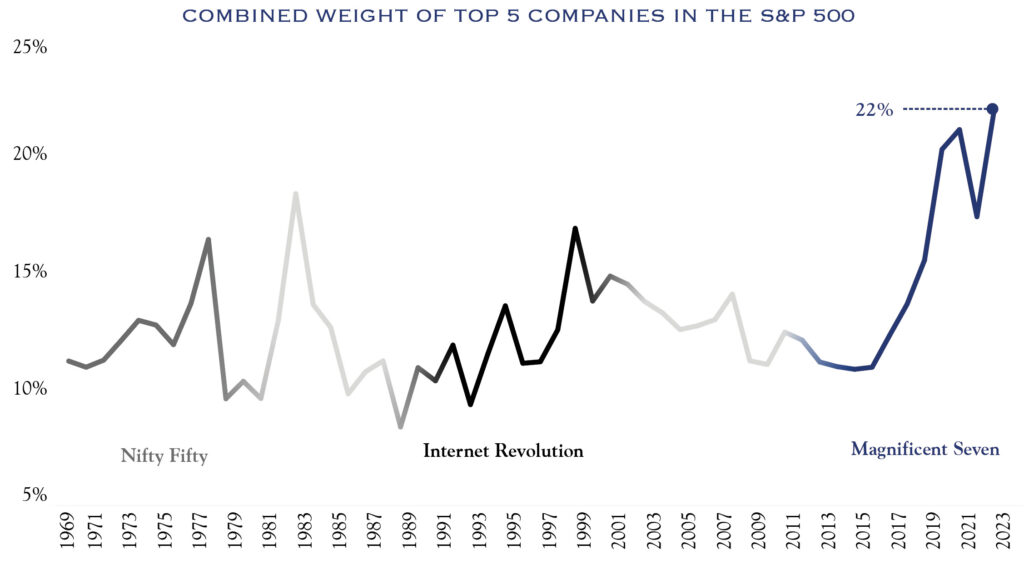

Seven stocks have driven the S&P 500’s 2023 returns. These companies have been dubbed the Magnificent Seven—Apple, Microsoft, Alphabet, Amazon.com, NVIDIA, Meta Platforms, and Tesla. While the largest five stocks in the S&P 500 today total the highest concentration in 60 years at 22%, the staggering advance of the market’s top stocks is not a new phenomenon. The 1970s saw the domination of the Nifty Fifty, and the leaders of the Internet Revolution defined the late 1990s. Why does this happen, and are there some clues as to whether the dominance of certain stocks is sustainable? History supplies us with two recurring dynamics essential to addressing these questions: 1) growth and innovation and 2) constant change.

Sources: Wolfe Research, FactSet, Bloomberg.

Growth & Innovation

Why is the market attracted to the top companies? The leading reason is growth and innovation. Similar eras have been marked by expansive innovation over the past 150 years, beyond even the Nifty Fifty and Internet Revolution. Other instances include the Industrial Revolution, the discovery of oil, the birth of automobiles and airlines, and the Third Agricultural Revolution. Each bred a revolutionary wave of new companies and new addressable markets.

During the time of the Nifty Fifty, top weights such as IBM launched the beginning of the computer era, Xerox redefined productivity, and Eastman Kodak revolutionized cameras. The Internet Revolution was no different. Microsoft offered a new operating system embedded with enterprise tools that permanently changed the knowledge worker. Intel became the engine inside personal computers (PCs). Cisco Systems found the missing link for the growing use of Internet bandwidth by enabling connectivity between PCs and servers. However, both eras ran their courses and top companies eventually lost fundamental momentum, experiencing the challenge of maintaining dominance and sustaining growth.

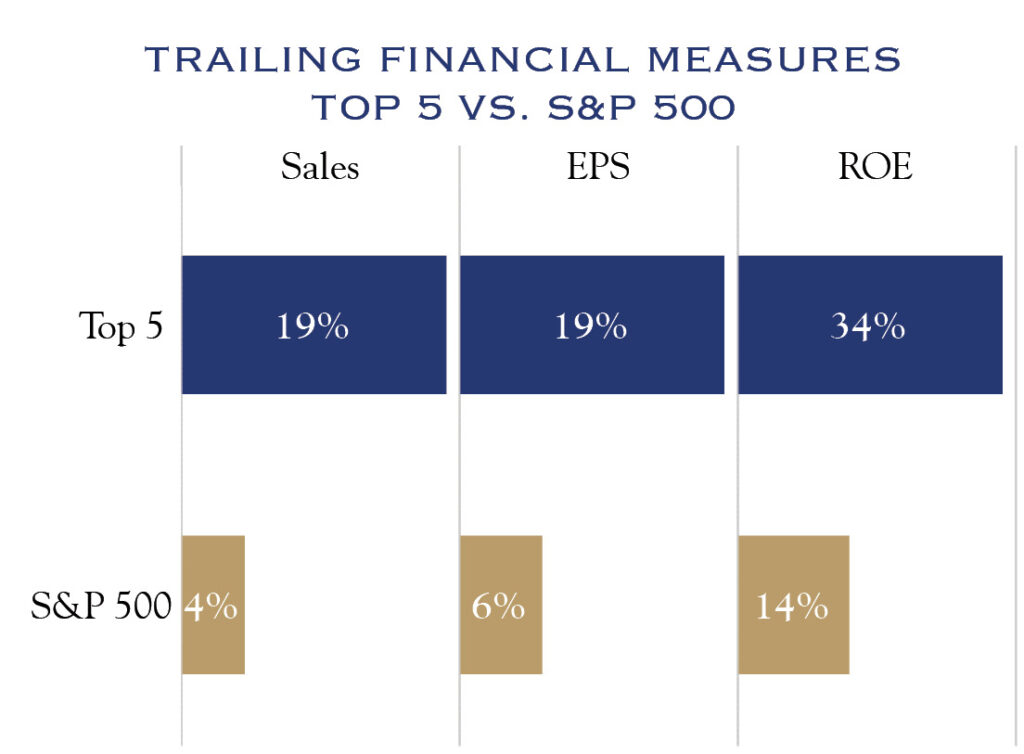

In the modern concentration era, the market has been enamored with the top five stocks, and rightfully so. Comparing the sales growth, earnings growth, and average ROE of these stocks against the entire S&P 500 shows the top five far ahead of the market. The superior metrics of these generational companies are a function of their innovation and inherent growth.

Constant Change

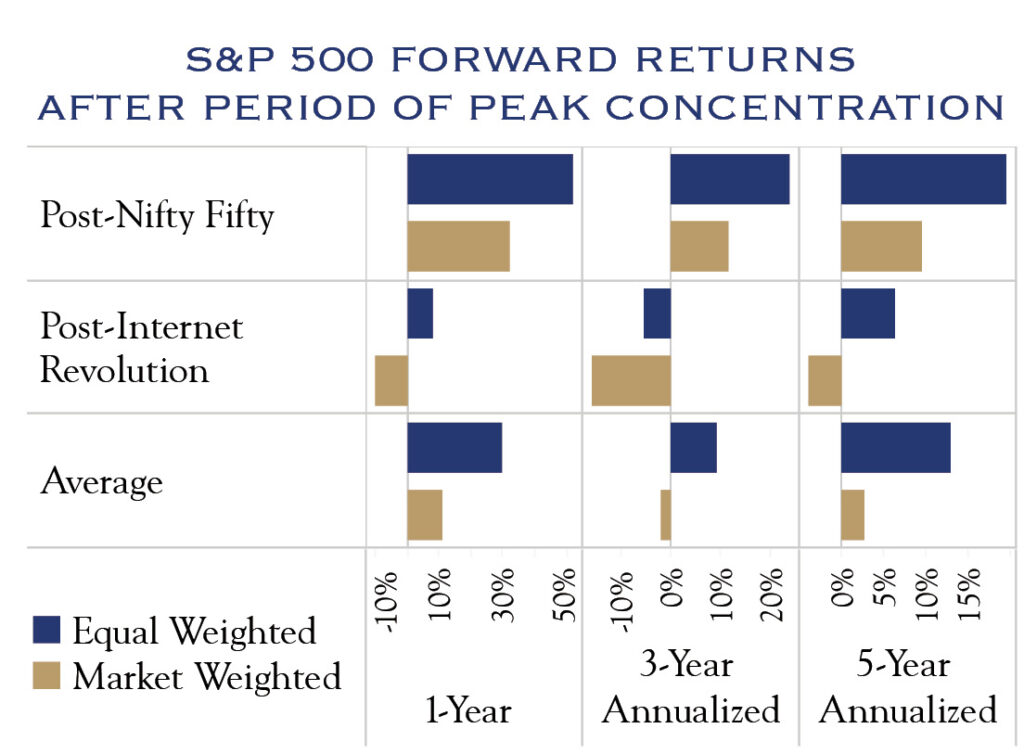

Source: Goldman Sachs. Returns from 1983, 1995, 1999, 2008, 2011, 2020, 2021, Third Quarter 2023.

Investor attraction to a given era’s top five weights is not permanent. While some constituents persist for a time as diamonds in the rough, most gradually lose their luster. Companies like IBM, AT&T, and Microsoft stayed in the top five for many years, yet those are outliers. Maintaining a kingpin seat at the top for long periods of time is difficult. Moreover, readmittance to the top is incredibly rare—lightning hardly ever strikes twice for the same company.

Given the nature of competition, peak periods of concentration in the market are typically followed by a changing of the guard. In the five years after the most admirable periods of growth for the Nifty Fifty and the leaders of the Internet Revolution, the top five underperformed considerably compared to the remainder of the S&P 500. Evidence is clear that investors who owned an equal-weighted portfolio would have fared far better after these periods of concentration than if they had invested in the market-weighted S&P 500.

Source: Goldman Sachs.

The Challenge

After concentration peaks, some juggernauts may remain in the top five, but a new cohort of companies typically emerges. Herein lies the challenge for investors: finding the next group of promising, next-generation leaders. Technology defines today’s era, as it has for the last 20-plus years, and there is no sign of this driver abating. The most prominent innovation today is generative artificial intelligence (GenAI), which is already pressing enterprises to develop the next killer application in hopes of a new billion-dollar venture. GenAI is disrupting how knowledge workers achieve success, data centers are built, and developers deploy and create code. Like the early 1990s with the advent of the Internet and PCs, GenAI appears to have a similar disruptive recipe that will craft a new set of winners. A few of today’s “investor favorites” might remain at the head of the S&P 500, but history hints that several gems are waiting to be discovered. A healthy dose of diversity and keen foresight for generational wealth is critical for investors preparing their portfolios for what will unfold in the coming decade and beyond.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Nevins. No part of Mr. Nevin’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC