Presently, we see three categories of importance for investors:

- The Macroeconomic Engine

- The Profits Cycle

- Valuations

The Macroeconomic Engine

The macroeconomic engine continues to be influenced by pandemic-related cycles. On February 4th, the Bureau of Labor Statistics (BLS) reported new job creation of 467,000, staggeringly higher than expectations. Two forces are at play. First, the pandemic wrought many starts and stops to the economic cycle, which in turn caused traditional economic metrics to be erratic at times. Second, employers and employees strongly desire to hire or be hired as they look beyond the Omicron wave. Employers have spent several months dealing with labor shortages at the same time stimulus savings ended for the unemployed. We expect continued job recovery—along with productivity gains—to drive above average economic growth in 2022.

The Profits Cycle

Productivity measures have been volatile, like most economic statistics during the pandemic. Nonetheless, the BLS announced a productivity 6.6% gain for Q4 2021. Outputs increased a whopping 9.2% despite only a 2.4% increase in hours worked. One quarter does not make a trend, but we foresee continued robust productivity gains driven by pandemic-era investments in efficiency.

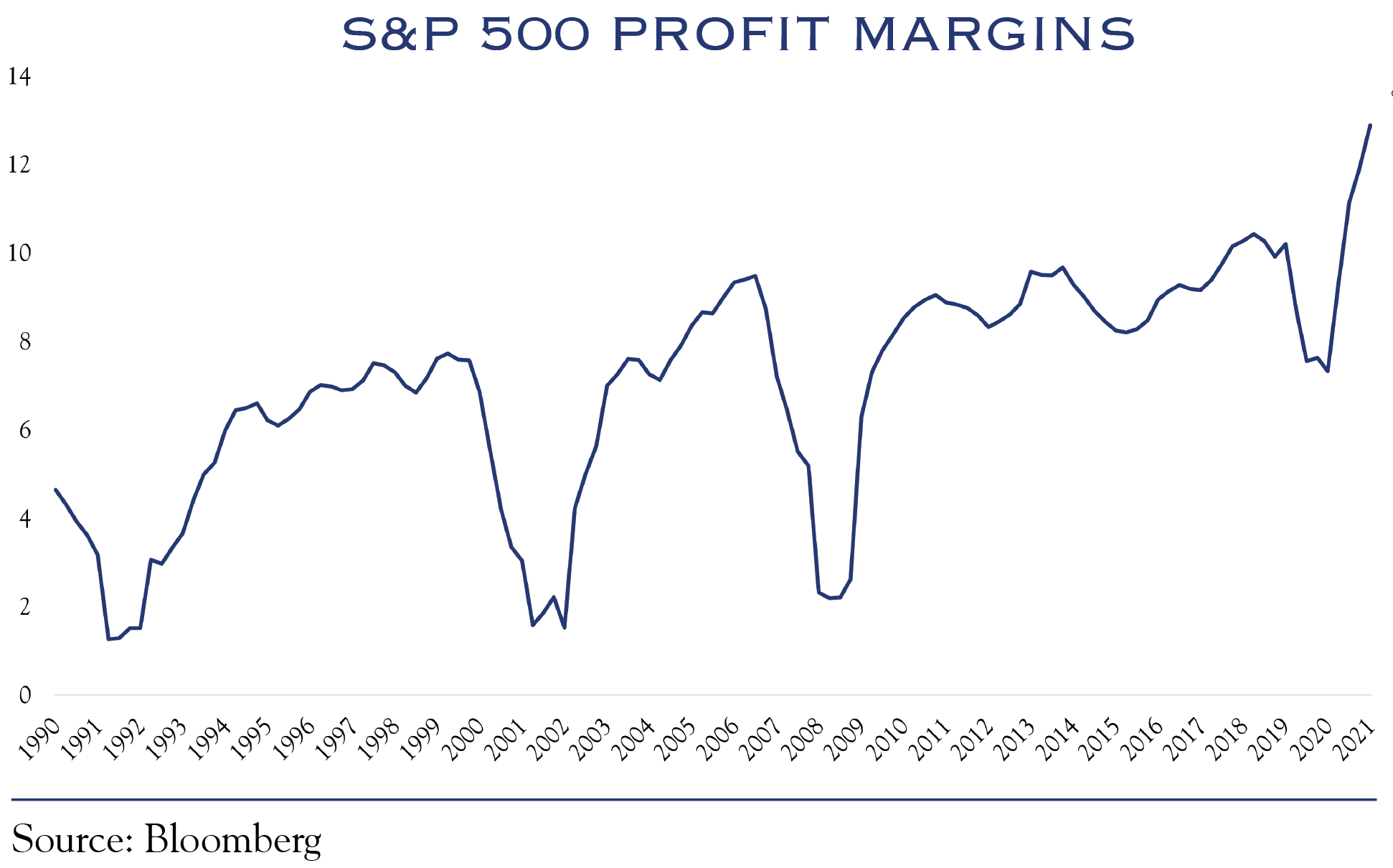

Those productivity-enhancing investments also show up at the micro level as strong corporate profit margins. While margins likely declined slightly in the 4th quarter, they remain near all-time highs. Further, earnings continue to exceed expectations by a larger gap than sales, indicating that analysts under-estimate the ability of companies to maintain profit margins. Companies are finding a way to make it all work, despite seemingly endless challenges across supply chains, logistics, and the labor market. We see great opportunities for stock selection as certain industries and companies prove more adept than others at managing through this complex and unpredictable economic cycle.

Valuations

Future interest rates profoundly affect how investors value corporate earnings. Anticipated rising rates, adds more uncertainty to how investors value companies. This results in additional market volatility as investors grapple with the answers. Current market-based expectations show a possibility of five rate hikes this year. While that’s possible, we expect the Fed to pause after four hikes, by the September or November meeting. That would allow Fed policy to focus more on economic growth and job recovery rather than inflation. In the final analysis, we see interest rates climbing, though not exceeding much more than 2.25%. Should they climb higher, there is ample historical evidence showing that price/earnings ratios can comfortably maintain current market levels, even with elevated rates.

Geopolitical fears have once again made front-page news. While troubling, history demonstrates that even tremendously significant events are often quickly deprioritized by markets as investor focus returns to earnings and economic growth. That’s not to say the recent meeting between Chinese President Xi and Russian President Putin was insignificant. Rather, the meeting’s significance pertains more to the political realm than the financial.

In coming weeks, we await likely choppy economic data from January, due to significant Omicron-related disruptions. This may provoke additional volatility as markets process a variety of contradictory indicators. The February 10th CPI report of a 7.5% rise in inflation surprised consensus, leading to short-term noise and volatility as the news is digested.

Over the course of our three-year time horizon forecast, we foresee a period of strong economic growth, followed by a return to slower (normal) growth. This backdrop is consistent with our expectation for equity gains mainly powered by modestly higher earnings. We expect continued rising interest rates but not to problematic levels for stocks. We advocate a long-term horizon and emphasize the value of the old-fashioned hard work of individual security analysis.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC