Before there were memes about stocks, one popular trend involved playing songs in reverse hoping to reveal a hidden message. Though most songs disappointed, the backwards sound was very strange. Today, we are living through an economic cycle that is largely unfolding in reverse. It too is producing strange-sounding messages.

The conclusion of a typical economic cycle begins when optimism and enthusiasm encourage an economic boom which leads to abundance and excess. The cycle continues, eventually peaking before a recessionary bust as the growth becomes unsustainable. In contrast to a normal cycle, the years prior to the pandemic were far from a boom and had been preceded by ten years of languid growth following the Global Financial Crisis. Further, the unexpected economic crash caused by COVID launched unprecedented reactions across governments, businesses, and consumers. Overall, the COVID years have seen a bust followed by a boom. In other words, a reverse cycle. Strange times, indeed. Many traditional economic metrics are producing mixed signals. The job market, prices, and consumption are just a few areas that have broken traditional patterns.

While inflation and COVID variants continue to linger, many consumers and companies are mostly back to normal. Nonetheless, the pandemic continues to exert an influence that is powerful and unpredictable. The latest COVID variant, Omicron, arrived in the news just after Thanksgiving, kicking off a new round of volatility. The VIX Index (a measure of volatility), was hovering between 15 and 20 before spiking to an intraday high of 35—a level exceeded on only a few occasions in the past five years. Moreover, investor sentiment tanked, with the American Association of Individual Investors survey showing only 27% have a bullish outlook—well below the average reading of 38% dating back to the 1980’s.

To further complicate matters, Fed Chair Jay Powell announced a quicker tapering of the Fed’s level of bond purchases. Normally, this type of action to reduce policy support would lead to a rise in interest rates. Prior to his comments, bond yields were at 1.65%. After, they dropped to 1.35%, and now reside at 1.50%. Clearly, an unusual reaction.

Our take is that the Fed taper is a minor event. The reduction of purchase levels in a market as large as the U.S. Treasury bond market has only a small effect on rates set by other market participants. Recently, investors are flocking to bonds out of a fear of the new virus variant. While the focus around tapering has been primarily on inflation, we think the Fed’s message is in part directed at consumers, not the bond market, as a way of acknowledging high prices on visible items such as gasoline at the pump. We anticipate the Fed racing to complete their intended progression through tapering into rate normalization. The economic cycle has been moving at warp speed, the unemployment rate is back down to 4.2%, inflation remains hot, and the Fed needs to restore some policy flexibility before the cycle ends.

Fed Chair Powell also provided testimony to Congress on December 1st announcing that he was retiring the word “transitory”, implying that inflation might be persistent. We see inflation remaining hot through the first quarter of 2022, then abating. Commodities related to the volatile components of the Consumer Price Index, such as oil and natural gas, are seeing price declines in recent weeks and are unlikely to repeat prior massive gains. Slower moving components (for example, the cost of shelter) are likely to remain elevated at least through the end of 2022.

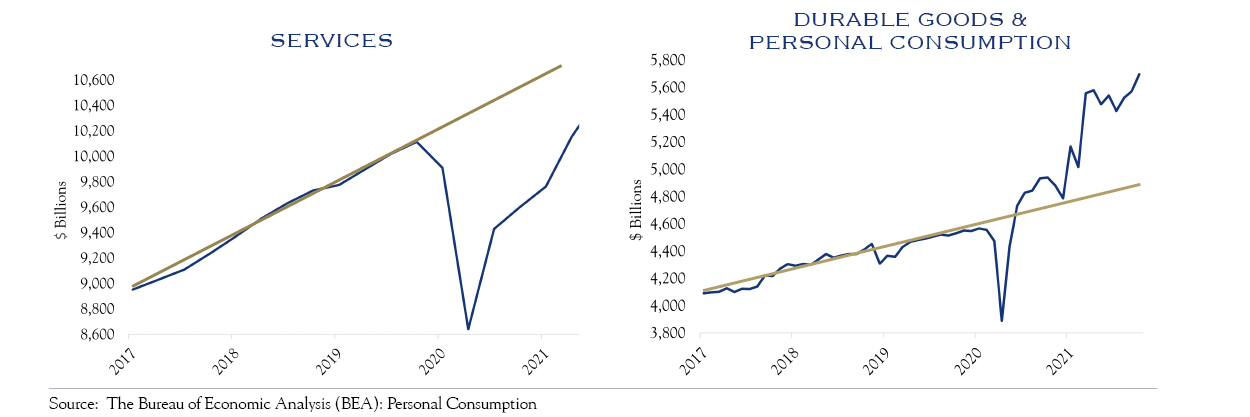

The biggest driver of prices will be the balance (or imbalance) between supply and demand. Presently, demand for goods is significantly above pre-pandemic trends, while demand for services is below trend. This change in the composition of demand has played a major role in supply chain and pricing issues. An eventual end to the pandemic will bring about a normalization of demand across goods and services. We think the bond market is correctly looking through the problem, with rates staying low regardless of hot inflation readings in the short term.

Despite the challenges of the pandemic, inflation, supply chain snags, and Fed policies, the underlying economy and earnings outlook remains sound. Consensus estimates are for an earnings growth rate over 7% for 2022—though the distribution of earnings throughout the year will be influenced by the path of the pandemic. While supply chain and labor problems abound, companies are problem-solving and enhancing productivity. Third-quarter profit margins are higher than the prior three-year average for 80% of the industry groups in the Russell 1000 Index.

We attribute the recent market decline primarily to a negative shift in sentiment as the earnings picture has not changed. While a rude interruption to the holidays, the most recent decline has thus far been quite mild, with the S&P declining −5% from an all-time-high. The normal heightened year-end anxiety intensifies with a year of ample gains to protect, and the juxtaposition of minor declines paired with rapid risk reductions causes a downward spiral. Experts in this type of hedging point to the mid-month options expiration date as a possible conclusion to this year-end dynamic. We are seeing a textbook-style, late-in-the-year reduction in risk forging choppy markets. One theme of the decline has been that the highest flyers, momentum driven stocks, have suffered the most. Perhaps this is the beginning of the end for memes in markets.

Looking further ahead, continued job gains and the re-opening of remaining disrupted sectors will contribute to above-average GDP growth and earnings in 2022. We estimate that 7% of the economy is still 25% below pre-COVID levels and anticipate an additional 1.5% of GDP growth from recovery in these areas.

We see opportunities in both growth and value as the productivity enhancing industries on the growth side will benefit from companies seeking to defend profit margins, while some value sectors will benefit from higher-than-average rates of economic growth and price flexibility. Stock selection remains paramount.

While the verdict is still out on Omicron, our base case assumes a path similar to the Delta wave, if not better, which is akin to the IHME forecast. In this scenario, economic activity will cool slightly with further recovery pushed out into 2022. While this may create additional supply chain challenges, it will also extend the economic recovery—with growth running slower for longer. Slow growth for an extended period is traditionally a favorable backdrop for equity investors. Ultimately, we see profit margins and economic growth setting the stage for a modestly positive 2022.

Until then, we remain in a short-term window of elevated risk, primarily from the pandemic, though inflation and year-end positioning will play a role. Risk is also highly unpredictable in this economic cycle, and while unusual developments and data persist, our advice is to think in terms of quarters and years, not weeks and months.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC