Stocks in April followed a two-part pattern, divided by the start of earnings season and the weeks following. Despite very strong reported earnings—at a level 20% above expectations—gains on this good news were very limited and stocks were mostly sideways in the second half of April. This is an indication that most of the good earnings news had already been factored in. The question going forward is what issue will propel stocks higher (or lower)?

We are moving beyond a one-issue market, and more normal state of affairs will emerge with many conflicting signals. In other words, for stocks, the COVID cycle is complete.

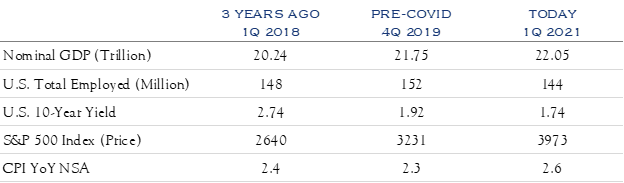

Below we evaluate the recent history and current status of a few key metrics. Equities are clearly taking their cue from GDP, which has largely recovered. Jobs, however, remain well below peak levels and demonstrate that the mix of GDP has changed, as has the implied productivity: similar output and fewer workers means productivity has increased.

Source: Bloomberg

The important jobs report number on May 7th showed job creation (or recovery) of 266,000 jobs in the month of April. This was well below expectations for 1,000,000 jobs to have been created, despite large numbers of job openings and some employers reporting difficulty finding workers. There are several factors at play. Closures or limitations of schools and childcare beget constraints for some employees to return to work. Others are reluctant to return to work due to lingering health concerns. Job transition issues may persist as some jobs never return, while new jobs are created in different fields. The stimulus payments and extended unemployment benefits also have some unintended consequences. About 30% of the jobs lost to the pandemic are in the leisure and hospitality segment. These jobs carry an average hourly wage of around $18—a level comparable to many enhanced unemployment benefit packages. Nonetheless, we believe the job market will continue to improve as economic activity normalizes and the challenges surrounding the pool of available labor begin to ebb.

Inflation remains a noteworthy concern, and we see a burst of inflation continuing in coming months before it fades as we approach year end. The reasons are numerous and generally have a root cause in the massive cycle caused by COVID shutdowns and re-openings.

To take one specific example, many commodity prices have some degree of seasonality which is colliding with a re-opening economy. Lumber prices are instructive, as they are among the most noteworthy of rising prices. For example, the Lumber and Plywood Index used in the Producer Price Index (“PPI”) calculations is about 70% higher than the pre-COVID low in 2019. Notably, lumber prices are one of a few commodities with prices higher than the mid-2000’s commodity boom. Looking at the influences, one longer lasting effect comes from the millennial generation, a large demographic now entering home buying/building years. This comes against a backdrop of low inventory, partly due to reluctant building in the past ten years as a continuing side effect of the global financial crisis. Nonetheless, many issues in this space are transitory. Several natural events conspired to temporarily limit the flow of materials, with disruptions from fires and weather events. Even though there is plenty of timber, some areas have seen limited access. The COVID cycle caused some capacity to be taken offline, limiting the supply of lumber. Summer is a period of maximum capacity utilization generally, so for the time being, there is no quick fix. COVID created an uptick in renovation work and this category is typically around half of lumber usage. As employees eventually return to in-person work, renovation demand for lumber will likely slow. Taken together, it appears that conditions are very tight temporarily, but not permanently.

Lumber is just one commodity and is only a small input into the overall calculation for the Consumer Price Index. Similar dynamics exist in other commodity prices, and in the supply/demand balance overall. It is well known that one year ago, many businesses were cutting back production. Demand returned more quickly than planned, and many workforces were partly hamstrung by COVID restrictions. Thus, it is unsurprising to see imbalances. We expect most to be transitory, lifting sometime later this year, though not without a burst of inflationary pressure in coming months.

One structural force pushing down inflation has been tech-enabled productivity gains. In the 1990s, tech spending increased dramatically, and inflation fell throughout that decade—from 6.3% in October 1990 to 1.4% in April 1998.

This summer will see an epic clash between these forces, and we acknowledge that while inflation may win the short-term battle, productivity will win the war. Inflationary bursts will occur this summer and will likely abate into the end of the year.

Similarly, while the economy will roar with growth over the summer, it will return to regularly scheduled programming later this year. There are various factors limiting growth—the two most prominent are slow population growth and rising levels of government debt. One positive influence will be productivity boosting growth. Overall, a return to trend of 2.5% GDP growth rather than a permanently elevated level seems likely.

We see slightly rising interest rates, and a less favorable policy mix keeping a lid on valuations, while a moderating economy will keep a lid on earnings growth. That will bring a return to mid-to-high single digit earnings growth, with a similar outlook for equity returns. Our model shows a three-year total return of a bit over 7% for stocks.

Recent months have seen rising prices in financial markets, including some with limited or no connection to fundamentals. Investors seem to be attracted to the potential of quick gains. It is human nature to seek to add, as a way to improve, to do more. Recently, Nature magazine published a piece called “Less is more: Why our brains struggle to subtract”. This article received some coverage in the financial press. The attention was well-deserved, and the piece is supportive of our concept of “addition by subtraction”. Specifically, in this environment, the deletion of investments untethered to fundamentals will be additive. Fundamentals always matter—real business models, real progress in revenues or earnings, real balance sheets, reasonable valuations, modest expectations, and tempered timelines.

All this conspires to make the ‘20s more boring than roaring. The single-issue macro move of COVID is done. Careful selection of individual stocks and bonds will matter greatly in the months ahead.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC