What is your endowment’s purpose? The most celebrated endowment investor of the 21st century is Yale University’s longtime CIO David Swenson. In his landmark book Pioneering Portfolio Management, Swenson writes, “Focusing on the fundamental purposes of an endowment provides a firm foundation for developing a sensible investment process.”

The primary fiduciary obligations of nonprofit directors are a duty of obedience to the organization’s mission and of care in overseeing its financial health in support of that mission. Developing a prudent budget, setting a reasonable endowment spending policy, and structuring a diversified endowment portfolio designed to achieve appropriate risk-adjusted returns in support of the spending rate and budget are chief among these duties.

Too many investment committees strive, sometimes recklessly, to outperform the investment returns of their peers while simultaneously being afraid to vary too much from the crowd. One clear example of this is in the widespread use of the MSCI Global Index as a benchmark for equity exposure. Yet this occurs against the backdrop of institutions that typically raise and spend upwards of 90 percent of their funds domestically. That sounds like basis risk hidden under a desire to keep up with the Joneses (or Yales).

Swenson credits some of his long-term success at Yale’s endowment to a careful study of John Maynard Keynes, who successfully managed King’s College, Cambridge’s endowment from 1921 until his death in 1946. Lord Keynes warned of the risk endowment managers face when straying from their first order of business, that of meeting mission-critical budgetary obligations.

Too many investment committees strive, sometimes recklessly, to outperform the investment returns of their peers while simultaneously being afraid to vary too much from the crowd.

How Do You Define Risk?

Frequently, risk is considered merely through the prism of volatility, relying on Monte Carlo simulations of historical asset class price fluctuations. However, as Warren Buffet reminded Berkshire Hathaway shareholders in his 2015 annual letter, contrary to what has been taught in many business schools, “Volatility is far from synonymous with risk.” At Silvercrest, a practical definition of risk is defined as the potential decline in a portfolio that will cause a change in investing behavior. What level of portfolio decline will cause a freeze in faculty salaries or put a halt to the construction of new facilities?

At Silvercrest, a practical definition of risk is defined as the potential decline in a portfolio that will cause a change in investing behavior.

The Importance of Preparation

While short-term losses can hinder a portfolio, the real, long-term damage to intergenerational equity is caused by forced selling of assets at a market bottom. This worst of all possible scenarios can only be avoided by having proper risk controls in place well before the havoc begins. Investors that perform appropriate risk analytics in advance and become comfortable through an understanding of drawdown scenarios are prepared to effectively weather the storm—and they can even benefit as they opportunistically purchase assets at fire sale prices from less well-prepared peers.

So what preparations can enlightened decision makers take today, as volatility begins to return to normal levels and before the next unsettling period for the markets? By shifting the focus from volatility to changes in behavior at both the institution and investment committee level, decision makers can more accurately assess risk tolerance. Using customized inputs tailored to an institution’s specific cash flow and budgetary requirements, a risk framework can establish an appropriate asset allocation and manager line-up that best prepares the organization for the inevitable next market pullback.

Every Portfolio is Unique

Each not-for-profit institution has unique cash flow considerations that drive its income statement. For example, many colleges and universities largely depend on tuition, annual giving, and endowment draws as their primary sources of revenue. Utilizing endowment spend rates, spending formulas, and assumptions regarding potential tuition or giving shortfalls during down markets, a more accurate tolerance for risk in the portfolio can be gauged.

Two key risk thresholds must be considered. First, risk must be high enough that it is reasonable to expect that, over time, returns will exceed the spending rate. While this is a critical consideration, it is typically impactful only over long time horizons. That said, the risk threshold cannot be too high that it allows for an excessive drawdown that can impair day-to-day, mission-critical operations.

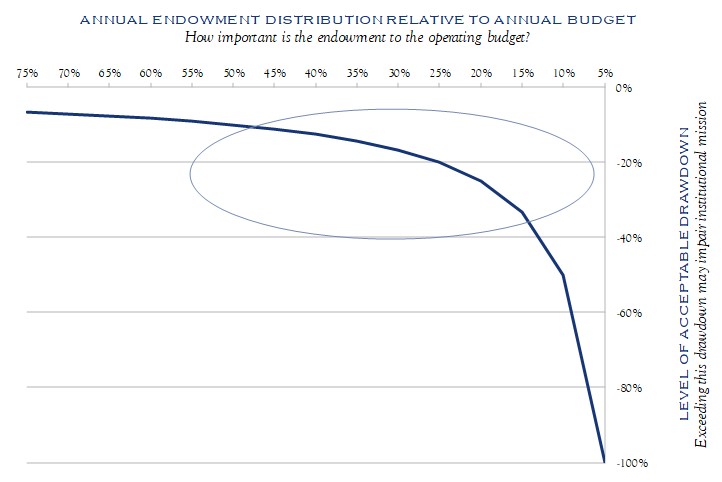

The key question is, what is excessive? Let’s look at an example where an institution has an endowment of $100 million, a spending rate of five percent, and where the budget calls for the endowment to contribute $5 million out of total revenues of $25 million. In this scenario, the acceptable shortfall that can be absorbed without impairing the mission of the institution is determined to be $750,000. That amounts to a three percent budget shortfall. Translating this back into endowment revenues, it represents a 15 percent drop. In this example, then, “excessive” is defined as an endowment drawdown of more than 15 percent. With this basic understanding, the institution’s decision makers can determine the best way to position the endowment portfolio so that it can prudently grow without risking a possible 15 percent drawdown.

Using customized inputs tailored to an institution’s specific cashflow and budgetary requirements, a risk framework can establish an appropriate asset allocation and manager line-up that best prepares the organization for the inevitable next market pullback.

Such analyses can lead to counter-intuitive conclusions. For an institution with a relatively modest endowment—relying almost exclusively on tuition and annual giving for its revenues—the tolerance for a drawdown in endowment spending can be high, as the short-term impact to the institutional mission will be minimal. The asset allocation for such an institution can be set with a more aggressive risk posture, thereby allowing the endowment to grow over the long term. However, as the reliance on endowment spending to fund operations increases, the impact to the institutional mission from endowment drawdowns becomes greater and the impact of risk posturing in the portfolio becomes more important.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Brown and Mr. Long. No part of Mr. Brown’s or Mr. Long’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC