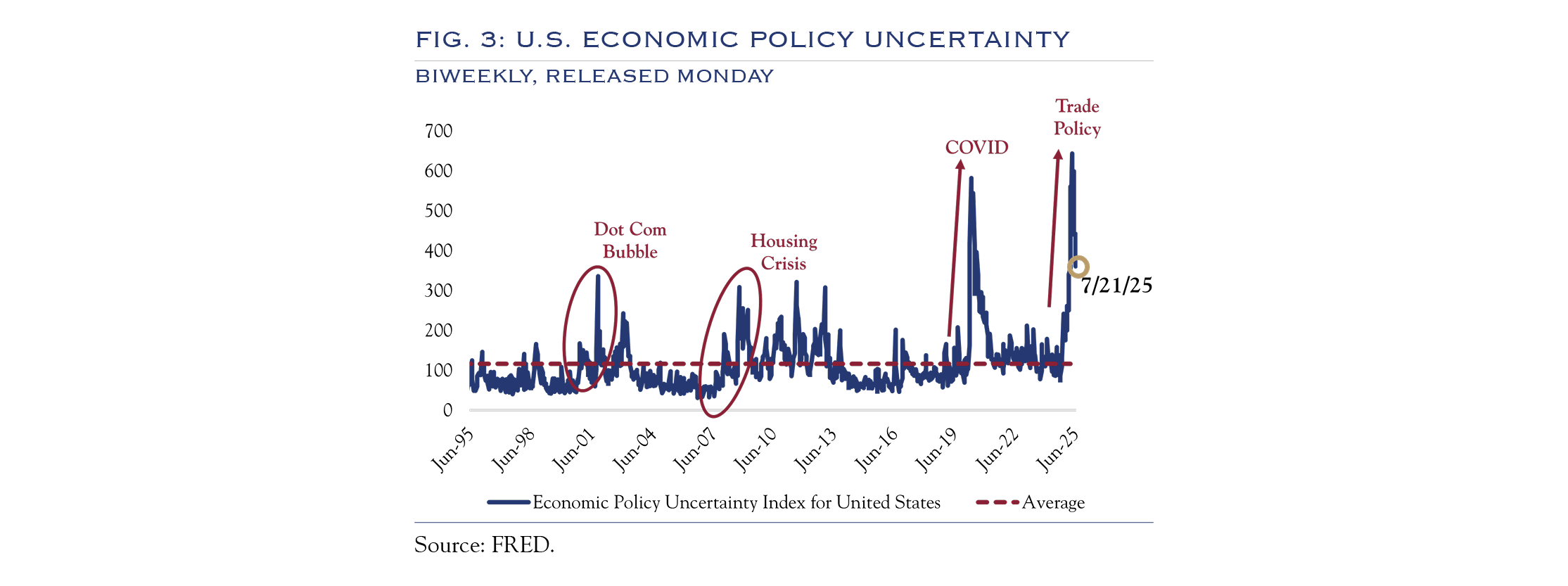

Macro Storm 2: Geopolitical stress is easing

Tensions from global conflicts, particularly those of an economic nature, are largely easing. Although the U.S.-China situation is not yet settled, recent interactions suggest a desire for a negotiated solution rather than a trade war. While events in the Middle East, Ukraine, and now Cambodia and Thailand remain tense, the market is becoming accustomed to this noise. The effects of tariffs on growth and inflation aren’t invisible, but they are manageable. This is especially true given the positive influence on growth from expected increases in capital expenditures stemming from policy changes to accelerate the depreciation of these items.

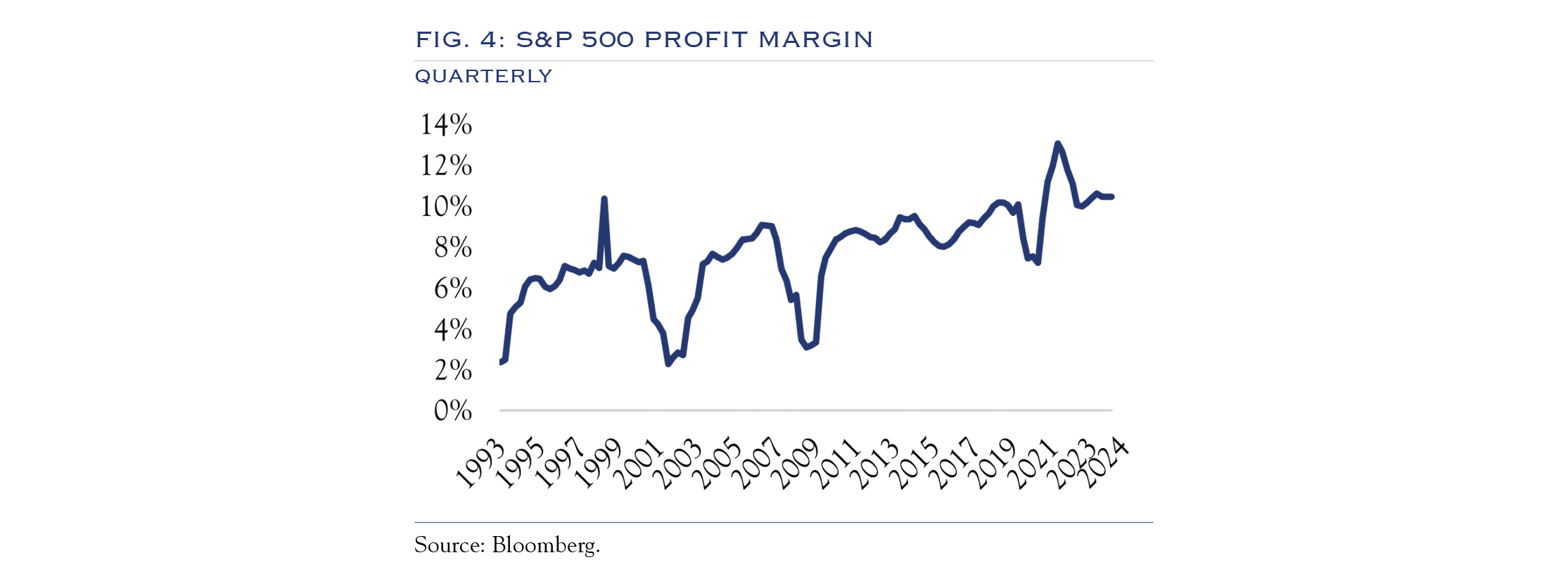

Equity Landmark: Earnings

With the focus shifting away from the macro picture, attention is increasingly turning to one of the most significant developments for equities in years: the ability to increase margins through productivity gains. The catalyst of the pandemic, followed by rapid advances in AI and robotics, is prompting companies to place an increasingly higher emphasis on productivity. Handling more revenue with the same (or fewer) employees while relying on AI assistance is becoming the equity market’s defining theme. On a micro level, this is likely to be a highly disruptive trend with a large divergence between those who adapt and those who lag. The importance of security selection, specifically, the ability to evaluate which companies are adapting, will be paramount. While earnings season is still underway, margin improvement has played an important role in driving earnings growth. We see a long runway for this trend and expect earnings growth to drive future equity gains in stock prices.

Fixed Income

At the July 30th FOMC meeting, two Fed voting members dissented and voted for a rate cut. Though the overall vote led to rates being maintained at the current 4.50% level, the dissents show that it is becoming more likely that cuts will begin in the not-too-distant future. We expect yields on the U.S. Ten-Year Note to follow Fed Funds in a gradual move lower. This will have beneficial effects on economic growth and stock valuations. At the press conference following the FOMC meeting, Chair Powell reiterated that the Fed mandate covers employment, not economic growth. The distinction was offered in support of maintaining rates at current levels, which were deemed to be modestly restrictive, as the employment picture remains strong. We eagerly await Fed commentary at the Jackson Hole symposium in August, as it should provide important clues as to the circumstances required for future rate cuts.

Outlook

With geopolitical tension easing and the tariff situation becoming clearer, the earnings outlook is becoming the critical element of the path forward. With elevated valuation levels, future gains require the backdrop to remain steady, while productivity gains drive profit margins, which will, in turn, lead to earnings gains and capital appreciation.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC