This winter issue of Silvercrest Insights focuses on the uncertainty of information during an uncertain time.

Political, social, and economic disruption leads many of us to gather as much information as possible to help make sense of events.

Richard R. Hough III

Chairman and CEOOur quest for more data is not itself enlightening, however, and can lead to greater difficulty assessing what’s important. Access to information used to be a great advantage in the marketplace. As data has become commoditized, the advantage now lies with how it is processed to find the signal amongst the noise. As Robert Teeter observes, counterintuitively, there may now be an advantage for those who go more “slowly”—for people and institutions capable of deep work to gain insight from information.

With so much more information to process, Mark Morris looks at how artificial intelligence may assist and better focus human intellectual capital by reshaping information to our use. Of course, information often have historical analogues and history provides a useful shortcut to understanding current events. Patrick Chovanec looks at the economic and pandemic crisis of 100 years ago. Finally, Bart Johnston, who works with many of our firm’s families, provides a practical view of how long-term planning can help investors achieve their desired goals through a long life of unpredictable events and times.

Economic & Market Overview

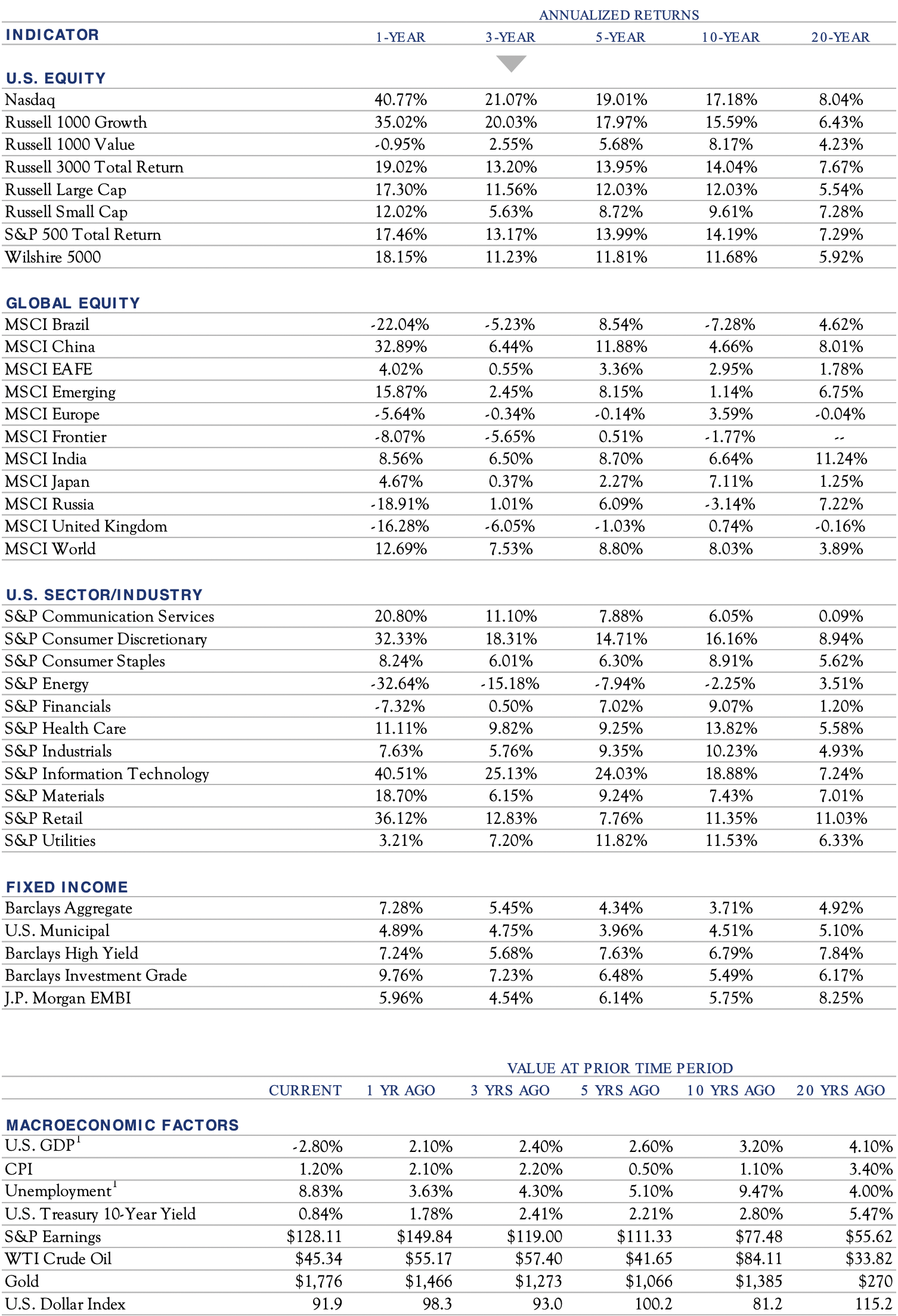

Price/Earnings

Source Bloomberg

Stock valuations, as measured by Price/Earnings (“P/E”) ratios, remain elevated primarily for two reasons. First, some segments of the index are seeing earnings declines due to COVID economic weakness. We believe this cyclical effect will recover through 2021. Second, interest and inflation rates remain low. Low interest rates, as seen in the chart above, make stocks more compelling, relative to bonds. While many investors look at long-term average P/E ratios, we think ratios must be viewed in context of the interest rate environment.

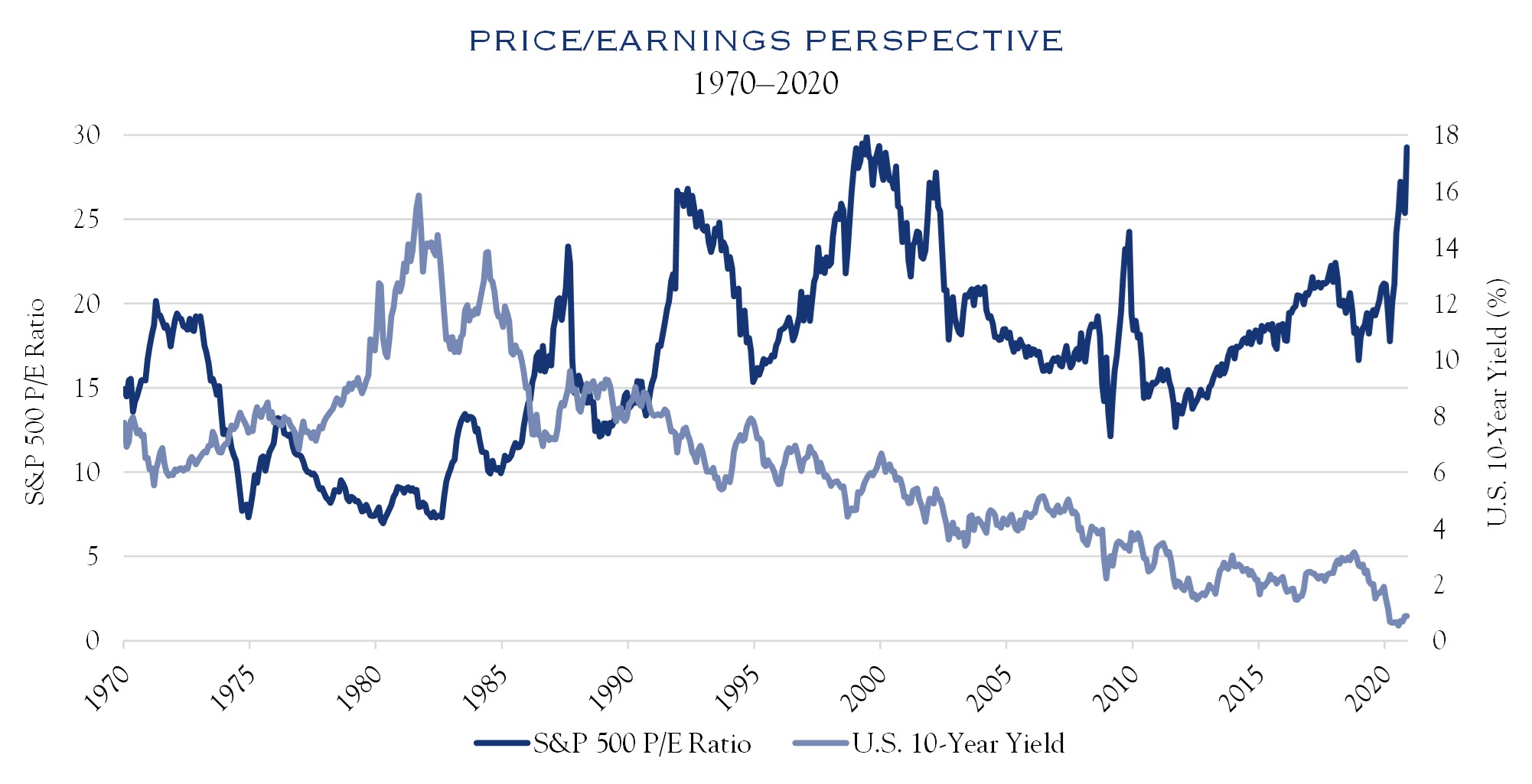

Sentiment

Source Shapiro, Adam Hale; Moritz Sudhof, and Daniel J. Wilson. 2020. “Measuring News Sentiment.”

The San Francisco Fed produces a sentiment gauge useful at capturing the nation’s general tone. The Fed creates the index with natural language processing to determine whether news articles have more positive or negative sentiment. The evaluation covers 16 major newspapers throughout the country. Sentiment often declines in a presidential election year, but in the past several years, prior to COVID, sentiment was in a declining trend. We attribute some negative sentiment to the discord between President Trump and the media. Changes in discourse or in COVID trends would likely lead to improvements in sentiment and support valuations.

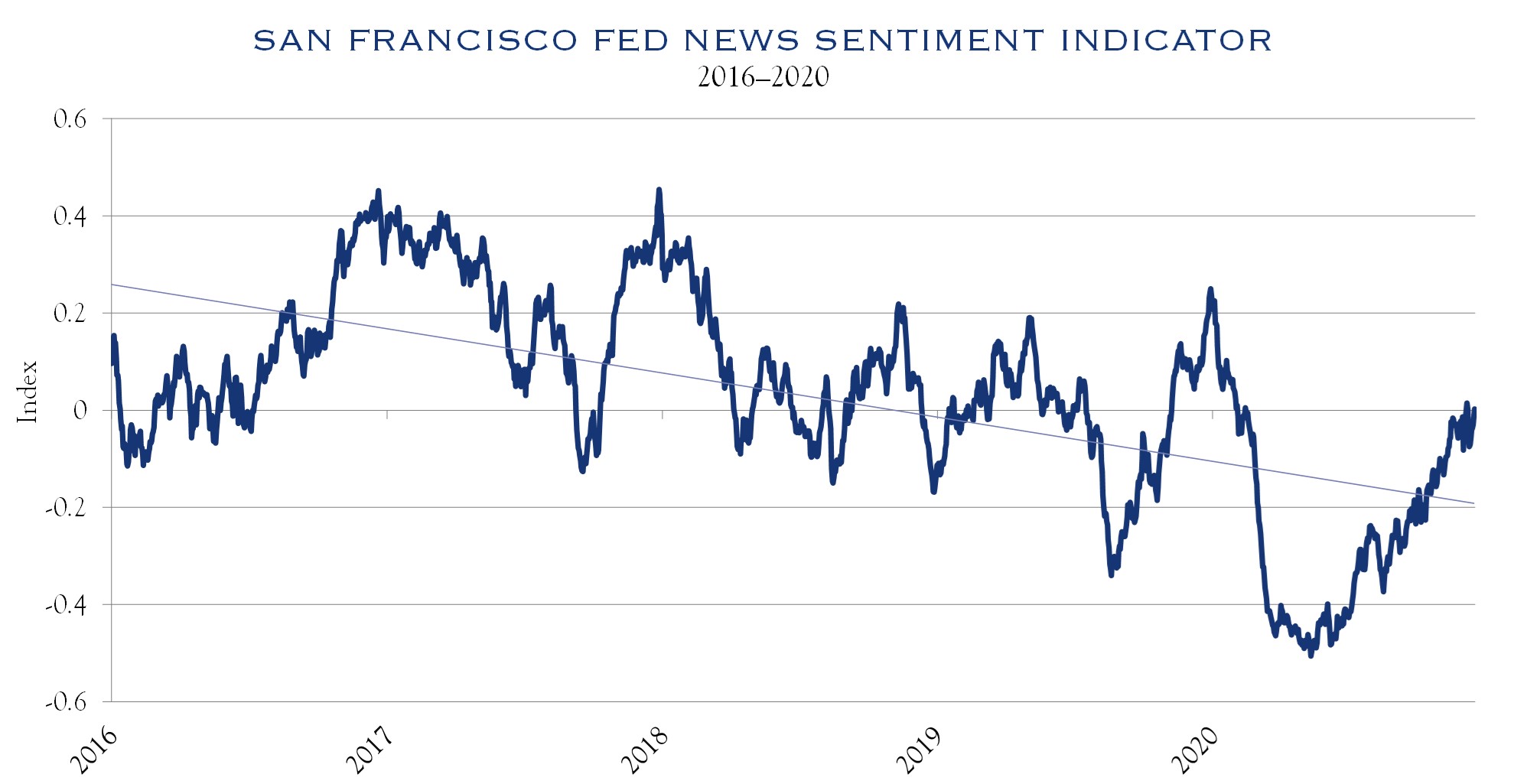

Population

As the millennial generation displaces baby boomers as the largest in the U.S., it is worth examining long-term population trends in developed markets. Population growth contributes to economic growth since a growing population promotes economic activity. While trends in the U.S. are not as favorable as demographically young and growing countries, U.S. population growth is projected to outpace not only Japan but also the U.K., Germany, France, and Italy. The U.S., therefore, has an expected economic growth advantage as compared with those countries.

Source International Institute for Applied Systems Analysis (IIASA)

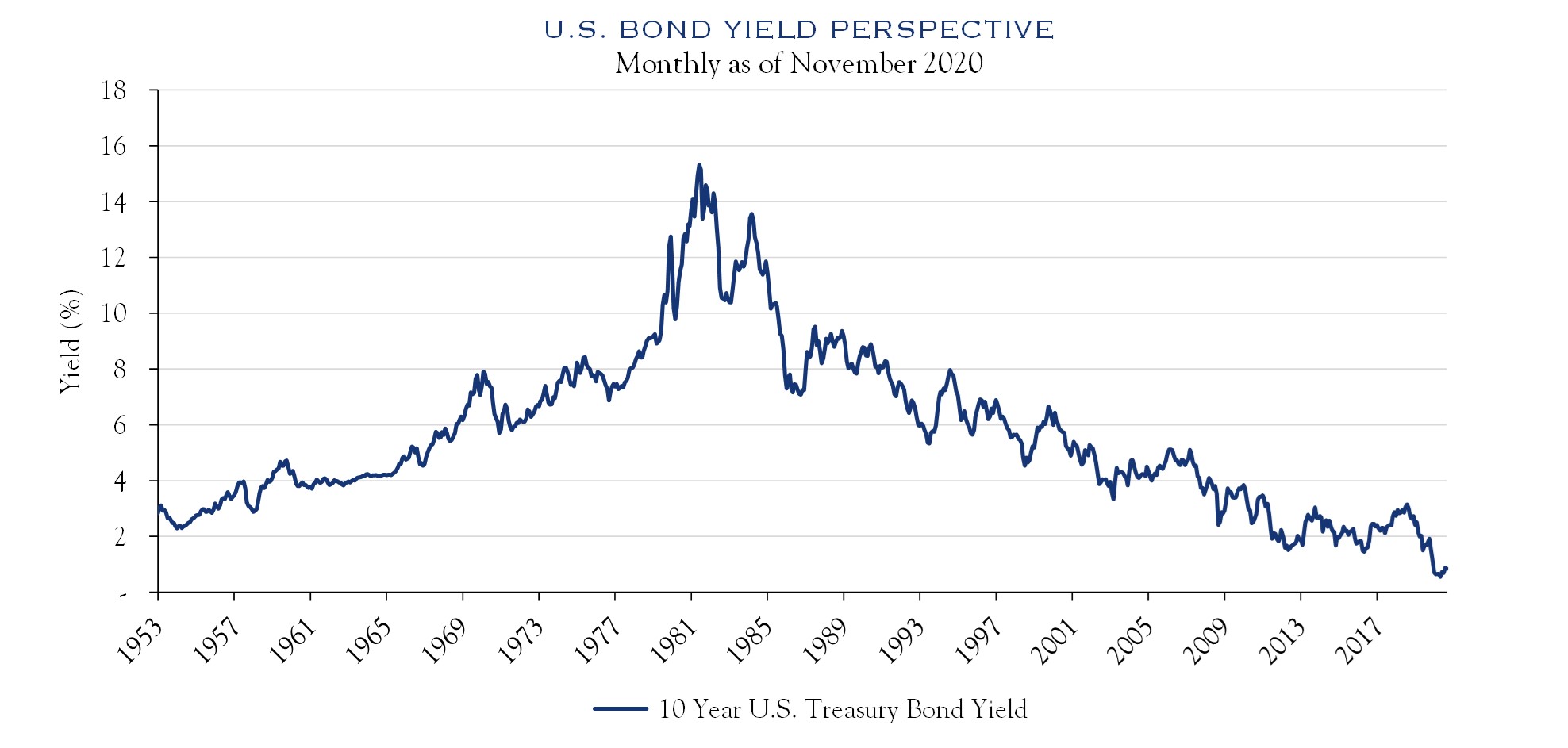

Bond Yields

Bond yields were significantly higher in the 1980s and have been declining since. In the 1990s, the risk-free rate of return, as measured by the U.S. Ten-Year Treasury Bond, was around 6%. As recently as 2018 it was 3%. With current yields under 1%, investors are paid little for risk free assets.

Source U.S. Department of the Treasury

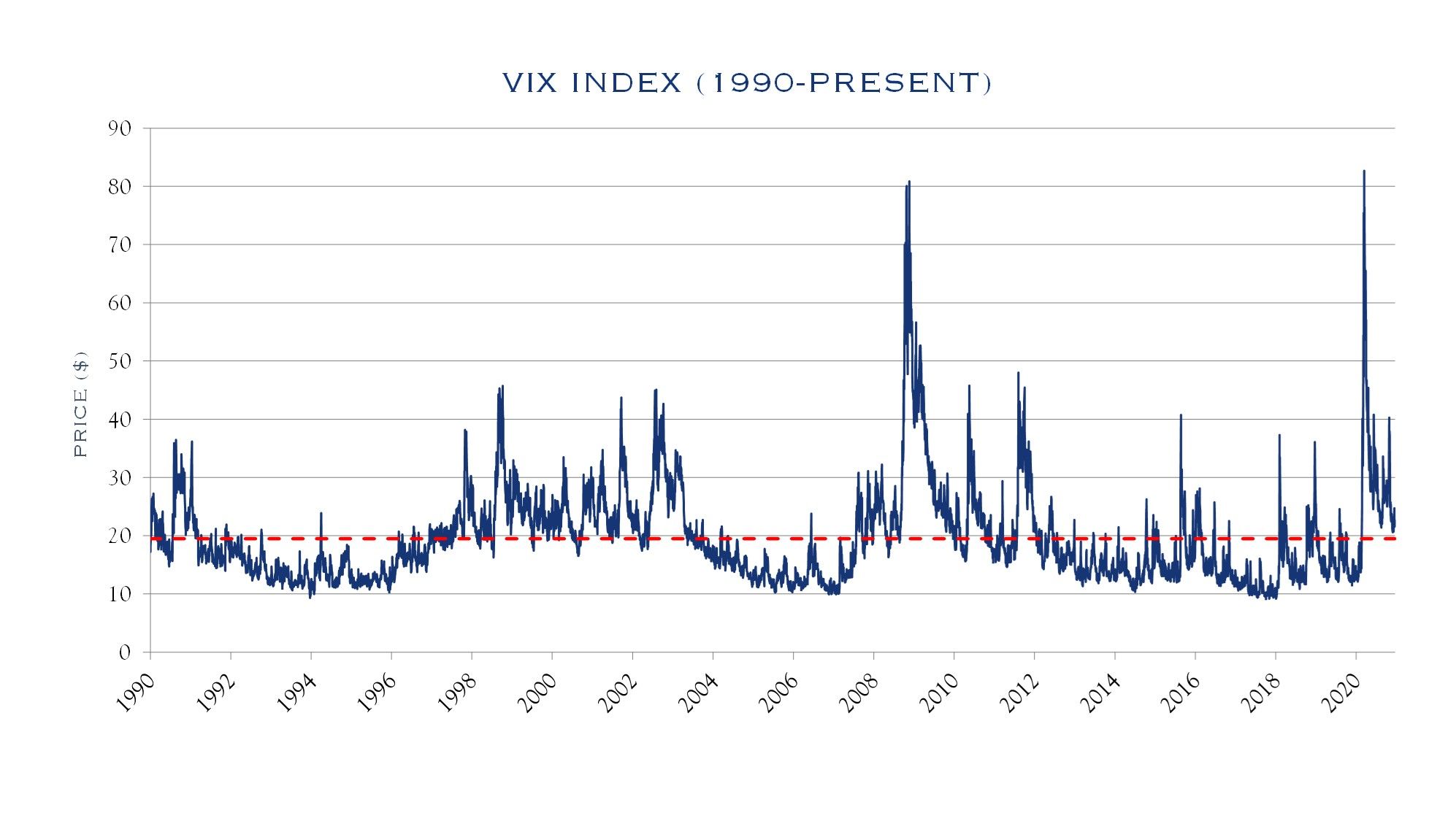

VIX

The VIX index measures implied volatility using S&P 500 options. This metric often resides in a band between 10 and 20, jumping above 20 in turbulent times, such as from the late 1990s into early 2000s, during the global financial crisis of 2008, and more recently during COVID. High spikes subside relatively quickly. When investors think of risk, they should consider the timeline and tolerance for volatility spikes that occur periodically.

Source CBOE

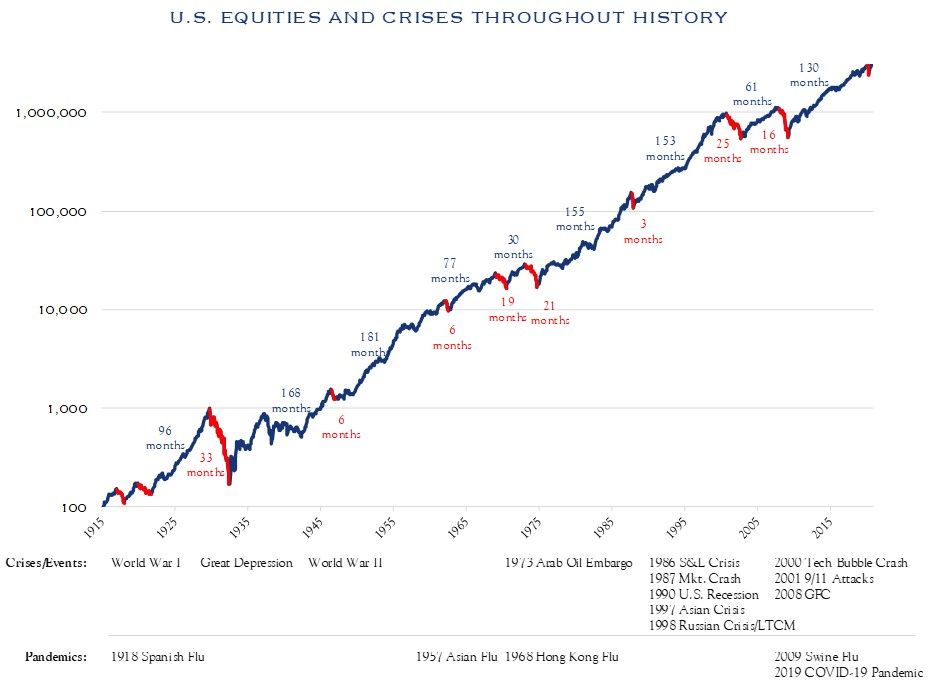

Time Matters

The chart above shows the stock market since the 1910s, along with major crises and the duration of declines. Driven by long-term economic growth trends, stocks generally move higher, punctuated by periodic declines. The stock market has endured many significant crises. While declines are painful, and occasionally last longer than a year, the overall trend is one of remarkable progress.

Source Macrobond, Bloomberg

Robert R. Teeter

Managing Director, Chief Investment StrategistDoes More Data Mean More Answers?

Twenty years ago, two incremental developments forever changed the investing landscape. First, in the late 1990s, the widespread use of the internet, along with emerging services such as Yahoo Finance—established in 1997—provided free and easy access to basic information on securities.

read the insight

Mark Morris

Senior AdvisorArtificial Intelligence—Answering a Few Key Questions

Defining artificial intelligence, or AI, is challenging because simply defining intelligence is not easy. Even dictionaries struggle! Marvin Minsky, an AI pioneer, described intelligence as a “suitcase word” packed with more than one meaning.

read the insight

Patrick Chovanec, CPA

Economic Advisor100 Years Ago & Now

One of my hobbies is to always be reading about whatever was happening 100 years ago. I often find that following it closely, day by day, offers some real perspective on what changes and what doesn’t over the long term. History may not repeat, but it does rhyme sometimes.

read the insight

Bart A. Johnston

Managing Director, Portfolio ManagerInvestment Goals Attained

A key part of our job as portfolio managers at Silvercrest is developing a plan with clients, executing that plan, and adjusting as one’s life evolves along with the investment landscape. It is always satisfying to work many years with someone and see realized success in delivering on that plan.

read the insightInvestment Outlook Summary

In the incredibly complex COVID investing climate, our focal point has been the metrics fundamental to investing: earnings and valuation. Our roadmap has been as follows. COVID leads economic growth, which drives earnings and dividends. Inflation, interest rates, and sentiment play a key role in valuation. While COVID remains a short-term wild card, and may temporarily slow the pace of recovery, the economy will continue to grow and adapt.

This economic backdrop will power further earnings growth in 2021. When the winter wave of COVID comes under control—whether by vaccine, restrictions, or naturally—earnings estimates will likely increase. The single largest influence on equity prices going forward will continue to be the path of the pandemic which is setting a speed limit on the economy. In the immediate future, COVID remains a grave concern. Nonetheless, with the very encouraging vaccine news, we expect the storm to quell. As it does, not only will earnings accelerate, but sentiment will improve.

With the election called for Joe Biden, political attention now shifts primarily to the Senate, where two seats will be contested in a runoff election, with party control at stake. While the political landscape is not yet set in stone, election outcomes were more moderate than expected by either side and now moderation is likely the name of the game—markets greatly prefer moderation over uncertainty. Moderation paired with efforts to stimulate the economy and job growth create a favorable scenario.

While the political landscape is not yet set in stone, election outcomes were more moderate than expected by either side and now moderation is likely the name of the game—markets greatly prefer moderation over uncertainty.

Ultimately the outlook for next year of rising earnings estimates, improving sentiment, low interest rates, and rising valuations will continue to power stocks higher in coming months. At some point, markets will need to contend with longer term slow global growth trends.

Equities: As we look ahead to 2021, we see an economy that is on the mend and making progress against COVID. With the economy running at about 95% of 2019, and favorable tailwinds for growth, we expect 2021 earnings for the S&P 500 at a level comparable to 2019. This would put earnings around $155–165. Longer-term earnings growth is likely to resume at a level slightly below the long-term trend of 6%. Our expectation is 5%. This rate of earnings growth, paired with a dividend yield of around 2%, and an expectation for stable to rising valuation metrics, leads us to an expected return of 7.5% annualized over the next three years for U.S. equities.

Fixed Income: With rates near all-time lows and credit spreads fairly tight relative to the economic backdrop, we continue to advocate fixed income as a capital protection allocation, rather than a return-seeking allocation. We suggest shorter durations relative to benchmarks (taking less interest rate risk). As the economic backdrop improves, rates will likely drift a bit higher, though we do not anticipate sustained, elevated inflation. Yield curves will likely steepen some, as the economy improves. Security specific credit analysis will allow for careful risk taking within the municipal and corporate segment.

Alternatives: While alternatives are generally pricey and illiquid, we do see three specific allocations that can be beneficial in portfolios construction. Lower-risk allocations bring diversification to fixed income, hedged equity can allow for unconstrained security selection and private equity—both classic buyout style and higher risk growth/venture—can play a role for return seeking investors.

Investment Styles: Balance between value and growth is preferred, as value will benefit from an economy with accelerating growth as COVID improves, while growth will benefit against a secular trend of slow global growth. We continue to suggest allocations to small cap, expecting that improving economic conditions will eventually begin to close the valuation gap against large cap. Modest allocations outside the U.S. can bring diversification and similar valuation benefit. Each should be pursued through active management as security selection will be critical to achieving these benefits. Importantly, active re-balancing is incredibly valuable in this volatile environment as allocations may have shifted given wide performance disparity.

– The Investment Policy & Strategy Group, November 2020

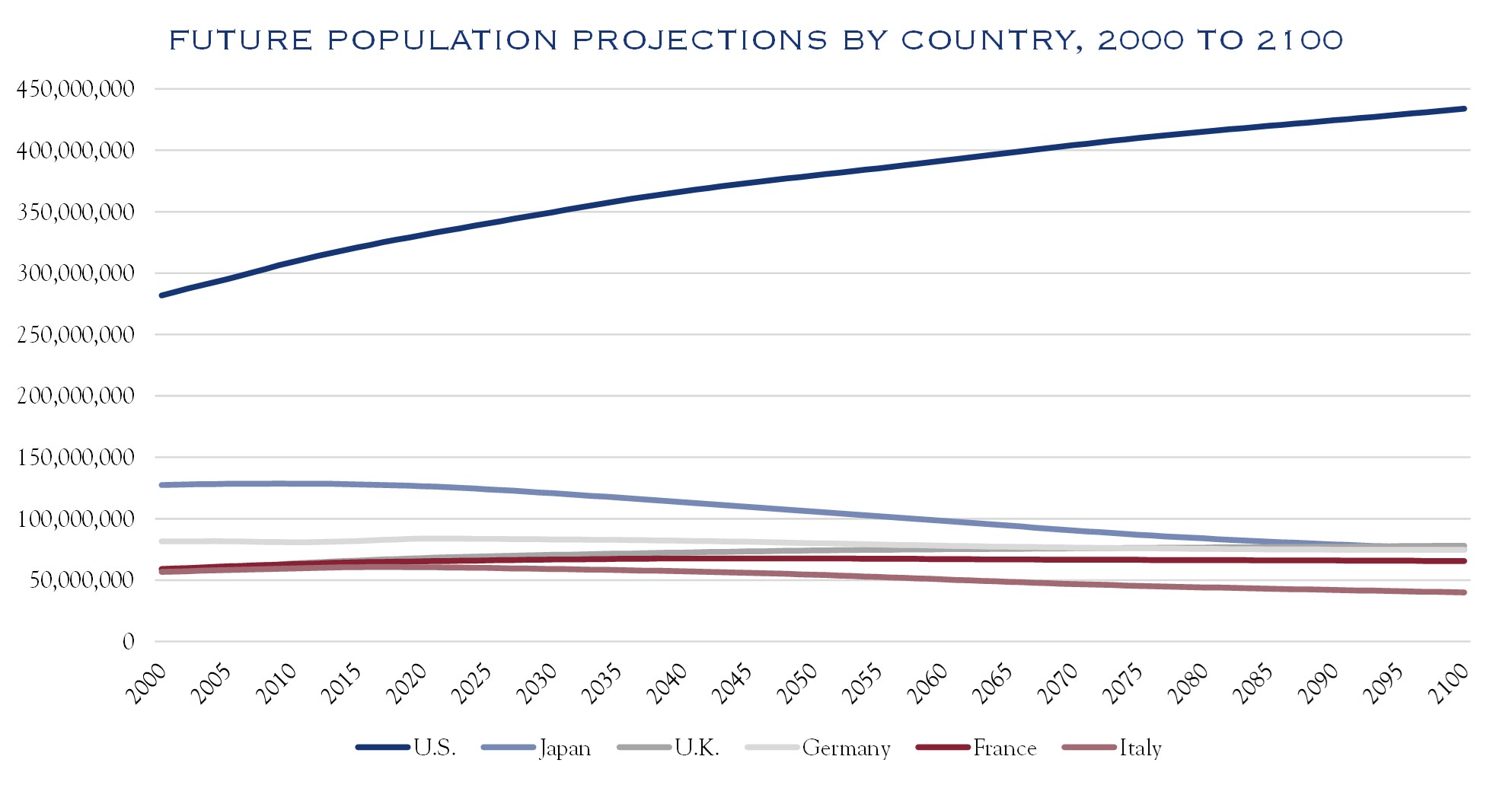

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.