The final quarter of the year is presenting investors with a challenging backdrop. While seasonal trends and weak sentiment create the opportunity for a rally, stocks face a range of complex headwinds.

Durable bull markets are typically built on an expanding leadership base. This year, market leadership has been exceptionally narrow, though that small group of top-performing stocks has delivered strong earnings gains. One problem for the laggards is that higher interest rates can cause financing pressure for many companies, so a broadening out isn’t likely until Fed policy becomes more clearly pointed toward interest rate cuts. We don’t expect cuts in the Fed Funds Rate until mid-2024, meaning current conditions are likely to remain volatile.

Earnings

Earnings season thus far has been decent; however, it has been received a bit less favorably than last quarter. Similarly, guidance has been okay, but cautious. One positive sign for future quarters: upside surprises on earnings have been running higher than those on revenues. Companies are continuing to exceed analyst estimates for profit margins. While margins are essentially flat year over year, they are holding up better than expected, especially given challenges with rapidly evolving pricing and rising labor costs.

Continued advances in technology present opportunities to generate efficiencies, partly through improved prediction. A recent column by sportswriter Peter King highlighted an example of improved predictions from Amazon’s Next Gen Stats in the broadcast of a football game. In the few seconds before the start of a play, Amazon’s artificial intelligence correctly predicted segments of a highly unlikely play. It is easy to imagine software increasing the odds of successful prediction across a wide range of activities and industries. Better prediction equals better profits.

Looking ahead to 2024, we expect an improved earnings outlook with gains in the mid-single digits. One reason for optimism on earnings is a durable economy. Growth in the third quarter was running at +4.9%, though we observe real-time data pointing to slower growth. Current readings from the New York Fed’s Weekly Economic Index and the Atlanta Fed’s GDP Now point to growth of +2.36% and +2.57%, respectively. Similarly, we estimate spending and mobility data point to growth running around +2.0%. Ongoing strength in the labor market is a key contributor to growth and modest expansion in the economy creates a solid backdrop for earnings.

Politics, Inflation, and the Fed

Uncertainty in global and domestic politics adds to volatility, especially in bonds. For now, markets are taking these stressors in stride. However, new discussions over a possible government shutdown in November have the potential to disrupt markets. We expect historical patterns to hold, with lots of stress leading to an eventual deal. Meanwhile, the supply of bonds is increasing via high levels of debt issuance, while demand is being reduced as the Fed continues a policy of shrinking their bond holdings. Bond investors face a conundrum: higher debt levels can be off putting, yet yields are more compelling than any time in the past 15 years. Overall, we believe yields will follow Fed Funds Rates and eventually head lower sometime in 2024.

Inflation data continues to improve, albeit slowly. Current readings for the Consumer Price Index (+3.7%) and the Personal Consumption Expenditures metric (+3.4%) are far below their peak readings. Data from Truflation has been sitting in a range below +3.0% since late May, and currently shows real-time inflation of +2.3%. Official data is poised to continue declining as inflationary fuel (supply chain problems, money supply, wage gains) has eased and slow-moving housing data flows through the inflation calculation methodology. While the 2.0% target set by the Fed is unlikely to be attained anytime soon, the gap between inflation and interest rates is significant. This restrictive policy is working to slow growth and ease inflation. These conditions also allow the Fed some flexibility. To date, the Fed has provided just a glimpse of future policy through statements indicating potential rate cuts if inflation approaches its target. This allows the spread between rates and inflation to remain restrictive, even with cuts in the Fed Funds Rate. These conditions should materialize sometime in the summer of 2024.

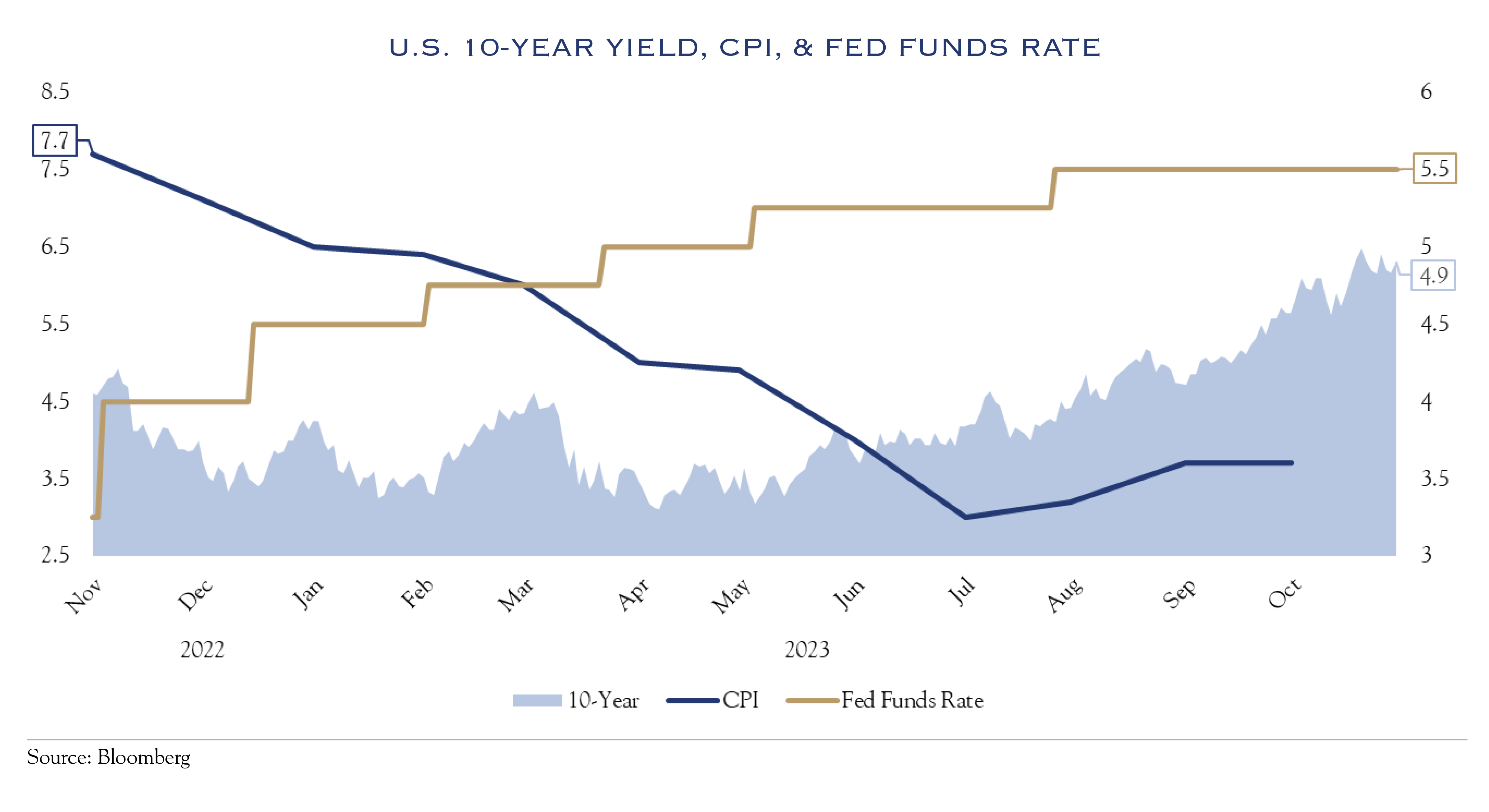

The graph above shows that the yield on the U.S. 10 Year has begun to take a cue from the Fed Funds Rate, rising from May onwards. While inflation has declined, the word and deed of Fed Policy has been to keep Fed Funds Rates above 5.0% for an extended period. This has pulled the 10 Year towards Fed Funds. From the perspective of the Fed, this is an ideal configuration—Fed Funds are high enough to be truly restrictive and bond yields are high enough to show that markets are taking the Fed seriously, while inflation continues to trend lower.

Outlook

Inflation and rates are poised to improve, but until they do, valuations are likely stuck. However, today’s valuations are not excessively high. In fact, ample historical evidence demonstrates that valuations can remain at current levels, even with rates on the U.S. 10 Year hovering around 5.0%.

Looking ahead to next year, 2024 is likely to bring a more normal backdrop with continued modest earnings gains alongside slow and steady improvements on inflation and Fed Policy.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC