Polar Opposites Co-Exist

Economists, companies, and analysts offer wildly disparate views on the economy, amidst sustained market volatility. Even business leaders at similar companies report substantially different conditions. Consumers who have reallocated spending in response to inflation, shifting consumption patterns from goods to services, further complicates analysis. For a sense of the discordant views on the economy, consider the economic models from two regional Federal Reserve Banks:

- The Atlanta Fed’s GDPNow estimates a negative rate of growth of −1.5%.

- The New York Fed’s Weekly Economic Index expects a positive rate of growth of +2.6%.

What’s the Sign?

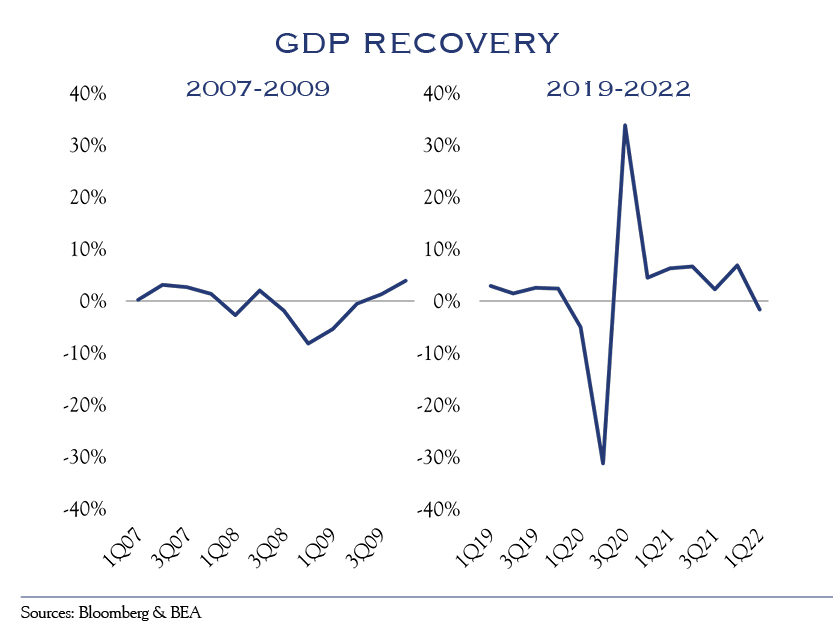

The Bureau of Economic Analysis (BEA) will release the second quarter Gross Domestic Product (GDP) report next week, Thursday, July 28th. All eyes will focus on whether a negative sign precedes the number. If the GDP number is negative, the statistic will have met the popular definition of a recession: two consecutive quarters of economic contraction.

The current economic cycle is the most complex and unique in modern history. Countless unusual circumstances, such as the COVID pandemic, created a massive, quick-moving, and unpredictable cycle. Such unpredictability creates real-world consequences for company planning and production.

Even minor forecast errors have amplified effects at various stages of the supply chain—the bullwhip effect. As with a bullwhip, whereby a small motion at the handle can generate great force at the end, incoming demand expectations lead to outsized production schedule changes. MIT research shows that small variations in a four-stage process can lead to a nine-fold change in production further down the chain.

At the pandemic’s outset, numerous predictions called for a slow recovery. Many businesses responded with significant production cutbacks. When the economy recovered rapidly, companies rushed to catch up but fell short, creating shortages across an array of goods. As conditions return to normal “pre-COVID” trends, necessary company readjustments feel like a slowdown. For instance, companies that benefited from selling into the “at-home” economy suddenly needed to slow down after several quarters of operating at warp speed. “Amazon’s new labor issue: What to do with too many workers,” pronounced a Washington Post headline.

The accelerated pace of this economic cycle also creates an extremely difficult forecasting environment for companies, economists, and analysts. Rarely has an economy torn through a full cycle this quickly.

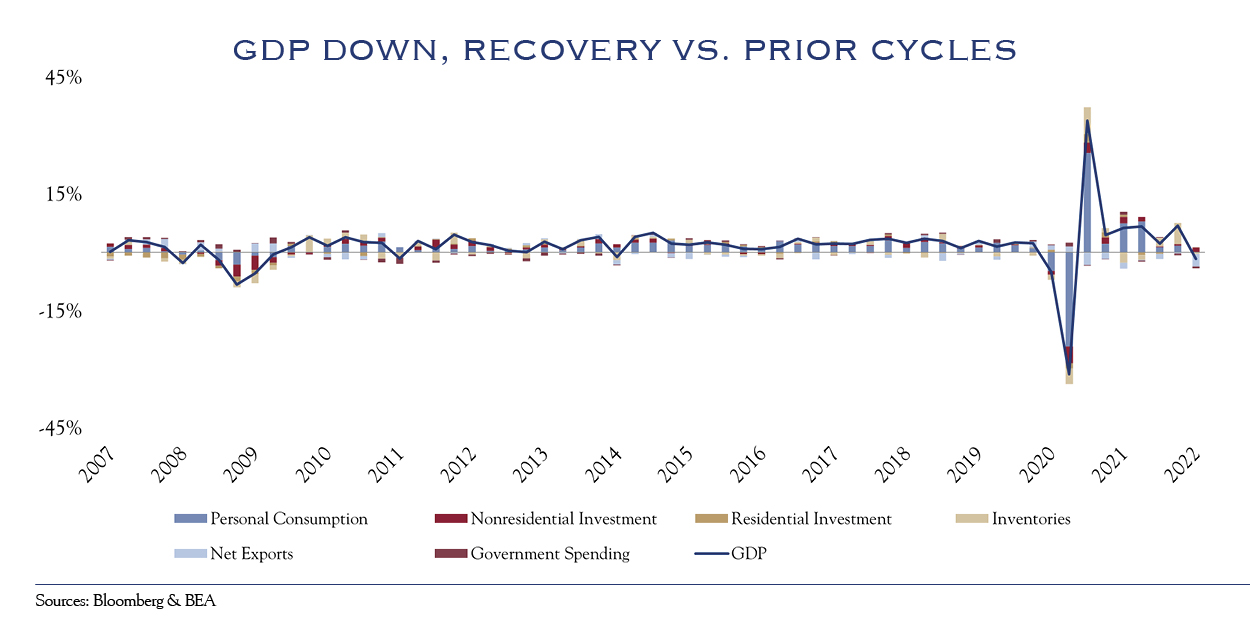

Two factors detracted from GDP growth during the first quarter: inventory decline and an increased trade deficit. GDP seeks to measure domestic economic production. Neither sales of already produced inventory nor purchase of goods from abroad contribute to new production. Nominal growth—the change in the size of the economy measured by dollars—ran quite high. Real GDP growth, which is adjusted for inflation, turned negative due to the high inflation we have all observed.

The second quarter looks like the first, and we may see the negative GDP figure that confirms the popular view of a recession. Despite this, the economy shows plentiful job openings, low unemployment, growing wages, and increasing consumption of goods and services.

An ordinary recession does not coincide with earnings growth. In these exceptional times, however, despite the first quarter’s negative GDP, corporate profits rose. Second-quarter earnings estimates remain positive as well, indicating that companies have found ways to generate profits in this economy, whether called a recessionary environment, a growth environment, or something else altogether.

Often investors hear the word “recession” and hastily sell stocks to reduce risk. This is frequently a losing battle as stock selloffs precede recessions, with a peak about six months ahead of a recession and a typical bottom about one year after a recession’s start. However, there is a wide range of timing across numerous historical episodes. Painful losses have unfolded for investors in the first half of the year. The S&P 500 declined −20.6%, while the U.S. Ten Year declined −11.45%. A simultaneous decline in both stocks and bonds occurs rarely, as bonds often cushion the decline in stocks. Yet, inflation and rising interest rates made bonds an unappealing investment. Undoubtedly, the primary culprit is inflation, running higher and for longer than expected, vexing investors and policymakers alike.

Half Empty or Half Full?

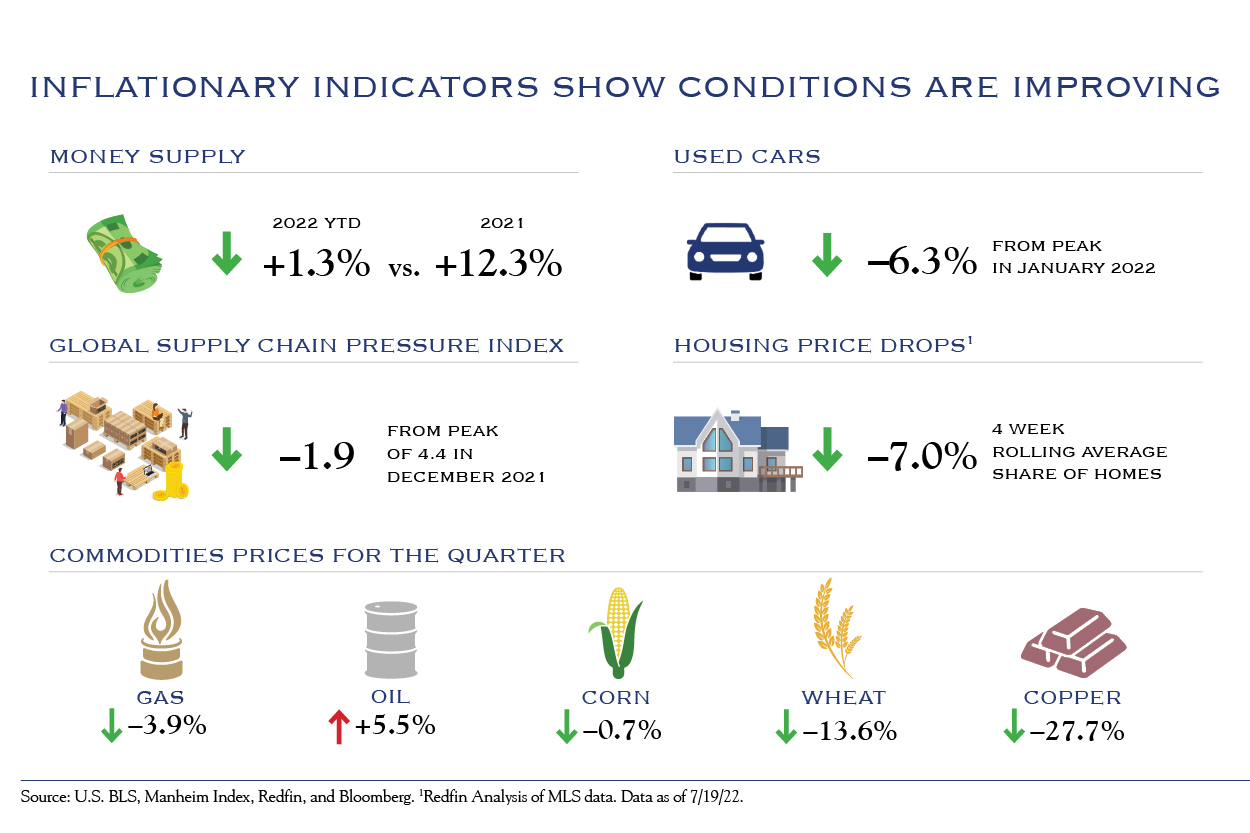

Economic pessimists think high inflation has taken hold and will remain disruptive for many years, as it did in the 1970s. We have a more hopeful view, as many of the conditions that support inflation change. It may be a long road back to low inflation, but Fed action and moderating inflation ingredients set a course for stabilizing and improving conditions.

Equities Face Adversity

Inflation has an insidious effect on equity valuations. Inflation drives interest rates higher, which in turn provokes downward pressure on company valuations. The exceptional economic landscape and higher inflationary environment add uncertainty and cause investors to question future earnings estimates, increasing equity market volatility.

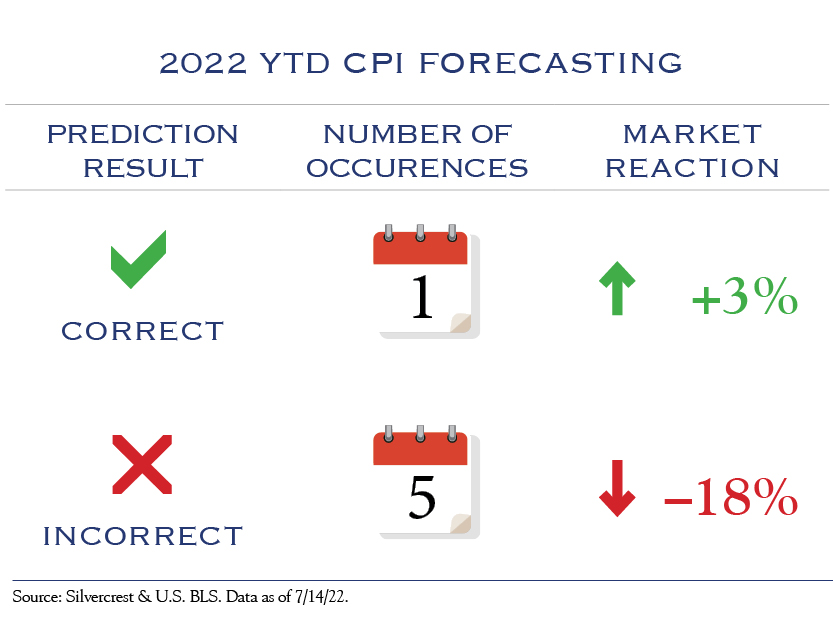

Inflation that is unexpectedly high has been especially painful for equities. Consider the table below, which illustrates the stock market reaction to inflation readings that have been as expected (even if high) vs. inflation readings that have been higher than expected.

Rates have quickly climbed from all-time low levels (1.17% on August 3, 2021) to around 3%. It is not certain when inflation will move in a better direction; however, interest rates are peaking. Consider this illuminating quote from Federal Reserve Chair Jay Powell: “Financial conditions have been tightening since last fall and have now tightened significantly, reflecting both policy actions that we have already taken and anticipated actions.” Anticipated is the important word here; it implies current market conditions already reflect upcoming rate hikes from the Fed.

Current market expectations and the Fed’s remarks hint that Fed Funds will peak at 3.00-3.25%, suggesting a range on U.S. 10-Year rates of 3.00-4.00%. Powell’s quote and the likely destination for the Fed Funds rate indicate that most of the damage has been done; current interest rates reflect much of anticipated future Fed rate hikes.

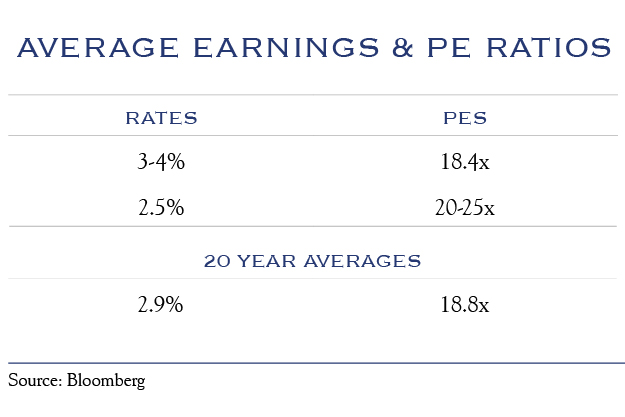

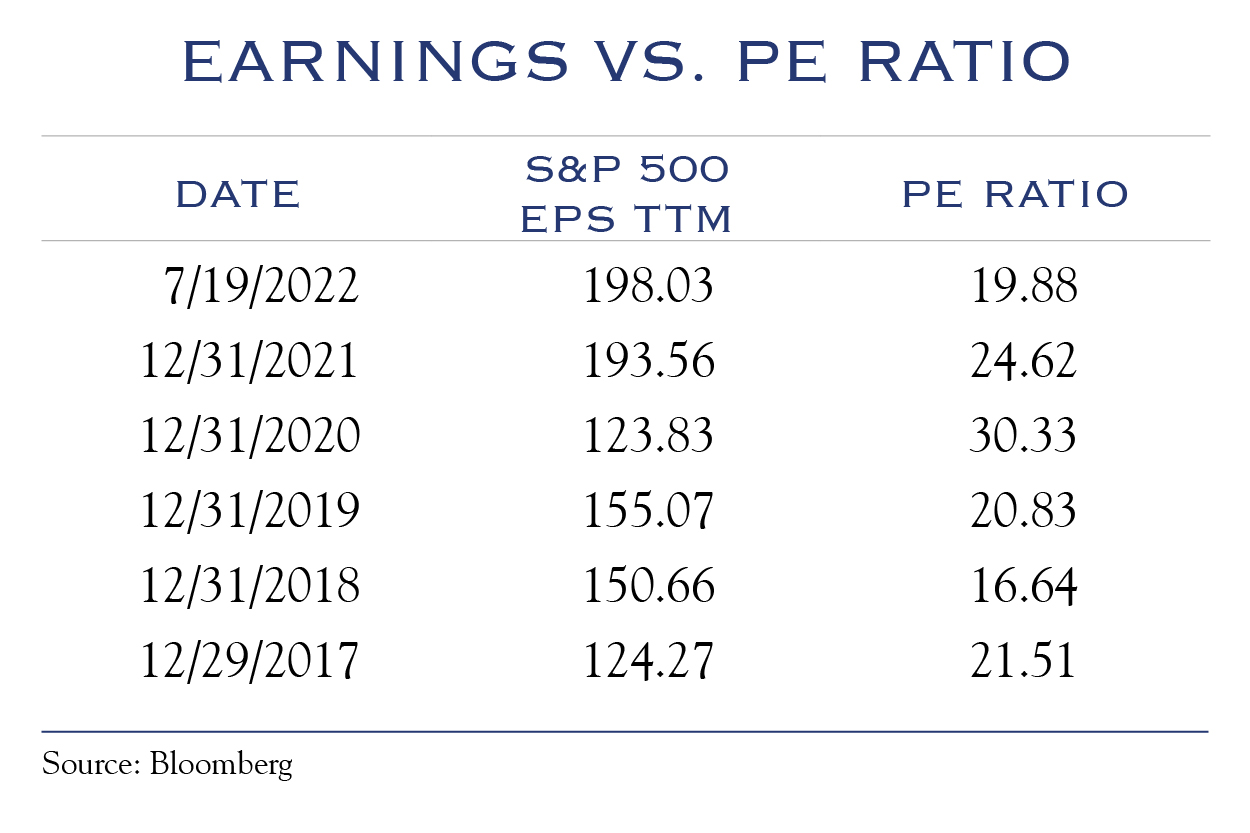

As of June 30, higher rates have contributed to the price/earnings ratio on the S&P 500’s declining from 25x to 19x. If rates have begun to peak, that will help stock valuations. As illustrated below, the comparison of interest rates and PEs shows that valuations have ample room for improvement if rates stabilize at current levels.

The Micro, the Macro, & Related Estimates

The first quarter presents a clear example of how GDP calculations may over-emphasize economic troubles. Just as companies grew earnings during a quarter of real negative growth, earnings estimates for the rest of 2022 remain robust. At the dawn of 2022, analysts estimated S&P 500 earnings at $220 for the year. Today—following the winter COVID wave, inflation, war, and continued supply-chain problems—estimates stand at $229.

While equity analysts are often too optimistic, the present economy suggests that those company analysts closest to specific conditions might have a better read on corporate earnings than those extrapolating top-line growth. In other words, company analysts may have a forecasting edge over their macro-focused strategist colleagues in the current environment.

Our take is more conservative. We think it likely some companies will succumb to economic challenges, and we anticipate earnings closer to the $220 that was expected at the start of the year.

Outlook

The short-term outlook depends heavily on upcoming inflation reports. Our work shows markets can tolerate high inflation consistent with expectations. However, higher inflation surprises have been met with swift selling, suggesting the issue remains whether inflation is getting better or worse. On July 13, the Bureau of Labor Statistics published the CPI report on inflation for the month of June showing a reading of +9.1 on a year-over-year basis. This was higher than expected and may contribute to short-term market struggles.

Recent Fed comments, and the potential peaking of inflation, should provide some stability or improvement in valuations. Inflationary forces have begun to moderate or improve in recent weeks. This should lead to cooler CPI readings in the upcoming months. As a result, we look for interest rates to remain in a broad range—no higher than 4.0% as earlier stated—and for PEs to stabilize at current levels of 18x earnings. Earnings are likely to fall slightly below analyst consensus and still show growth rather than contraction. It is all a good reminder that the best response to unpredictable events is to view investing over a longer timeline. Our preferred metric of three years allows ample time for great companies to build profits and wealth. Buying great companies at current valuations will provide favorable returns over a multi-year timeline with risk exposure levels that are consistent with investor risk tolerance.

We favor equity allocations at a level just above the mid-point for investor risk tolerance. We see the continued emphasis by U.S. firms to “re-onshore,” bringing supply chains closer to home, as a tailwind for small cap domestic companies as activity shifts to the U.S. We see opportunity in these smaller companies. In the current economic climate, we view individual company circumstances as more meaningful than “growth” or “value” designations and recommend a balanced exposure across both.

We continue to emphasize the importance of active, individual, security selection. The complicated macroeconomic backdrop will cause some companies to falter, while others flourish. Difficult circumstances often separate the great from the mediocre.

Turning to fixed income, current yields have become more appealing. Good yields provide investors with a strong opportunity for both conservative shorter-duration government bonds and high-quality corporate bonds, as well as many opportunities for security selection in municipal bonds and higher-yielding securities. While rates may drift higher, and cause some short-term decline in bond values, the yields available are more compelling than they have been in years. Taken together, we see a reasonable investment opportunity set for the patient, longer-term investor.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC