Leadership cannot be outsourced; it must come from within the family.

Wealth is more than a balance sheet—it is a story, a responsibility, and a legacy. For families who have spent years or even generations building substantial assets, effective wealth planning is critical. However, successful families understand that management alone is not enough. Without strong leadership, wealth can become a source of tension, division, and squandered opportunity. A true legacy requires moving beyond management and tending to a culture of family leadership that transfers not just assets but also purpose, responsibility, and vision. There are a variety of options for outsourcing management that will serve a family well. Leadership, however, cannot be outsourced; it must come from within the family.

The Power of Family Leadership

Leadership is deeply personal. It is about influence, inspiration, and vision. Leaders within a family take ownership not only of the wealth but also of the values and vision that come with it. Leadership emphasizes people—their growth, their understanding, and their alignment with a broader purpose.

Where management is about preservation, leadership is about transformation. Leadership asks: What do we want this wealth to mean? How do we want it to shape the world and the people in it?

A strong leader ensures that family members understand that wealth is not merely a privilege but a responsibility. With this understanding comes stewardship—the idea that wealth is not just to be enjoyed but cultivated for the benefit of both current and future generations. Leaders help embed this ethos through vision casting, active mentoring, and emotional intelligence.

The role of a leader is not freely given; it is earned. Therefore, a leader’s influence is only regulated by the respect that is garnered. There can be, and should be, multiple leaders within a family, each making a positive contribution in an area of importance, such as the family business or among their peers in their generation. The overlap of influence should be valued for the different perspectives it brings together. Embracing these different perspectives facilitates an opportunity to revisit the family’s values and make decisions employing a methodology that holds true to those values.

When family members have personal buy-in and are involved in the evolution of the family’s mission, the wealth structure becomes a source of pride, not resentment.

Importantly, leadership allows for decentralized control. A rigid central authority may become ineffective or outdated as families grow and diversify across geographies, industries, and life experiences. By contrast, leadership enables shared responsibility and relevance across generations. When family members have personal buy-in and are involved in the evolution of the family’s mission, the wealth structure becomes a source of pride, not resentment.

Legacy: More Than Wealth

A family’s legacy is not determined solely by financial metrics. It is measured by the strength of relationships, the endurance of shared values, and the family’s positive impact on the world. This kind of legacy is built intentionally through communication, trust, and long-term thinking.

Legacy doesn’t happen by accident. It must be led.

Families with strong legacies often share the following characteristics:

- They talk openly and often about values: There is no ambiguity about what the family stands for.

- They plan for change: They understand that future generations will live in a different world, and they build flexibility into their governance structures.

- They invest in people, not just portfolios: They prioritize education, mentorship, and personal development.

Leadership works hand-in-hand with management. The structures remain intact, but their application evolves to reflect the family’s growth and shifting priorities.

Creating Leadership Opportunities

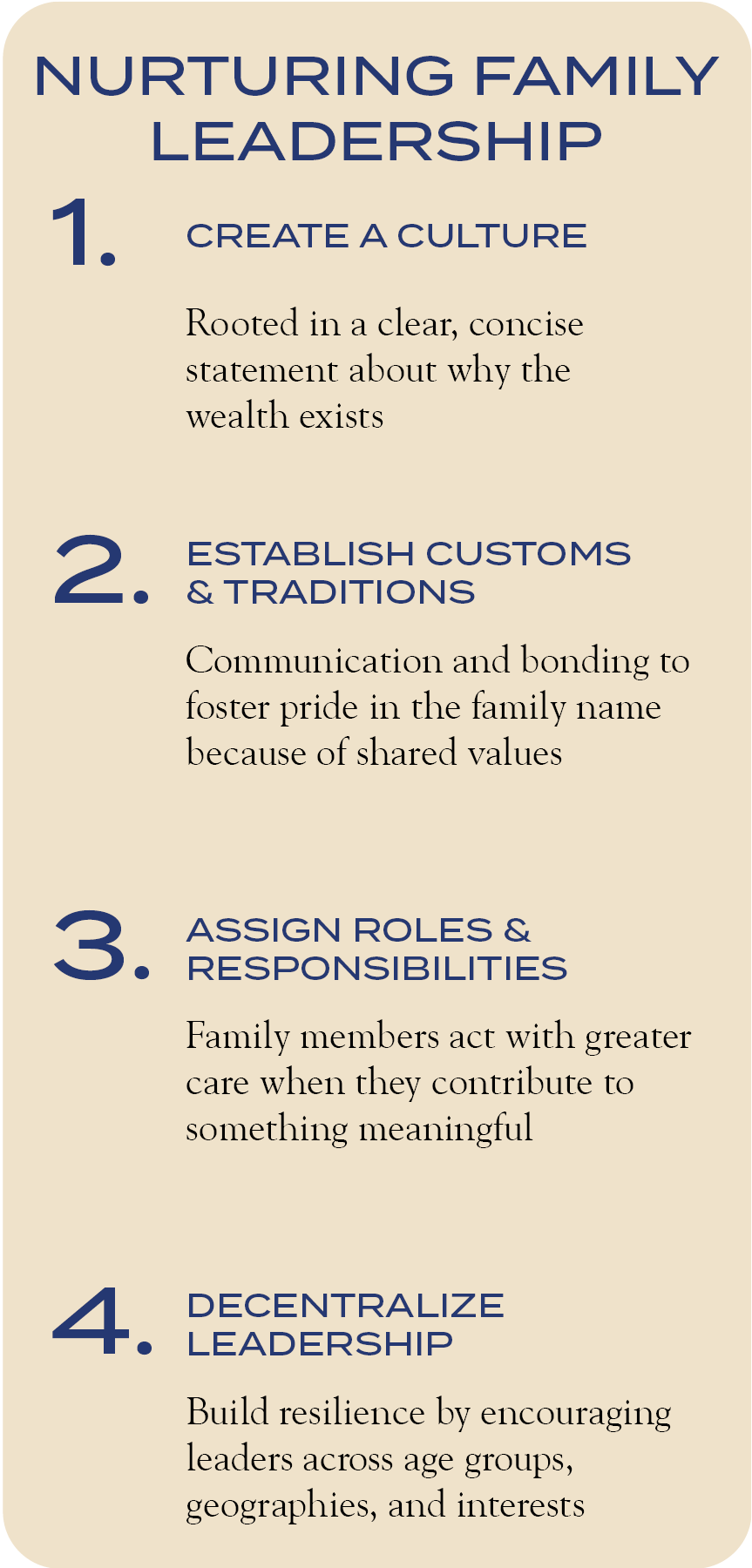

Leadership doesn’t emerge spontaneously—it is nurtured. Families that aspire to create a long-lasting legacy must actively cultivate leadership in each generation. This process involves several deliberate actions:

1. Create a Culture

Culture is the invisible hand that guides behavior when no one is watching. A family’s culture should be rooted in a clear and concise mission statement that explains why the wealth exists, not just how it should be used. This mission should be shared early and revisited often. It becomes a rallying point and a lens through which decisions are made.

2. Establish Customs & Traditions

Regular family meetings, retreats, and governance forums create opportunities for communication and bonding. Over time, these traditions foster pride in the family name, not because of its financial power, but because of its shared values. This emotional equity is critical in holding the family together during transitions and challenges.

3. Assign Roles & Responsibilities

When family members feel they are contributing to something meaningful, they act with greater care and intention. Even younger members can be given roles—perhaps on philanthropic committees, event planning teams, or legacy storytelling groups. These roles build confidence and capability.

4. Decentralize Leadership

The family builds resilience by encouraging multiple leaders to emerge early across age groups, geographies, and interests.

One of the most common mistakes in family wealth is overly centralized leadership. When one person holds all the power or responsibility, succession becomes fraught with tension and uncertainty. The family builds resilience by encouraging multiple leaders to emerge early across age groups, geographies, and interests. When the patriarch or matriarch eventually steps aside, others are already prepared to step forward.

An example of where these leadership opportunities play out is when the family undertakes a project to revamp their charitable giving. Across three generations participating in the project, there will be significant differences in experience, perspective, and approaches to the work. The natural inclination might be to let the elder generation direct the project and everyone else fall in line. In this scenario, a natural outcome might be for each generation to make changes when it is their turn to be in charge. The result reflects who is pulling the levers at the moment. Conversely, if there were a true collaboration that benefited from the older generation’s experiences, the younger generations’ innovations, and an alignment of mission, there would likely be fewer directional changes from generation to generation. The consistent pursuit of purpose creates a legacy.

Conclusion

Generational wealth is both a gift and a challenge. While effective management creates the structure for financial continuity, only leadership can breathe life into a family legacy. Leadership ensures that the wealth is more than numbers in an account—it becomes a force for good, rooted in purpose, and guided by shared values.

The families that thrive across generations are those that move beyond mere management. They invest in their people as much as their portfolios. They adapt without abandoning their core beliefs. They communicate, delegate, and elevate each member’s potential.

Ultimately, the greatest risk to family wealth is not market volatility or poor tax planning—it is disconnection. Without leadership, wealth can divide. With leadership, it can unite, inspire, and endure.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Kelleher. No part of Mr. Kelleher’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC