Productivity is the Path to Profits in 2024 and Beyond

In the years ahead, economic growth will likely remain near long-term trendlines, averaging around 2%. That backdrop influences the path to revenue growth for companies in the investable part of the economy—like those in the S&P 500 or Russell 2000.

Source: Bureau of Economic Analysis.

Individual companies will have a wide range of revenue growth rates. However, at the aggregate level—say for the S&P 500—revenue growth will be limited by modest economic growth. A simple formula for calculating earnings gains is revenue less expense divided by shares outstanding. With constrained revenue growth, efficiency becomes increasingly relevant. Earnings gains must come from doing more with less or increasing expenses slower than revenues.

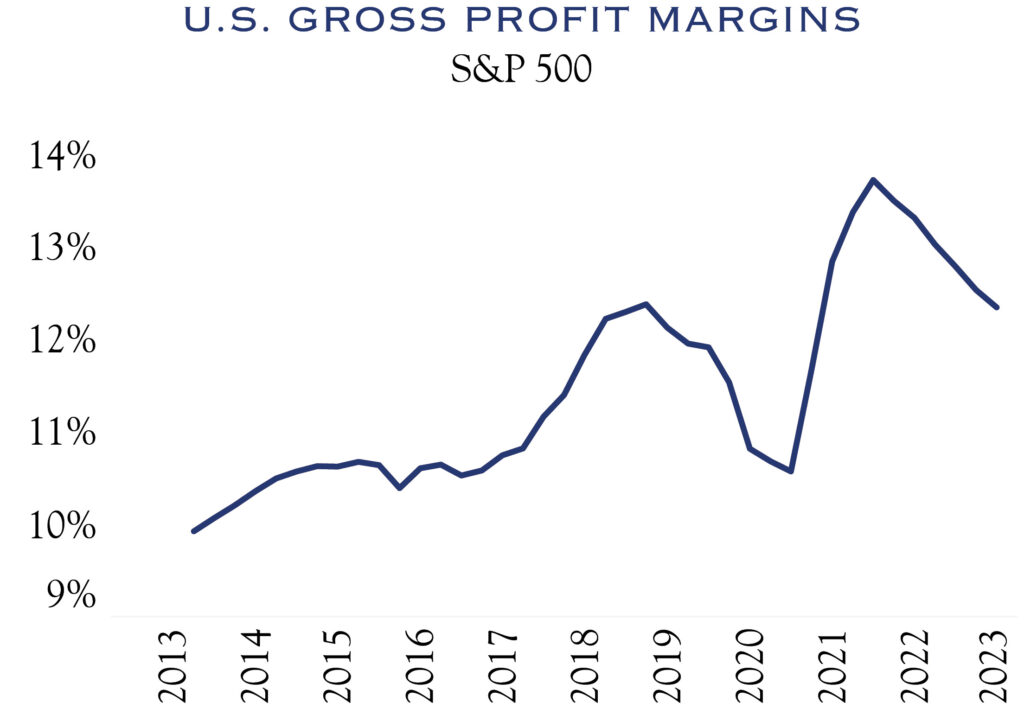

Thus, the expansion of already elevated profit margins is the key to earnings growth in the years ahead. While companies have battled against increases in their cost structures from inflation and rising wages, the worst appears to be over. Both inflation and wage gains are fading, which should allow productivity to move to the forefront as the primary driver of profit margins and earnings.

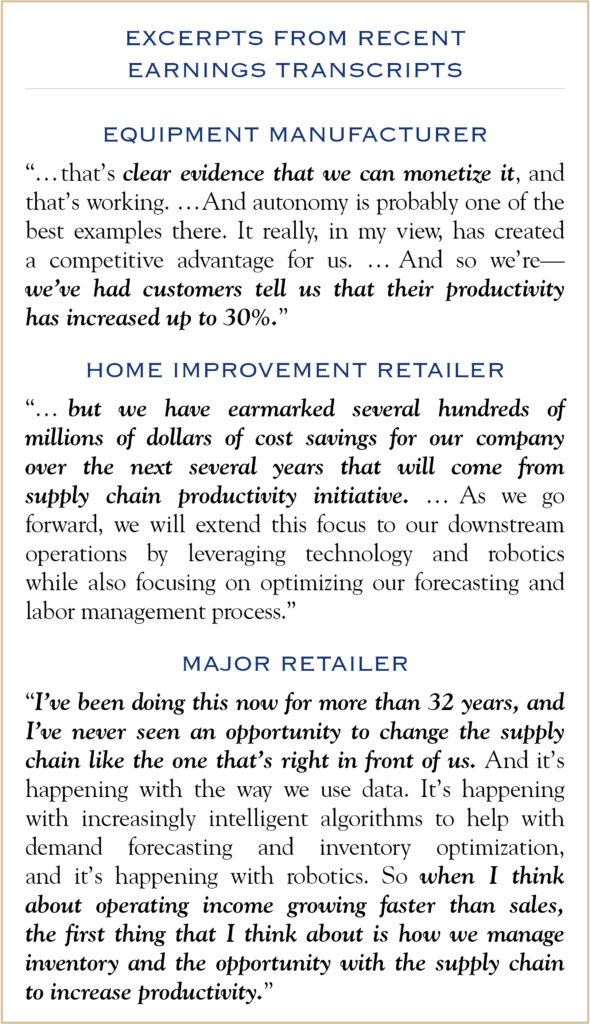

There is an abundance of optimism about productivity, much of it well-founded, primarily due to improved quality and increased availability of robotics and artificial intelligence.

Source: Bloomberg.

Robots Help With Cost Controls

A survey from the Stanford Institute for Human-Centered Artificial Intelligence showed a decrease of nearly 50% in the cost of a robotic arm from 2017 to 2021. At $22,601, the resource is widely accessible, and additional cost reductions are expected. Options to utilize robotics on a rental basis should further broaden availability. Estimates vary across research sources but generally point to a doubling in the utilization of robotics as a service in the next five years.

Though investors have been recently laser-focused on increased labor costs, companies have a newfound ability to utilize robotics to reduce overall costs. Most vendors offer online pricing comparisons and examples of fully implemented solutions and cost savings. It’s not uncommon to see success stories with boosts in productivity of 25% or more. An article in Wired magazine contained an illustrative anecdote from a manufacturing company located in Chicago. The company could lease a robot for $8 an hour without any upfront costs. Deploying the robot meant that workers could handle other tasks. As such, the company was able to expand production without hiring any additional workers. The same article provided this prediction from a company that leases robots:

Saman Farid, CEO of Formic, “Robots are going to be able to do a lot more tasks over the next five to 10 years,” Farid says. “As machine learning gets better, and you get to a higher level of reliability, then we’ll start implementing those.”

AI Enables Employees to Do More, Better, and Faster

Similarly, the increased ease of access to artificial intelligence (AI) tools will likely create opportunities for improved productivity. A recent issue of The New Yorker was dedicated to AI and highlighted some interesting observations. In one article, “Begin End,” author James Somers describes how “a shockingly short time” was needed to deliver a piece of custom software and shed light on several real-world examples across various types of coding. He also describes the reaction of another programmer regarding early experiences with AI:

“By now, most people have had experiences with AI. Not everyone has been impressed.” Ben recently said, “I didn’t start really respecting it until I started having it write code for me.” I suspect that non-programmers who are skeptical by nature, and who have seen ChatGPT turn out wooden prose or bogus facts, are still underestimating what’s happening.”

We are still in the early days of the move to unleash the potential of AI. While specifics are unclear on how productivity will manifest itself in corporate activity, it is increasingly apparent that the changes are likely to be significant. Early research shows substantial gains in productivity from early versions of AI tools—especially in the area of “up-skilling” workers by equipping them with instantly available and detailed knowledge on a wide range of topics. Further applications are emerging in the fields of demand prediction, helping companies to manage inventory better.

As compared to historical averages, more companies are surpassing earnings expectations while falling short of expectations for revenue, implying that analysts are underestimating the ability of companies to improve their profit margins. We expect this trend to continue as companies increase the deployment of robotics and move forward with implementing AI-based tools. While the economy may be slowing and revenue growth more challenging, we expect productivity gains to drive higher profit margins and increased earnings growth in the years ahead.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC