The End of the Biggest News Story Ever

The Economist magazine analyzed prominent news stories dating back to its founding in 1843, including stories from The New York Times since its first printing in 1851. What it found will surprise no one. COVID was the most prominent news story apart from the World Wars. Throughout 2020, COVID appeared in nearly 50% of all stories across these two publications. During “Peak COVID” a startling 80% of stories in The Economist focused on the topic! Thankfully, COVID is subsiding—medically, in news coverage, and in its dominance of daily life. Now, the headline question for investors is: What Comes Next?

You are Here

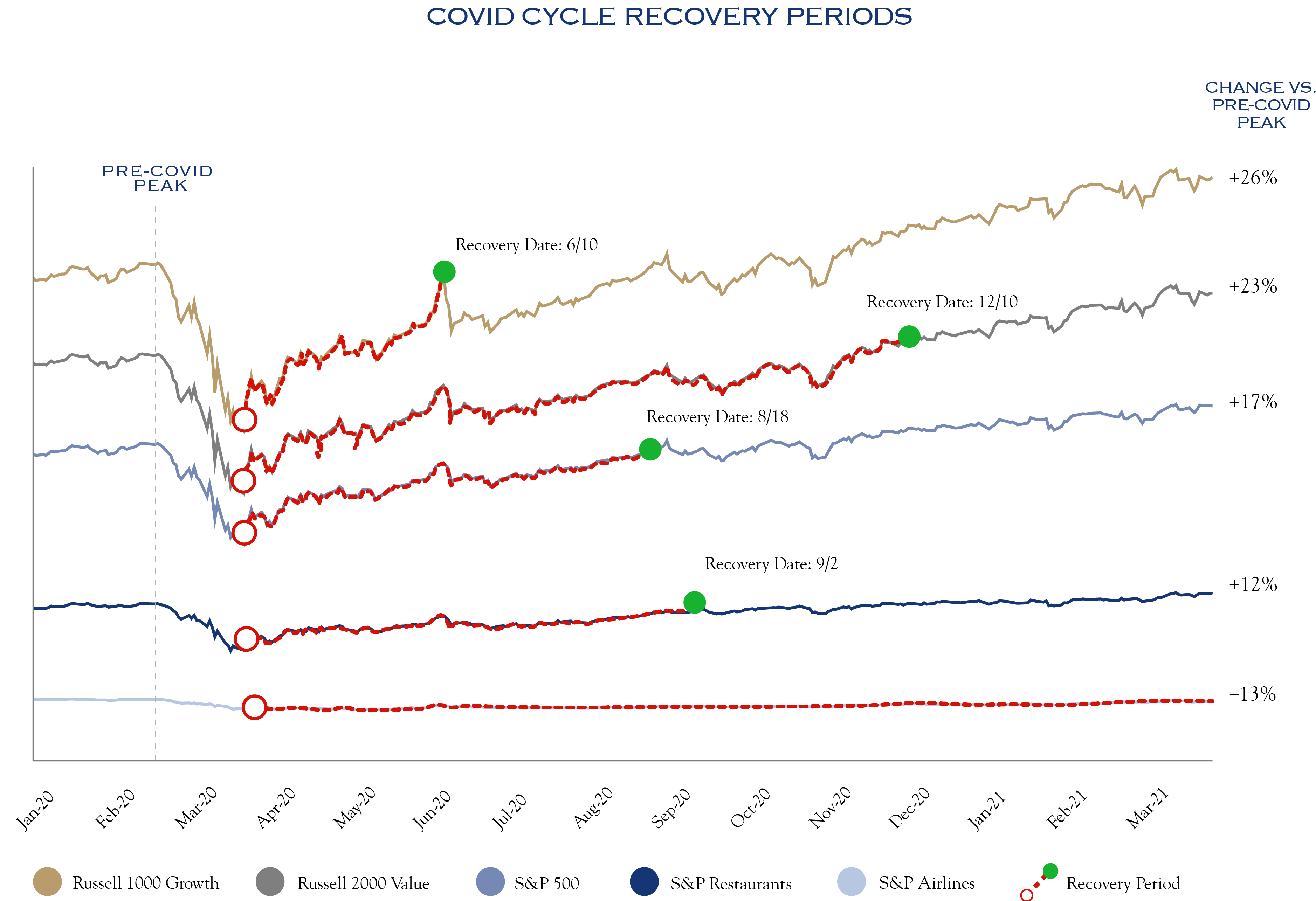

A violent economic cycle was wrought by severe economic restriction, massive stimulus, and now, a re-opening. After this roller coaster ride, most market segments now reside well above pre-COVID levels. A few representative market segments are shown below, along with their recovery dates.

Source: Bloomberg

Source: Bloomberg

Most major market indices recovered to their pre-COVID highs by the end of 2020; we may now ask what lies ahead for 2021 and beyond.

Markets are experiencing a day-to-day battle, with one side favoring the recovery trade and cyclical growth (value stocks), and the other following the pre-COVID trend of paying up for organic growth (growth stocks). The debate centers largely on inflation and interest rates—both critical elements of our investment outlook. While closely linked, each must be viewed separately since they have different influences and in turn create different effects for investors.

Inflation

Inflation is typically measured using the Consumer Price Index (“CPI”) which reflects changes in prices for over 200 categories of items over the prior 12-month period. Macro Strategist Cameron Crise of Bloomberg takes a wise approach by looking at the normalized deviation of inflation as compared with its 10-year average. This has the benefit of showcasing whether inflation is running hot or cold relative to the norms of the time. His work shows that if the Consumer Price Index (“CPI”) were to post a reading of up 3.5%, that would register as two standard deviations above the average of the past ten years. This is typically a painful level of inflation for equities. The issue is not simply whether CPI reaches that level, but if it does, whether it stays there long enough to matter. The next few monthly CPI readings will be critical, as they represent a window of time in which inflation has the potential to take hold. Recently released CPI data show an increase of 2.6%, with much of the increase due to rising energy costs, specifically gasoline prices. There were few categories showing large increases and energy prices have moderated in recent weeks. While there will continue to be some confusing comparisons, and upward pressure on inflation (potentially as high at 4.0% in the May data release), we expect the increases will be temporary.

Consider the forces aligned against inflation—slow population growth, the march of technological innovation, global competition, easy price comparisons, strong incentives and policies against price collusion, the emergence of traditional energy substitutes, and so on. Due to this bulwark against inflation, any elevated CPI readings are likely to be short-lived and related primarily to transitory issues of the post-COVID economic recovery cycle.

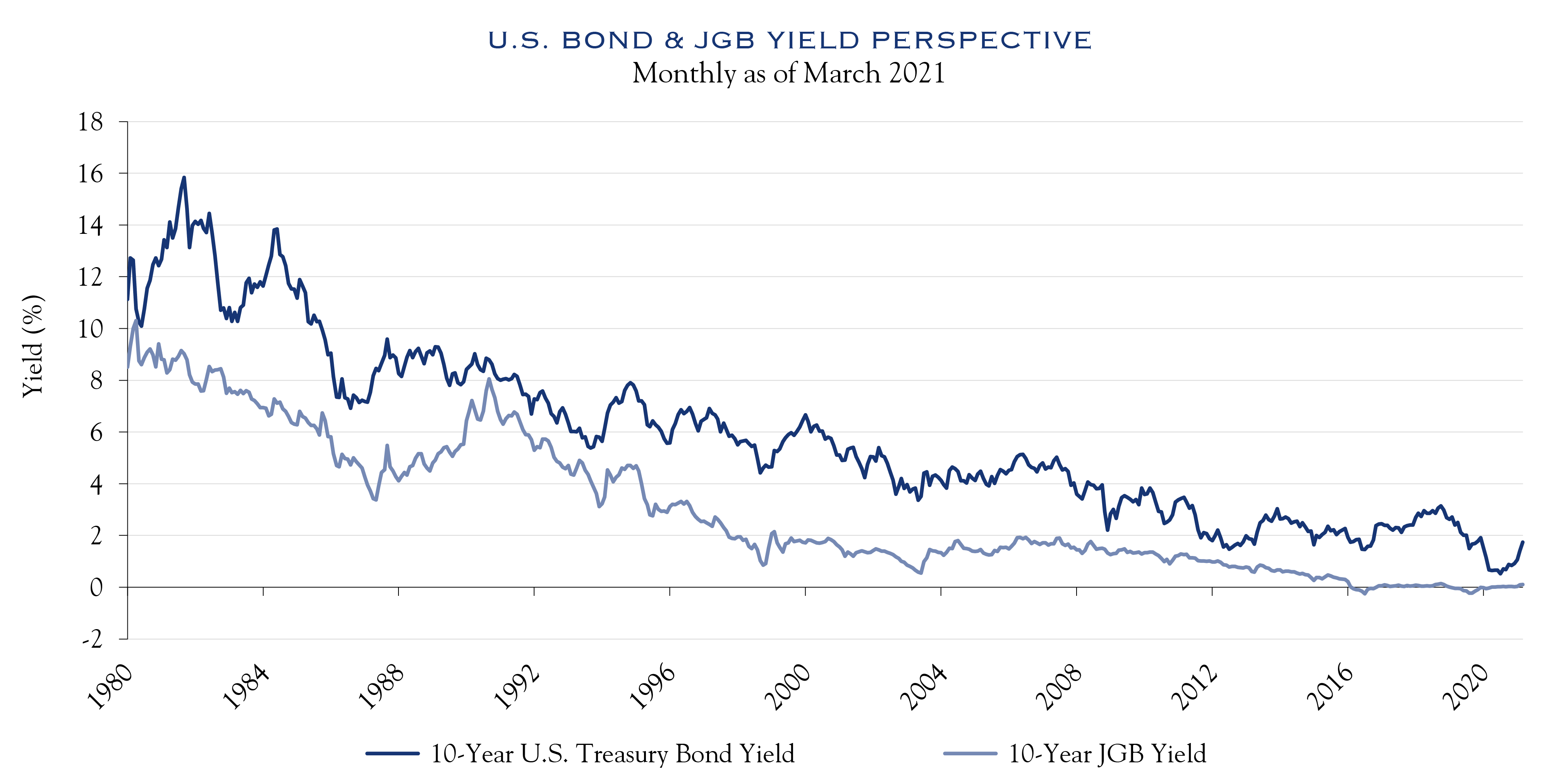

Interest Rates

There has been an intense focus on the increase in interest rates in recent months. It is important to bear in mind—contrary to much recent commentary—that rates have merely normalized and remain at levels below rates of the pre-COVID era. While the mostly transitory inflation issues will continue to pressure on bonds, with rates rising in turn, these increases are likely to remain fairly modest. Global investors, specifically Japanese and European bond buyers, are faced with minuscule yields on government bonds. Japanese government bonds (JGB) yield 0.10%, while French and German bonds have slightly negative yields. The strong yield differential to U.S. Treasury rates should create demand for U.S. Treasuries. It will be a welcome outcome, as recent and planned government fiscal activity require robust new issuance. Overall, our view is that rates will continue to move modestly higher to levels that represent normalization to the post-COVID era rather than inflation fear.

Source: U.S. Department of the Treasury, Bloomberg

Springtime for the Economy & Earnings

The Poetry Foundation created a list of poems celebrating springtime including one titled “More Than Enough.” It includes this line: “The green will never again be so green, so purely and lushly new…” As the nation has eagerly anticipated a change in season, economic recovery is in full swing and earnings estimates are rising in lockstep.

The publication Consensus Economics provides a consolidated view of GDP expectations from 20 or so leading economic forecasters. At the March survey, expectations were for the GDP to grow by +11.9% in Q2 of this year as compared to Q2 2020, with the growth rate declining to +6.1% by the end of 2021 and +2.8% by the end of 2022. Growth may never again be so growthy.

The New York Fed Weekly Economic Index posted a reading of a robust +9.5% annual growth rate. This metric is an index of ten short-cycle economic indicators scaled to align with the four quarter GDP growth rate. Bank spending metrics show consumer spending has largely recovered, though a bit below pre-COVID peaks, largely owing to segments of the economy still under restrictions and still-recovering employment. Employers cite hiring difficulty despite high unemployment rates. The employment situation will eventually resolve as conditions continue to normalize, with temporary unemployment benefits rolling off and some workers choosing to transition across industries. No doubt, some stickiness will remain between increasing the labor force participation rate and fully healing the labor market.

Alongside robust economic growth, earnings estimates are quite strong. For calendar year 2021, consensus forecasts for S&P 500 earnings are $175 in 2021, rising a further +15% to just over $200 in 2022.

With these green shoots as lively as they could be, cynics and old hands will start asking, “Where do we go from here?”

Beyond the Horizon for the Economy

To assess economic and earnings growth going forward, we must examine long-term trends, changes in monetary and fiscal policy, and recent influences such as the COVID recovery cycle.

Economic growth potential is traditionally evaluated on labor force growth—or population growth—and productivity. These forces set the baseline trend for economic growth. We think growth will ultimately return to its long-term trend line of around +2.0% annual growth, or a bit better, in the U.S., driven by minimal population growth paired with an uptick in productivity.

While population trends tend to change slowly, and population growth remains slow in the U.S., the size of the labor force is more dynamic. We will especially monitor whether the longer-term unemployed return to the workforce as economic conditions continue to improve. If labor force growth is constrained—whether by choice, incentive, or lack of opportunity—then expect economic growth to lag. On the other hand, if a strong economy and the new business formations that took place during COVID are paired with a supportive policy mix, labor force growth could be quite strong. After all, the employment participation rate was starting to improve in 2019–2020, so the key unknown variable is the policy mix. If tax, minimum wage, and unemployment policies become stifling, we would expect labor growth to be slower. Investors looking for sustained strong economic strength must hope for a growth-friendly mix to be implemented.

There are good reasons for optimism regarding productivity growth. In the journal Business Economics, KPMG Chief Economist Constance Hunter notes, “In terms of productivity, COVID has brought forward digital transformation that will likely improve the diffusion of technology to a wider array of firms.” An example would be the local restaurant adding a new online ordering system during COVID. Initially, these technologies increase costs through capital expenditures and the required learning curve to adopt the technology. Those costs at first create a drag on profits. Yet over time, wise investments increase productivity and profits. Erik Brynjolfsson, an economist and faculty member at Stanford University, describes the productivity J-curve which describes how productivity growth of new general-purpose technologies is often underestimated in the early years of adoption.

Technology adoption and business process changes will lead to above-average growth in productivity. This will contribute to slightly increased economic growth and will equip companies to better manage margins, despite potentially rising labor and other input costs, and possible changes in the corporate tax code.

Offsetting potential labor force and productive growth are the limiting effects of high levels of debt, both corporate and government. Debt service costs constitute the most relevant factor. With interest rates remaining quite low relative to historical averages, debt service costs are currently manageable. Nonetheless, every dollar borrowed reduces flexibility to respond to future crises and becomes more costly to service if rates rise. On the corporate side, ample financing has allowed companies to survive revenue lost during the pandemic. However, even before COVID arrived on the scene, financial conditions were fairly loose, allowing weak companies to carry on.

Current events are shining a light on the risks of loose lending as recent weeks have seen the devastation of a specialty finance firm (Greensill) and a leveraged investment strategy (Archegos). Looking ahead, debt in the real estate sector—especially city center commercial real estate—may come under pressure. In most cases the workouts are likely to occur gradually, avoiding any large-scale dislocation or disruption. Furthermore, the increase of non-bank lending to fund property transactions has reduced the risks of a traditional financial crisis.

Primary Forces

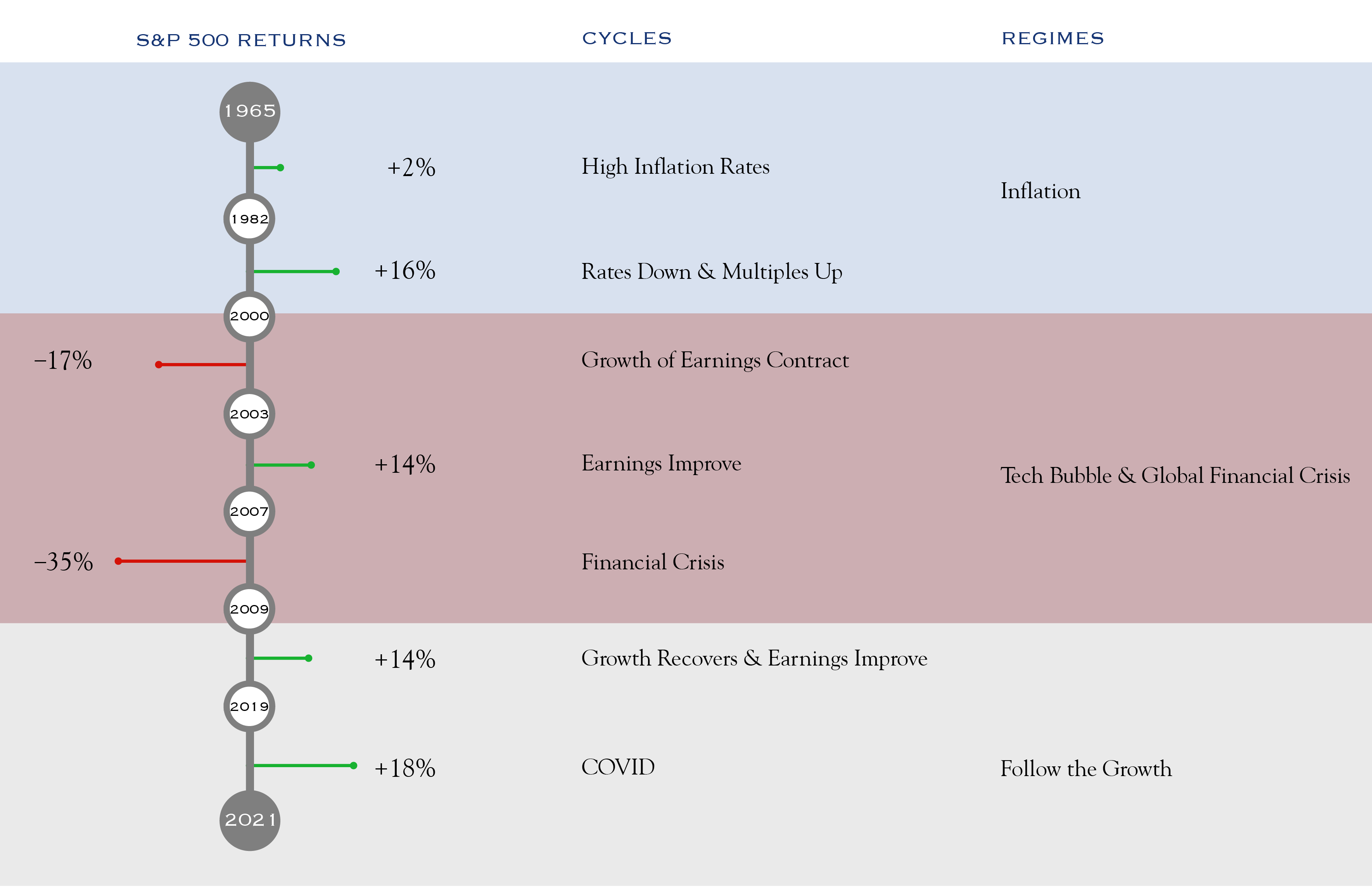

At any point in time, an issue, or collection of issues, will grab investor attention and become the primary force driving investor preferences. Those preferences manifest themselves in valuation metrics. As a result, often one key factor becomes a primary influence on investment results.

To identify important drivers of investment results, we applied two techniques. The first is a simple review of a few market fundamentals, paired with bull and bear markets over the past fifty years. These are displayed as market cycles below. We then used data analytics—specifically a few artificial intelligence algorithms—to see how the cold-hearted rationality of the algorithm would characterize the market cycles. These quant tools found three primary regimes. In the first, inflation seems to be the primary factor. Next was a bubble era—first the internet bubble, then the housing bubble. For the past dozen years, the regime has been one where growth is the main issue—a lack of it at the macroeconomic level, and a willingness to pay up for it at the stock level, alongside patience to look through any valuation swings, betting that growth would persist.

Sources: Bloomberg, Silvercrest

Sources: Bloomberg, Silvercrest

What does this mean for investors? The most important question is whether the extreme economic cyclicality introduced by COVID is enough to enact another regime change—either back to inflation and rates being the dominant force, a return to the quest for growth, or to a new regime altogether.

Outlook

The COVID recovery trade is closer to an end than a beginning. The most likely scenario is a return to a slow-growth world, where individual company performance matters most of all.

This shift from the macro to the micro will benefit active management. Stock-pickers can find motivated management teams and great business models that are able to outperform a relatively low-growth environment which is likely to persist from 2022 onwards.

For now, the green shoots in the economy are encouraging, the spring flowers in Central Park are beautiful, and we enjoy each day of robust growth and recovery. We favor continued exposure to equities at a level slightly above baseline, and a diversified mix across value and growth including both cyclical growth and organic growth, recognizing that stock selection remains critical.

April 15, 2021

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC