These are extraordinarily unusual times for investors. A massive fiscal and monetary policy cycle, the confluence of pandemic and recovery, global lockdowns, and war is an especially combustible mix. It is no surprise that sentiment levels are extremely depressed—these conditions cause a great deal of short-term uncertainty. Short-term challenges present an opportunity for investors to assess their risk tolerance and remember its role in the pursuit of returns.

Throughout the past two-plus years, we have extended time horizons and encouraged patience. That advice remains true today as the short term is more obscure than usual. However, longer time horizons provide grounds for optimism, as both the economy and corporate profits are highly likely to return to long-established trends—around 2% GDP growth and 5% corporate profit growth.

Equity markets are facing a struggle between growth and inflation—both are in a race of attrition. The short-term path depends heavily on whether growth or inflation will decline first.

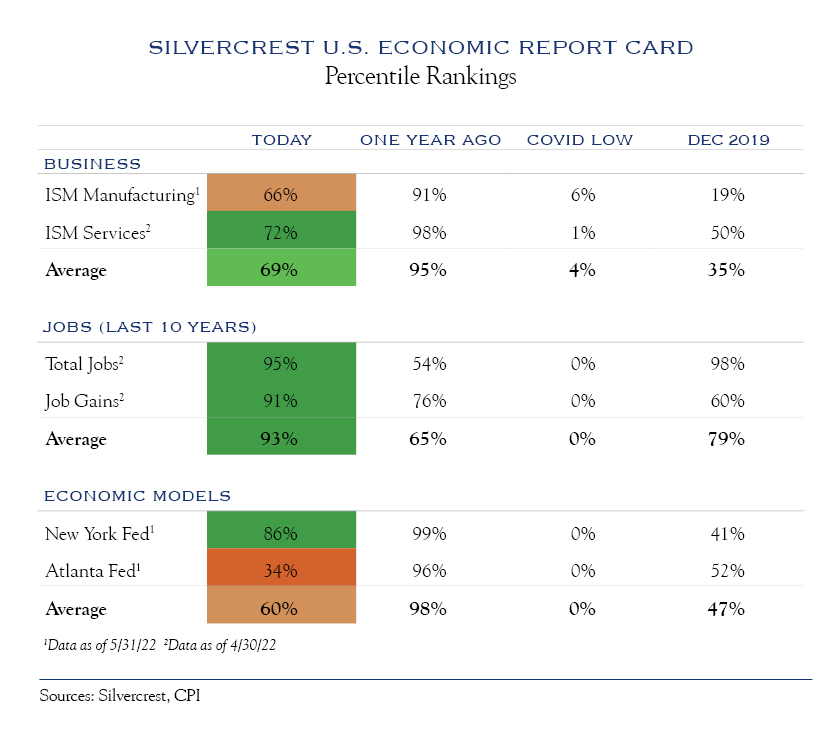

Growth is slowing but remains above historical averages, and still has some altitude left. This indicates that further weakening will be required to push the economy toward recession.

Inflation has been elevated and persistent. The most recent report shows a slight uptick owing to energy costs and a stabilization (at high levels) for the core index which excludes food and energy. While commodity components—especially energy—are likely to remain elevated in the short run, other components are starting to see some signs of dissipation. We monitor the spike, spread and stick (persistence) of the many components in the CPI index. Notably, core-CPI (excluding food and energy) currently shows the start of a peak. While this process will take some time, declining inflation is better than accelerating inflation, and may start to provide the Fed with a bit of policy flexibility.

Rising labor costs can create sustained upward pressure on inflation, and while this has been a concern, costs have recently moderated following rapid wage growth—especially at the lower end of the job market. These conditions should continue to normalize for several reasons:

- Improvements in labor participation rates

- A resumption of the natural flow of “un-retirements”

- A return to demand equilibrium across goods and services

- A slowdown in hiring pandemic beneficiaries

Rising home prices, which are up significantly year-over-year, is another fear factor for sustained inflation. However, Fed rate hikes led to increased mortgage rates and decreased activity in the housing market. Prices are more likely to stabilize than accelerate from here, eliminating some inflationary fuel.

Consensus earnings estimates have come down slightly with a high single-digit growth rate. We anticipate earnings to be a touch lower since companies are facing numerous complex issues. Any review of earnings is on a case-by-case basis as each company will approach obstacles with different strategies and varying rates of success. At an aggregate level, as China begins to re-open while the U.S. dollar stabilizes after a strong run, global companies that dominate the main indices should see some relief on the earnings front.

Interest rates on bonds currently reflect multiple anticipated rate hikes. Thus, while rates could drift a bit higher, we expect range-bound trading for U.S. government bonds.

Overall, battleground conditions are likely to continue in the short term as concerns about inflation and growth remain unresolved. Nonetheless, over a longer time horizon, we expect inflation to ease, the economy to decelerate back to trend growth around 2% and earnings to persist in the mid-single digits.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC