A New Economy is Emerging

Following a few tumultuous years, a new economy is emerging. Though scars remain and fresh challenges percolate, we see more themes to celebrate than lament. News coverage of positive economic developments often have the lifespan of a mayfly. News sentiment remains quite negative, which informs investor sentiment. Yet many elements of the new economy have long-lasting positive implications for investors. While interest rates and banking challenges will keep growth rates low, rising productivity and falling inflation provide a modestly favorable environment for investors with reasonable time horizons.

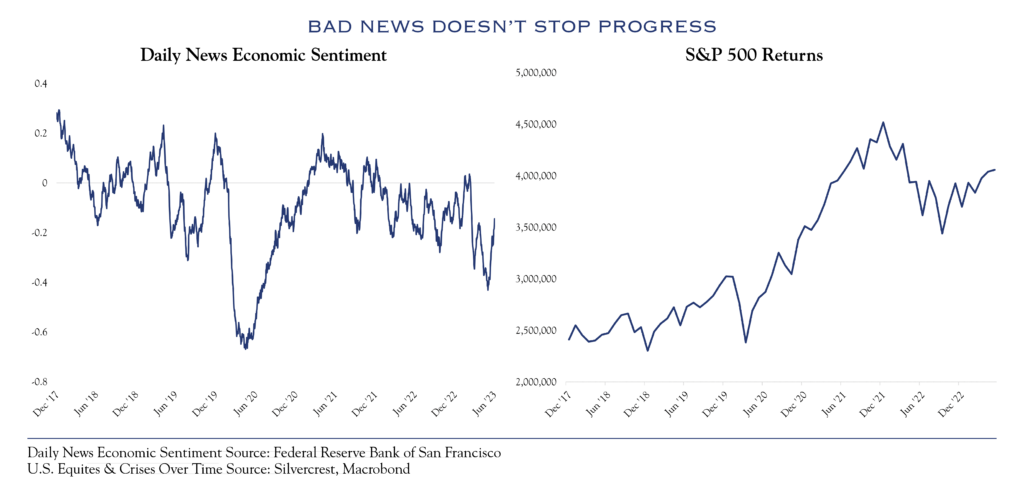

The San Francisco Fed publishes a review of sentiment using natural language processing (NLP) to analyze the tone of news stories, as seen in the chart below on the left. While the Fed analyzes the news, the news is likewise analyzing the Fed. Bloomberg News conducts a similar analysis of commentary by Federal Reserve speakers, categorizing the comments as dovish or hawkish.

The righthand chart below illustrates the progress of wealth creation in equities despite many significant challenges. Companies find a way to adapt and to evolve, create solutions, and generate profits, regardless of any given era’s problems.

Ten Themes For A New Economy

Within the U.S., ten themes are influencing the new post-pandemic economy.

1. Inflation Is Bad, but Improving

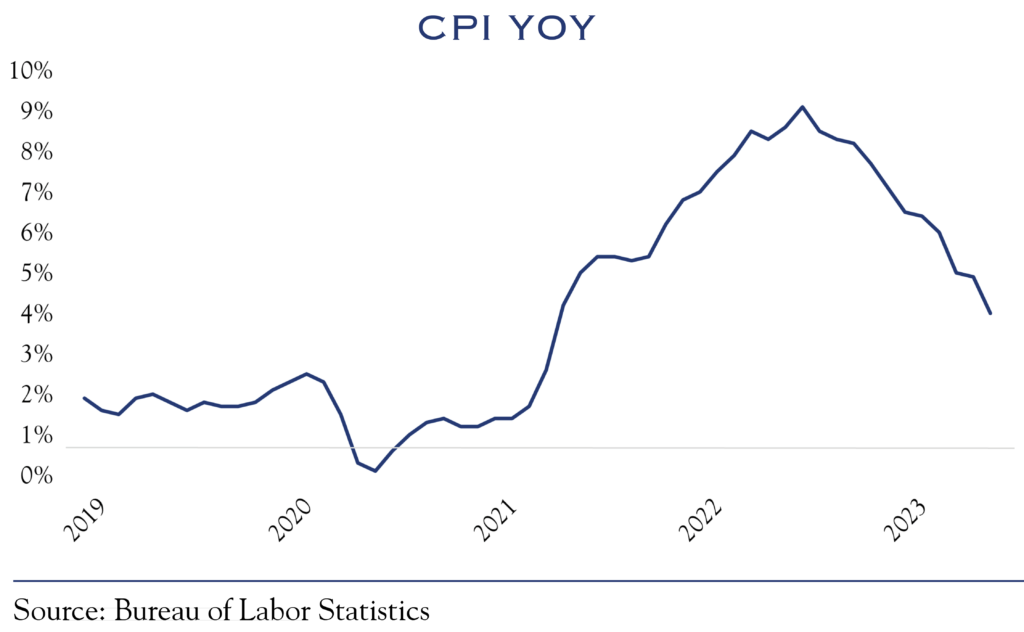

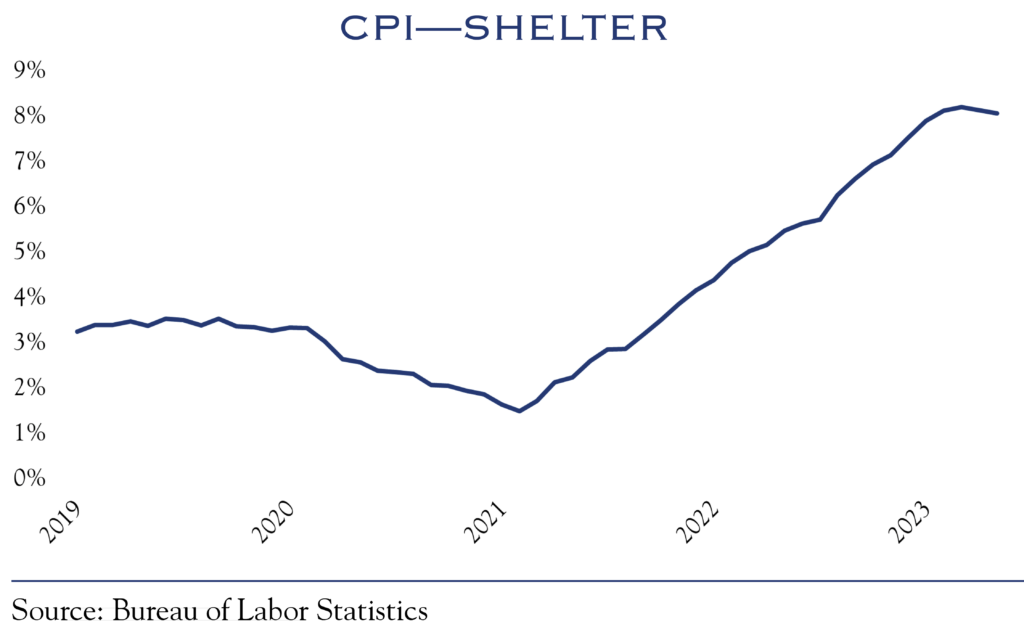

Inflation is on a clear path to lower levels, and the conditions that spurred inflation have improved dramatically. Supply chains have largely healed, money-supply growth has stopped, and the economy is rebalancing. While inflation smolders in the large and vital “shelter” component, indicators point toward moderating housing costs in the coming months. A portion of the service economy remains elevated; progress has been slow, but things are headed in the right direction. While the Fed’s 2.0% inflation target may not be immediately achieved, inflation should continue to improve. That will relieve some pressure and give the Fed policy flexibility, allowing it to more effectively respond if economic conditions worsen. This restored flexibility provides a source of improved equity valuations.

2. Fed Policy Restrictiveness Is Nearing a Peak

The Federal Reserve is nearing for the end of interest rate increases. The present Fed Funds Rate of 5.25% is above the 4.05% rate of inflation measured by the Consumer Price Index, a level which indicates “restrictive” interest rates. Since inflation has fallen for 11 consecutive months, there isn’t a discernable need for the Fed to increase rates much further.

3. Rising Housing Costs Are Stabilizing

While housing costs have rapidly increased over the past few years, relief is coming. At present, owners who financed at lower interest rates have been reluctant to sell their homes if it meant taking on a new, higher mortgage rate. Interest rates will likely decrease as inflation improves, leading to lower financing costs and more willingness to transact. A better financing environment also will bring more housing supply to market through financing for new home construction.

4. Commercial Real Estate Will Struggle in Some Spots

Changes in for the use of office space and increased finance costs have created a troubling situation for commercial real estate. Some transactions have been made at significantly reduced property values. While a recent transaction was hailed as a sign that activity was picking up, the price was lower than in 2017. Other transactions have seen more significant price reductions. While there will be problems for this sector, we see three reasons why it is unlikely to cause significant damage to the economy:

- The office sector is of modest size—about 15% of commercial real estate

- Location is critical, as is the problem; some cities are faring much better than others

- Individual property owners have different views on return-to-office, work-from-home, and hybrid. Some are finding that hybrid configurations—and even extensive work-from-home configurations—still require office space capable of handling high attendance on certain days of the week

Some troubled properties will experience problems and complicated financial workouts. However, those problems are unlikely to affect the overall economy.

5. Artificial Intelligence Will Bring Productivity Gains

While some of the commentary surrounding advances in artificial intelligence (AI) is filled with hype, there are many use cases where AI is already creating massive gains in productivity. One of the best studies to date is “Generative AI at Work” (Brynjolfsson et al., 2023). This research studied call-service workers equipped with an AI-trained chatbot. A massive +14% increase in productivity was observed, with beginners able to reach expert status quickly. Errors, such as AI inventing things that don’t exist (“hallucinations”), are problematic. However, the technology has made massive strides when deployed for specific tasks in controlled environments.

The economy likewise benefits from technological upgrades to accommodate the computing horsepower demanded by AI implementation. Survey data from the CNBC Technology Executive Council shows 47% of tech officers making AI their top spending priority. As in the early days of the internet, AI will likely include elements of both “vaporware” and massive productivity gains. This next wave of innovation will pervade across industries, bringing productivity gains to a broad swath of the economy.

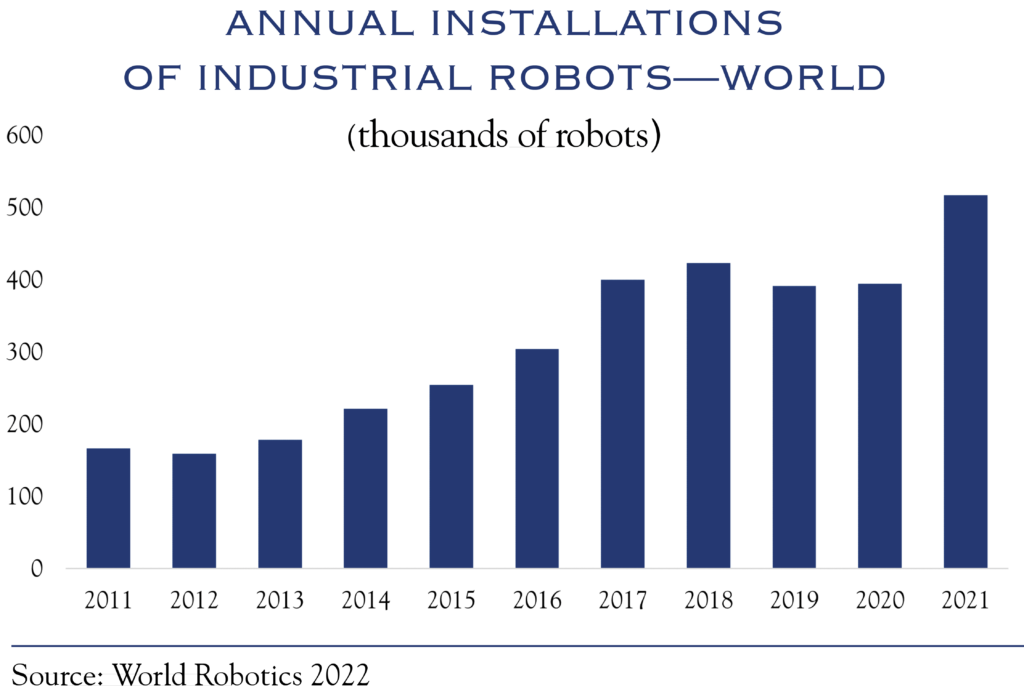

6. Robots Help Manage Costs

Another reason for long-term optimism on productivity and earnings gains is the deployment of robotics in U.S. manufacturing. The automotive industry is leading the charge, though consumer-facing companies are also participating. The chart below shows the increase in the installed base of robots in the U.S.

7. Health & Wellness Will Increase Labor Market and Consumer Spending

A recent article in The New York Times, “Suddenly, It Looks Like We’re in a Golden Age for Medicine,” outlines significant advances in medical technology. The pandemic was so exhausting and polarizing that we lost sight of other medical advances. Challenges abound in the medical field, particularly the cost of care in the U.S. compared with other countries. However, when viewed from an economic vantage point, this expensive innovation will likely lead to increased lifespans and wellness. In turn, the economy’s capacity for productivity and the pool of available workers will increase. More people working and spending supports a larger economy.

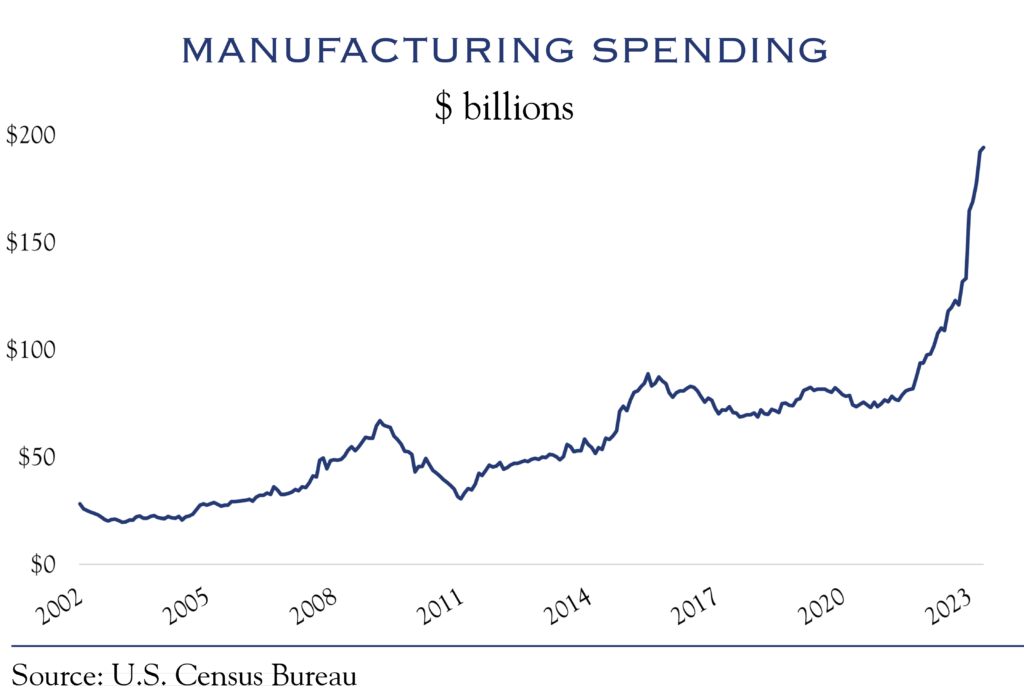

8. Reshoring Is Leading to Construction and Jobs

The challenge and vulnerability of complex and far-reaching supply chains were revealed during the pandemic years. As a results, companies and policymakers have sought to create additional productive capacity within the U.S. This desire to reshore, along with government-funded reshoring incentives, has led to a massive uptick in construction spending on manufacturing. Manufacturing jobs are now above their 2019 level.

9. The Energy Transition Brings More Supply

Over the past twenty years, the renaissance of American energy production led to lower energy costs and increased employment in this critical industry. While political allegiances often unveil a preference toward either traditional oil and gas or new energy sources, each brings new energy capacity to the economy. As with any commodity, more supply likely leads to lower cost. Lower energy costs benefit the consumer and make more domestic manufacturing businesses profitable.

10. U.S. Dollar Stability Helps Profits and Planning

In recent years, the U.S. Dollar rallied strongly against most major currencies. While this was primarily a reflection of stronger U.S. economic conditions, it created a headwind for the profits of globally-focused U.S. companies. More recently, the Dollar has been range-bound—a more historically common pattern. Dollar stability helps corporate planning and boosts the relative attractiveness of U.S. manufacturing. A stable Dollar has a twofold benefit: it helps economic activity via manufacturing, and helps the profitability of U.S. companies operating on a global scale.

Here summarized are the current and expected effects of ten significant issues facing the economy and investors. Each is classified as to whether they are positive or negative influences on the economy and whether they are getting better or worse. Outside of some pockets of commercial real estate, negative items will likely improve. Those exerting a positive impact on the economy are more numerous than those that are negative, which should translate to better economic conditions in the future.

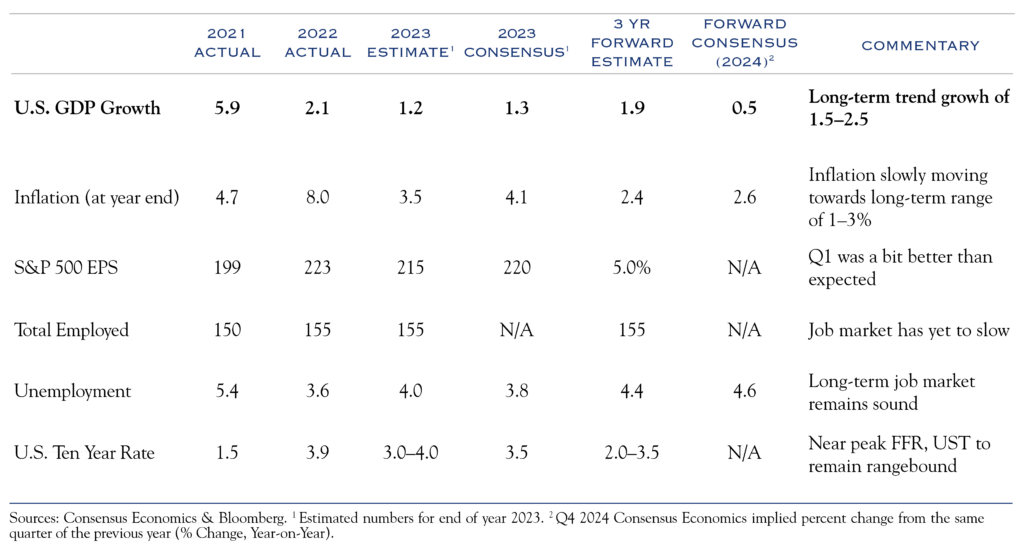

Economic Outlook

The latest estimates from the New York Fed and the Atlanta Fed indicate the U.S. economy is expanding at a rate of 1.1% to 1.9%. Our analysis of consumer activity from real-time metrics on spending and mobility is consistent with a growth rate of +1.5%. With unemployment relatively low and the total employed in the U.S. at a record 156.1 million, consumers are working, spending, and keeping the economy growing modestly. In coming quarters, higher interest rates, financial stress at some banks, and problems in pockets of real estate will weigh on that growth. However, the economy should avoid recession, posting growth that is just barely above zero. The long-term trend rate of economic growth in the U.S. is around 2.0%; the themes above should slightly boost that rate in the coming years. In effect, the economy should see minimal growth over the next two-to-three quarters, with gradual improvements from +2.5% to +3.5% over the next few years.

Earnings Outlook

A slow economy followed by a better one will flow through to earnings in like fashion. 2023 earnings should be essentially flat, with recent consensus earnings estimates beginning to tick up a little. We expect economic improvements over the next few years to boost earnings above our prior long-term trend assessment. Thus, earnings will grow by approximately +7% over the next few years.

Areas of Opportunity

Small-cap and some non-U.S. equities have especially compelling valuations, though quality metrics vary. Active management is essential. Increased U.S. reshoring activity should be expected to flow through to small caps, given their exposure to domestic activity.

For much of 2023, gains have been heavily concentrated in a small group of stocks. Following the resolution of the debt-ceiling stress, markets began broadening out, with more securities participating in gains. This is an encouraging development and will continue in coming years.

Innovation in the United States

The United States economy has persistently exhibited a high degree of dynamism. New business formations have surged in the past few years and patent issuance has remained robust. In the most recent quarter, transcript analysis of company calls has indicated an increase of +27% in references to productivity. In other words, despite all the bad news, there is reason to believe that many emerging themes will exert a positive influence on the economy.

Outlook

Valuation levels are high by historical standards, having improved this year based on improving inflation and a better outlook on the Fed rate hike cycle. Current valuation levels are fair, and some short-term choppiness is expected as investors process a revised outlook for Fed policy, one with no expectation of rate cuts in the short term. The Fed will remain vigilant, keeping rates at current levels (or a touch higher) for the foreseeable future. In addition to official CPI statistics from the Bureau of Labor Services, real-time estimates from services like Truflation show rapid inflation cooling. Truflation’s data shows a current estimated inflation rate of +2.21%, down from +11.2% one year ago. This progress gives the Fed a degree of flexibility such that cuts could be merited under certain circumstances. That was clearly not the case just a few quarters ago. With inflation improving and Fed flexibility increasing, likely, the longer-term path for valuation is a touch higher.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC