The range of opinions on the state of the economy is widening with each new data point. With the S&P 500 down −17.0% year to date through August 31st, the pessimistic take seems to have prevailed. This is reflected in negative sentiment readings at near all-time highs. The AAII survey reports 53.3% bearish sentiment vs. 18.1% bullish sentiment, indicating that a lot of bad news is reflected in the current pricing of securities. Yet, the following indicators of economic activity paint a picture that is not as decisively pessimistic or recessionary.

Expansion in Manufacturing and Services

One important indicator of economic growth is the Institute for Supply Management (ISM) surveys. For ISM indices, readings below 50 indicate economic contraction, and above 50 indicates expansion. The most recent reading on the ISM Manufacturing index was 52.8 and the ISM Services Index was 56.9. Both are pointing to an expanding economy. Both reports suggest inflation is improving, as the prices paid component of the survey reflected that, while prices are still rising, the pace has slowed. Further, a few survey comments pointed to an easing of supply chain problems which is a change from prior months and consistent with a decline in the New York Fed’s Global Supply Chain Pressure Index.

Jobs

The consumer segment of the economy is the largest and most important contributor to economic activity, representing about two-thirds of Gross Domestic Product (GDP). For that reason, our view on the economy is highly influenced by the job market. Starting in April, weekly jobless claims ticked up a bit, but have now been stable since the start of June and remain at a level consistent with pre-pandemic conditions. Job growth has been a bit volatile, however the number of employees on payrolls increased by an average of 381,000 per month over the past six months, and over the past three months increased by 378,000. Job openings remain strong at a level of 11.2 million. This figure is nearly double the pre-pandemic readings, and a tight job market is consistent with comments from corporate surveys across large portions of the economy.

GDP Estimates

Recent estimates from the Atlanta Fed’s GDPNow forecast show expected growth in the economy of 1.4% for the third quarter of 2022. The New York Fed’s Weekly Economic Index provides an estimate of “real-time” growth for the week and currently points to growth of 2.5% in the economy. We see growth remaining positive, albeit at a low level. Over the next few years, we expect GDP to expand at about 2% per year, consistent with the pre-pandemic anemic growth rate.

More Good than Bad

While many strategists are predicting recession, the ISM surveys, job market and economic forecast models are all pointing to a growing economy, albeit slowly. Because the economy creates an engine for corporate profit growth, positive economic activity is important for the outlook on stocks. We expect this slow growth in the economy to drive mid-single digits gains in earnings.

Inflation

Currently, the most important economic statistic is inflation. Both market forces and Fed policy draw heavily on inflation when setting interest rates. The importance of the relationship between rates and equity returns is especially evident recently. In the second quarter of this year, the S&P 500 declined −16.5%, aligning almost perfectly with a near doubling of interest rates on the U.S. Ten Year from 1.7% in early March to a high of 3.5% in mid-June.

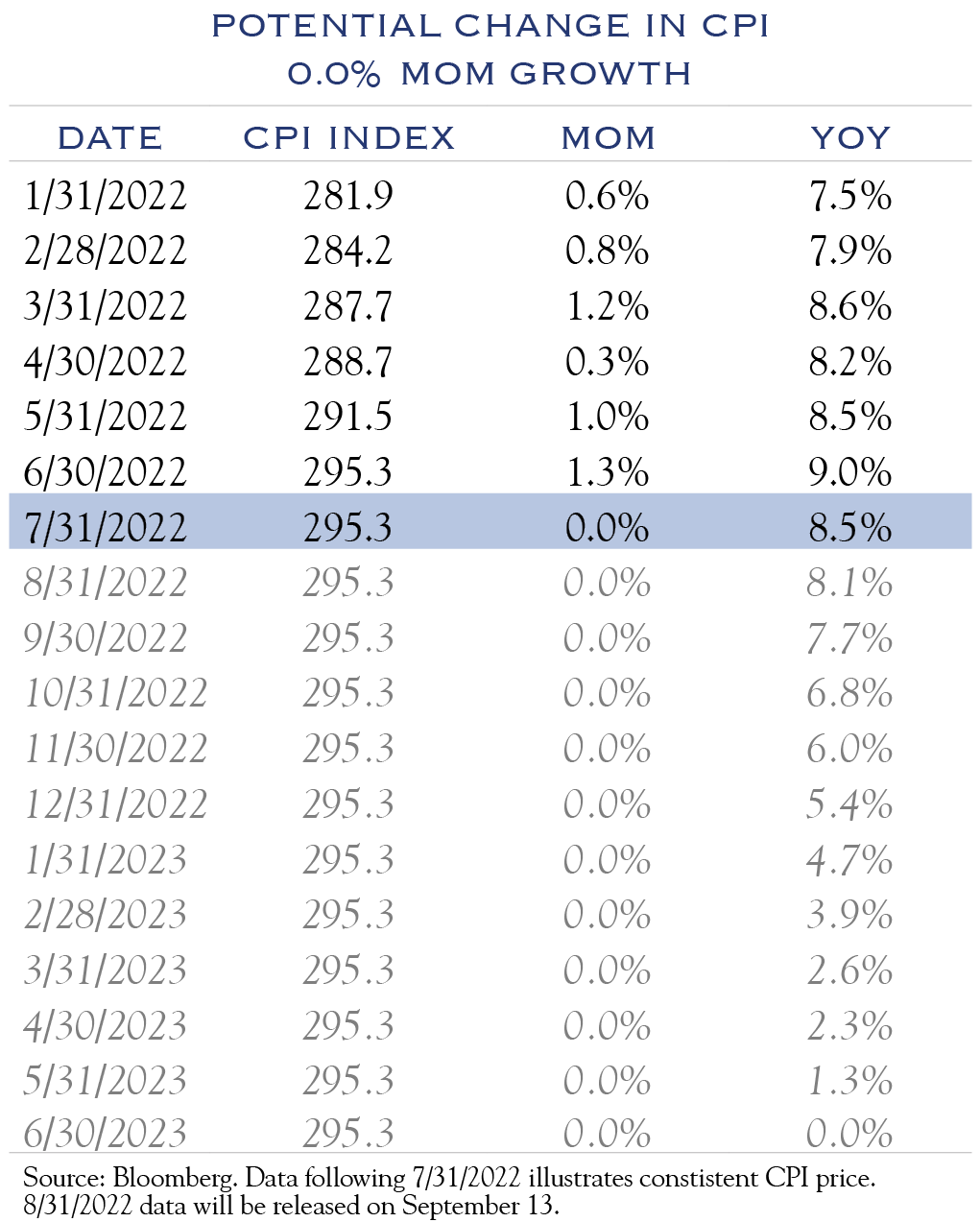

Inflation is predominantly measured by the Consumer Price Index (CPI), which tracks the total of a large basket of prices. In this way it is similar to a stock index such as the S&P 500. Yet unlike the S&P, conventional CPI reporting shows the percentage change in the index as compared to one year prior. For example, the most recent reading of +8.5% represents an increase in prices of 8.5% as compared to a full year prior. In addition to this year-over-year (YOY) measurement, the CPI index is also measured on a month-over-month (MOM) basis. The most recent MOM reading showed no change in prices. To take the example one step further, if CPI prices continued with no changes, the YOY reading would reach 0.0% in June 2023, and would have arrived at the Fed’s target of 2% inflation only by April. The table below illustrates the concept.

The divergence between the two readings is worth noting because it remains to be seen whether investors and the Fed will focus more on short-term changes or on the longer-term—and more commonly referenced—readings. Since there has been a cooling of the forces behind inflation (money supply, fiscal spending, supply chain challenges, shipping costs, quirky pricing as demand patterns changed, etc.), we expect inflation to continue to moderate. Even so, YOY readings will remain high.

The Fed is likely to keep raising the Federal Funds Rate as they aim to cool demand and hopefully ease inflationary pressures. Market-based projections show the Federal Funds Rate increasing through March 2023 and hitting a peak of about 4.0%. However, that path and peak are certainly subject to change and will be primarily influenced by upcoming inflation readings.

Outlook

Our expectation is that coming months will see continued volatility alongside a moderation of inflationary pressures and a subsequent stabilization of both interest rates and valuation metrics (such as ratios). We look for slow economic growth to create a conducive backdrop for earnings growth on the track ahead in the mid-single digits. We look for bond returns to be in line with current yields, and stock returns of 6-8% over our three-year forecast horizon.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC