We live in an era of big data and artificial intelligence, yet today’s situation is often described as incomprehensible. Many giants of the investment world have expressed bafflement at recent market developments. Who can blame them? To paraphrase composer Richard Wagner, 2020 is being written with an exclamation point. Consider these developments and market reactions over the four weeks of May 2020.

Major News Events of May 2020

- A Grim Milestone for COVID

While the Growth Rate of New Cases is Moderating, deaths in the United States Exceed 100,000. - Massive Unemployment

The Bureau of Labor Statistics Employment Situation Report for April, released on May 8, tallies 23.1 million unemployed. - Brand Name Bankruptcies

Hertz, Pier One, JCPenney, J.Crew, and Neiman Marcus all file for bankruptcy in May. - Economic Collapse

Consensus forecasts for second quarter U.S. GDP are revised to -34%. - Unrest Emerges

A conflagration both figurative and literal emerges from a mix of peaceful protests alongside violence and looting at a scale unseen in many years. While the immediate catalyst was the death of George Floyd, the underlying issues and their potential resolutions are complex. - China Conundrum

Bipartisan pressure against China, increasing tension in Hong Kong and technical issues such as accounting requirements for Chinese listed companies create conditions that some are referring to as the new Cold War. - American Astronauts Alight

NASA and SpaceX deploy American technology piloted by American astronauts to dock with the International Space Station. - Vaccine Velocity

The number of possibilities increases and early results from a leading mRNA candidate continues the rapid progress towards a vaccine against COVID. - Global Stimulus Reaches Epic Proportions

Announced stimulus has reached levels in excess of 25% of global GDP, and is even higher in the key developed markets of the U.S., Japan, and the Eurozone.

Against this backdrop, markets powerfully advanced when assessed against typical metrics of market strength, such as breadth and declining volatility. It is no surprise that any intelligent investor—artificial or human—would be flummoxed. Responding to similarly confounding news during the global financial crisis, a wise Silvercrest investment committee member said, “we don’t count the news, we weigh the news.” In other words, despite their shock value, headlines each don’t all carry the same weight in the price-setting process of markets.

The catalyst for economic destruction was COVID and the catalyst for economic recovery will be a weakening of COVID, whether through natural causes or the massive array of brilliant medical and technology talent, fiscal and monetary stimulus, hard work, innovation, or luck. The news was bad, but the market went up and—as crazy as that seems—it is also highly rational and pragmatic. Below we examine the path taken by markets this year.

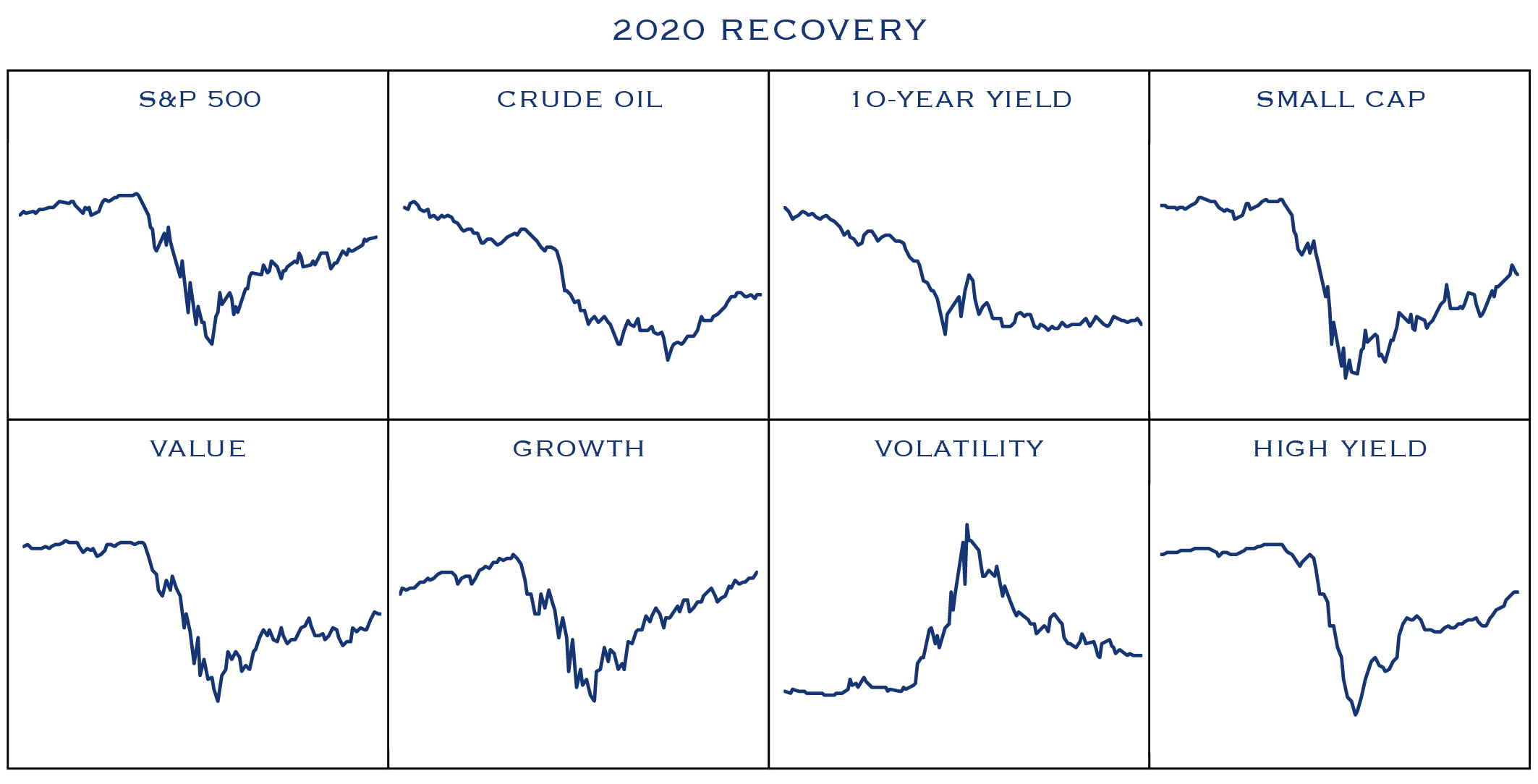

Source: Macrobond, Bloomberg. Data from 1/1/2020 to 5/29/2020. Scaled to 100 starting 1/1/2020.

Source: Macrobond, Bloomberg. Data from 1/1/2020 to 5/29/2020. Scaled to 100 starting 1/1/2020.

Anticipating a turn in economic data, major markets began improving in late March. Real-time economic indicators appeared to bottom out in mid-April, grinding higher since. From that turning point, these asset classes reacted in a manner that was consistent with an emerging economic recovery. Interest rates rose slightly, oil prices recovered, high yield bonds improved, volatility declined, and a broader swath of equites advanced.

Tomorrow’s Game

The great baseball player and humanitarian Roberto Clemente once said, “Why does everyone talk about the past? All that counts is tomorrow’s game.”

Tomorrow’s game is always uncertain, recent events further exacerbate the issue, making it more important than ever to use robust, fundamental tools and to set modest expectations over reasonable time frames. Our asset allocation philosophy states:

- We recognize that the pursuit of long-term returns depends on the investor’s ability to accept volatility. The acceptance of short-term price volatility creates the opportunity to achieve superior returns over time. A reduction in portfolio volatility goes hand-in-hand with greater capital stability and commensurately lower returns.

Safety remains in high demand, pushing the expected return on risk-free assets to near all-time lows. For instance, an investor would receive approximately 0.77% annually over the next ten years when investing in the U.S 10-Year Treasury Note. Typically, this configuration would favor equities, which presently offer a dividend yield of approximately 2.0% and the potential for upside from earnings growth. The standard playbook looks to valuation as a gauge on the attractiveness of asset classes. Equities are far from cheap, at least when measured at the index level using near-term earnings estimates. However, two fundamental approaches paint a more appealing picture for equities, especially over a reasonable time horizon.

Method One: Price-to-Earnings

The first method is to simply invert the usual price-to-earnings ratio (PE), use a five-year average PE of 20 and impute the level of earnings implied in current prices. Today, this figure hovers around $150 in earnings for the S&P 500, a level that represents around 90% of 2019 earnings. The current quarter will see depressed earnings resultant from economic stoppages and these effects will linger in part for upcoming quarters. Conventional wisdom is that markets look ahead six months, placing the focal point towards year end. With the balance sheet support delivered by the Treasury and the Fed, investors can rightly begin looking to 2021 earnings. On that basis, current prices seem fair, with upside driven by the grinding economic re-opening and long-term earnings recovery. Cyclicality is present in the economy, and this requires a willingness to view normalized earnings over a cycle and be comfortable paying higher multiples on cyclically depressed earnings.

Method Two: Timeline

The second method is to formulate a timeline for recovery to prior highs, which would produce a further 10-15% gain. Recall original estimates for a vaccine timeline were 12-18 months, though some time has passed and enough progress made that several prominent voices are cautiously considering initial vaccines may be available selectively by year end. Taking the conservative estimate of 18 months and recognizing that at that point markets will look forward another six months, the bulk of earnings recovery ought to be in hand 24 months out. That maps out to returns in the 7.5% annualized range, which happens to be in line with our three-year expected return on equities. Whether the next year is higher or lower will depend greatly on the virus, though the path over time is compelling—especially relative to ultra-low risk-free rates.

The risk that becomes apparent from this timeline-based approach is balance sheet resilience if current economic conditions persist throughout the timeline. There are some factors that mitigate balance sheet risk over the full recovery. At present, economic re-openings are beginning and green shoots are emerging, and there does not yet seem to be a significant increase in COVID case counts. Recoveries are typically a long slow grind higher, rather than a stair step function with minimal activity until the vaccine is widespread. This reduces the amount of near-term support needed. In addition, large segments of many sectors are balance sheet sufficient and have experienced minimal revenue disruption. Finally, large measures of stimulus have been provided to assist banks in meeting lending needs of businesses. Nonetheless, some business models will need to embark on change—for better or worse. Therefore, we continue to place great emphasis on the importance of bottom-up security selection.

On the Long & Bumpy Road To Recovery

These “micro” issues of stock specific evaluation are essential. Active management avoids the problem of drowning in a river that is only four feet deep on average, and allows one to cast about for opportunity. In this environment especially, we strongly favor fundamentally-based active management as the best approach to avoid problems and find opportunities.

While many express consternation at market action in May, we think it is more reasonable than it may appear. Progress has been made in the tug of war against COVID, and this progress has been reflected in market activity. The near-term will see volatility driven by an increasing list of ongoing challenges, be that social unrest, China, or setbacks due to the virus, yet the longer-term path is favorable. The recipe for success will include matching risks tolerated with risks taken, time horizon with expectations and stock selection with opportunity set.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC