Much ink has been spilled in recent years about the Bitcoin network’s energy consumption. For those who believe that bitcoin (the asset) offers little value or that Bitcoin (the network) serves no monetary or societal purpose, or for those who are otherwise opposed, it is understandable that any energy consumption seems unjustified. In contrast, for those who believe the opposite, Bitcoin’s energy usage is not just intentional but foundational: it serves the vital purpose of binding Bitcoin’s digital ledger to the physical world in an unforgeable way, using the laws of physics to underpin its core attributes of immutability and permissionless usage. Unfortunately, much of the media discussion focuses solely on how much electricity is being used by the network. However, energy systems are diverse and complex, and a deeper look offers clarifying nuances about Bitcoin and its relationship to energy. We consider three related but fundamentally different questions:

- What kind of energy is the Bitcoin network consuming, especially as it grows?

- When, or at what times, are bitcoin miners using that energy within each individual and dynamic energy system?

- Bitcoin mining uses energy, but what externalities and second-order effects occur (and are they positive or negative) when it is added to a given energy system and the society it serves?

Bitcoin mining is very often a non-rival consumer of electricity

A portion of the energy that we already pay to convert to electricity cannot actually be used consistently or effectively… except by participants with a peculiar energy demand profile, like bitcoin miners.

What does non-rival mean? It means that the kind of electricity that bitcoin mining is uniquely suited to consume (a key driver of expanding its energy footprint) is energy that otherwise has no other natural buyer. Therefore, the current status quo is that this energy is often wasted or dissipated without productive use. In other words, a portion of the energy that we already are paying (in dollars and carbon) to convert to electricity cannot actually be used consistently or effectively… except by participants with a peculiar energy demand profile, like bitcoin miners. Why is this the case?

First, we should note that using primary energy inputs (coal, natural gas, nuclear, wind, hydro, solar) to create electric power is inherently leaky; when energy is transformed to a different state, or it is moved from one place to another, some of the original potential energy is lost. According to data from the Lawrence Livermore National Laboratory and the DOE, only about 65% of the primary energy input gets translated to electricity production for the U.S. residential and commercial sectors and approximately 49% for the industrial sector.1 This is also the step (from primary energy to electricity) where most CO2 emissions occur. Once electricity has already been generated, the “usage” of that electricity does not emit carbon. Carbon emission intensity is mostly driven by the mix of primary energy inputs, not how the electricity is used. Therefore, bitcoin mining facilities—essentially just special-purpose data centers—emit no direct CO2 and are no different in this respect than using the same pool of grid electricity to charge an EV or power a household appliance.

Second, the nature of electricity is that it is delivered in real-time and you essentially have to “use it or lose it.” Grid-scale battery technologies are not yet widely feasible from both a time duration standpoint (storing energy long enough, efficiently enough, at scale) and a production-feasibility standpoint (current technologies would require potentially impractical amounts of battery-grade metals to be mined to be useful at grid scale).

With the way our grids work, the amount of electricity being injected into the system must always be equal, within a narrow tolerance, to the amount consumed. Some have referred to this as the “heartbeat” of the grid, which must be maintained at a frequency of about 60 hertz in the U.S. or about 50 hertz in Europe. The essential responsibility of a grid operator is to keep this dynamic system in balance. Otherwise, blackouts can occur and, in extreme weather, lives are quite literally at stake.

More renewable energy generation = more need for flexible demand loads

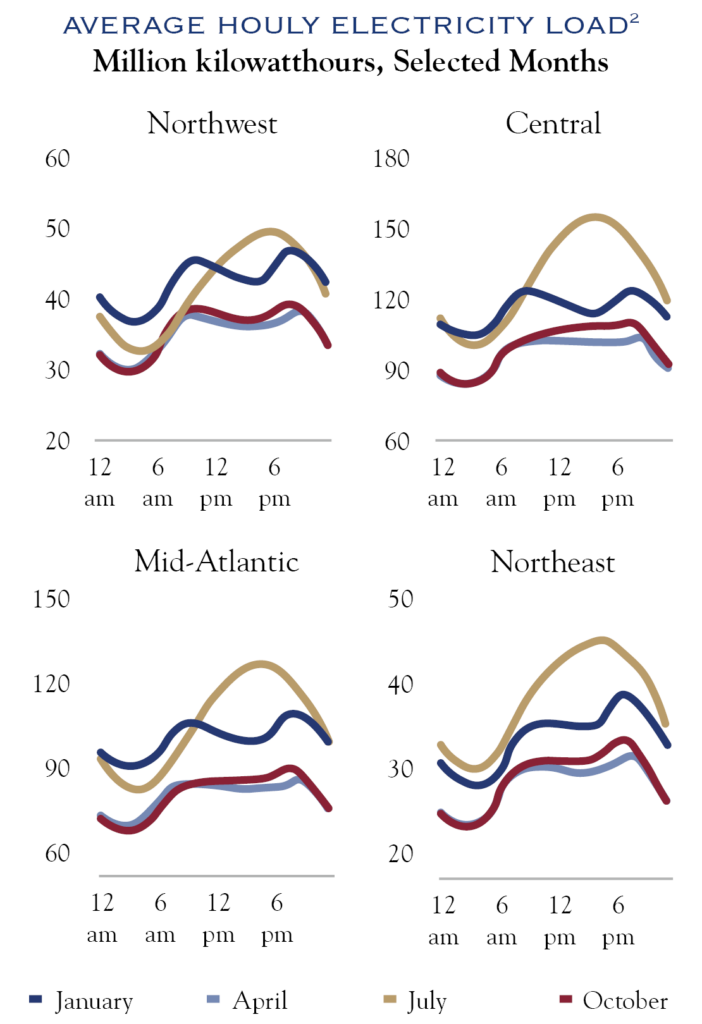

Planning for grid stability was easier before the proliferation of renewable energy investment in recent years. Relatively stable “baseload” generation (electricity supply) from nuclear, coal, and natural gas plants was planned in relation to society’s naturally variable but reasonably predictable electricity demand. In the winter months, electricity demand generally peaks in the mid-morning and again in the evening; in the summer, there is typically one higher peak in the late afternoon into the evening.

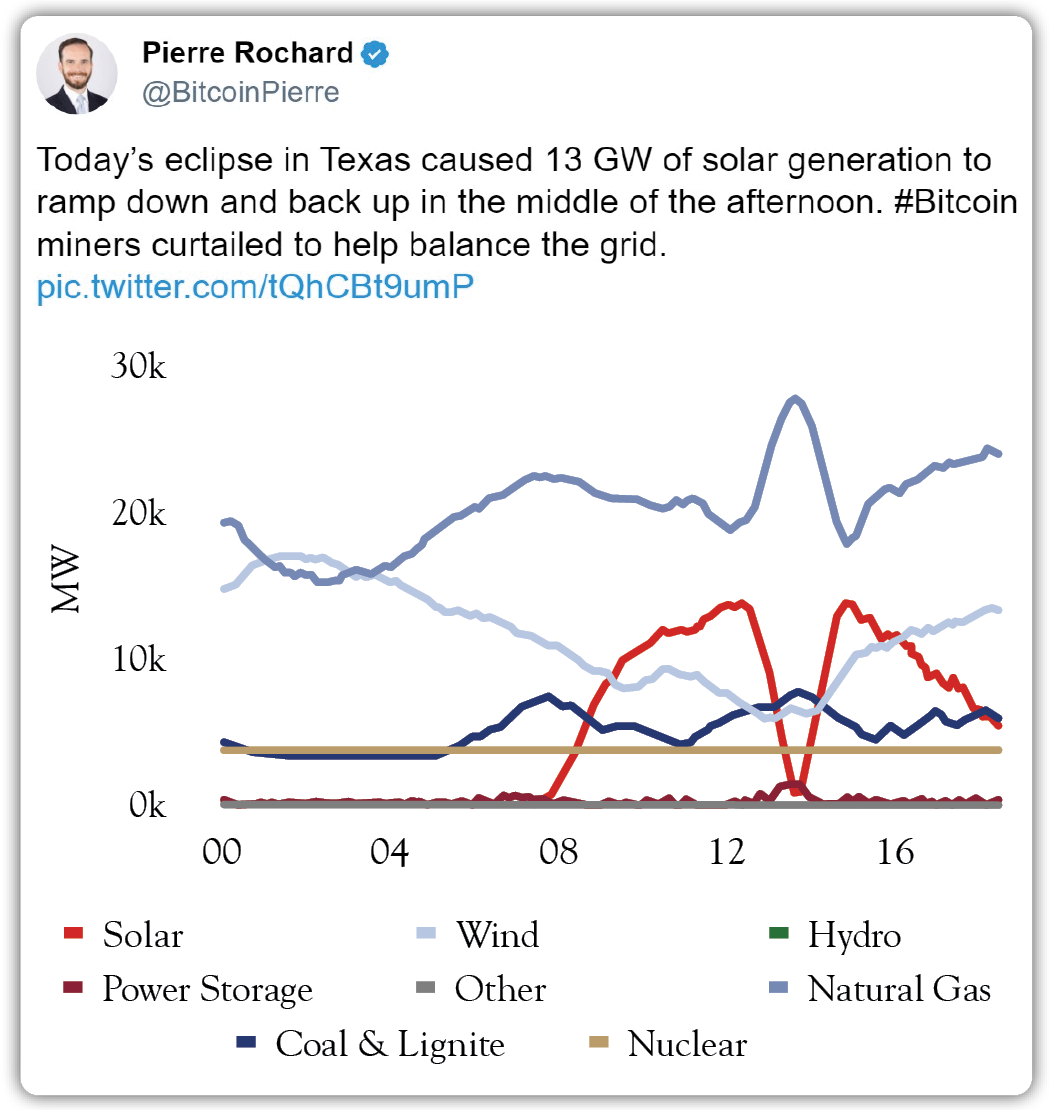

However, wind and solar generation is inherently variable and intermittent. A fun and recent example: here is an hourly graph (from Riot Platform’s Pierre Rochard) of the grid generation mix in Texas during the recent solar eclipse on April 8, 2024.3 You can see the drop in solar generation (red) at the time of the event:

How can grids accommodate substantial increases in variable renewable generation (electricity supply) as the energy transition progresses while keeping grids resilient and the “heartbeat” in balance?

One key answer is through demand response programs, where utilities incentivize certain grid participants to reduce (curtail) electricity usage during times when overall demand is high, thereby maintaining system reliability. The problem? Not many industries have an electricity demand profile that is 1) large enough to matter to the grid yet 2) hyperflexible enough to ramp up and down (instantaneously and/or multiple times per day) in response to the increased variability of electricity supply entering the grid. The need becomes more pressing as renewable energy increases as a percentage of total generation within a system.

If society’s power demand growth is to be partly met by an increasing percentage of generation by renewables, then Texas provides one lens into the opportunities and challenges of the “grid of the future.”

Texas is an interesting example because it has its own relatively self-contained grid (ERCOT) and is home to a massive amount of newly installed renewable generation, given its abundant wind and solar resources (plus recent Federal tax incentives). Approximately 29% of Texas’ total utility-scale electricity came from renewables in 2022, well above the U.S. average of about 21%.4 On some days (sunny and windy), the percentage is substantially higher. Because of its size, Texas is also the largest (by far) wind energy producer and second only to California in solar. Therefore, if society’s power demand growth is to be partly met by an increasing percentage of generation by renewables, then Texas provides one lens into the opportunities and challenges of the “grid of the future.”

