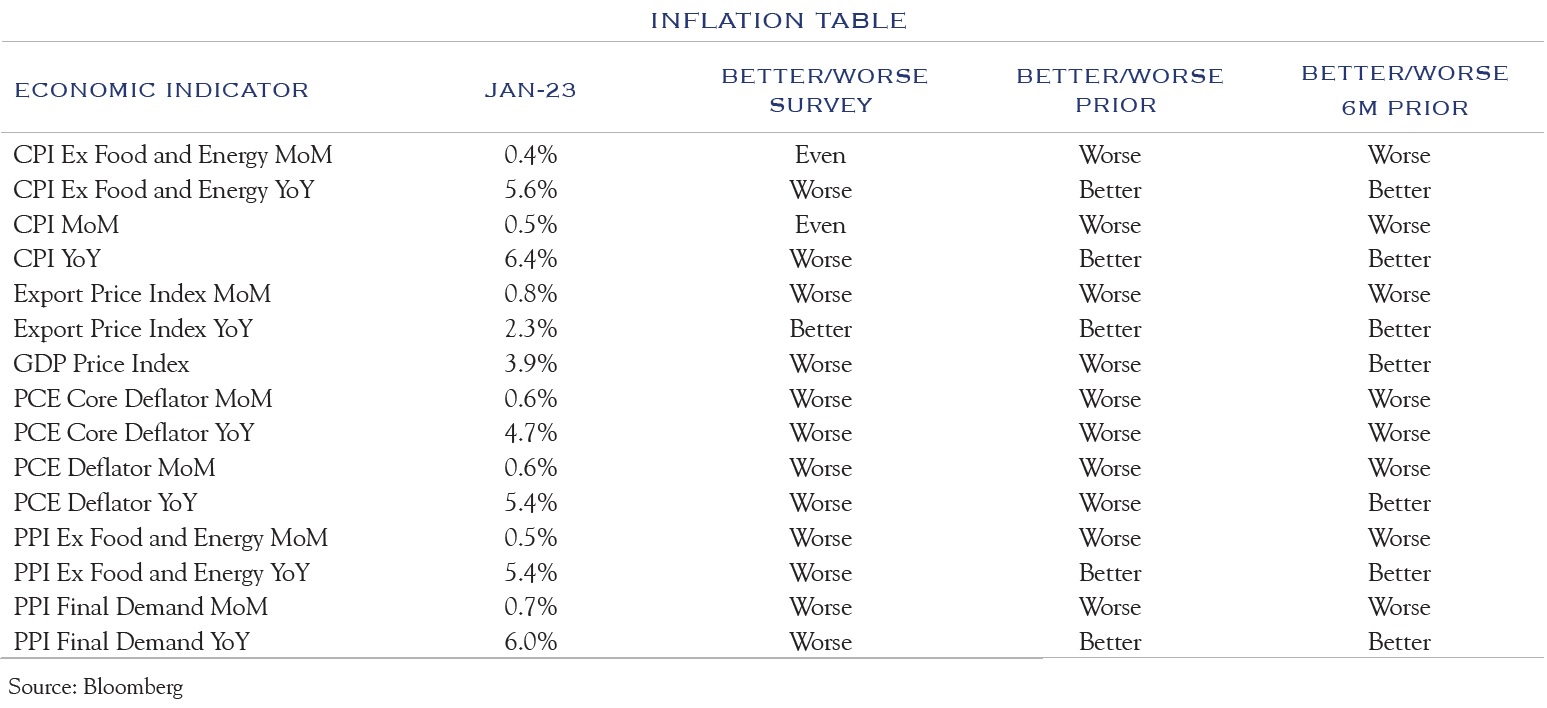

Inflation is back; not that it ever went away. Stocks and bonds had started the year with strong gains backed by an improving inflation situation, by February, inflation was once again a problem and markets suffered. While many inflation readings showed improvement vs. prior months, some did not, and even worse, a few key readings were worse than expected. Our research shows an even mix between better/worse vs. prior and vs. expected. Though that mixed picture for inflation is not surprising, it was painful for markets.

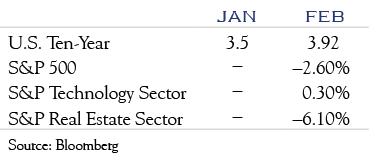

The S&P was down –2.6% in February and interest rates on the U.S. Ten-Year Note rose 42 basis points. Despite that reversal, results across sectors remained consistent. The technology sector continued to lead, while real estate continued to struggle. Until recently, as rates have moved higher, both tech and real estate have struggled.

This unusual configuration provides some possible clues for the road ahead. Lately, the consensus message on interest rates is that rates will remain higher for longer—we agree. That’s not entirely bad news though, as this expected posture on rates reflects a stronger-than-expected economy. In fact, the message from sector performance seems to be that the investor view of “higher” is different from the investor view of “for longer.” From an equity point of view, investors seem to have mostly priced in the “higher” concept. If investors expected the level of rates to head much higher, tech stocks would be unlikely to remain strong. In general, higher interest rates lead to lower valuations on more growth-oriented assets. Seeing the resilience of the technology sector in February, we think the market has mostly factored in higher rates. However, the suffering in real estate is ongoing. We suspect that is because the market is still coming to terms with how much longer rates will be elevated, as rates have a direct effect on the business prospects of real estate, unlike technology, where the effect is primarily on valuation. This divergence seems to indicate some level of acceptance of higher rates and a degree of uncertainty about rates being high for longer.

This somewhat confusing interest rate outlook, as well as the more mixed message from inflation, means that short-term volatility is likely to continue, particularly around announcements for inflation-related metrics.

Zooming out a bit, the situation isn’t quite as challenging. Inflation continues to improve and has been improving since July. With inflationary fuel mostly spent, we expect that process to continue. Consider that supply chains have mostly healed, monetary growth has turned negative, real wages have not accelerated, housing prices have cooled, and many of the price changes enacted in the pandemic have largely flowed through the system. While inflation is improving, it won’t necessarily do so every month, nor will it conform to expectations. The process will be choppy.

On the economic front, current models forecast continued slow economic growth. The Atlanta Fed GDP Now model predicts +2.3%, while the New York Fed’s current Weekly Economic Index is running at +1.1%. The job market remains strong, with payroll tallies gaining 365,000 on average over the past three months. There are signs of slower growth in the labor market, though the overall picture remains quite solid. This ongoing strength continues to fuel consumer spending and the consumer is the largest segment of the U.S. economy. Unsurprisingly, the consumer discretionary sector posted large gains in revenue and profits. Another area of economic strength is the continued focus on reshoring. While the reshoring contribution to economic growth for any single quarter will be modest, this trend is likely to be long lasting and provide a growth tailwind over the next few years.

A mostly stable economy should lead to a mostly stable earnings outlook. Our view is consistent with consensus in seeing mostly flat earnings in the quarters ahead. That flat headline figure for earnings growth will mask a lot of divergence across sectors and even within sectors. The complex environment across inflation and labor, paired with sectors that are experiencing different parts of the economic cycle means that security selection is incredibly valuable. Despite a challenging macroeconomic backdrop, investors should be willing to reward individual companies who successfully navigate these confusing crosscurrents.

Our view is that interest rates are closing in on peak levels. The Federal Reserve is likely to enact a few more 25bps rate hikes, putting upward pressure on rates which are currently around the 4.0% level. Rates could move a bit higher but over a longer time horizon. With inflation improving and the Fed likely to hit pause this summer, we expect rates will stabilize in a broad range of 3.50% to 4.50% before easing later in the year.

Stability on the interest rate front is likely to benefit stock valuations. Some of this has already been seen in the technology sector. Overall, we see a slow economy fueling moderate earnings gains, paired with modest improvement in valuation. This likely leads to mid to high single-digit gains on stocks. We continue to advocate for a healthy balance between growth and value and some diversification across market cap and geography, though security selection is far more valuable than investment style at this point in time.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC