Securing Your Family Business’ Legacy & Future Leadership

“Succession is one of the toughest age-old problems. It’s plagued countries, kings, prime ministers and presidents and CEOs since the dawn of history.”

—Elon Musk

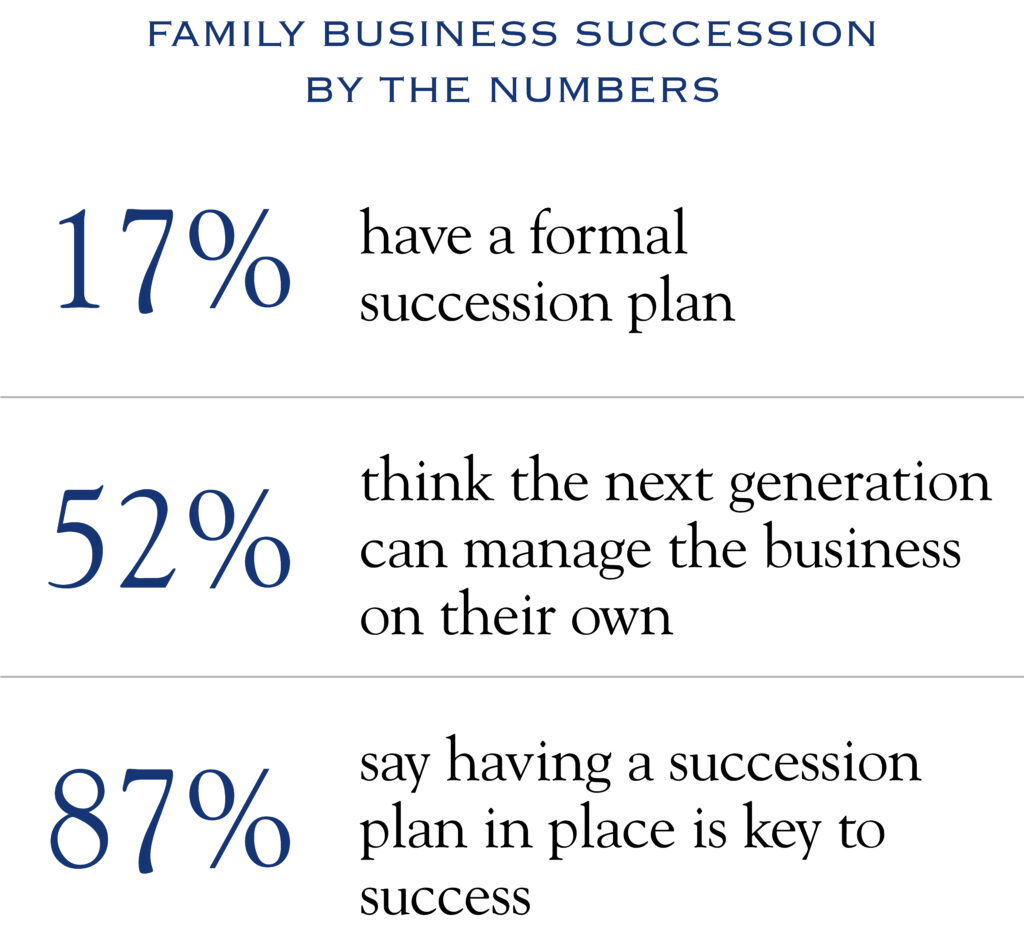

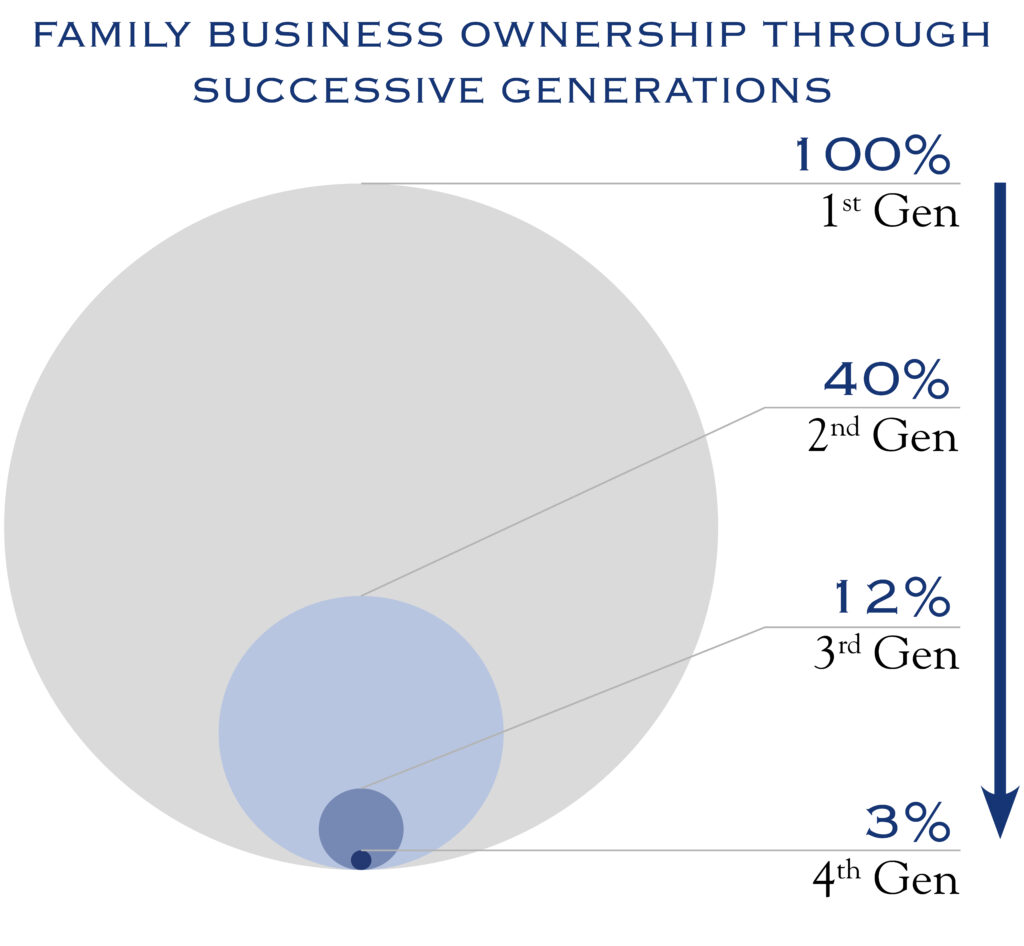

97% of family businesses fail to stay in the family by the fourth generation. It may seem like the goal of every family business is to hand the leadership to the following generation, but this is the exception, not the norm. Shockingly, although 87% of family business owners believe having a succession plan in place is key to achieving a smooth transition, only 17% have a formal plan in place. Recognizing the necessity of a plan is a good first step, but recognition holds little value without a properly designed plan and the subsequent implementation of it.

Sources: Forbes, Caldwell, Deloitte

With the popularity of the hit HBO series, Succession, the topic of succession within family-owned companies comes up a great deal. For a family business to succeed from one generation to the next requires a great deal of thoughtfulness, communication, and a long-term strategy that needs to be updated and reviewed periodically. Ironically, these concepts are largely absent from the approach Succession’s main character and patriarch, Logan Roy, takes with his children.

Source: Businessweek

In his defense, Roy is not alone. According to Business Week, only about 40% of U.S. family-owned businesses transition into the second generation, less than 12% make it to the third generation, while just 3% survive to a fourth and beyond. The culprits of these widespread failed transitions are numerous, including:

- A lack of interested family members

- Miscommunication between the generations

- Inserting under-qualified family members

- Not including senior management and the Board in the process

Succession Planning Is Not Easy

While challenging, it becomes more achievable with a commitment from each generation and guidance from trusted advisors who understand the family business and what is required for senior management to operate it.

The odds of a successful generational transition are drastically improved when trusted advisors, each generation of the family, senior management, and the Board work together to execute the following five steps:

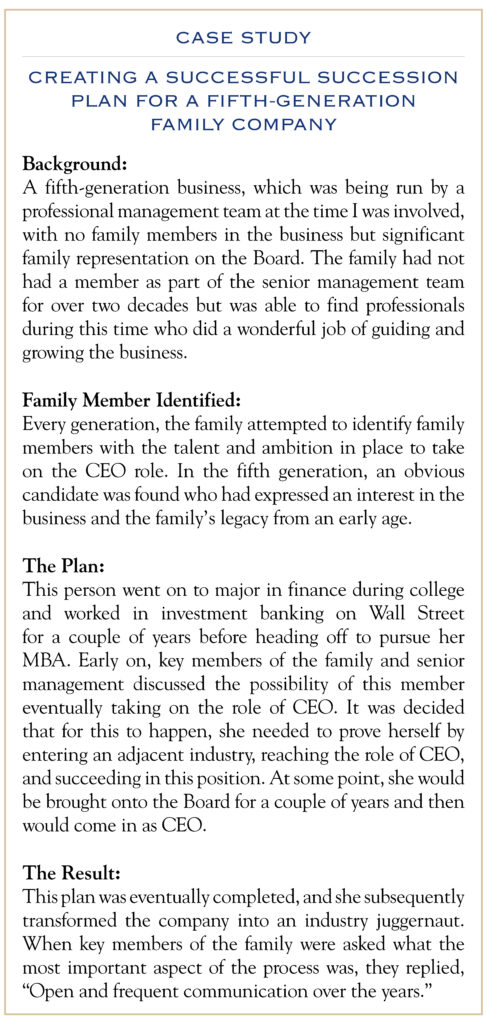

- Identify

When a family is considering which members of the next generation could serve as potential leaders for the company going forward, talent is but one part of the formula. Other required variables include a deep desire to succeed, the willingness to take on an array of interim positions, a good work ethic, and patience. Many family members might be identified as potential leaders early on, with some choosing alternate paths going forward or others finding different roles within the company. - Communicate

Open communication between the generations needs to happen relatively early as part of the identification process. This communication needs to continue throughout the course of succession, which could take years if not a decade or more to eventually achieve. Senior management and the Board should also be included by the family when creating the succession plan to leverage their experience and avoid any surprises. - Develop

Depending on the nature of the business and how early on a family member is identified, it could be helpful for them to pursue a certain educational path; however, this is not always required. It is valuable if the next generation proves itself either within the company or in another industry. Over time, they can take on more responsibilities and move up within the organization, ideally achieving a C-Suite position where they can demonstrate strategic and managerial decision-making, which we will address later on. - Expose

At some point during the process, it makes sense to have the candidate join the Board of Directors of the family business so that they can understand the major strategic, financial, and operational issues the company faces. This will allow them to get to know fellow Board members and senior management and to demonstrate the skillsets they have acquired over the years. - Execute

The final component is having the family member join the C-Suite. By this time, they will have spent years accumulating leadership and management responsibilities. Also, they will have been integrated into the Board of the family business for several years, which will allow them to learn the business and industry. Conversely, this integration gives senior management and the Board a chance to evaluate the candidate and be comfortable with the transition of leadership.

Reading these c

What follows is a redacted case study of a family business that I worked with for 10+ years and how they were able to achieve a well-executed leadership succession by following the playbook outlined above.

There is one question you are probably wondering about: What happens if there is no capable candidate in the next generation who wants to take on the role of leading the family company?

“One of the things we often miss in succession planning is that it should be gradual and thoughtful, with lots of sharing of information and knowledge and perspective, so that it’s almost a non-event when it happens.”

—Ann M. Mulcahy,

Former Chairperson & CEO of Xerox Corp.

The answer does not necessarily mean that the family needs to sell the business and be done with their legacy. A family can simply hire professional management to take on the responsibilities of leadership during the tenure of the current generation and wait to see if any future generations demonstrate an interest. This strategy will likely require incentivizing these external management professionals so they can align themselves with the family’s interests, but such an outcome is achievable as history has shown.

Ultimately, to ensure a successful transition to the next generation, it is critical to identify a candidate, openly communicate between generations and company leadership, develop the candidate’s management capabilities, expose the candidate to the company’s leadership, and execute the business transition. No matter what the next generation of your family looks like, you can begin drafting a plan right now to ensure the business you have built is in safe and steady hands—and ready for the future, whatever it looks like.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. O’Dowd. No part of Mr. O’Dowd’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC