As COVID and politics continued to ravage the American landscape, stock market indices reached fresh highs in the early days of the new year. Investors were buoyed—despite a calamitous end to the election season and botched initial rollout of the COVID vaccine—by the prospects of political accord and COVID containment.

Such a future supports rational expectations of improved sentiment, economic growth, and future earnings power.

The broad move upwards in stocks is powering narrow pockets of investor exuberance, some seemingly supported merely by tweets and dreams. While the long-term outlook offers opportunity for patient investors, the near term presents challenges as investors sort through the mixed messages of COVID, political turmoil, economic recovery, record stock prices, and upcoming policy shifts.

Uncharted Territory

In 1596, the Dutch navigator and explorer William Barents began his third and final Arctic journey, seeking trade routes to Asia by sailing farther north than any other ship. Author Andrea Pitzer describes Barents journey in Icebound: “Sailing day after day without a map into unknown territory is a completely different experience. It’s impossible to know which kinds of shores, or what animals, wind, and weather may appear next.” Barents perished on the voyage, but his crew survived, and today the Northeast Passage is viable, enabling nautical navigation from Europe to Asia.

Stocks are in uncharted and potentially perilous territory, with prices and valuation metrics breaking records. Will investors get trapped in the sea ice of excessive optimism, or will they find a new passage to future gains?

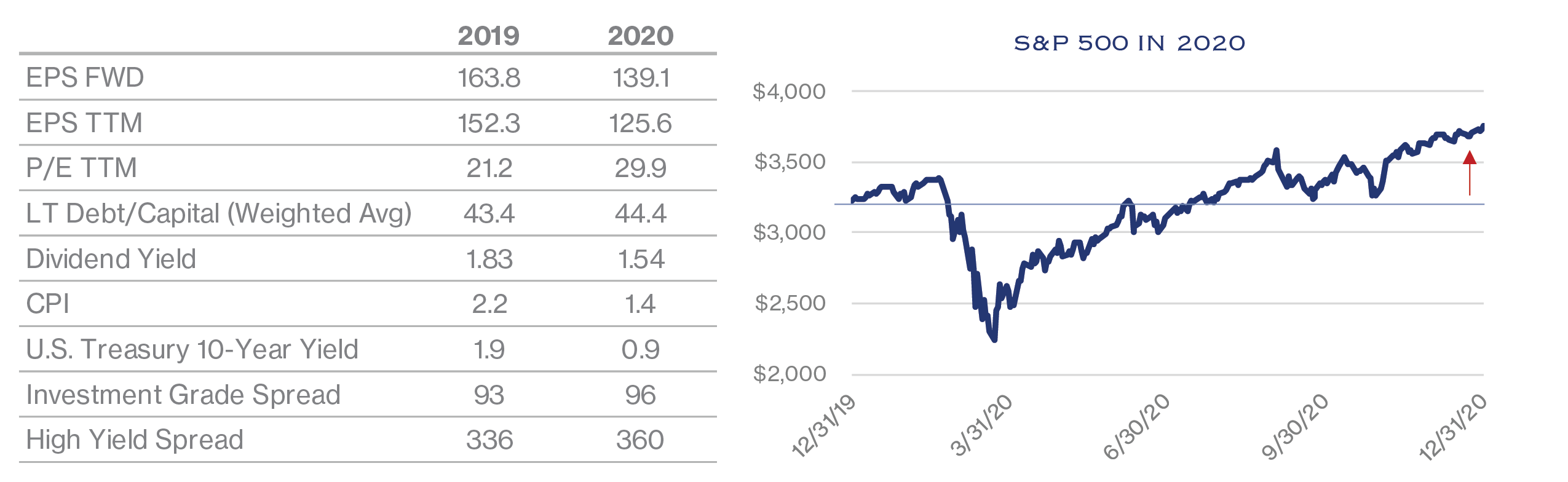

The primary thesis for investors has been predicated upon COVID’s effect on economic activity: so long as the economy improved, stocks would rally. It is time to change that view, as economic recovery is well embedded in current equity prices. The economy will continue to recover, benefiting earnings in coming quarters. However, stocks have now gained enough ground that prices move due to non-COVID issues. In other words, earnings and other company-specific fundamentals once again matter.

Sources: Bloomberg, FactSet

Sources: Bloomberg, FactSet

COVID

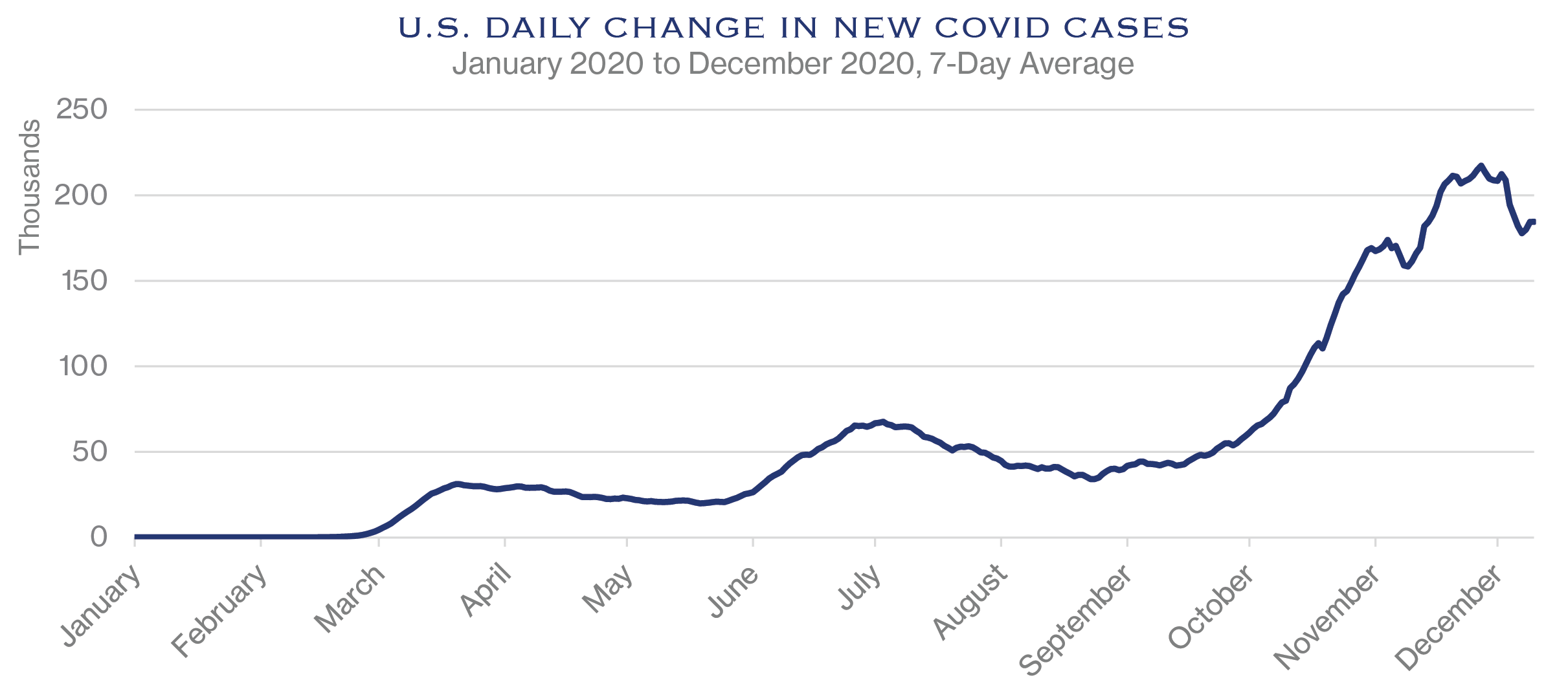

Occam’s razor is a principle stating that the simple explanation is often the right one. Regarding the economy, there is no metric more simple and useful right now than daily COVID cases.

Source: The COVID Tracking Project

Source: The COVID Tracking Project

The current COVID tally is over 200,000 new cases per day, on average, over the past seven days. In the summer, this figure was as low as 20,000. This elevated count, paired with a patchwork of differing regulations and restrictions, are the primary reasons for portions of the economy running well below potential.

With vaccines now being distributed, an eventual decline in COVID cases will exert a positive influence on economic activity as consumers return to a more normal set of behaviors. An early read on this effect may come from Israel which is starting to reach high levels of vaccinated and infected. Future case counts there will give some clue as to the potential timing of a return to normalcy. Eventually, pent-up demand will emerge, though this interpretation bears caution. In the spring, when businesses were shutting down due to regulations and/or health concerns, it was important to recognize that not every segment of the economy was shutting down. Now, we must recognize that not all segments will benefit from pent up demand. Thus, growth will accelerate, though perhaps not at the pace called for by the most enthusiastic commentators.

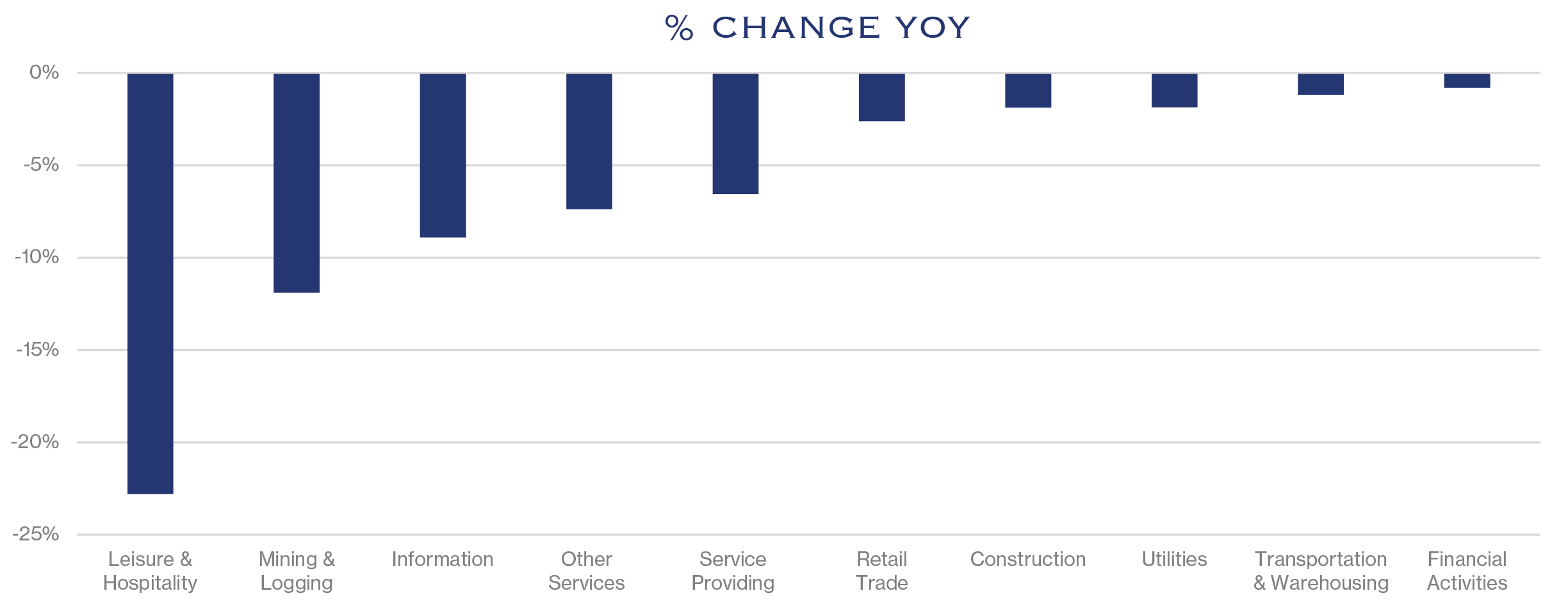

Employment Plateau?

Meanwhile, the pace of improving employment has slowed, mainly due to disparate conditions across industries. The Bureau of Labor Statistics shows a decline in total employment, following several months of gains. While most of the job loss was in leisure and hospitality, these industries are partially frozen due to COVID. Firms in other industries report having a hard time finding skilled laborers. This dichotomy can be seen in the chart below, which maps changes in total employment by industry compared with one year ago.

As of 12/31/2020. Source: Macrobond

As of 12/31/2020. Source: Macrobond

Consider this comment from the Institute for Supply Management (“ISM”) survey of business conditions in the services industries. A construction company notes: “Lack of labor continues to be a significant drag on the business. We have plenty of work but are now considering rejecting some orders due to shrinking capacity.” While this is only one example, it highlights the very different employment situation across industries, depending primarily on their ability to conduct business in the COVID era.

These imbalances should correct themselves as conditions improve in the most disrupted areas and as workers switch fields to pursue better job prospects. In the meantime, daily COVID cases are the single most important metric for the leisure and hospitality industries.

Favorable Financial Conditions

On the balance sheet side of the economy, conditions are challenging but manageable. Financial conditions are relatively robust, with ample liquidity funding all but the most troubled businesses. The St. Louis Fed’s metrics of financial stress have been favorable over the past six months. In real estate, demand profiles are changing due to ongoing trends (such as retail shopping patterns), as well as shifts caused by the pandemic (such as office space utilization). These changes could lead to some friction in lending markets as owners re-configure properties. Banks, however, appear to have adequately reserved against losses while the Federal Reserve and Treasury continue to foster a supportive lending environment. Fiscal stimulus has ballooned the national debt. For now, lower interest rates help to offset and minimize the debt service burden, and the U.S. remains a strong credit in a challenging world.

Economic Activity Continues Apace

On the income statement side of the ledger, economic growth has shown momentum and the outlook is encouraging for coming quarters. A combination of stimulus, savings, pent-up demand, and economic recovery post-COVID will lead to above trend growth in GDP. Growth will support gains in revenue and profits—including productivity gains that often follow recessions and that have been uniquely achieved through COVID repositioning.

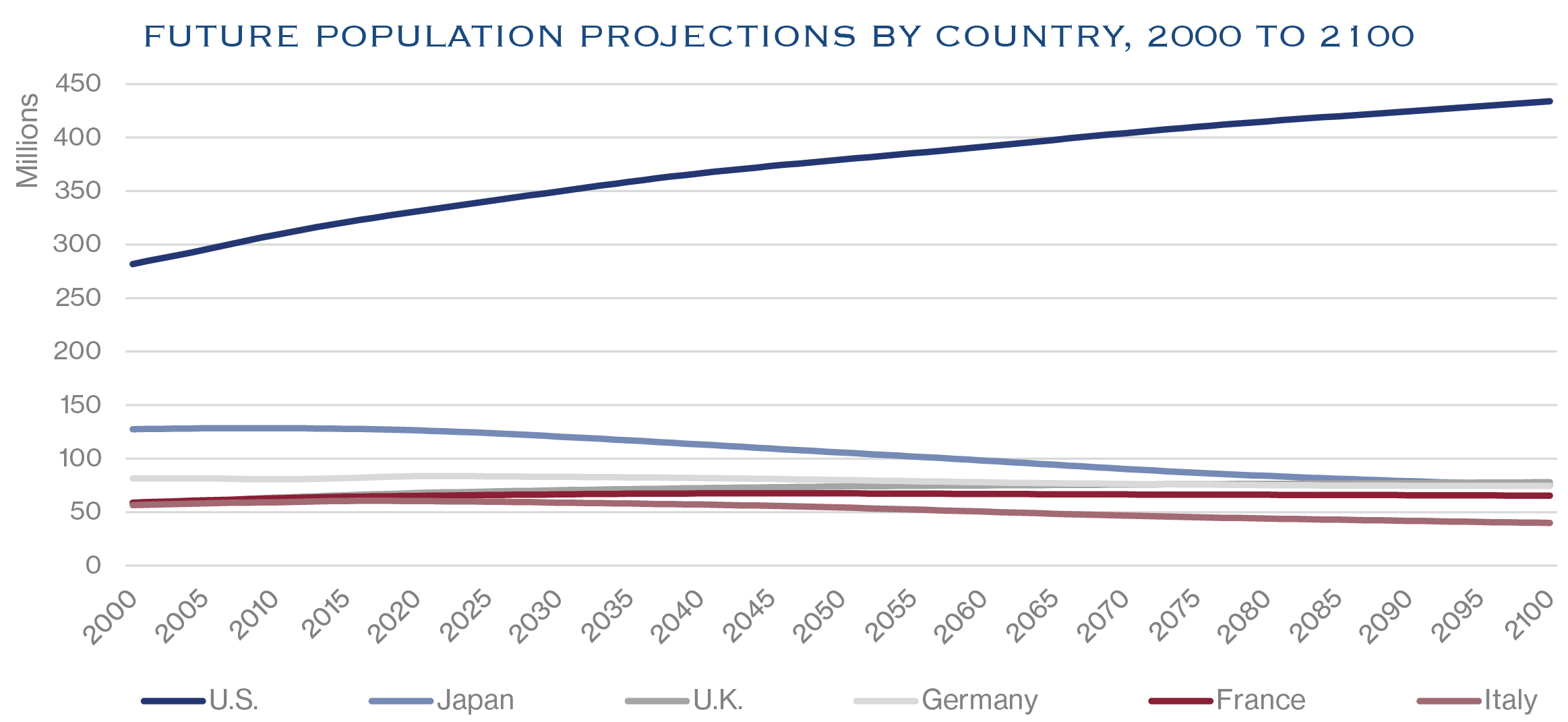

Looking further ahead, the long-term trend of slow, sustained growth is likely to prevail. One relevant note, especially for global investors, is that population trends in the U.S are favorable relative to much of the world. That often supports a better growth environment and one reason we continue to see appeal in U.S. equities.

Source: International Institute for Applied Systems Analysis (IIASA): World Population and Human Capital in the Twenty-First Century (Population)

Source: International Institute for Applied Systems Analysis (IIASA): World Population and Human Capital in the Twenty-First Century (Population)

Policy Outlook

The sequence and magnitude of policy initiatives will play an important role in economic activity. If the incoming administration places an immediate focus on changes in tax and regulatory policy, it would damper investor optimism. Prioritizing pandemic recovery and job creation will be viewed much more enthusiastically. Given the rancor that lingers from political polarization, having only a slim advantage, and recognizing that midterm elections are only two years away, Democrats may choose to pursue a more moderate policy course. Already, some green shoots of bipartisanship are emerging based in part on the prior working relationship between President-elect Joe Biden and Mitch McConnell. Stability and moderation from Washington supports a favorable investment scenario. Regardless of the specific path of policy, significant stimulus has already been deployed and more may follow.

Inflation Outlook

The Fed announced in August a new policy framework, allowing inflation to run above 2% as an offset to even lower inflation, so that inflation averages 2% over time and provides an environment conducive to job growth. Large amounts of fiscal and monetary stimulus, a supportive Fed, and reduced resistance to budget deficits in DC raise a question of whether inflation may become a concern.

In our view any emerging inflation is likely to be transitory and effect narrow segments of the economy. Much of the forthcoming pent-up demand will be concentrated in areas that also have excess supply—such as leisure and travel. Nonetheless, some signs of inflation may emerge; these concentrated areas of inflationary pressures could be thought of as “thin-flation”. Low-capacity utilization, large numbers of unemployed and under-employed, easy price comparison shopping, and a globally competitive marketplace should help to limit any broad price increases. Further, the digitally focused, consumer- and service-based economy has a very elastic supply curve—witness the dramatic growth in digital consumer facing companies in recent years.

While measures of inflation will likely increase and the attention paid to inflation may soar, we believe investors will rightly look through any rise, recognizing that it is likely to be short-lived and narrow.

Valuation Outlook

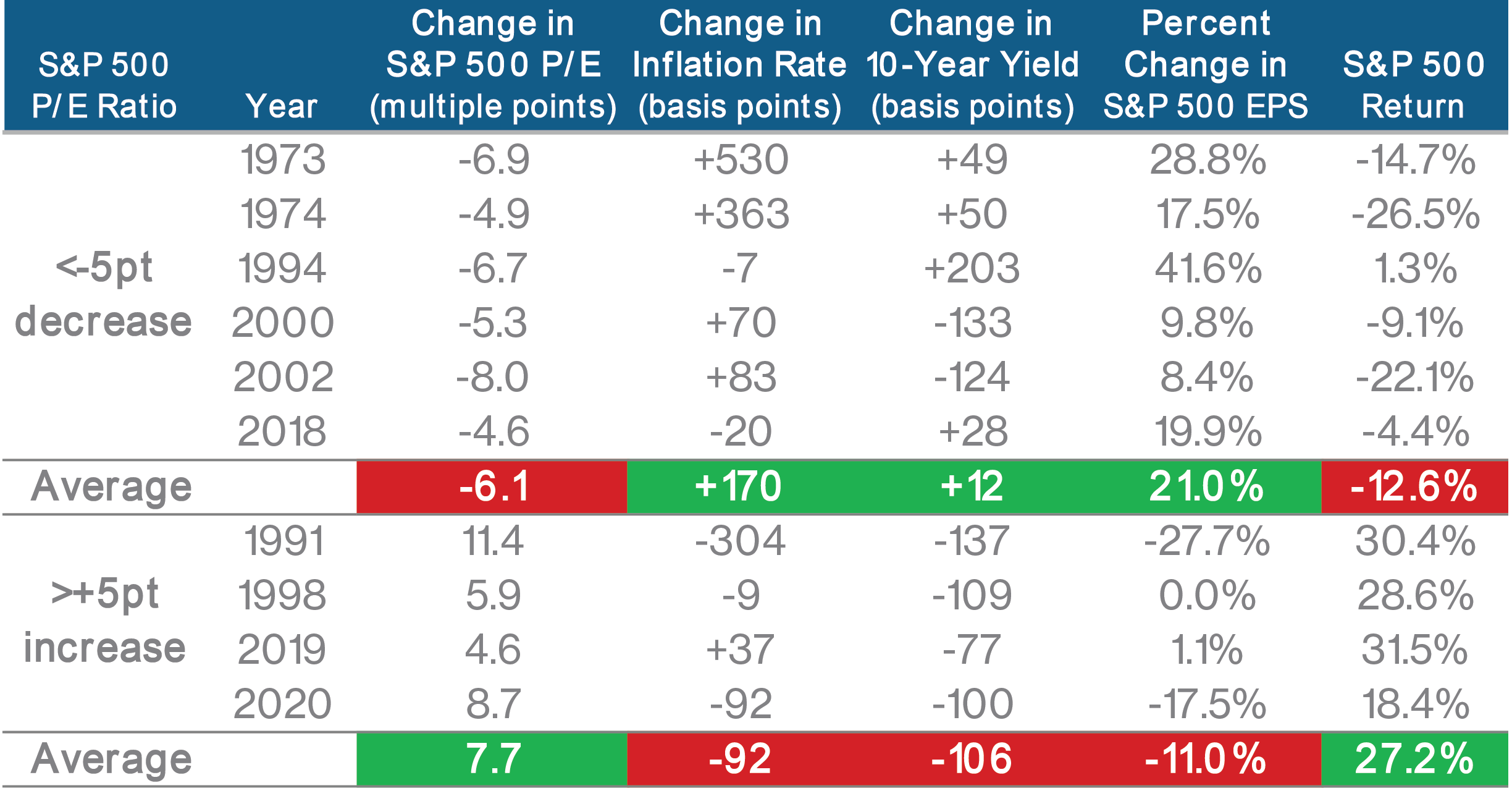

With valuation levels near all-time highs, we carefully reviewed historical changes in valuation, focusing on key metrics that might influence sustainable valuation levels going forward.

Our deep-dive research covers data dating back to 1962, with a primary focus on changes in the Price/Earnings (“PE”) ratio by calendar year.

Most of the observations fell in a range of +/− 3 multiple points. From today’s forward-looking PE of 22x, this would imply a decline to 19 or an advance to 25. All else being equal, this equates to a change in price of +/− 13%, which is surprisingly in line with the rule of thumb that a 10–15% decline is a common occurrence.

Next, we identified the largest PE swings, focusing on those years where PEs expanded or contracted by more than 5 multiple points. Our work showed six declines and four advances. The table below summarizes the findings.

Sources: Bloomberg, Bureau of Labor Statistics

Major PE declines occur against a backdrop of exogenous events and/or inflation. The two years with declining PEs and no inflation pressures were 1994—which saw a strong and surprising Fed rate hike cycle—and 2018—which experienced a swift year-end selloff, partly fueled by concerns of a Fed rate hike cycle. The year 2002 was full of exogenous events including the aftermath of 9/11 and the accounting scandals at WorldCom and Enron.

The tech bubble in 2000 saw PEs decline after having peaked at levels well above those in the current environment. Unsurprisingly, the rampant inflation of the 1970s produced several years with PE multiple contraction. That is a topic unto itself, though we recently attended the American Economic Association virtual conference, where a presentation put forth a novel explanation attributing inflation at that time to regulations limiting the rates paid on savings, in spite of high rates in the rest of the economy. In our view, this work also supports the theory that asset allocation changes are driven by relative rate differentials.1

The large advances in PE multiples have all come in years that saw rates decline, typically by 100 basis points or more. This supports the thesis that allocation decisions are made on a relative basis. When risk free yields decline, equity investments look relatively more compelling and investors are willing to pay more for stocks.

The implications for today are as follows.

Upside valuation: While sentiment may continue to improve, PEs are already elevated and it is unlikely that 2021 follows the pattern of large increases seen in 2019 and 2020.

Downside valuation: We do not see persistent sustained inflation, thus any large PE decline is unlikely and unexpected, as it would probably emanate from an unpredictable exogenous event.

Base Case valuation: The most likely scenario is PE ratios remain around current levels, +/−3 points.

Outlook

We take a three-year forward-looking view and over this horizon, the outlook is encouraging. Stock dividends and earnings yields still widely exceed the risk-free rate, thereby offering reasonable expected returns. Further, the eventual progress in vaccinations, economic recovery, and sentiment improvements set a favorable scenario for earnings growth. We expect a move towards the long-term trend line of mid-single digit returns, allowing for normal 10–15% corrections along the way. The earnings path is likely to be favorable, and dividends remain above 1.5%. Overall, we look for PEs to remain around current levels, and stock moves to be fueled by earnings and dividends.

At some point in 2021, a sense of normalcy will likely return to daily activity, though the post-COVID version of the global economy will be different, bringing new challenges and new opportunities. Some companies will have endured the fate of William Barents, trapped in the sea ice of COVID, while others will find passage to an exciting new territory. Our approach to this challenging environment includes customized asset allocation, fundamentally-driven security selection, and prudent rebalancing.

January 15, 2021

Robert Teeter

Managing Director

Investment Policy & Strategy Group

1 Drechsler, Savov, Schnabl

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC