Walk into an investment office and you may spot works with titles such as Mastering Asset Allocation Models or Practical Portfolio Attribution. These books, a staple of financial education programs, convey the theory and math behind asset allocation, which uses the statistical analysis of asset classes to determine the portfolio allocations required to achieve certain risk and return profiles.

Known as Modern Portfolio Theory (MPT), the method treats client asset allocations as engineering problems. Get the math right; get the asset allocation right. What could be easier? Some technology-enabled firms advertise their implementations of MPT as set-and-forget allocations based on proprietary algorithms. They ask questions to ascertain client circumstances and risk tolerances to create “optimal portfolios.” They attempt to build confidence through ease of use and the appearance of reliable science. MPT models, however, suffer from the classic problem of garbage in/garbage out. The math works brilliantly, but the formulas require inputs predicting the future statistical attributes of asset classes, including future returns; volatility; and correlation coefficients within the portfolio.

Known as Modern Portfolio Theory (MPT), the method treats client asset allocations as engineering problems. Get the math right; get the asset allocation right.

None of these expected values can actually be known. More often than not, therefore, past performance and attributes are used to make future predictions. The models assume past is prologue, regardless of any significant structural changes to the economy or investment environment.

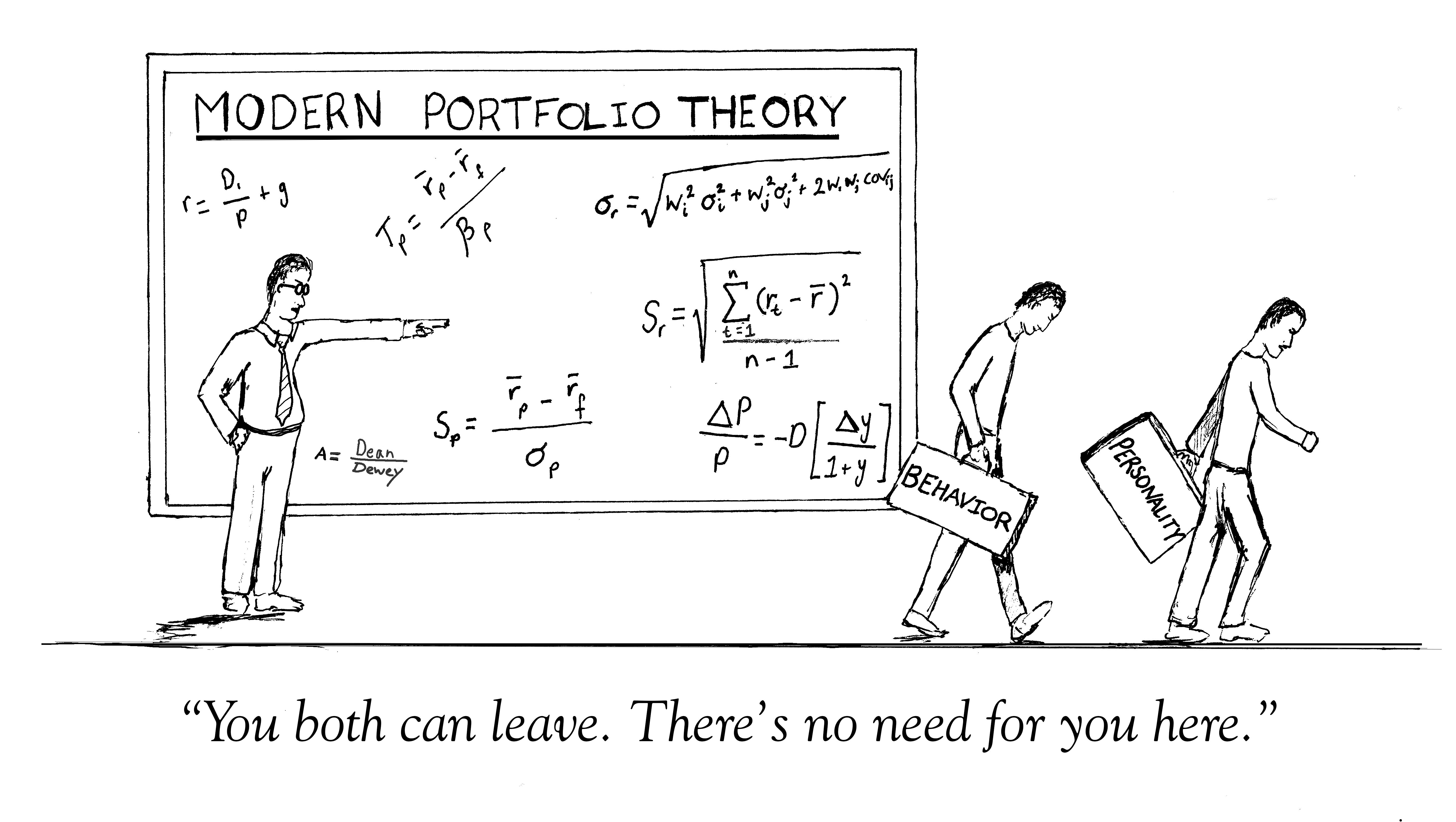

Even if the future optimal portfolios could be known with certainty, their effectiveness also relies upon optimal behavior by the individual investor! It’s as if investors were computers who find it easy to maintain an asset allocation over time. Clients—the human beneficiary—are not formulas or computers but people with emotions. No one has developed an MPT formula that properly models two of the most important investment variables, (B) and (P): Behavior and Personality. The world doesn’t work that way and neither do investors. I do not behave optimally for long, and I don’t know anyone who does.

No one has developed an MPT formula that properly models two of the most important investment variables, (B) and (P):Behavior and Personality.

Asset Allocations—even optimal allocations—only work with the benefit of time, which requires consistent behavior. Our behavior, in turn, is shaped by our perception of risk. We assess risk differently, and we know investors overestimate the downside portfolio risk they can actually sustain. A key assumption of MPT is that risk should primarily be understood in terms of portfolio volatility for a given return and that we all will react to this risk the same way. Yet behavioral psychology shows that we experience risk asymmetrically; we are hardwired to care much more about losses than gains. Investors have very personal and different ideas about risk: total portfolio downdraft; risk of permanent loss; time of sustained loss before recovery; and circumscribed cash flow. Risk also includes the effect of wealth on family legacies and dynamics or philanthropy. Finally, investor concepts of risk and personal circumstances change over time, defeating previously determined portfolio allocations.

Due to the unreliability of both future predictions and behavior, asset allocation work is as much an art as a science. There is no point modeling a portfolio nobody cares about or can sustain in practice. Portfolio managers and clients who seek scientific formulas or certainty through math are bound to disappointment. Quantitative minds in particular are drawn to beautiful mathematical solutions that portend certainty.

The most effective portfolio managers understand the markets through long practical experience and how clients react to their portfolios and wealth in different market environments.

It’s an illusory comfort. The fact is, for a given level of return, there is an optimum (minimum) amount of risk that can be taken; it just cannot be modeled. That’s the art of portfolio management and the value of a wise and steady portfolio manager who aligns portfolios with the Behavior and Personality of clients. The most effective portfolio managers understand the markets through long practical experience and how clients react to their portfolios and wealth in different market environments. Portfolio managers take into account the moving parts of a family’s situation, income needs, purposes, vision and investing psychology, as well as how investing affects their clients’ behaviors. No computer any time soon is going to be able to replicate this aspect of investing.

Due to the unreliability of both future predictions and behavior, asset allocation work is as much an art as a science.

I greatly admire Silvercrest’s portfolio managers who have mastered the science and the art of asset allocation. Portfolio Theory is important to understand; we use it at Silvercrest, but its application has limits and we employ it with great humility. Silvercrest’s portfolio managers seek to find the “right” allocation that complements a client’s behavior and personality, an understanding based on deep mutual trust. The optimal allocation is not a pure matter of science: it is the one that allows a client to be at ease, to sleep at night, and not to worry inappropriately about investments. The right allocation can be sustained through time because Behavior and Personality has been given its proper respect, thanks to the hard work of portfolio managers who marry science with art.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Hough. No part of Mr. Hough’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC