Standing astride the Prime Meridian at the Royal Observatory Greenwich, a traveler can balance perfectly between the Eastern and Western Hemispheres. Investors are similarly between two realms, with one foot in a high-growth, high-inflation, post-pandemic economy and one foot in the future economy of slow growth and low inflation. Similarly, interest rate policy is balanced between two realms. One side is characterized by a tough-talking, hawkish, inflation-fighting Fed. The other is a view to the future, with rate cuts expected as inflation continues to decline. This realm-straddling will create market volatility and demand patience from investors as the cycle gradually evolves into a “back-to-boring” economy.

Economy

Economic growth in the fourth quarter was robust, with a GDP reading of 3.3%. Meanwhile, surveys reveal a cautious view of the economy. As the election cycle progresses, we expect a louder debate between economic views. Payrolls and wages continue to increase, expanding real-time growth metrics. The Weekly Economic Index and GDPNow models show growth of 1.90% and 3.04%, respectively. Long-term trends in population and productivity also point to growth of around +2%. The economy is getting back to normal.

Inflation

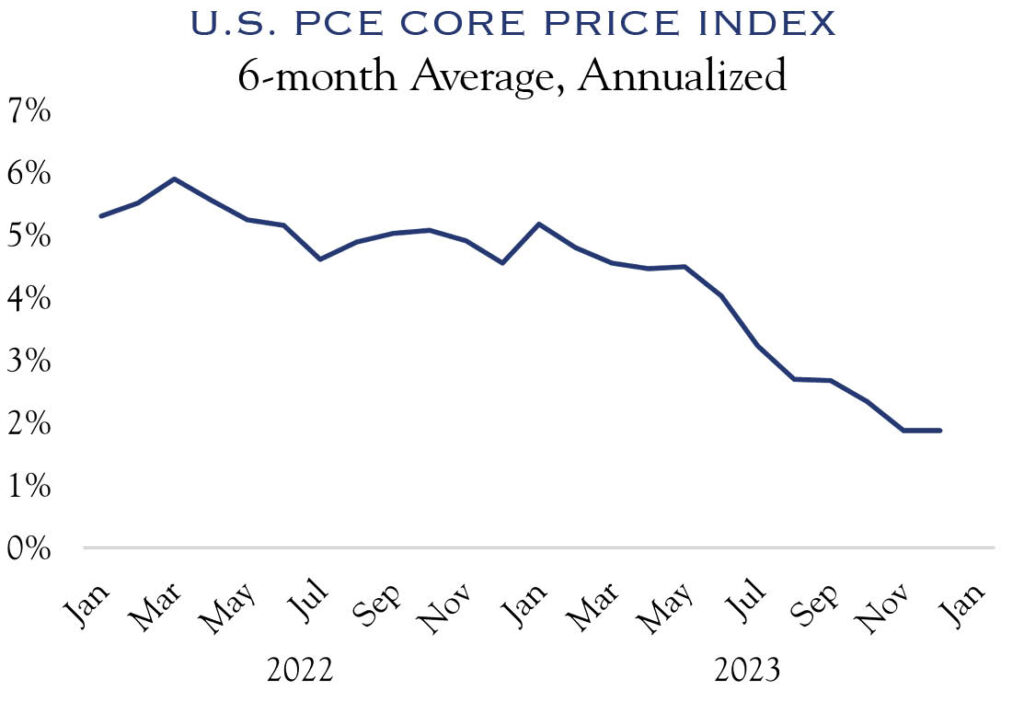

The debate over inflation continues. Prices remain at meaningfully higher levels than before the pandemic. For example, the Consumer Price Index (CPI) level is currently 306.75 compared to 257.98 in December 2019—an increase of 19%. On the other hand, price levels have largely stabilized. On a year-over-year basis, CPI registered a gain of 3.4%. Measured on a six-month annualized basis, Core PCE—the Fed’s preferred metric for measuring inflation—dipped to +1.9%, below the Fed’s target for 2.0% inflation.

Earnings

We expect earnings to advance by about +6% in 2024, absent any shocking changes in outlook from earnings season. Our research shows that a 2.0% level of economic growth is consistent with a 6% earnings gain. As the year progresses, the earnings outlook could improve, especially if the Fed enacts rate cuts and as companies deploy technology to boost margins. While economic growth and the interest rate cycle will remain important, company-specific adaptation to a slower-growth environment will be critical for earnings. The past few years’ highly disruptive and rapid economic cycle is giving way to an “everything old is new again” slow-growth economy. Companies must find ways to do more with less, and advances in artificial intelligence and robotics provide the means to do so.

Good News

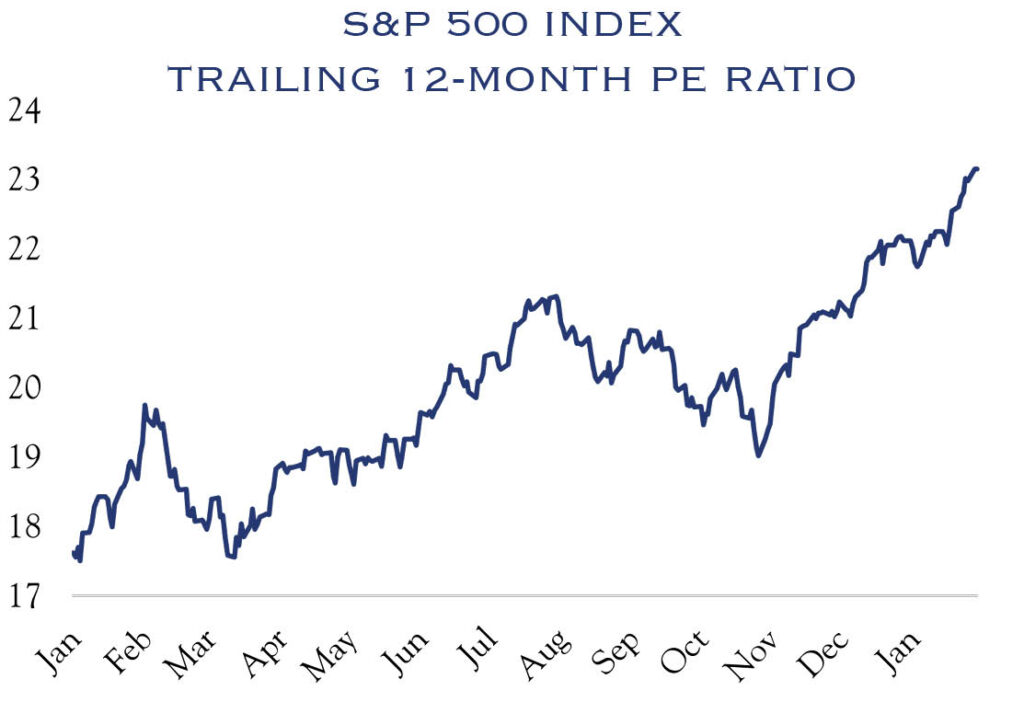

The rapid advance of bonds and equities in late 2023 stole some of the thunder from 2024. At present, a lot of good news is priced into both stocks and bonds.

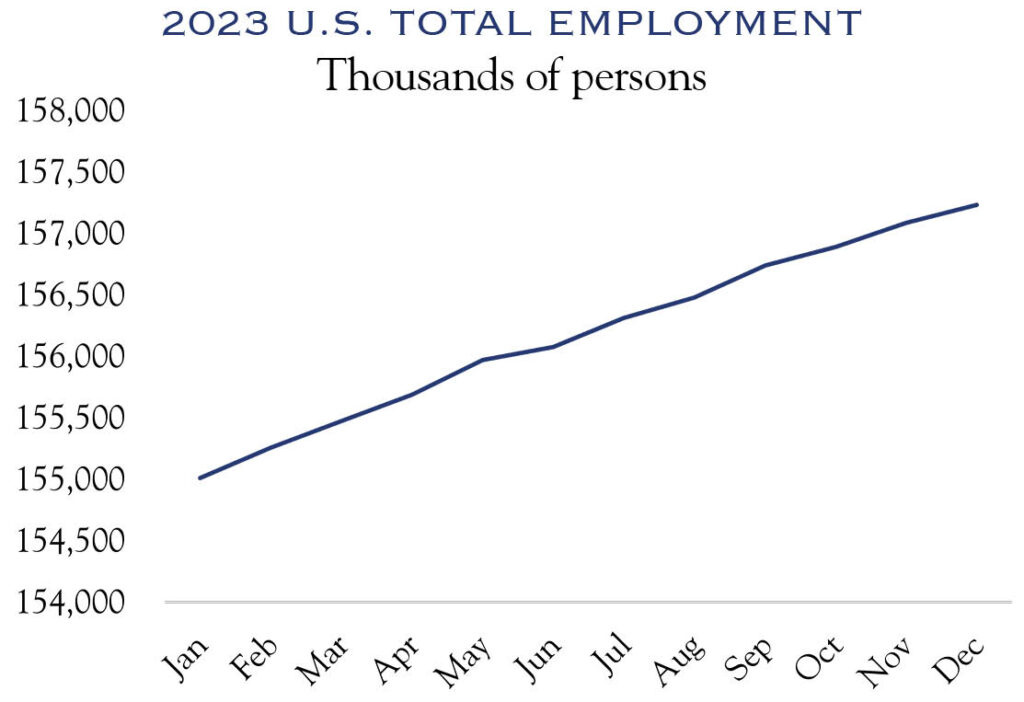

Source: Bureau of Labor Statistics. Nonfarm payrolls.

Recession predictions have been declining, and rightly so. 91% of respondents in a National Association of Business Economists survey placed recession odds at less than 50%, compared to 42% of respondents one year ago. The optimism over avoiding a recession is well-placed, as the economy remains on solid ground, with payrolls continuing to expand.

Source: Bureau of Economic Analysis.

Another piece of good news that is priced in is the expectation of future Fed rate cuts. This optimism is well-founded as inflation continues to abate. Shown above is the Fed’s preferred metric—Core PCE—on a six-month average, annualized basis.

Sources: Standard & Poor’s, Bloomberg.

As fears over recession and inflation have cooled, valuations on equities have expanded. The chart above shows the PE ratio on trailing 12-month earnings for the S&P 500. The sharp uptick in late 2023 coincides with vastly improved expectations over inflation and Fed policy.

The economy and earnings will continue to expand modestly. However, patience is required, as further advances in stocks and bonds will require fuel from a lower Fed funds rate. The economy and inflation are still in two places at the same time: the post-pandemic high-growth, high-inflation environment and the newly emerging, back-to-boring, slow-growth, low-inflation economy. Policy and markets will continue to straddle these two worlds until the Fed executes the first rate cut.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC