As we cut through the noise, embark on a journey through the financial landscape as we explore the history of banking, tackle trustee challenges, delve into ESG investing complexities, and uncover the secrets of successful family business succession.

Introduction

Richard R. Hough III

Chairman and CEOWe are delighted to present our latest Insights. In this edition, we delve into a range of topics, each offering unique insights into the financial landscape. Let’s take a brief look at the four compelling essays featured in this issue:

“The History of Banking” by Patrick Chovanec, an advisor on our economic team, takes us on a journey through the historical development of banking. Patrick focuses on the insights of Walter Bagehot, who established the idea of central banks as lenders of last resort. By examining Bagehot’s experiences and the lessons learned from financial crises, we gain a valuable perspective on the role of central banks and lessons applicable to today’s uncertainties.

In “A Trustee’s Dilemma: Defining Intergenerational Equity,” Christopher Long, a member of our Outsourced Chief Investment Officer (OCIO) team, sheds light on the challenges faced by trustees of endowed institutions. He explores the considerations trustees must grapple with to ensure sustainable growth amidst inflation, economic uncertainty, and an organization’s evolving cash flow needs.

Ian Smith, a Managing Director and senior portfolio manager, discusses the complexities of Environmental, Social, and Governance (ESG) investing. He highlights the need to recognize that ESG is not a one-size-fits-all approach and emphasizes the importance of a client-centric investment model. By tailoring ESG strategies to individual preferences and values, investors can control their portfolios to align with their personal broader societal objectives.

Seán O’Dowd, inspired by the hit HBO series Succession, examines family-owned companies and the challenges of succession. As head of Silvercrest’s Family Business Advisory Group, Seán provides an overview and case study regarding how family businesses can successfully endure from one generation to the next. It requires a great deal of thoughtfulness and communication, along with a regularly reviewed long-term strategy.

Thank you for your continued support, and we hope you find this newsletter both informative and engaging. Should you have any questions or wish to discuss these topics further, please do not hesitate to reach out to our team.

Warm regards.

Economic & Market Overview

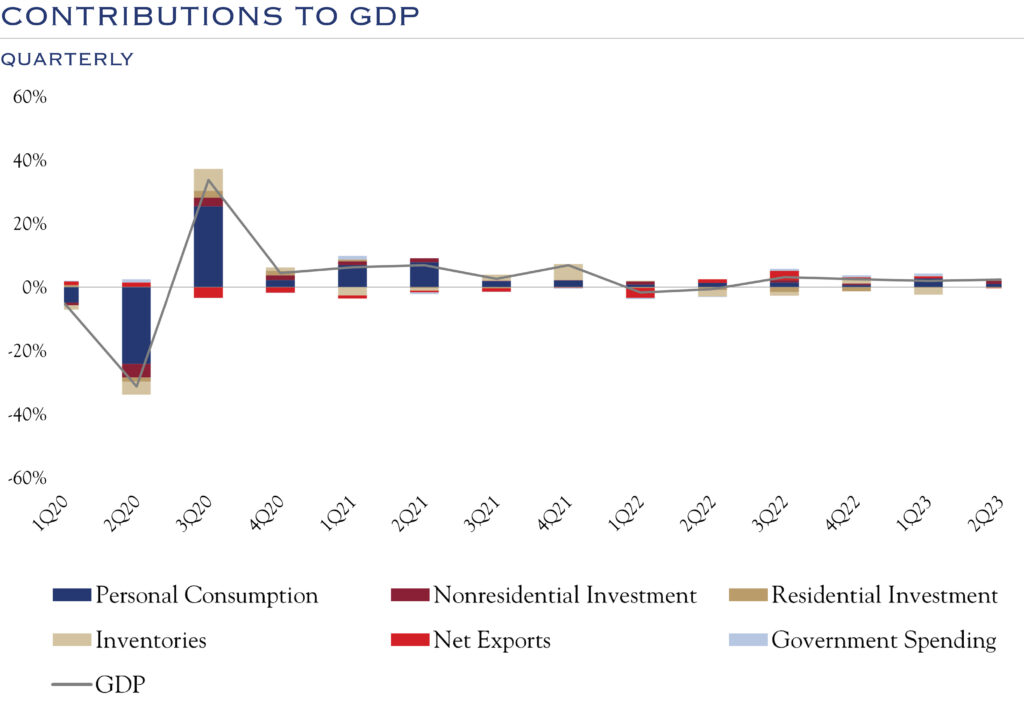

Sources: Bureau of Economic Analysis & Federal Reserve Bank of St. Louis

- Following a large and fast-moving economic cycle, conditions are returning to normal (slow) growth.

- Presently, personal consumption is fueling economic growth.

- Demand has been shifting within the economy and even within personal consumption.

- Going forward, we expect growth slightly above prior trends, with continued strength in personal consumption.

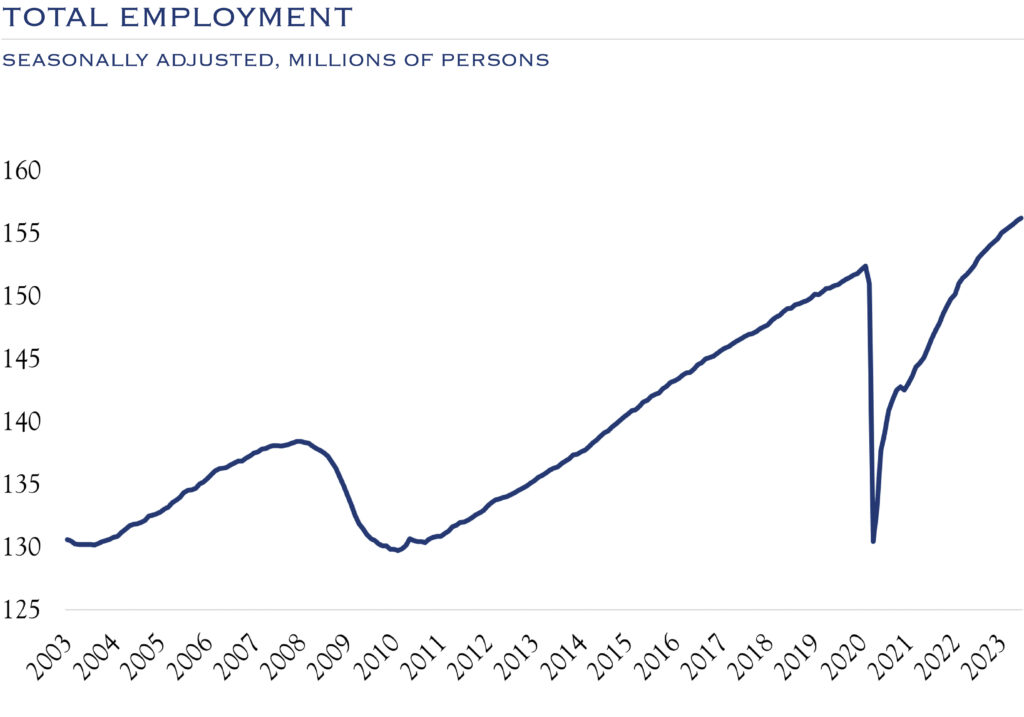

Source: Bureau of Labor Statistics. U.S. employees on nonfarm payrolls.

- Total employment has exceeded 2019 levels and is a good signal of economic health.

- Participation rates have also improved, so these job gains are unlikely to produce much inflation pressure.

- We look for modest gains in the size of the labor market, particularly relative to other countries, as the U.S. has a decent demographic backdrop.

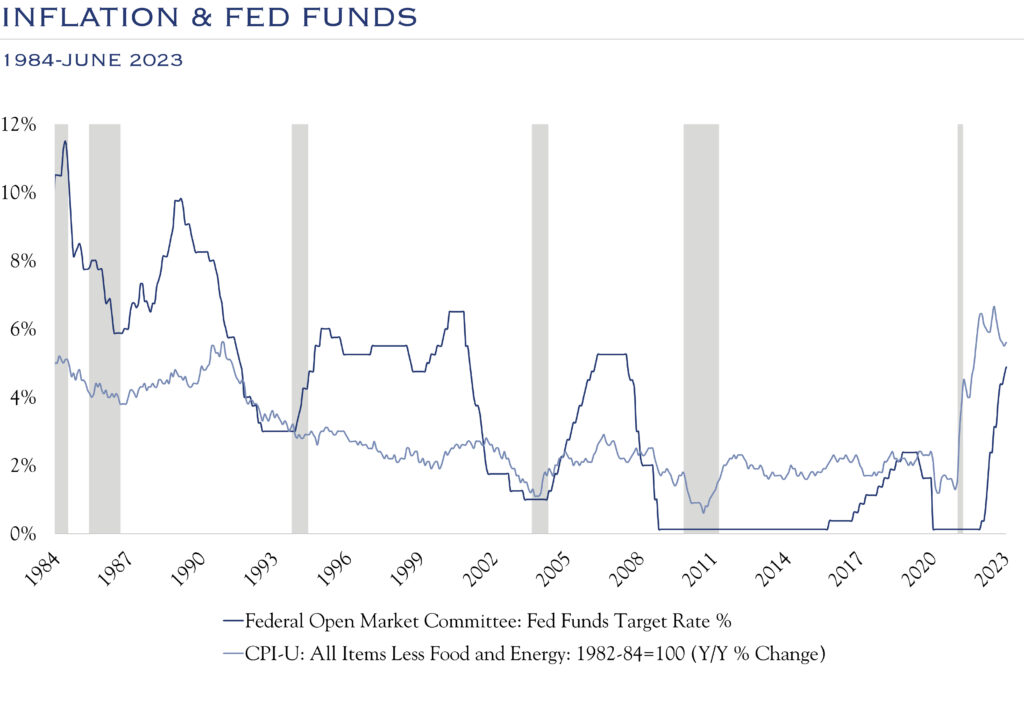

Sources: Federal Open Market Committee & CPI Data

- Inflation remains above target (2.0%) but has been clearly and swiftly declining.

- While inflation has clearly been on a decelerating path, the Federal Reserve is applying additional pressure on inflation through higher interest rates.

- It is possible the Fed is at or near peak rates at 5.5%.

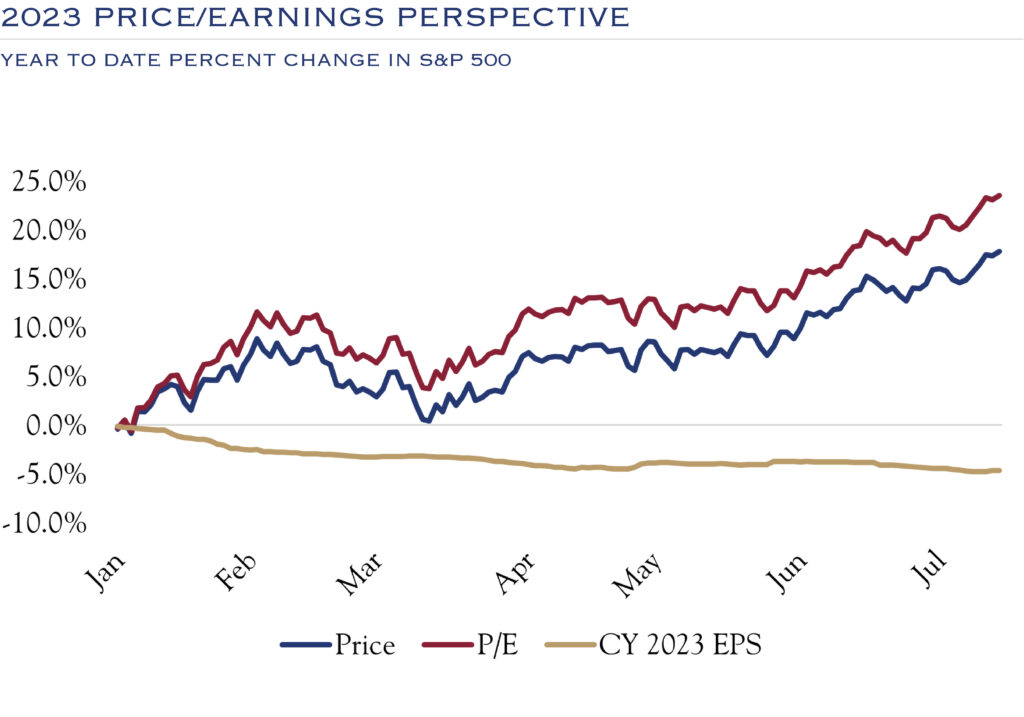

Sources: Strategas & J.P. Morgan

- The market’s decline for 2022 was driven by multiple compression.

- Earnings in 2023 have declined a bit, but have been mostly steady, while multiples have expanded, mostly due to declines in inflation.

- Looking ahead, a solid (but slow) economy is likely to create a stable earnings backdrop for 2024.

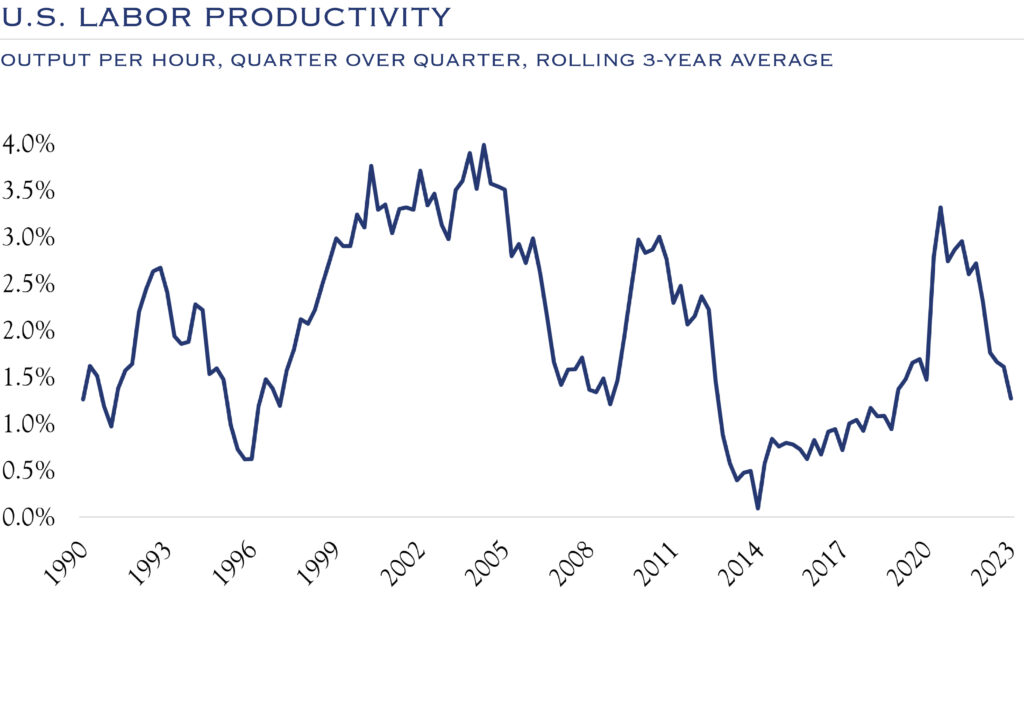

Source: Bureau of Labor Statistics. Nonfarm business sector

- Productivity is a key component of economic growth. Sluggish productivity and minimal gains in the size of the working population have led to relatively lackluster economic growth for much of the past 15 years.

- Looking ahead, advances in technology and health care have the potential to increase productivity and expand the size of the workforce, potentially leading to higher economic growth.

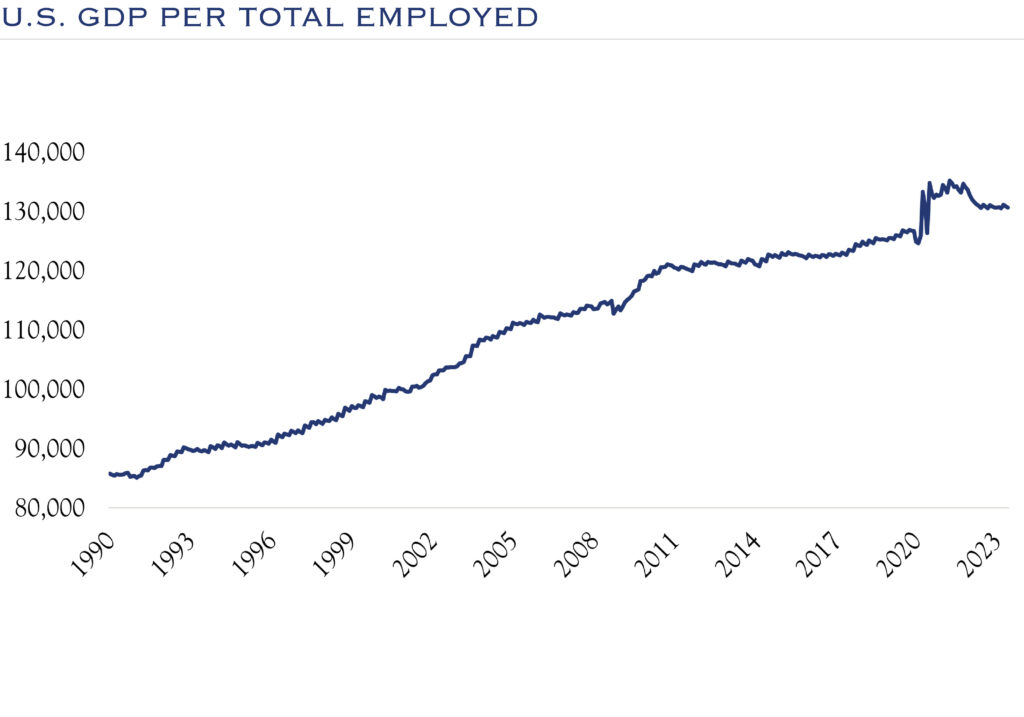

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, Macrobond

- An informal technique for examining productivity is to review the ratio between the size of the economy and the total number of workers in the economy.

- This chart shows a slow but steady increase since the mid-90s and is likely indicative of gains in technology over that time frame.

- While recent data have been noisy, we expect this trend to continue and perhaps accelerate.

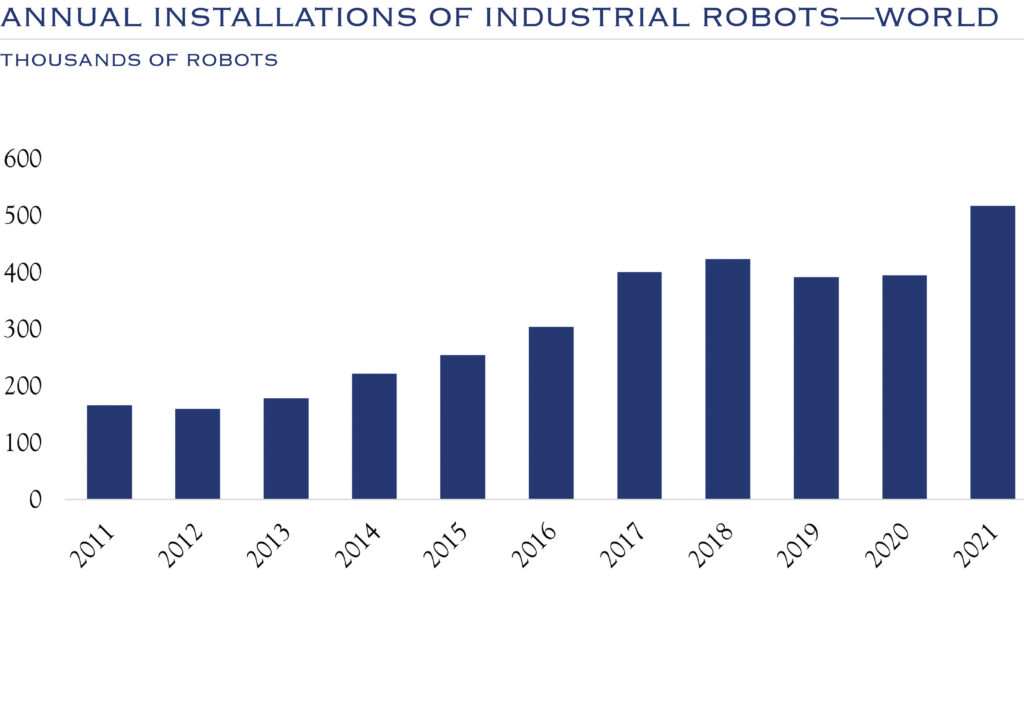

Source: World Robots 2022

- Widespread use of robotics in manufacturing drives long-term optimism for productivity and earnings gains, as it efficiently manages costs.

- The automotive industry leads the way. Consumer-facing companies are also embracing robotics.

- The global increase in the industrial installed base signifies a shift towards automation.

Patrick Chovanec, CPA

Economic AdvisorThe Historical Roots of Modern Banking: Lessons from Walter Bagehot and London's Financial Crises

read the insight

Christopher G. Long

Managing Director, Consultant & Client RelationsA Trustee's Dilemma

read the insight

Ian W. Smith

Managing Director, Portfolio ManagerEmpowering Investor Autonomy: Redefining ESG Investing Beyond Generic Approaches

read the insight

Seán O'Dowd, CFA

Managing Director, Family Business AdvisoryPreserving Your Family Business Legacy: The Real Story of Succession

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Inflation

Inflation persists above the 2.0% goal set by the Federal Reserve. However, inflation has declined significantly from peak levels, and momentum continues to the downside. This progress in the battle against inflation has fueled gains in stocks and bonds.

GDP

Economic growth has been resilient, supported largely by a strong job market. As more participants enter the workforce and more people are employed, higher levels of aggregate income drive increases in spending. Economic growth is likely to return to long-term trend levels of around 2.0% as a result of anemic population growth and small productivity gains. It is possible that advances in technology and medicine fuel additional productivity and a larger workforce. If that materializes, growth could exceed 2.0% over the next few years.

Earnings

Slow GDP growth has collided with a complicated set of cost structure issues to create a lethargic earnings backdrop. We expect a wider-than-average dispersion of results within sectors, as individual companies are likely to have varying degrees of success in problem-solving. We look for earnings to be broadly stable, with progress starting to materialize next year.

Rates

Fed Funds rates are at or near expectations for peak levels in this cycle. Given the progress in inflation, the Fed has reclaimed some policy flexibility. While the Fed is unlikely to cut rates any time soon, we think the peak is in for interest rates. Our expectation is for a wide range between 3-4% for the U.S. Ten Year.

Stocks

Over our three-year horizon, we expect stocks to generate gains based largely on modest earnings growth but also on some degree of valuation recovery as inflation continues to improve.

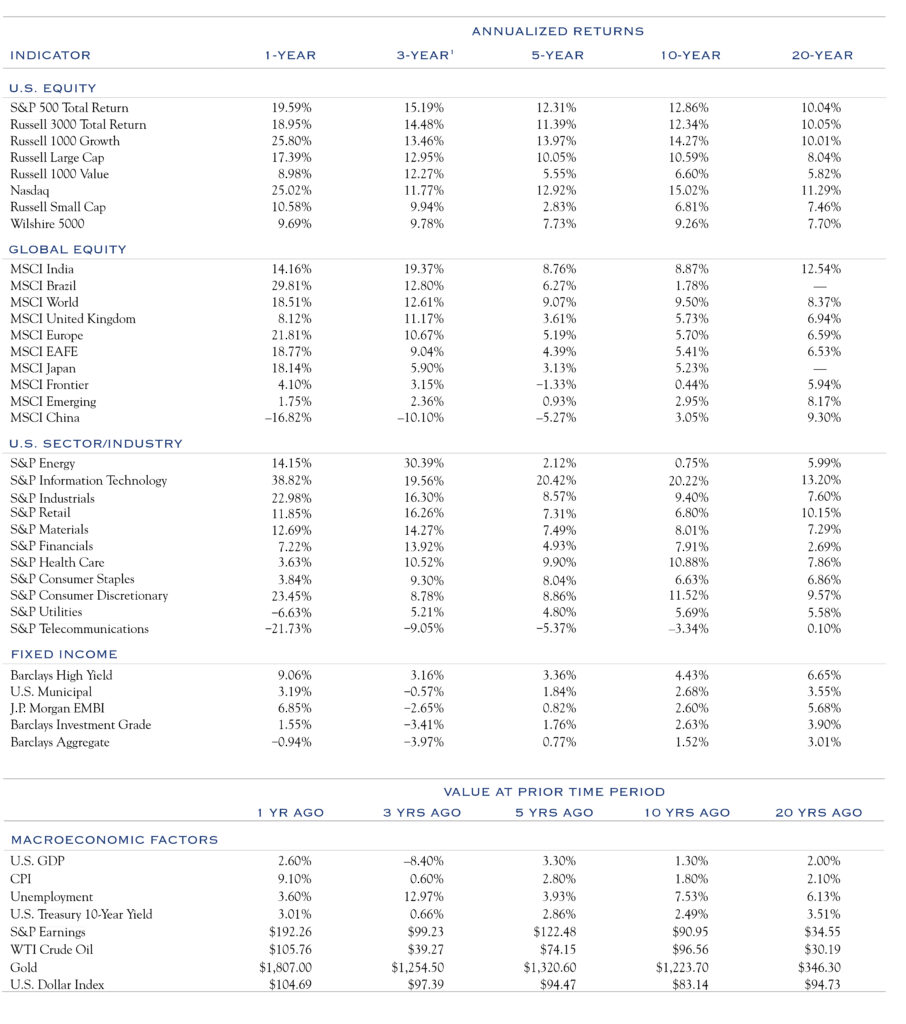

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 6/30/2023.