Investing for growth affords access to a wide range of companies in dynamic industries. In some ways, the growth style provides exposure to the future. Of particular interest are those companies exhibiting durable industry leadership, as well as compounding improvements in revenues and future earnings. Below, the Silvercrest Large Cap Growth team describes their unique approach to identifying winners in this exciting area.

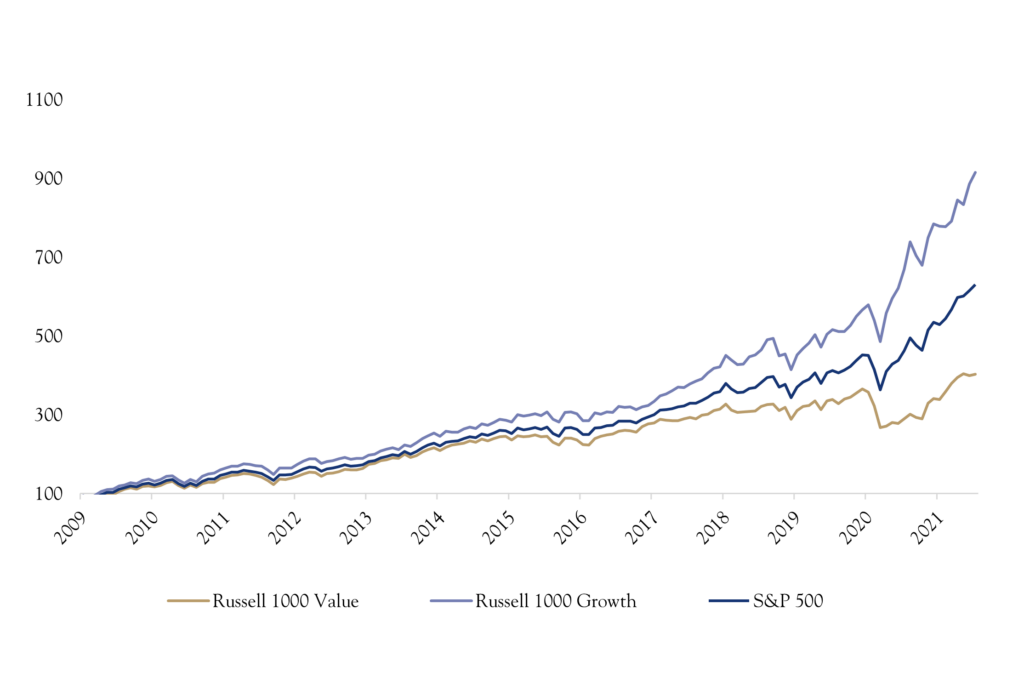

It is widely understood that the last decade was quite prosperous for Growth investing and conversely challenging for Value investing. The Great Recession inflicted deep and lasting scars on the U.S. and global economy. In fact, the ensuing recovery was one of the weakest economic recoveries on record, with real GDP (annually on average) growing at approximately half the rate experienced in prior non-recessionary periods in the post-WWII era: 2.3% vs. 4.1% going back to 1948. As a result of the damage, central banks around the world, including the United States Federal Reserve, resorted to extreme and unconventional monetary policy tools which had the effect of keeping interest rates extraordinarily low (even negative in some cases) and market liquidity high. The combined effect of scarce growth and sustained, abundant monetary policy primarily benefitted financial assets broadly and Growth stocks particularly. More speculative “long duration” stocks, those with earnings and cash flow visibility far out into the future, were the biggest beneficiaries. As seen in the following chart, for the period between December 31, 2009 and December 31, 2020, the Russell 1000 Growth Index return handily exceeded the S&P 500 and more than doubled the return of the Russell 1000 Value Index. Interestingly, this period includes the recession and bear market resulting from the pandemic, which merely accelerated the trend already in place. Momentum stocks, particularly those with exposure to secular trends accelerated by the pandemic, such as “work and learn from home stocks” thrived during 2020.

Source: Bloomberg

At Silvercrest, we take a bottom-up approach to stock selection that relies on a proprietary valuation model. We seek to combine elements of both Growth and Value, while avoiding speculative investment environments and limiting drawdowns. Through our process, we isolate high-quality Large Cap companies that operate in growing industries and have enduring competitive moats built around their businesses that can help sustain above average earnings momentum.

We are optimistic that our disciplined approach to Growth investing will deliver both solid absolute and relative performance for our clients. Over the last decade, some of the best performing strategies were Large Cap strategies with aggressive, price-momentum philosophies. Those more sensitive to valuation, while producing solid absolute returns, were often relative underperformers. We anticipate the next market cycle will look different with the likelihood of higher inflation and higher interest rates. This should work to the advantage of disciplined Growth strategies as higher risk-free rates will most impact those stocks with the loftiest valuation multiples. Many companies—both secular Growth and cyclical Growth companies alike—have expanded their competitive advantages during the pandemic due to permanent shifts within their respective industries, from self-help actions taken during the pandemic, or a combination of both. We believe the combination of strong intermediate-term Growth opportunities coupled with reasonable valuations will benefit our disciplined strategy in the period ahead.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Jung. No part of Mr. Jung’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC