Game On!

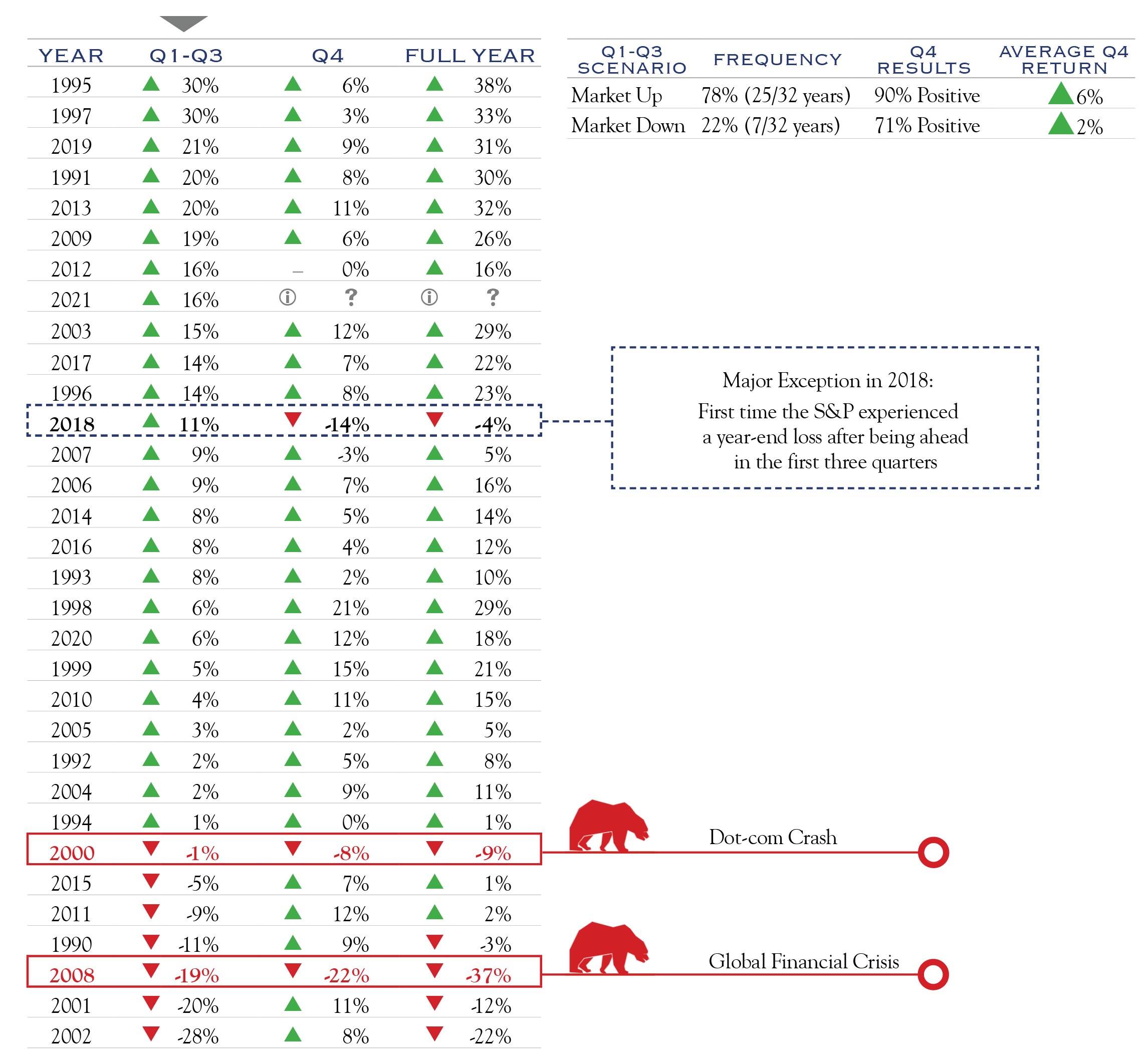

The fourth quarter press is on and it’s never easy in sports, life, or investing. Issues that hadn’t seemed important suddenly take on new urgency with time running short. The calendar is arbitrary for investments as year-end has little significance, yet the final three months tend to give investors a “ninth-inning” mindset as results are typically evaluated by year. Often, momentum accelerates in the final stretch, either to the upside or downside. As outlined below, many sharp declines have materialized in autumn, yet the final months of the year are positive on average.

This year, with broad portfolio gains, the stakes are high and the issues numerous. The path of COVID, shipping delays, inflationary pressures, slow recovery in labor participation, stalemates in Congress, and taper time for the Fed all weigh on investor sentiment.

Collectively, these problems are slowing the economy—and likely extending the cycle—as demand is stretched out into the future where it can meet increased supply and prices. Prices (inflation) are likely to remain higher for longer, though we expect to see prices subside by the middle of next year.

The return from summer coincided with this longer-than-normal roster of critical issues and increased volatility. The VIX index increased from 16.5 at the end of August to roughly 23.0 in early October. We attribute at least some recent short-term weakness in stocks to be connected to an ever-changing timeline for resolution of these problems. Above all, markets crave clarity: bad news is okay, but bad news with unclear severity and timelines can be damaging to confidence, sentiment, and valuation.

Data shown is from S&P 500 Index. Source: Bloomberg

Take Your Time

Few of these problems will be resolved in coming weeks, though collectively they will play a role in the direction of markets. The challenges are complex and multi-faceted, and the same goes for their solutions. We do, however, anticipate most of these issues resolving without inflicting any long-term damage to stock valuations. Nonetheless, the final months of 2021 seem more unpredictable than usual, and we advise investors to maintain a focus well beyond year-end as the following issues resolve. In each case the direction of progress is more important for markets than the current level of the problem.

COVID

COVID continues to be an important factor affecting all assessments of economic activity. While each wave has had less of a negative economic effect on activity, it remains a vital force with regards to labor participation and logistical and supply side problems. Presently, the Delta wave of COVID cases is on the decline. Our base case economic analysis is supported by the IHME expectation of an undulating plateau through the winter months, reflecting regional breakouts and relatively high levels of vaccination in many areas. COVID’s pressure on the economy has declined in recent weeks, and we don’t anticipate disruption at the national level beyond what we have seen in recent months.

Shipping: So Fast It’s Slow

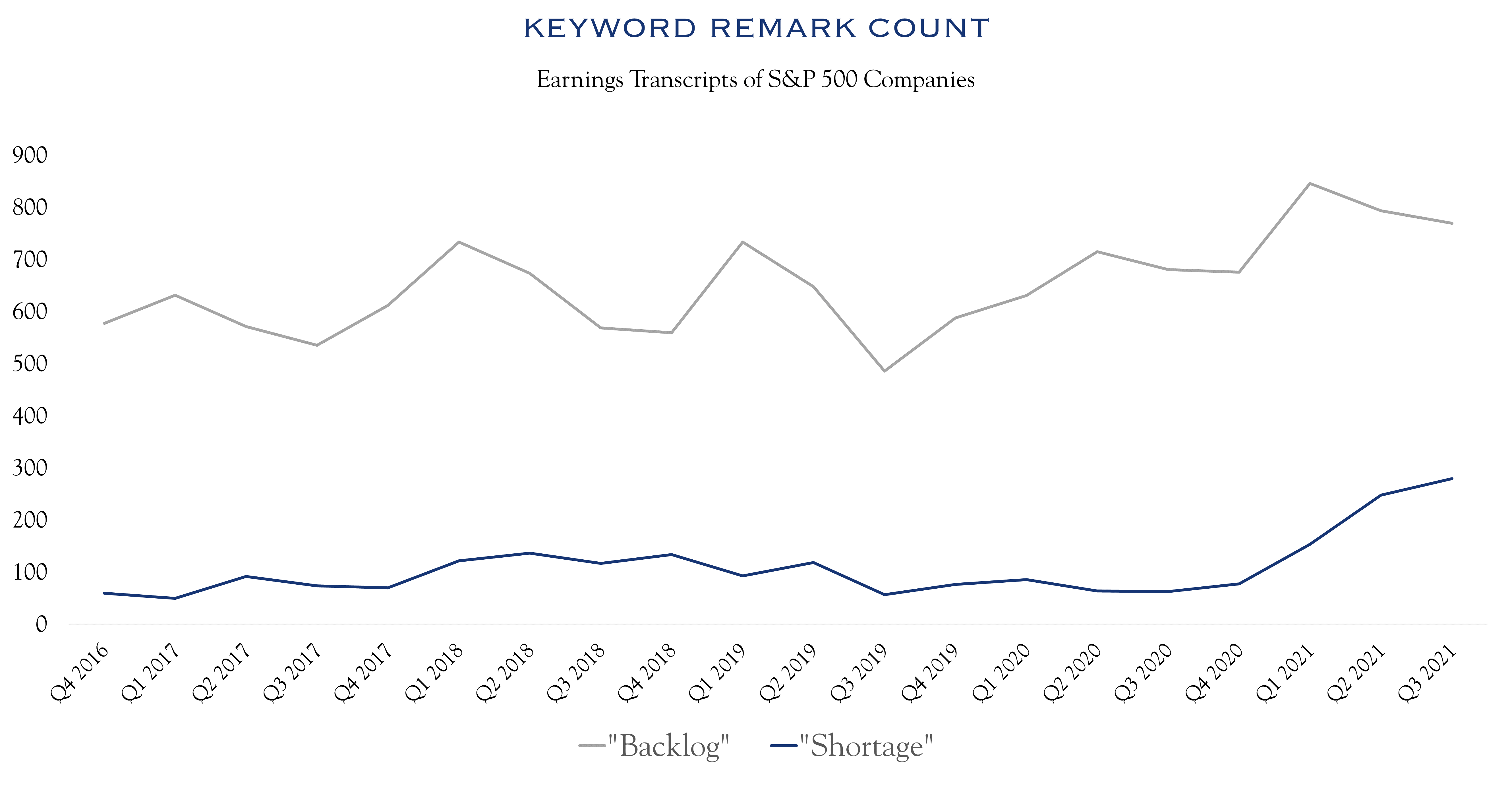

Stories abound of delayed deliveries with ships at anchor outside major ports, shortages of trucks and truckers, and backups on rails. A recent review of earnings transcripts of S&P 500 companies revealed that terms such as “backlog” and “delay” have increased from the same period in prior years.

Source: Bloomberg

Source: Bloomberg

These problems inhibit economic activity; they are numerous and incredibly difficult to solve. Plenty of proactive energy is being expended to squeeze every last bit of throughput out of the system. We expect most transportation channels to experience an extended busy season through Chinese New Year (February), with an easing thereafter.

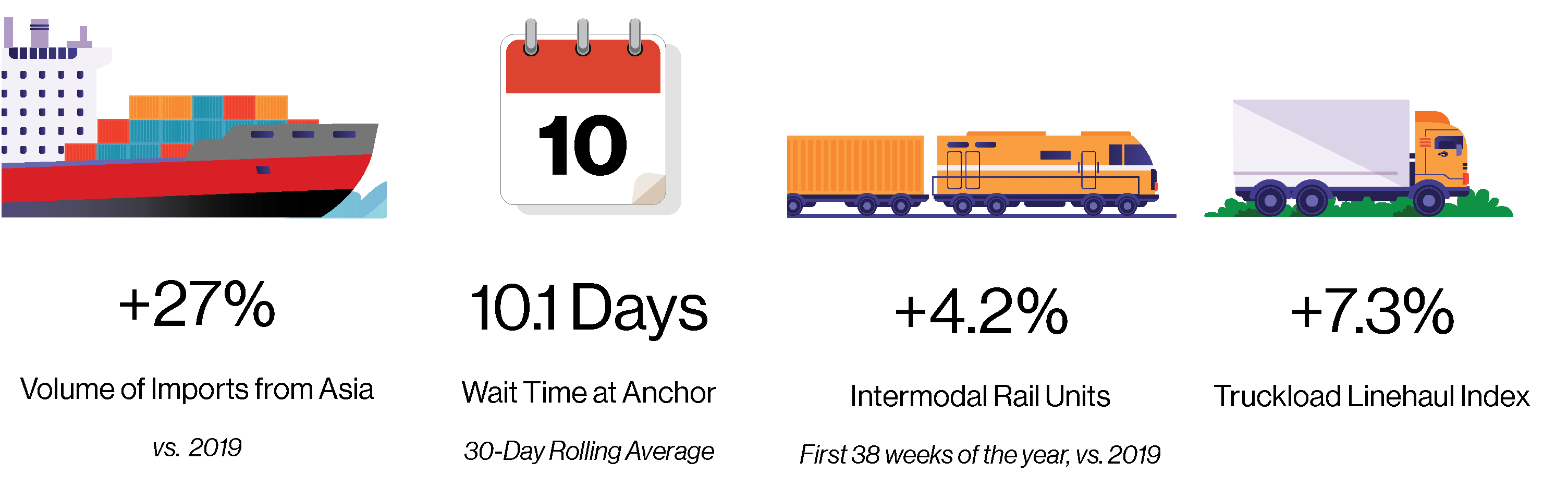

Many obstacles are responsible for the transportation logjam but the primary cause is an increase in imports from Asia due to consumers shifting demand by buying more goods and less services. As the graphic illustrates, imports from Asia are up +27% from 2019, causing a slowdown at ports. Further down the transportation supply chain, a review of railroad data (speed and volume) from the U.S. Surface Transportation Board and a similar review of trucking data explains that conditions are more akin to prior years—very busy, with volumes increasing and some snarls, but nothing like the backlog at ports.

Sources: Silvercrest, BIMCO, Port of Los Angeles, Association of American Railroads, CTR Index, Bloomberg

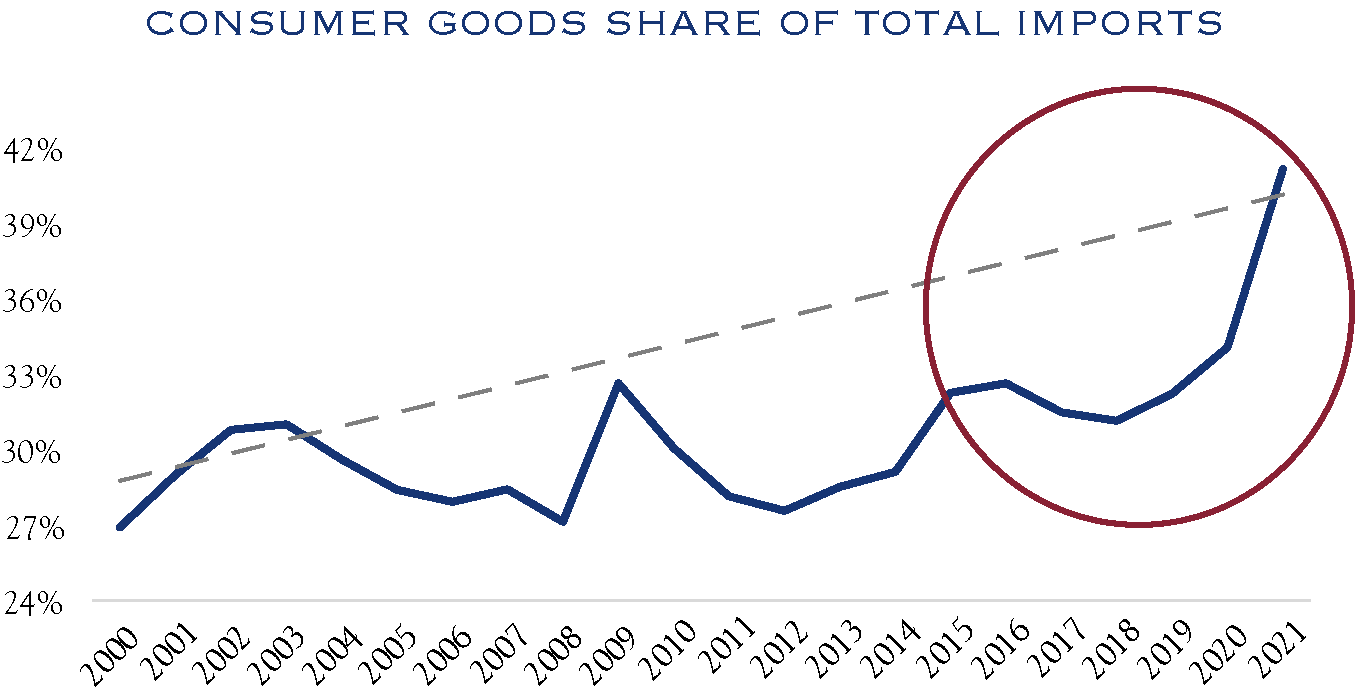

From there the story gets more complicated, with delays originating deep in the process, close to delivery points, causing congestion all the way to ports. For example, much increased demand comes from eCommerce, which involves goods being transferred from standard cargo containers into more specialized forms of storage to be held in warehouses. Further, the share of imports that are consumer goods has risen from 30% to 40% over the last year, requiring an additional mix of transportation requirements. This in turn creates an increase in trans modal shipping, which involves multiple transfer points and types of transportation, each offering opportunity for delays. To limit inventory shortages, many importers also elected to order early, which often results in full warehouses and trucking hubs. Anyone who has tried to exit a stadium parking lot after an event knows what that does to travel times. Lastly, a combination of health concerns and other employment options make for a tight labor market.

Working in the other direction, export ports (mainly in Asia) have experienced COVID-related shutdowns. Numerous countries—especially China—are pursuing zero COVID strategies, whereby just a few cases can trigger a 50% reduction in capacity for as long as two weeks—at some of the largest ports in the world. This introduces yet another layer of complexity to the challenge.

Overall, these problems are solvable; for example, the Port of Los Angeles recently announced plans to experiment with extended operating hours. Similarly, the Port has created additional information dashboards to better coordinate trucks with inbound ships. Longer term, technology and further automation are likely to increase throughput. Following the busy holiday season, demand may also ease, notably if health confidence rises, prompting a shift of discretionary spending from goods toward services.

Other transport nodes are also experiencing volume increases and logistical difficulties. Some of these are volume-related: warehouses, rail-yards, and trucking hubs are crowded and incrementally slower. Other challenges are related to a shifting product mix. Though the busy season may run slow, we expect time to heal these shipping and transportation wounds, as all participants adapt to this changed environment.

Source: TTX, U.S. Board of Governors of the Federal Reserve System (FRB), Bureau of Economic Analysis (BEA)

- Consumer spending on goods jumped higher as preferences shifted during the pandemic

- Consumer goods are often imported from Asia

- These imports create additional traffic at ports, rails, and trucking

Inflation

Inflation remains elevated, with the most recent reading of 5.3% for the headline Consumer Price Index and a core reading of 4.0%. Importantly, this reading was slightly lower than the prior month. This slight moderation of increased rates brings hope that while inflation might be a bit more persistent than anticipated, it does not appear to be accelerating out of control. The key going forward is whether the behavior of price-setters remains in check. As we approach the last few months of the year, there is a window of opportunity for inflation to take hold, as supply/demand imbalances percolate around the economy. We continue to closely monitor whether inflation is spreading, spiking and sticking around. Other metrics we will watch closely are shipping and follow-on price increases. Here we have a close eye on transportation issues and monitor whether price-setters are taking multiple actions. For now, we see a difficult situation that is not abating as quickly as we had expected. Our view remains that prices are at, or close to, peak levels of increase and will begin receding in coming months.

The growth in demand is moderating (growing at a slower pace) and supply will continue to gradually ramp higher—due to a mix of technology/automation, improvement in labor markets, and good old-fashioned problem solving. This might make for a challenging few months of statistical interpretation, which is why we urge a focus on a longer time horizon.

Labor Participation

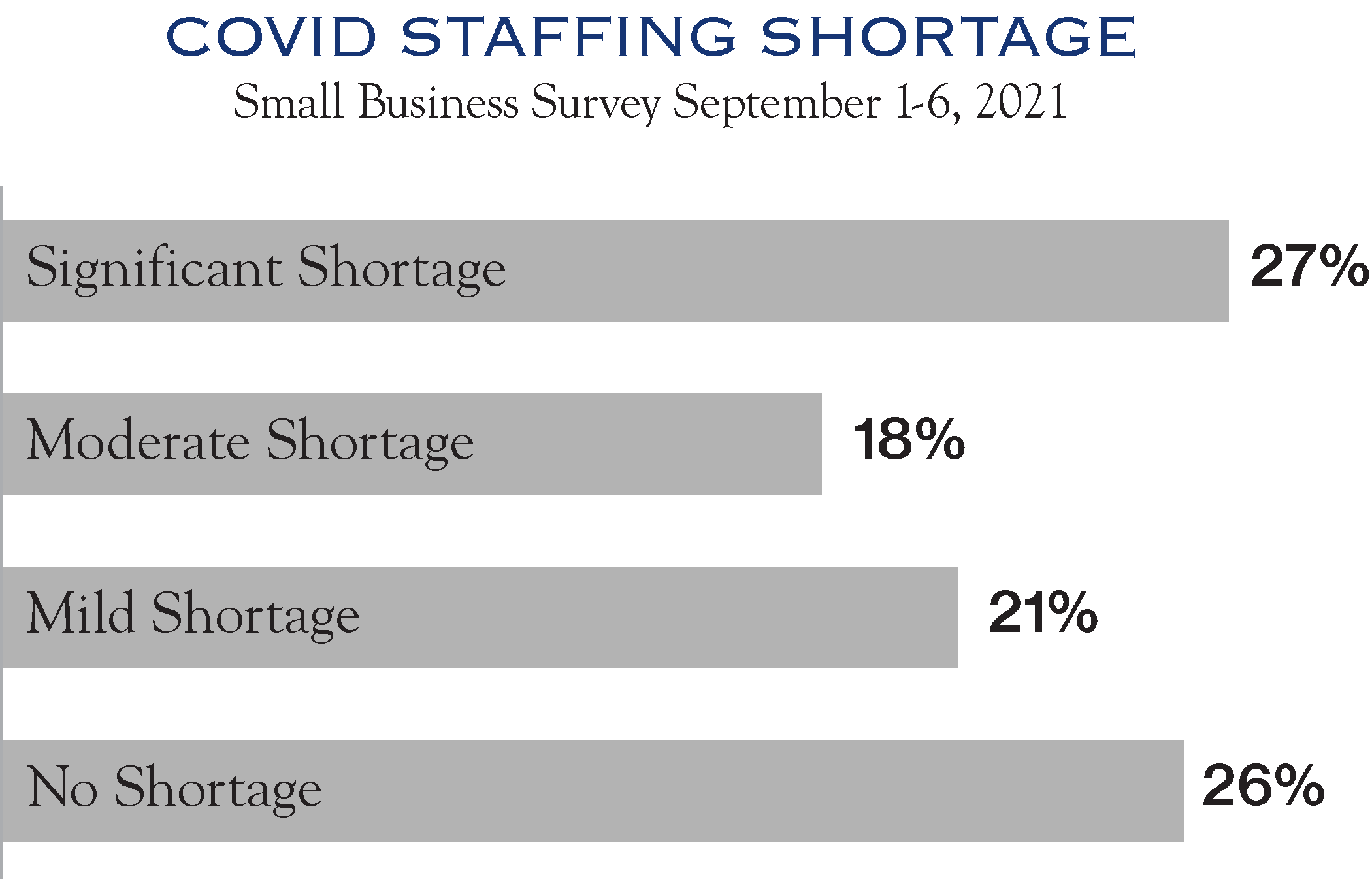

One of the most important factors for continued economic growth is labor participation. The Bureau of Labor Statistics displayed 10.9 million jobs offered in October 2021 with 8.4 million unemployed vs. 6.4 million jobs offered and 5.8 million unemployed in Q4 2019. This implies 2.5-5.0 million jobs have been created—the faster the better. The National Federation of Independent Business (NFIB) recently surveyed their small business members regarding the COVID related staffing shortage.

Source: National Federation of Independent Business

Source: National Federation of Independent Business

The sand in the gears of this situation is multi-faceted. Lingering health concerns, difficult childcare situations, and training issues are the most likely culprits. Problems due to health concerns and childcare are likely to dwindle as COVID recedes. However, mismatches between jobs offered and the labor pool may not clear so quickly.

Roughly 20% of the jobs lost due to the pandemic were related to the restaurant and bar industry, which currently represents only 14% of jobs offered. Data from the W. E. Upjohn Institute for Employment Research highlights that female workers without a college degree have had significant difficulties with regaining employment. Even though job openings are plentiful, it may take some time, transition, and training to close the gap. Nevertheless, the next 12 months look to be fruitful for job creation; this will be a welcome tonic for economic growth.

D.C. Dallies

One major set of unresolved issues remains with pending legislation in Congress. Uncertainty looms over Washington with the potential debt-default on U.S. Treasury interest payments; a fiscal stimulus dilemma around infrastructure and the massive $3.5 trillion Build Back Better plan; as well as the future tax structure for corporate and capital gains. This headache-inducing amount of uncertainty will have investors on edge as legislation passes through Congress—or not. The issues have been on the table since earlier this year, so these are not new unknowns. Even the potential worst-case outcomes have been at least partially factored into investment outlooks around the country. Most research expects a corporate tax increase at a modest level. Goldman Sachs estimates a 5% decrease in after-tax earnings. Our base case incorporates a modest increase in both corporate and capital gains taxes, painful to earnings and after-tax returns, but bearable. That’s especially true as gains and profits are in ample supply. As for stimulus spending and inflation, actual spend rates are almost always slow to ramp up, thus minimizing inflationary pressures. At the moment, a temporary stalemate and partisan political risk may give rise to some moderating efforts from Congress. The most important outcome will be one that provides clarity, particularly if it represents a more moderate or minimal effort, especially on taxes. All eyes will be on the debt ceiling negotiations for the remainder of the month. Crystal balls are especially cloudy this time around, though we agree with the consensus that disaster will be averted.

Taper Time

In recent comments, members of the Federal Reserve have clearly communicated two key concepts. First, a tapering of purchase rates of bonds is imminent. Second, tapering is a first step and not directly linked to a timeline for any future rate increases. While there has been quite a kerfuffle over Fed Policy, the actual effect is rather minor. Consider that the Fed is likely to chart a multi-month path to glide from $80 billion per month in purchases towards zero. Further, the Fed currently publishes its purchases by day, each month. Taking the all-important U.S. Ten-Year Note as an example, the Fed is often not in the market for this security, typically only five days per month, at around $1.0-1.5 billion each of those days. While we won’t know for sure until it happens, it seems unlikely that a gradual and well-telegraphed tapering will cause substantial problems for interest rates.

Outlook

Our view has not changed: earnings will continue to improve (albeit at a slowing rate) and this will create positive returns for investors. In the short term, expect volatility until at least one of the several major issues we reviewed become resolved.

Economic activity for 2022 will remain above average, driven by a combination of three factors:

- Continued COVID recovery in disrupted sectors has the potential to add over 1% to GDP.

- Ongoing (even if gradual) recovery in jobs and labor participation will increase the total employed,

and the size of economy. - Investments in technology and process engineering will bring productivity gains, allowing more growth from the same resources.

Against that backdrop, we expect forward earnings over our three-year time horizon to average slightly over 7% and look for multiples averaging a touch over 20, with some volatility in the short run. We re-iterate our view, however, that there will be wide earnings divergences, requiring careful stock selection based on detailed analysis, as this rising tide will not lift all (earnings) boats. Certainly some companies will be caught in a margin squeeze, while others will find ways to hold the line, or reduce costs.

October 7, 2021

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC