Summer Days Fly By

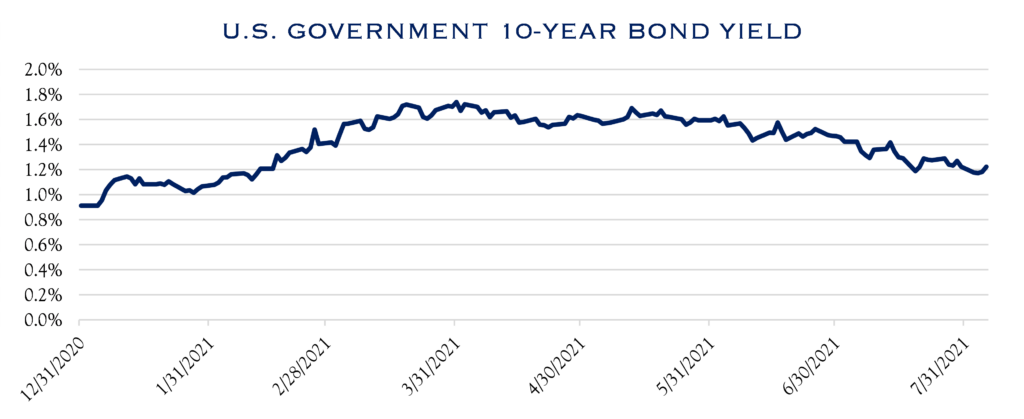

It was fun while it lasted. The summertime blast of improving economic conditions and declining COVID cases made for a clear and compelling investment narrative. Now the situation is more complicated, with a slowing economic growth and rising COVID cases. The emergence of the Delta variant in China is causing concern that the world’s second largest economy may further exacerbate supply chain disruptions. Together, a picture emerges of a slower growth rate for both the domestic and global economy. That slower growth rate is a key reason for the deterioration of U.S. 10-Year Treasury Note.

Source: Bloomberg

Our view is that the economy—and markets—are experiencing the start of an economic cycle transition. Transitions can be tricky to navigate, especially when as massive and quick moving as the cycle we’ve seen over the past five quarters. Typically, a massive boom ends in a bust, but this time, we see the cycle fizzling out gradually, with a return to a more normal and healthy environment in 2022. Such an environment is likely to be favorable for equity investors, owing primarily to very strong earnings, driven by robust margins and productivity.

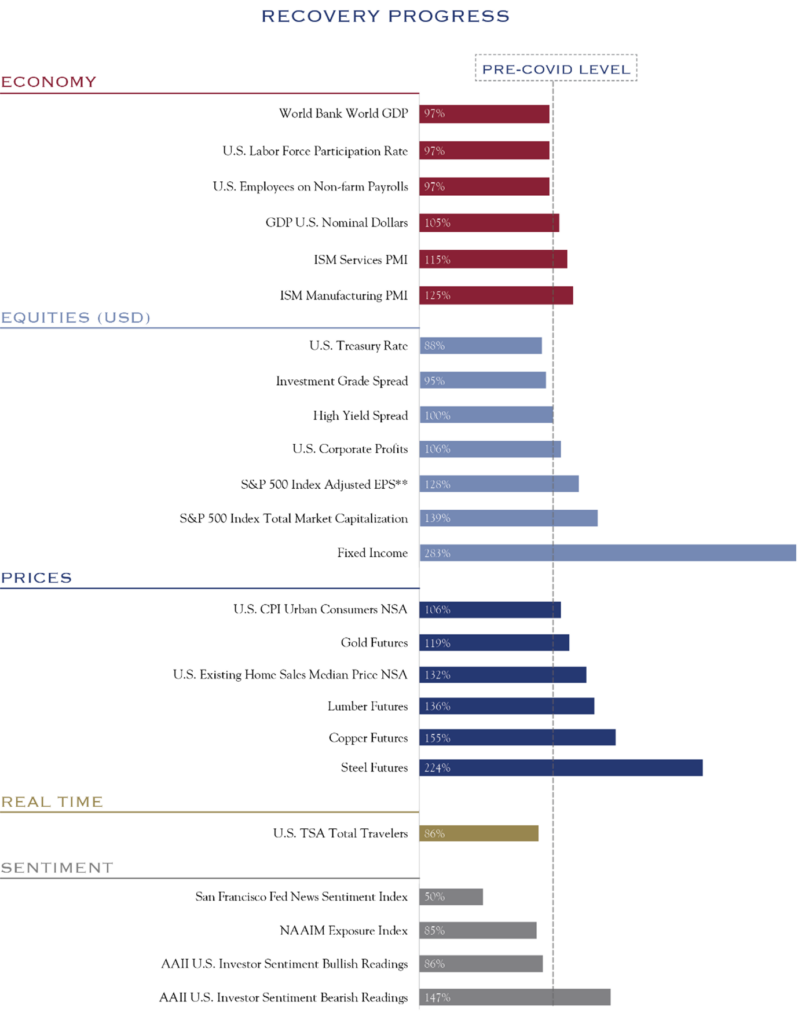

Given the fickle economic and market conditions, it’s helpful to step back and compare today’s situation with that of pre-pandemic era of 2019. Our review covers the following categories: Economy, Equities, Prices, Real Time, and Sentiment. With most indicators near all-time highs, the overall picture indicates a strong recovery. Jobs, however, remain the exception at about seven million below the February 2020 peak.

Sources: Bloomberg/NAAIM /Macrobond. Data points range from 12/31/2019-8/5/2021, with following exceptions.

S&P 500 Index Adjusted EPS start date: 1/14/20, GDP U.S. Nominal Dollars SAAR end date: 6/31/21, World Bank World GDP end date: 7/31/21, U.S. Employees on Nonfarm Payroll end date: 12/31/20, U.S. Corporate Profits end date: 3/31/21, S&P 500 Index Total Market Capitalization end date: 7/31/21, U.S. CPI Urban Consumers NSA end date: 6/30/21, U.S. Federal Reserve Bank end date: 8/1/21, and NAAIM Exposure Index end date: 8/4/21.

Outlook

Silvercrest’s model for earnings and valuation considers:

- A three-year time horizon

- Historical averages adjusted for current and projected conditions

We see a robust earnings backdrop, with projected S&P 500 gains just under 8% annualized over the next three years, a view slightly below consensus projections. We base our view on a slowing but strong economic backdrop through 2022, before returning to the slow and steady growth trend in place prior to COVID’s dislocations. Despite supply chains and logistics challenges, as well as rising labor costs, we see an increase in technology adoption and a focus on operational excellence giving a boost to productivity and thus margins.

Valuations remain elevated when compared to long-term historical norms, as they have been for several years. That said, asset classes are generally evaluated relative to one another, and the historically low interest rates on bonds provide support for elevated equity valuations. We expect inflation to slow and interest rates to gradually normalize. Sentiment is bullish but not at peak levels, and exposure metrics paint a similar picture—enthusiastic, but not exuberant. The policy picture is challenging, with several unknowns in the U.S. and globally. Nevertheless, the geopolitical landscape has weathered numerous storms over the past decade, with only minimal disruption to valuations.

To conclude, we anticipate valuation levels to remain unchanged with future expected returns owing to earnings growth and dividends. This equates to U.S. equities generating returns slightly above 7% over a three-year time horizon. In the short term, we expect the economic and market transition (from late COVID cycle back to normal) will lead to increased volatility. We forecast that skies will clear in 2022 as solid earnings growth results in normalized equity returns.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC