In the book How to Read Water, Tristan Gooley observes that “We will spot motion in the water before we see any subtle shifts in color or shade.”

Thus, while large changes are spotted as they occur, close observation and experience are often required to spot more subtle changes that develop.

Robert R. Teeter

Managing Director, Chief Investment StrategistPainting by Factors

To help put things in perspective, we recently examined a handful of key metrics at the beginning and end of each major market cycle of the past fifty years.

The Most Important Metric

A highlight of this issue is a discussion by our CEO, Richard Hough, regarding the critical need to match investor personality with investing style. All too often, returns are placed at the forefront of decision making, yet a much more powerful indicator of long term success is finding the right fit.

In Pursuit of High Quality

Our insightful equity team shares some thoughts on how to identify quality and why quality is an important metric to consider in stock selection.

Striking a Balance Between Risk and Mission

Silvercrest benefits from not only the deep experience of our team but also the integration of these resources. Experienced endowment professionals Christopher Brown and Christopher Long collaborated with our risk analytic team to help institutions manage to a better and more practical definition of risk.

The Challenge of Shareholder Liquidity

A new resource at Silvercrest is our enhanced capabilities in the area of family business advisory. As public valuations and economic conditions remain strong, families may be wondering what approach to take with regard to the various liquidity options available to privately owned businesses. Seán O’Dowd discusses this important topic.

Do the Budget and Trade Deficits Matter?

The budget deficit and the trade deficit are often referred to as the twin deficits. They feature prominently in political and economic debate and are linked in ways that are not readily apparent. Patrick Chovanec explains.

Diversification vs. Complexity

In this era of limitless information, complexity abounds—all too often for the wrong reasons. Mark Morris and Martin Loeser discuss how to diversify while avoiding excess complexity.

Economic & Market Overview

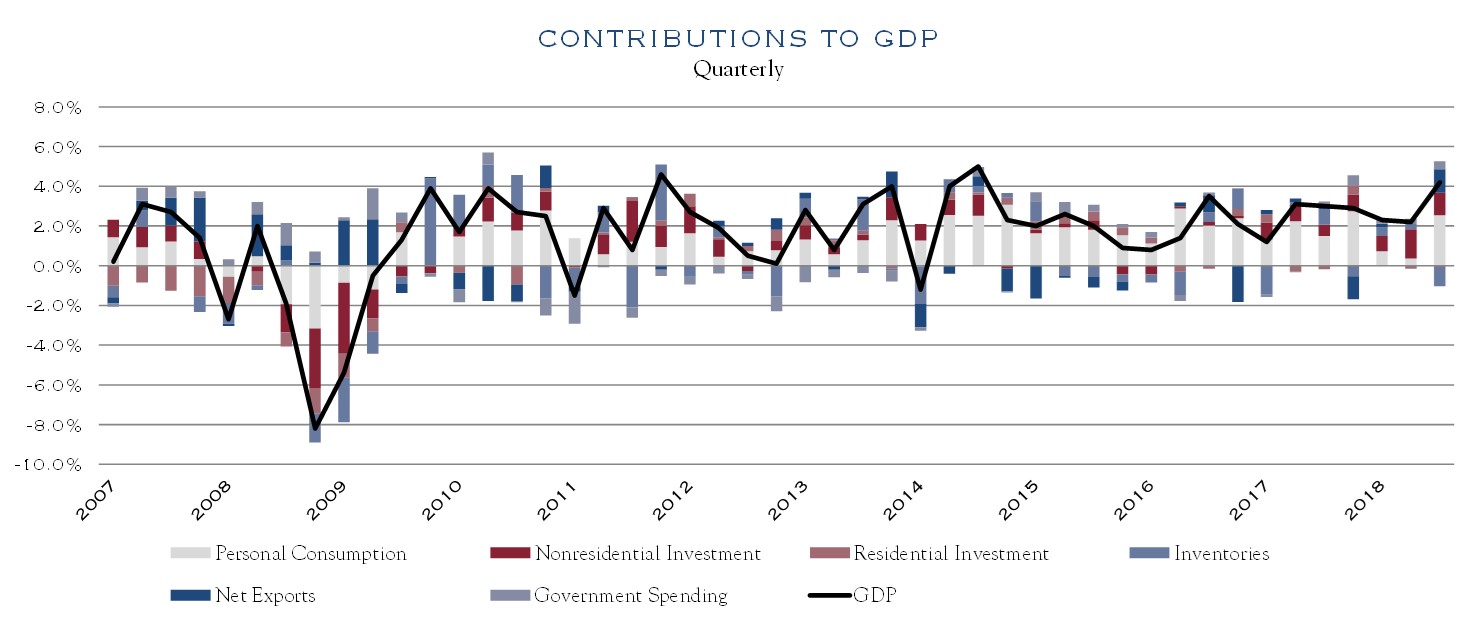

GDP Contributions

Quarterly

Source: BEA, as of June 30, 2018

The U.S. economy grew by +4.2% in 2Q18, its strongest quarter of growth in nearly four years. The most noticeable improvement was a solid rebound in consumption, which in Q1 had fallen to its slowest growth rate in five years. Business investment continues to show confidence, growing at an +8.7% annualized rate. We expect this momentum to continue in the second half of the year, for a 2018 growth rate of at least +2.9%.

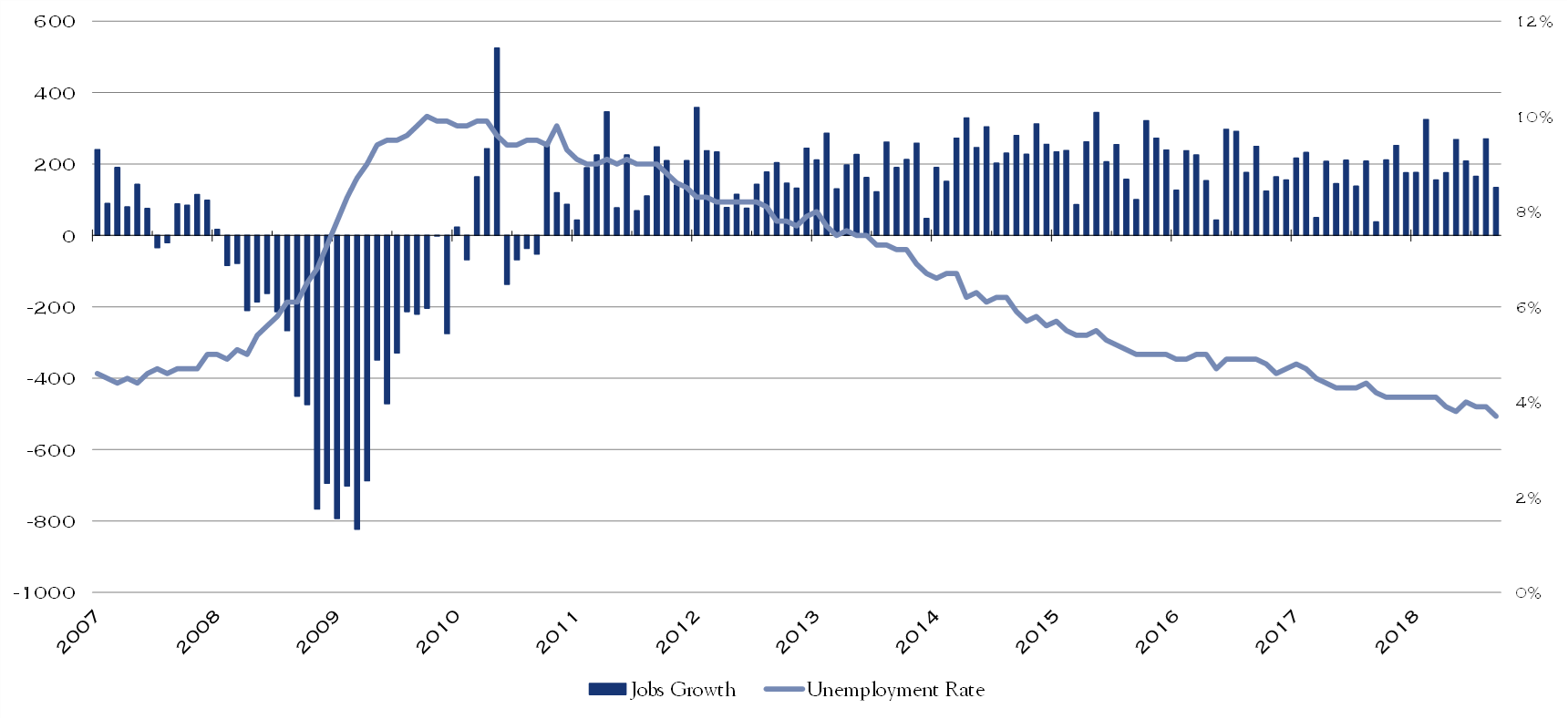

U.S. Jobs Growth & Unemployment

U.S. Jobs Growth/U.S. Unemployment Rate

Total Non-Farm Payrolls Change, Thousands of Persons, Monthly, Seasonally Adjusted

Source: FRED, as of September 2018

The number of new jobs created in the U.S. economy in the first nine months of 2018 averaged 208,000 per month, outpacing the past two years. The unemployment rate has fallen to 3.7%, the lowest since 1969. These solid jobs numbers have helped drive strong consumer confidence and spending, but have yet to boost wage growth significantly, which remains fairly sluggish at 2.8%, not much higher than inflation.

Richard R. Hough III

Chairman and CEOThe Most Important Metric

Walk into an investment office and you may spot works with titles such as Mastering Asset Allocation Models or Practical Portfolio Attribution. These books, a staple of financial education programs, convey the theory and math behind asset allocation, which uses the statistical analysis of asset classes to determine the portfolio allocations required to achieve certain risk and return profiles.

read the insight

Roger W. Vogel, CFA

Managing Director, Portfolio ManagerIn Pursuit of High Quality

In line with our firm culture of managing risk appropriately and seeking to preserve client capital in times of duress, Silvercrest believes that when investing in equities, certain advantages accrue over time to higher “quality” companies. Of course, quality is a somewhat amorphous term.

read the insight

Robert R. Teeter

Managing Director, Chief Investment StrategistPainting by Factors

Numerous books reference a concept often attributed to Galileo, stating that math is the language of the universe—an excellent tool for communication. These communicative properties are not predictive properties. Yet, they can allow for a factual examination of past and present conditions.

read the insight

Christopher D. Brown, CFA

Managing Director, Portfolio Manager

Christopher G. Long

Managing Director, Consultant & Client RelationsStriking a Balance Between Risk and Mission

What is your endowment’s purpose? The most celebrated endowment investor of the 21st century is Yale University’s longtime CIO David Swenson. In his landmark book Pioneering Portfolio Management, Swenson writes, “Focusing on the fundamental purposes of an endowment provides a firm foundation for developing a sensible investment process.”

read the insight

Seán O'Dowd, CFA

Managing Director, Family Business AdvisoryNavigating Liquidity for Family Businesses: Balancing Legacy and Financial Needs

One of many challenges facing family businesses is how to address the various liquidity needs of shareholders. With publicly traded family businesses, this issue can be resolved simply by selling shares in the open market. But for privately-held family businesses, alternatives must be considered. Too many family business owners of privately held companies believe that the only way to generate real liquidity is to sell the business entirely.

read the insight

Patrick Chovanec, CPA

Economic AdvisorDo the Budget and Trade Deficits Matter?

The Twin Deficits are the federal budget deficit and the trade deficit. Both have been salient features of the U.S. economy for several decades and are more closely connected than many people appreciate.

read the insight

Martin Loeser

Head of Manager Research, Portfolio Manager

Mark Morris

Senior AdvisorDiversification vs. Complexity

Starting a collection as a hobby can be quite fun. Whether it is baseball cards or classic cars, there is pleasure to be had in finding the next item for an ever-expanding collection. Unfortunately, when this mentality extends to investing, complexity ensues. It is all too easy to think that the next great idea or fund will make everything better. It is equally easy to cross over from diversification to diworsification. We often deploy our risk analytic tools towards the task of simplifying portfolios by eliminating duplicative or deleterious holdings.

read the insightInvestment Outlook Summary

The Investment Policy & Strategy Group (“IPSG”) met in October 2018 to review asset allocation.

Numerous potential concerns were discussed and evaluated, though economic and corporate fundamentals remain sound. For some time, the guidance of the IPSG has been for equity exposure that sits just above the midpoint of range. As such, it reflects not only sound fundamentals but also the ever-evolving roster of nascent risk factors including events such as the recent increase in interest rates, the continued tension with China and nervous anticipation over earnings expectations, to name a few. With moves in interest rates, the U.S. dollar, oil prices and wages, the growth rate of earnings will no doubt be under fresh scrutiny. Some prior concerns have faded—the situation with North Korea has been quieter and the “new” NAFTA has emerged. All the while, the economy and corporate earnings do continue to grow. A recession at some point is inevitable, but is not likely imminent. Similarly, a “normal” market correction would not be unusual. In fact, early October has been a rocky road for markets.

With moves in interest rates, the U.S dollar, oil prices and wages, the growth rate of earnings will no doubt be under fresh scrutiny.

Our asset allocation philosophy notes that “Short-term market behavior is volatile and inherently unpredictable. Volatility becomes less of a factor as the investor’s time-horizon is extended.” The current suggested equity allocation reflects both opportunity and risk and assumes a reasonable time-horizon.

While interest rates continue to grind higher, credit spreads remain tight. Thus, the potential for returns from fixed income at the asset class level remains somewhat limited. However, we continue to believe that a well-constructed bond portfolio is an important part of capital preservation and liquidity. Our guidance is for maintaining shorter duration and higher credit quality to emphasize the capital protective elements of a bond portfolio.

While interest rates continue to grind higher, credit spreads remain tight. Thus, the potential for returns from fixed income at the asset class level remains somewhat limited.

Allocations across geography, market cap and investment style were maintained. While non-U.S. equities offer a slightly better valuation profile, economic recovery in many regions has occurred in a sputtering fashion. We also note the evergreen issue of a generally preferable legal and governance environment in the United States. We maintain a balance between growth and value within U.S. equities. When adjusting for the differing rate of change of earnings, growth stocks valuations do not appear to be excessive though they are far from “cheap”. Strong divergences of quality continue to exist in the small cap area, making the asset class less compelling yet opening opportunity for skilled active managers.

Alternative investments such as hedge funds and private investments offer a wide range of strategies and risk profiles. Private investments can selectively offer an opportunity for the more aggressive investor to seek higher returns either through equity-related strategies, such as venture capital or growth equity, or as a higher risk return alternative to traditional fixed income, such as private credit or private real estate offerings. While hedge funds have been maligned, when they are chosen appropriately, they can play an important role in managing risk.

While hedge funds have been maligned, when they are chosen appropriately, they can play an important role in managing risk.

With a transition in the level and direction of interest rates, we expect that volatility will continue. Against this backdrop, continued attention to rebalancing can add significant value. It is critical to establish a reasonable timeframe as an offset to what has been a very noisy investment environment.

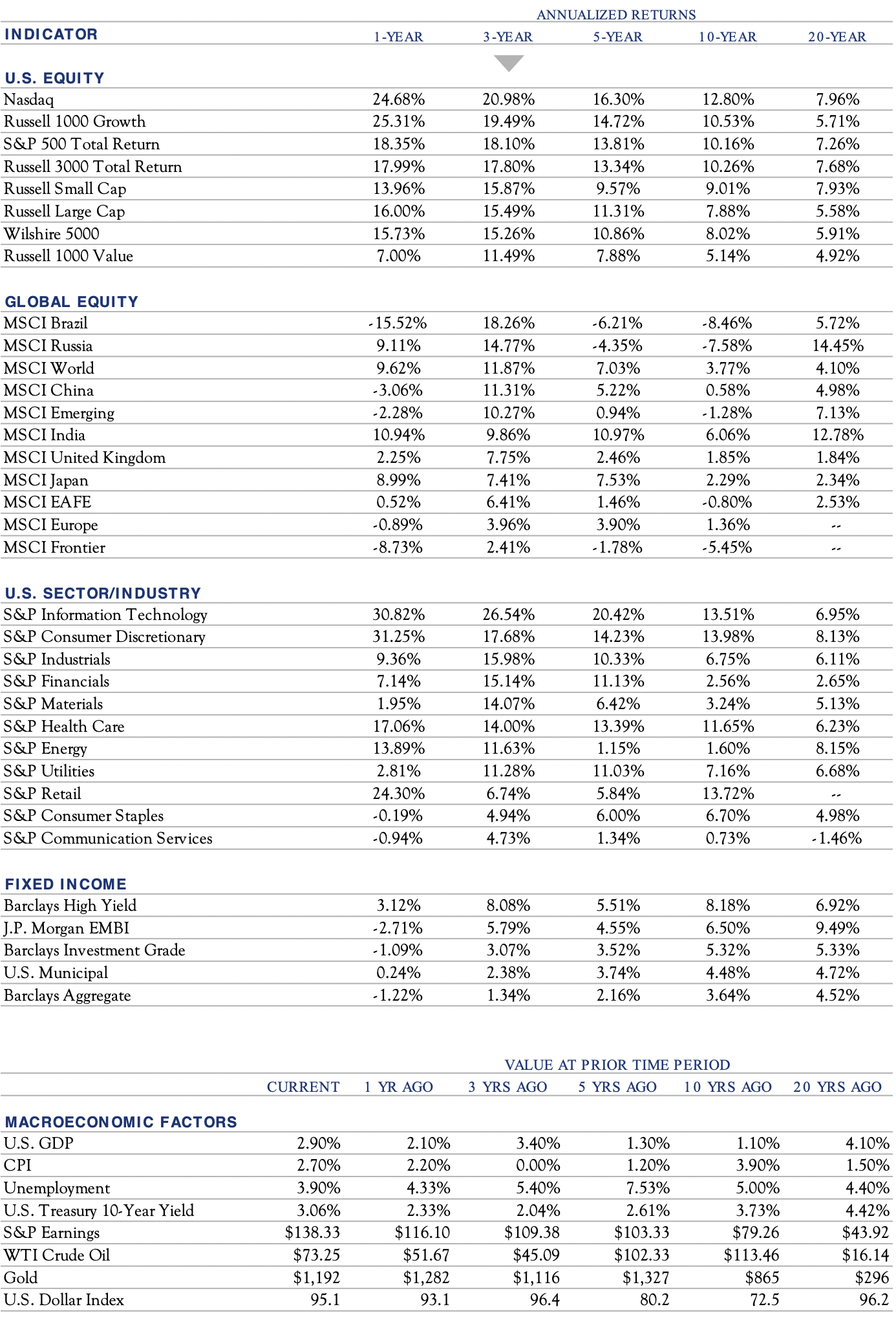

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.

Source: Bloomberg, data as of 9/30/2018