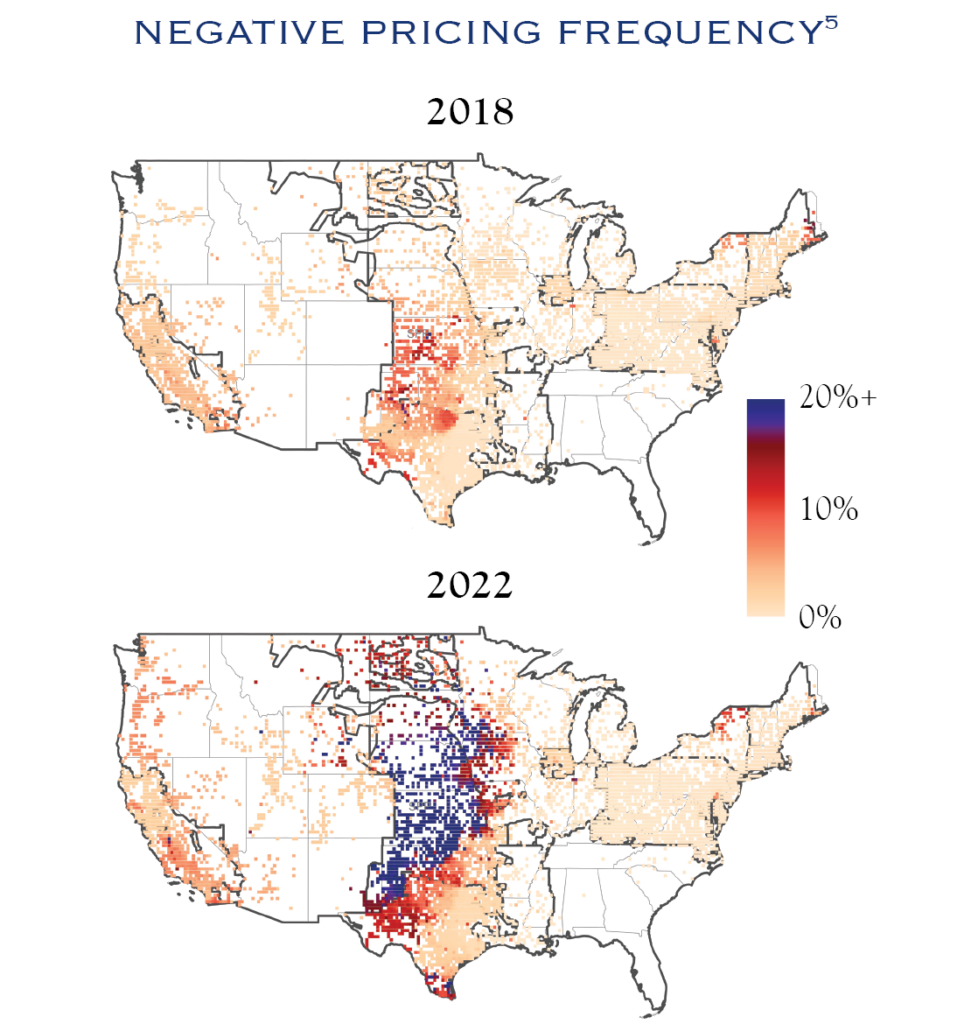

During low electricity demand periods (e.g., in the middle of the night in rural West Texas), there can be tremendous wind energy generation, pushing electricity supply up and electricity prices down (or even negative). One way to visualize this oversupply of electricity is the frequency of negative wholesale electricity pricing events, which have increased considerably as more renewables (particularly wind, in Texas and up through the Great Plains) are put onto the grid:

During these periods of renewable electricity abundance, this excess needs to be “soaked up” by a demand source, or it is simply wasted. However, this same demand source—if it is going to be useful to grid functioning—must also be able to react quickly and curtail itself flexibly as conditions change (e.g., when there is higher power demand on the grid, but less renewables generation, you get higher electricity prices, which curtail demand). Traditional participants in demand response programs, such as high-energy industrial processes, generally cannot be interrupted or flexed anywhere near as dynamically as is possible with bitcoin mining’s advanced data centers. As described in a November 2023 research paper co-authored by the former head of Texas’ grid operator (ERCOT):

“Bitcoin miners emerge as a uniquely adaptable category of loads, demonstrating remarkable flexibility and ability to curtail their energy consumption in a controlled manner with minimal latency over extended periods.”5

Below, the authors describe what an ideal demand response participant would look like:

“The optimal load resource would exhibit instantaneous reactivity, responsiveness to localized price signals, continuous curtailment capacity, minimal opportunity cost during downtime, high granularity curtailment, and significant energy contribution in MWh.”5

This pretty much describes bitcoin mining, and uniquely so. In modern and complex grids, bitcoin mining facilities have the rare and valuable attribute of being large potential electricity consumers, but flexibly so (only when electricity prices are very low), consuming otherwise-stranded electricity. Yet, they stand ready to instantaneously turn themselves off to give power back to the grid when needed.

Because of how brutally competitive bitcoin mining is as an industry, miners generally cannot afford to pay “average” electricity rates (energy is by far their largest cost) within a modern grid. Miners must confine their energy consumption to lower-price, lower-demand periods. Therefore, bitcoin mining does not “take energy away” from other end users, and in fact, it can facilitate higher reliability and functionality for grids, particularly complex ones with large amounts of intermittent generation from renewables.

Bitcoin mining creates new incentives to harness nature’s abundant potential energy

There is a tremendous amount of natural, already-existent potential energy.

Let’s consider another example from a completely different energy system. In Africa, around 600 million people, or approximately 43% of the total population, lack fundamental access to electricity, according to the IEA.6 Grids often don’t exist at all in rural areas, governments don’t have resources to expand access, and existing pathways to fund remote infrastructure investment (such as pure philanthropy or aid-related agencies, often with conditionalities attached) have had drawbacks and spotty success historically. “Mini-grids” built in remote areas are challenging to finance: they have relatively high upfront capital expenditure, are isolated from other energy systems (can’t sell the excess energy elsewhere), have low rates of initial consumption, and, therefore, long payback periods.7 However, there is a tremendous amount of natural, already-existent potential energy (hydro, solar, geothermal, etc.) in many of these same places across the continent.

Bitcoin mining introduces a new buyer for the excess energy produced by these isolated mini-grids. It is a win-win for the local community as it helps expand access to electricity and self-finance infrastructure, inject new economic resources (BTC), and improve quality of life.

One example is Bondo, a group of villages in a remote mountainous area of Malawi with high rainfall. Foreign donors funded a micro-hydro plant there that began operation in 2016, but the raw cost of power was extremely high at roughly 90 cents per kWh (vs. 10–20¢ in the U.S. or Europe), according to author and human rights activist Alex Gladstein.8 Despite philanthropists subsidizing these costs, the operations were not economically sustainable, partially because the surplus hydro energy had no buyer. A solution was introduced by Gridless, a Kenyan company focused on off-grid bitcoin mining in Africa which helped connect bitcoin mining infrastructure to the hydro operation in 2023. Before this, whatever electricity generated here through gravity and rainfall, above and beyond what could be used by the few thousand households in the area, was simply wasted. Now, this excess energy is sold to a new customer, the Bitcoin network, providing net new economic resources to the community. Importantly, this customer is available 24/7/365 through satellite internet and pays in BTC, which is particularly useful in a country where the local currency (the kwacha) is unstable, having just experienced a 44% overnight devaluation by the government in November 2023.9

Other areas in Africa are similarly putting excess (clean) energy to productive use. Virunga National Park—the subject of the 2014 documentary about protecting the largest population of remaining mountain gorillas—became the first known national park to mine bitcoin in 2020.10 Virunga has used excess hydro energy to fund operations and pay rangers. Ethiopia changed its laws around high-performance computing infrastructure in 2022, partly to allow its large (multiple gigawatts) excess hydroelectric generation capacity—which is currently being wasted—to begin to be monetized productively via bitcoin mining. And on May 24, 2024, the government of Kenya, along with leading bitcoin miner Marathon Digital Holdings (MARA), announced an agreement in which the Kenyan energy ministry will begin to deploy bitcoin mining operations “to optimize renewable energy projects that produce surplus energy due to intermittency and seasonal variations.” Investments into these improvements are initially expected to exceed $80 million.11

This use of energy and new incentives can actually lead to more net energy abundance rather than less.

The fact that otherwise stranded or wasted energy can now have this new “anchor” customer is a potentially powerful idea. While counterintuitive, this use of energy and new incentives can actually lead to more net energy abundance rather than less.

In conclusion, when it is said that the Bitcoin network “uses a lot of energy,” we should be careful to define what is being asserted about a global, decentralized, and inherently heterogeneous system. It is especially relevant to qualify what kind of electricity is being used (would it otherwise be wasted?), when and where it uses that energy (is it when there is no other buyer?), and the second-order effects within the communities these different energy systems serve.

1 Lawrence Livermore National Laboratory, Estimated U.S. Energy Consumption in 2022, https://flowcharts.llnl.gov/

2 Hodge, Tyler. 2020. “Hourly Electricity Consumption Varies throughout the Day and across Seasons.” U.S. Energy Information Administration. February 21, 2020. https://www.eia.gov/todayinenergy/detail.php?id=42915.

3 https://twitter.com/bitcoinpierre/status/1777480011374628938

4 “Texas State Profile and Energy Estimates.” n.d. U.S. Energy Information Administration. https://www.eia.gov/state/compare/?sid=TX#?selected=US-TX.

5 Carter, Nic, Shaun Connell, Brad Jones, Dennis Porter, and Murray A Rudd. 2023. “Leveraging Bitcoin Miners as Flexible Load Resources for Power System Stability and Efficiency.” Social Science Research Network, November 22, 2023. https://doi.org/10.2139/ssrn.4634256.

6 “Africa Energy Outlook 2022.” International Energy Agency. 2022. https://www.iea.org/reports/africa-energy-outlook-2022/key-findings.

7 “Energy and Bitcoin in Africa.” 2023. Gridless. https://gridlesscompute.com/wp-content/uploads/2023/05/blueprint-energy-bitcoin-africa.pdf.

8 Gladstein, Alex. 2024. “Stranded: How Bitcoin Is Saving Wasted Energy and Expanding Financial Freedom in Africa.” Bitcoin Magazine. January 24, 2024. https://bitcoinmagazine.com/check-your-financial-privilege/stranded-bitcoin-saving-wasted-energy-in-africa.

9 Jegwa, Peter. 2023. “Malawi Kwacha: 44% Drop in Value against US Dollar Sparks Unease.” BBC News, November 9, 2023. https://www.bbc.com/news/world-africa-67367983.

10 Popescu, Adam. 2023. “Gorillas, Militias, and Bitcoin: Why Congo’s Most Famous National Park Is Betting Big on Crypto.” MIT Technology Review, January 13, 2023. https://www.technologyreview.com/2023/01/13/1066820/cryptocurrency-bitcoin-mining-congo-virunga-national-park/.

11 “Marathon Digital Holdings Enters into Agreement with the Ministry of Energy and Petroleum of the Republic of Kenya to Enhance Kenya’s Energy Sector.” 2024. Marathon Digital Holdings. May 24, 2024. https://ir.mara.com/news-events/press-releases/detail/1358/marathon-digital-holdings-enters-into-agreement-with-the.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Waldorf. No part of Mr. Waldorf’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC