The common expression, “valuation is a terrible timing tool,” is a great way to describe how valuation metrics are informative but not predictive.

Valuation metrics like the Price/Earnings (“P/E”) ratio are a common and important way to assess whether equities are “cheap” or “expensive” and to deduce whether they might produce gains or losses in the future. However, the application of valuation metrics to investment decision-making is an imprecise science. The common expression, “valuation is a terrible timing tool,” is a great way to describe how valuation metrics are informative but not predictive. Below, we examine several long-lived eras under different valuation regimes, comparing the current environment to other “expensive” eras. We also share recent quantitative machine learning work conducted by our analyst team, which sheds light on some important influences on valuation.

The Best of Times & Worst of Times for Valuation

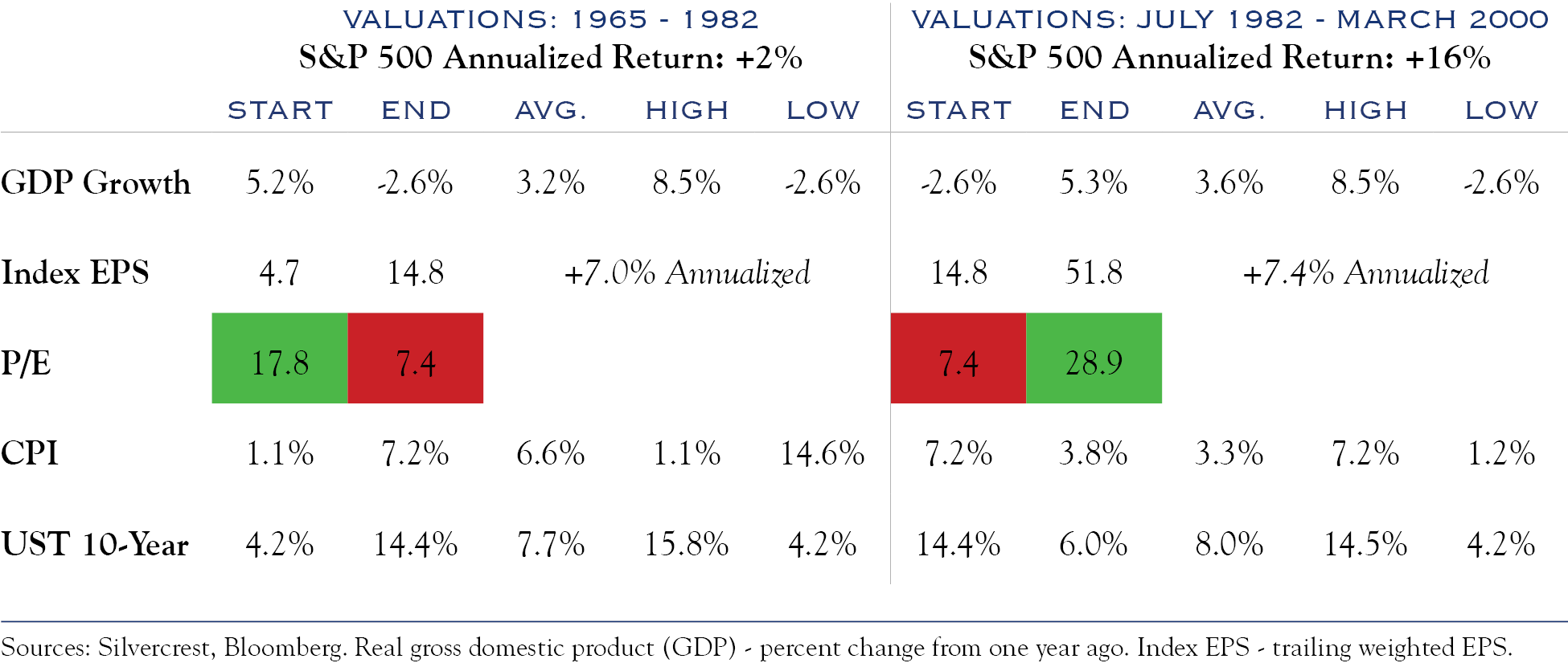

Over the 17 years from 1965 through 1982, the P/E ratio dropped from 17.8x to 7.4x, creating an awful era for equity returns, despite decent growth in the economy and earnings. The culprit was inflation and rising interest rates. Conversely, from 1982 through the internet era, equity peaked in 2000, and P/E ratios expanded from 7.4x to 28.9x. Certainly, declining inflation and interest rates played a key role, as did strong optimism over technology and economic growth.

A Return to the Top?

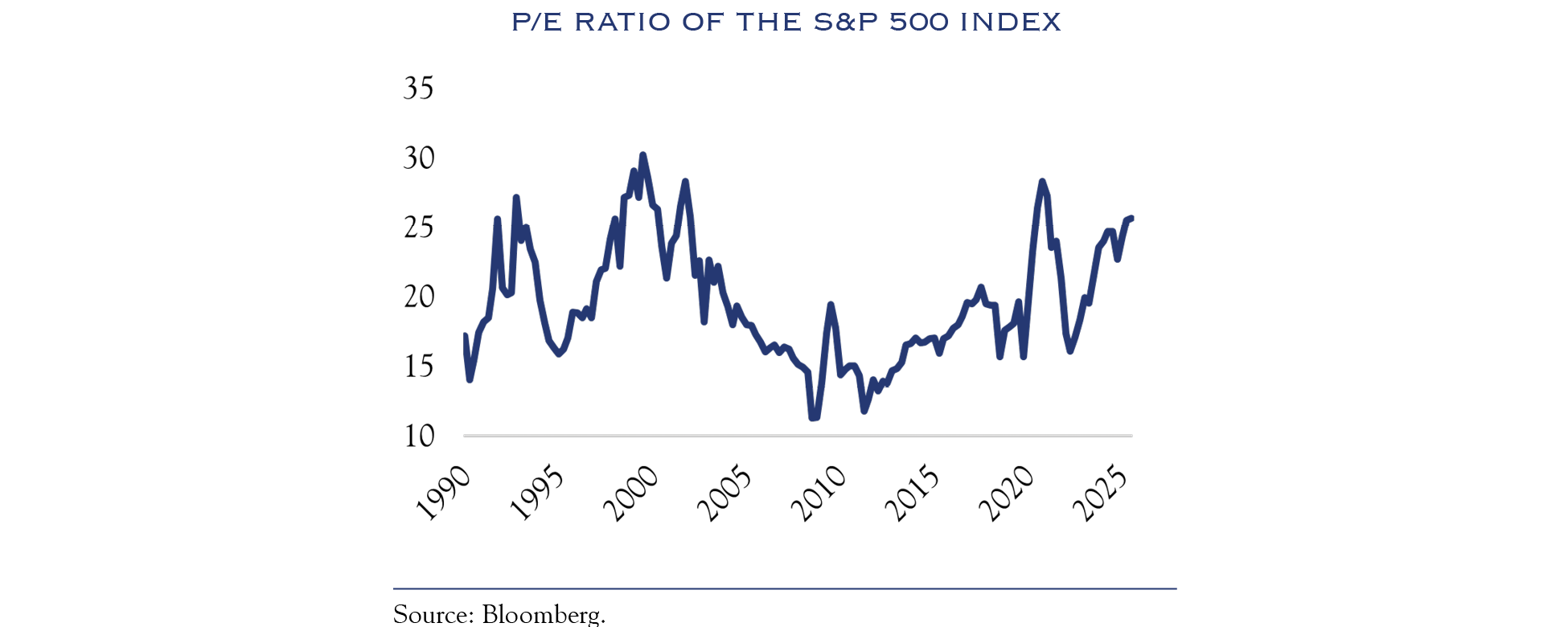

Given the similarity of optimism surrounding technology and economic growth, the current environment is often compared to that of the late 1990s. Valuations today are elevated and in the top decile vs. historical ranges. However, as we and others have frequently noted, they aren’t at the peak readings seen in the 1990s, or at levels seen in the Nifty Fifty era. While some prognosticators take a view that a return to those elevated levels is likely, we see signs of enthusiastic valuation in areas away from public equities that may be draining some fuel from the fire. High levels of interest and investment in both cryptocurrency and private investing (two very different areas) are attracting some of the attention that might otherwise have gone to public equities.

An Experiment to Determine What Matters for Valuation

In our valuation model, we evaluate five metrics:

- Inflation

- Interest Rates

- Sentiment

- Domestic Policy

- Geopolitics

We review each area in comparison to its historical ranges and develop a forward-looking view. For example, the current CPI inflation reading of +2.7% is below the long-term average since 1913, and close to the average for the past 40 years, though it is above the range for most of the period following the Global Financial Crisis. Thus, it is fairly neutral to valuation at current levels, and since we expect inflation to further decline, it should be supportive of valuation levels going forward.

Projecting each category into the future is hard enough, but weighing the importance of each category relative to the others brings an additional challenge. To bring some rigor to this task, we partnered with a talented member of our tech team, Sumit Pal. With Sumit, we were able to quantitatively evaluate many of our assumptions around our key inputs to valuation. We employed a range of techniques, from simple to advanced, and found that Vector Autoregression was most suitable for this exercise.

Some Findings:

- Our instincts were correct that most metrics spend a lot of time in a “normal” range, and when they reside in that range, they are mostly useless as predictors of future valuation levels.

- When any one metric moves to an outlier level, it can become incredibly influential, such that nothing else matters. Consider bouts of inflation or, at times, massive geopolitical events.

- The designation of “most important” metric can change over time. Factors such as periods of inflation, high growth, and anticipated policy changes can all significantly influence valuation, particularly in shorter time periods.

- In most circumstances, inflation was the primary influence, followed by interest rates.

- Lastly, we did some testing on various macro surprises or “shocks.” Here we found that a move upward in inflation of 0.5% tends to reduce valuation levels by nearly 0.5 P/E “points” over a period of five months, with a recovery of half of the drop in just over one year. In other words, a relatively modest move in inflation would inflict a relatively modest detrimental effect on valuation. Throughout history, it has only been the major shifts in inflation that have caused significant damage to valuation metrics.

Today, most conditions are favorable, and we view valuation levels as elevated but reasonably well-supported.

Since there is no crystal ball for predicting valuation, we continue to assess potential factors relative to historical norms and adjust those metrics for current and expected conditions. Today, most conditions are favorable, and we view valuation levels as elevated but reasonably well-supported. Since most metrics have little room for further improvement, we see little upside to valuation levels. Thus, our equity markets forecast is based primarily on earnings gains.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC