Small cap stocks led the way in January with the Russell 2000 index of small cap companies posting a +5.0% gain. Large cap stocks struggled, with the S&P 500 posting a slight loss of −1.0%. This divergence reflected several factors, including continued re-balancing and rotation, as well as the dynamics of retail trading and short selling in small caps. While we believe small caps offer a rich opportunity set, careful attention must be paid to quality as many small cap companies are losing money and/or have weak balance sheets. Across all market caps, active management may cause some short-term opportunity cost, due to avoiding high-flyers and zombie companies, but over time, our belief is that fundamentals drive long-term results.

For example, within the Russell 2000 index through February 9th, 50 stocks posted gains over +100% so far in 2021. That sounds compelling, though note that 48 of those stocks have a negative return on equity. Short squeezes and story stocks seem to dominate the list. While those can be entertaining in the short term, they are hardly a recipe for long-term success. Our advice: remain selective and favor quality.

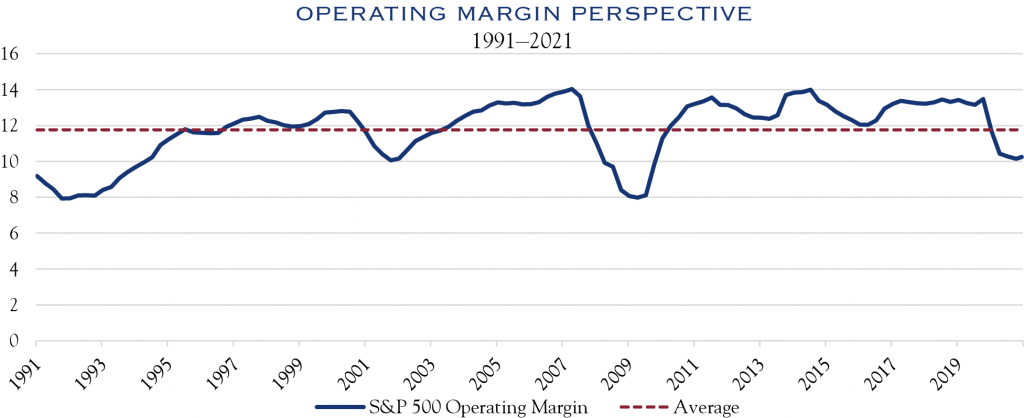

For stocks at large, better-than-expected earnings and the vaccine rollout are clearly positive news for markets, but there’s also the possibility of a sweetener from improved profit margins.

Over the past 20 years, profit margins have hovered around 12% but were elevated for the eight quarters leading into COVID. Those higher margins were partly driven by tax policy; post-COVID productivity gains could again drive margins higher, giving upside to earnings and stocks. Industries and companies with operating leverage and those which made deliberate efforts to improve productivity during the pandemic should see further earnings gains, giving more fuel for equities.

Source: Bloomberg

ECONOMIC UPDATE

Weather conditions throughout the U.S. remain quite mixed—lovely in some places, frozen in others. The same dynamic exists across economic sectors. The January jobs report showed an addition (or restoration) of 49,000 jobs, albeit with job losses in leisure & hospitality and retail. This followed aggregate job losses in December. The total employed in the U.S. is about 10 million jobs less than the pre-COVID peak. While the Biden administration is embarking on another round of fiscal stimulus, job creation will only result from extinguishing COVID, restored confidence in consumer health, and the concurrent re-opening of economic sectors.

Traditional measures of consumer confidence fared well through most of COVID. While slightly off the recovery peak—and well below pre-COVID highs—the University of Michigan Consumer Sentiment Index reading of 79.4 for January is comparable to the 2012 through 2014 readings, and remains well above the readings around 60 that lingered for a full year after the Global Financial Crisis. Three dynamics are at play: 1) employment pain is concentrated; 2) stimulus has provided buoyancy; 3) individuals have a resilient ability to look through the pandemic. Lapping the one-year mark on the pandemic, these sentiment measures are equal parts encouraging and discouraging. It is discouraging that COVID remains a dominant force among consumers, although it is encouraging that readings remain stable and not far below the long-term average for this index. As health conditions improve, confidence will follow suit.

The surveys from the Institute for Supply Management (ISM) provides insight into the condition of manufacturing and services. These surveys show continued economic expansion with mixed conditions across industries. Manufacturing survey comments indicated growth limitations due to difficulty hiring skilled workers and in required sanitization logistics. Several areas in services remain highly disrupted due to COVID: restaurants, arts and leisure, and retail are industries desperate for improvement in operating conditions.

The Bureau of Economic Analysis reported Gross Domestic Product (GDP) statistics for Q4 2020. GDP advanced at an annual rate of +4.0% in the fourth quarter. While this was slightly below consensus expectations, several internal metrics give reason for optimism. The largest contribution to growth came from investment, especially in residential property, equipment, and intellectual property. Savings rates were elevated, which should provide cushion against further delays in economic re-openings due to COVID, and represents fuel for pent-up demand as conditions normalize.

OUTLOOK

We remain mindful of elevated valuations and highly aware that support for valuations comes from low interest rates and low levels of inflation. While another round of fiscal stimulus is being contemplated and may add inflationary pressure, we believe that structural issues of low-capacity utilization, flexibility in supply, and the high number of unemployed will limit price increases across the general economy. With inflation under control, interest rates will continue to provide a favorable backdrop for valuations over the short and intermediate term. We will closely monitor productivity and profit margins for signs of improvement as they can help drive further gains. Some segments of the equity market are showing high levels of enthusiasm, somewhat detached from fundamentals. This type of environment is susceptible to correction, typically a 10–15% market decline. However, the big picture of valuation appears reasonable, with the S&P 500 trading at around 22x forward earnings. Overall, our three-year outlook remains favorable, with progress in vaccinations and economic recovery contributing to earnings gains.

February 16, 2021

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC