Dive into the latest issue of Silvercrest's Insights, where we examine the history of S&P 500 giants, explore the keys to generational wealth, consider the future of AI's impact on productivity, and navigate the complexities of China's relationship with the U.S.

Introduction

Richard R. Hough III

Chairman and CEOWelcome to Silvercrest’s latest issue of Insights, covering a range of topics across investing, family dynamics, and foreign affairs.

In the “Concentration Conundrum—Lessons from the History of S&P 500 Giants,” Jeff Nevins, our Large Cap Growth portfolio manager, examines the nearly unprecedented domination of the S&P by a handful of companies. Innovation often results in such concentration, but constant change makes it difficult for incumbents to hang on—leading the way for a new generation of market leaders.

Two articles focus on the principles for preserving and perpetuating wealth across generations. In “Family Wealth—Engaging the Next Generation,” portfolio manager Jennifer Baker discusses three components of generational wealth: financial acumen, financial principles, and financial assets. Continuing this theme with “Prudence in Prosperity—The Family as a Living Institution,” portfolio manager Bernard Paternina describes the role of family governance in creating an enduring legacy.

Looking into the future, Robert Teeter, head of Silvercrest’s Investment Policy and Strategy Group, explores the ramifications of Artificial Intelligence (AI), offering insights into how emerging technologies are reshaping productivity expectations.

Finally, in “U.S.-China Relations—A Brief History,” Patrick Chovanec shares a question-and-answer session on the complexities of U.S.-China relations, offering first-hand experience. He provides a fresh perspective on the risks businesses face from the conflicting demands of two hostile nations whose economies rely so deeply on each other.

With a blend of historical retrospection, timeless principles, and forward-thinking analysis, we hope that you enjoy reading this issue of Silvercrest’s Insights.

Economic & Market Overview

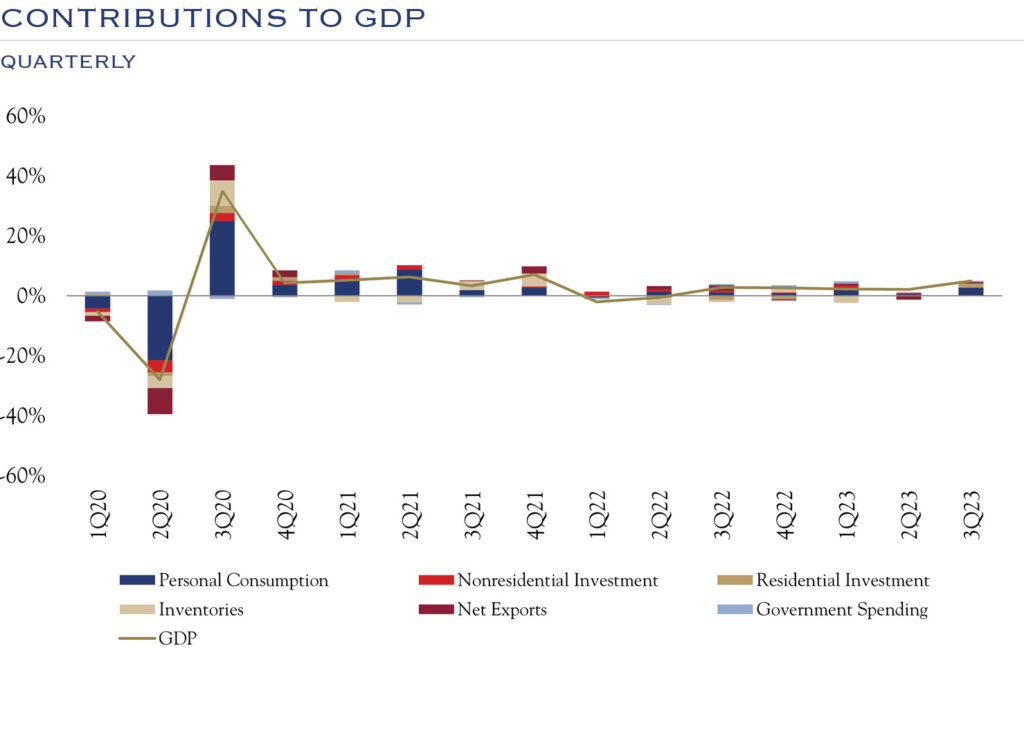

Sources: Bureau of Economic Analysis & Federal Reserve Bank of St. Louis.

- Growth conditions are moving toward those seen in pre-pandemic times. Slowly but surely, growth has continued to rise.

- Personal consumption continues to drive most of the economic growth. Non-Residential (business) and Residential (housing) investment has begun playing a more prominent role in the more recent economic growth.

- We continue to expect growth around long-term trends of 2%, with the majority being driven by the consumer complimented by both nonresidential and residential investments, exports, and government.

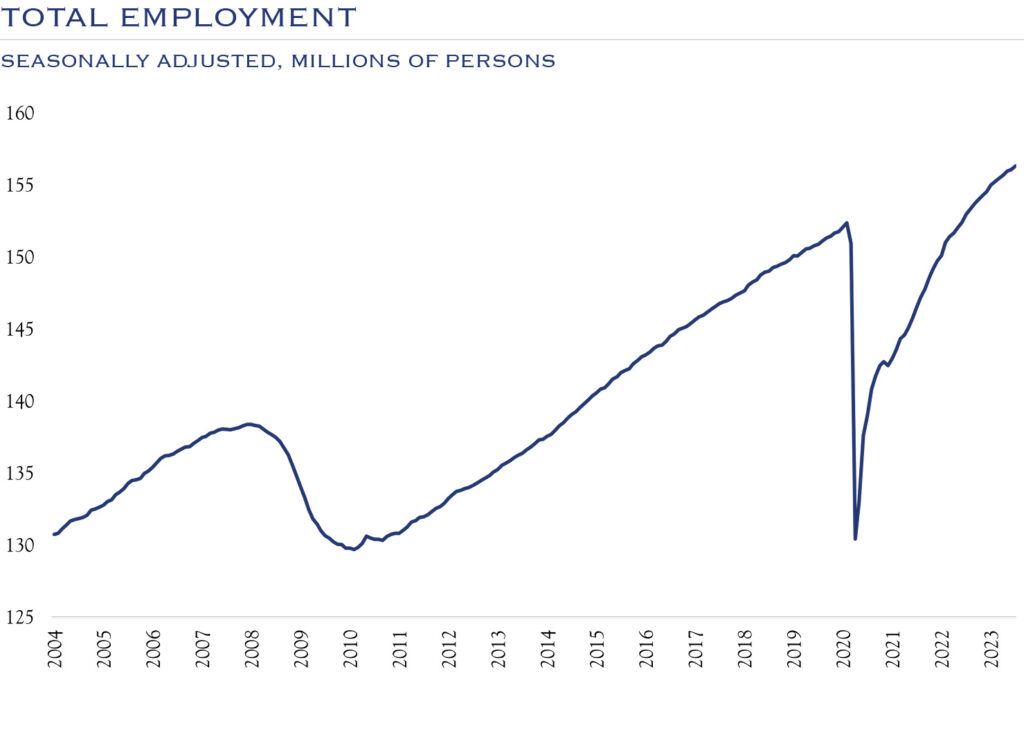

Sources: Bureau of Labor Statistics. U.S. employees on nonfarm payrolls.

- Employment continues to improve and remain stable. Year to date, employment changes have ranged from +105K to +472K, averaging +239K additional workers per month.

- Participation rates are now above 2019 levels.

- We look for modest gains in the size of the labor market, particularly relative to other countries, as the U.S. has a decent demographic backdrop.

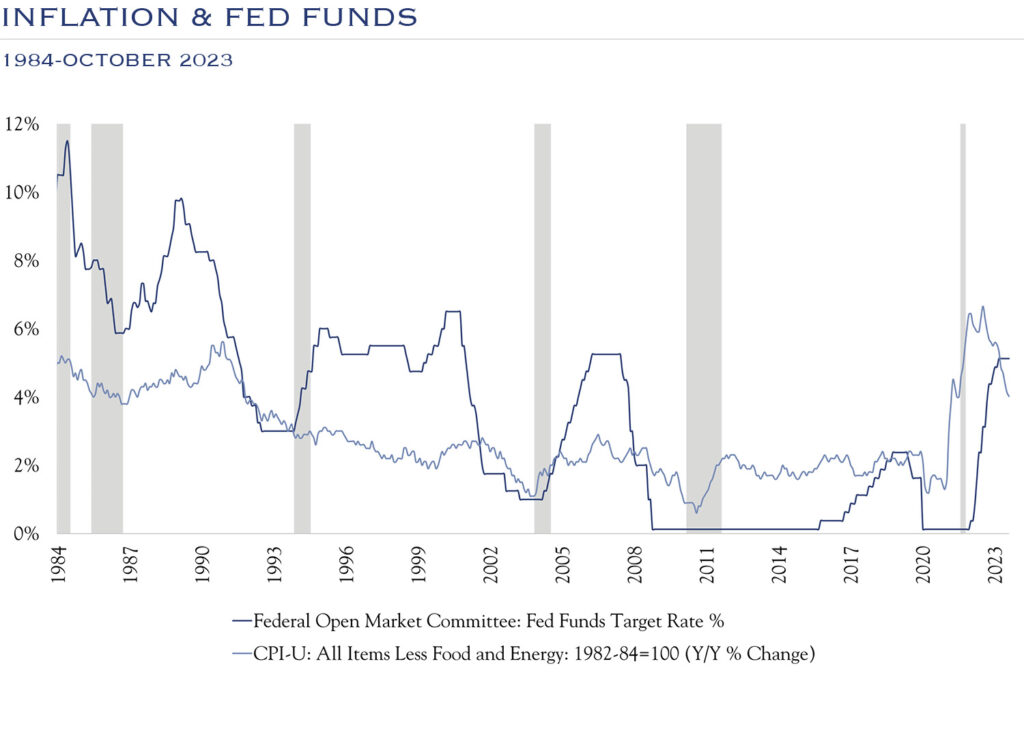

Sources: Federal Open Market Committee & CPI Data.

- Inflation continues to decelerate, yet remains above the 2.0% target rate set by the Fed and may for some time to come. Since the 2.0% target rate was set in January 2012, 43.7% of readings have been higher than the target rate. Year to date, half of the MoM annualized changes in CPI have been around the Fed target.

- We believe the Fed Funds rate has peaked and is now on pause indefinitely.

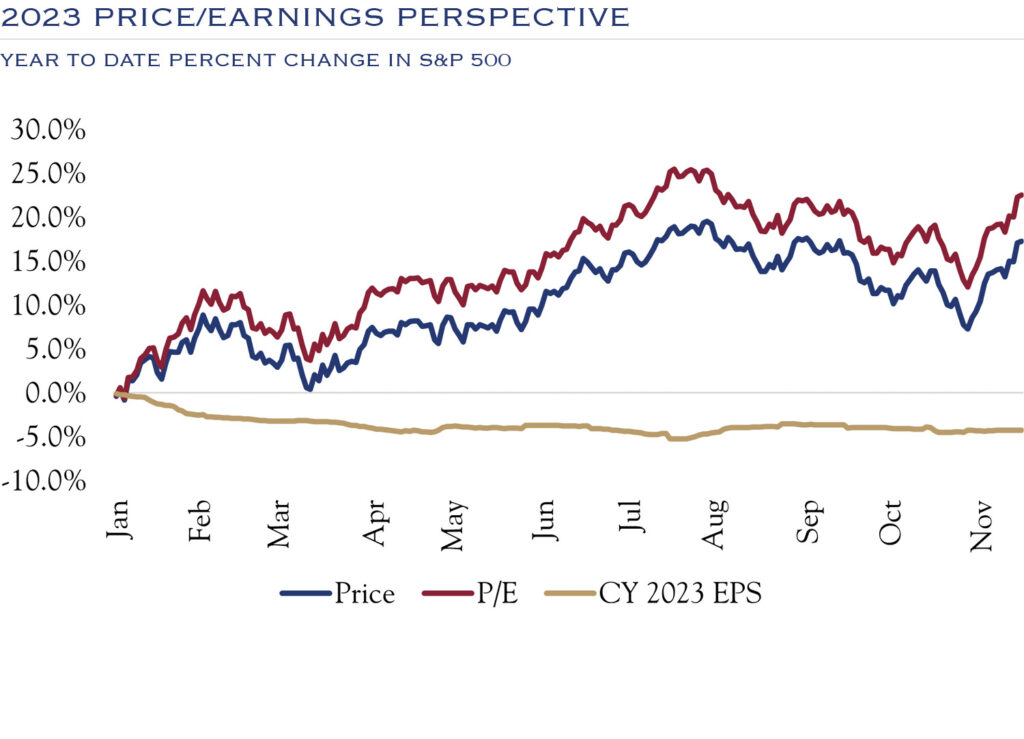

Sources: Strategas and J.P. Morgan.

- Earnings in 2023 have declined a bit, but have been mostly steady, while multiples have expanded, mostly due to declines in inflation.

- Looking ahead, a solid (but slow) economy is likely to create a stable earnings backdrop for 2024.

- Inflation and rates are likely to decline in 2024 allowing for further increases in valuation.

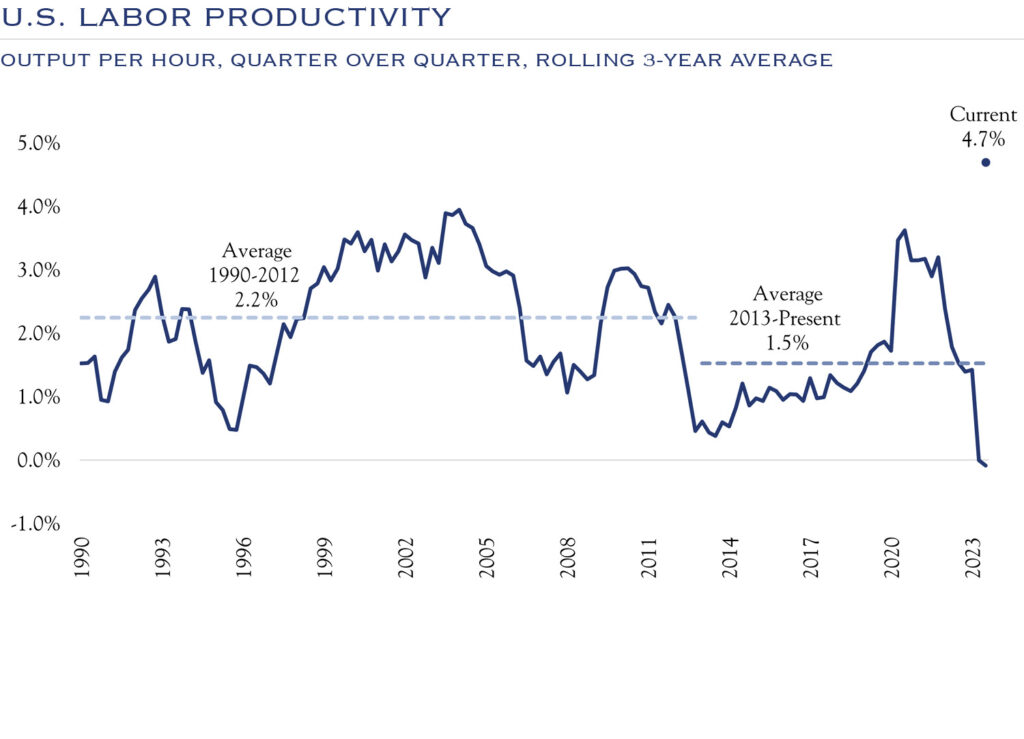

Source: Bureau of Labor Statistics. Nonfarm business sector.

- Productivity is a key component of economic growth. Sluggish productivity and minimal gains in the size of the working population have led to relatively lackluster economic growth for much of the past 15 years.

- Looking ahead, advances in technology and health care have the potential to increase productivity and expand the size of the workforce, potentially leading to higher economic growth.

Jeff Nevins, CFA

Managing Director, Portfolio ManagerConcentration Conundrum—Lessons from the History of S&P 500 Giants

read the insight

Jennifer M. Baker

Director, Portfolio ManagerFamily Wealth—Engaging the Next Generation

read the insight

Bernard M. Paternina

Portfolio ManagerPrudence in Prosperity—The Family as a Living Institution

read the insight

Robert R. Teeter

Managing Director, Chief Investment StrategistAI & Productivity—A Shift from Effectiveness to Efficiency

read the insight

Patrick Chovanec, CPA

Economic AdvisorU.S.-China Relations—A Brief History

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Equities

We look for equities to generate returns around 6-8% annualized over the next three years, driven by continued progress on earnings (via efficiency gains), and a recovery in valuations beginning sometime in 2024.

Growth & Value

We recommend a balance between the growth & value investing styles. Similar to the last few years, individual company activity is far more likely to drive results. We expect continued rotation between growth and value and prefer to focus on stock selection.

Small Cap & Large Cap

While large cap returns have dominated 2023 results, we anticipate that an eventual easing of interest rate stress will accrue to the benefit of small caps. Small caps have compelling valuations, though quality considerations are important. We continue to recommend a modest allocation to small caps, above benchmark/policy targets.

U.S. & Non-U.S.

While many great companies based outside the U.S. have compelling valuations, we remain cautious about the global outlook. The interaction between a slowing China and a slow-growing Europe presents macro headwinds. We continue to advocate for exposure to non-U.S. equities through active management focused on identified compelling individual companies.

Fixed Income

While rates are likely to remain elevated in the near term, an eventual shift in language from the Federal Reserve will ultimately bring relief to interest rates. Current yields are compelling, and the long-term outlook for bonds is favorable. Within credit, we continue to advocate for careful active management, as higher rates will require diligent navigation of the financing environment.

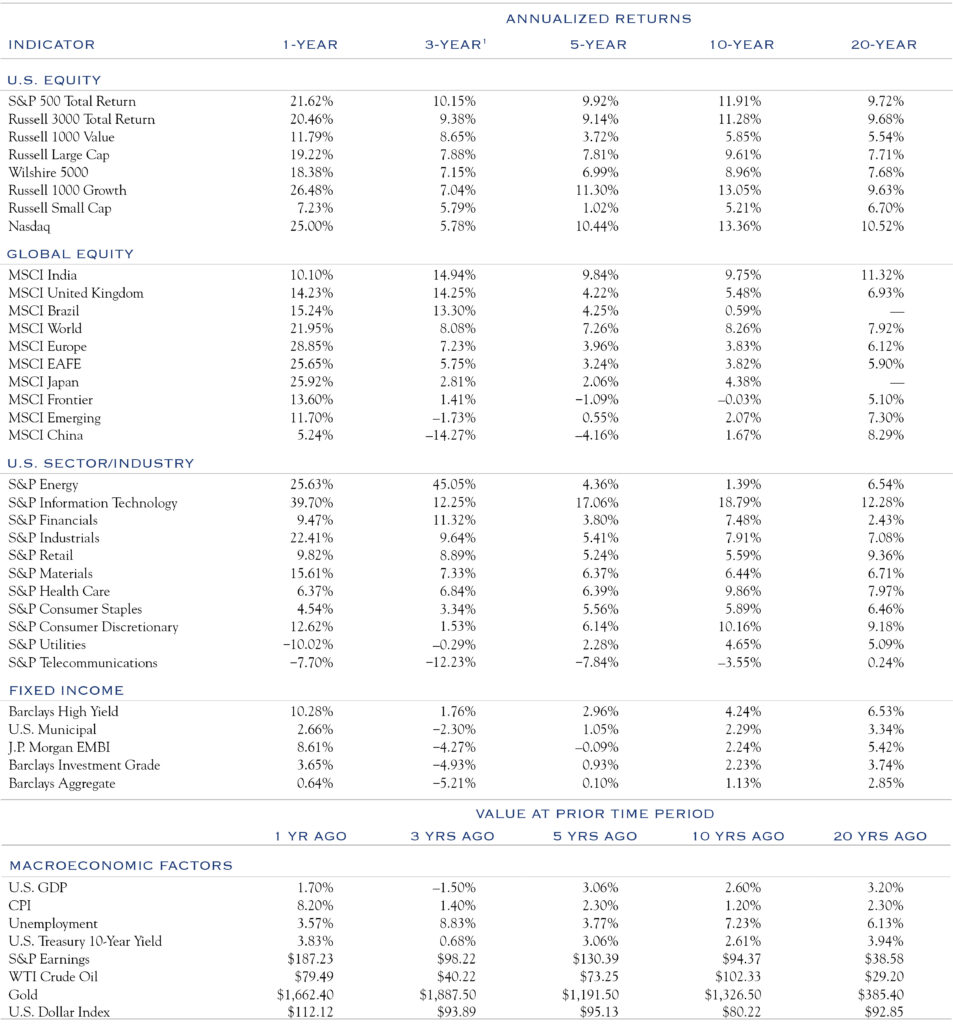

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 9/30/2023.