Explore the latest edition of Silvercrest's Insights, where we discuss Bitcoin's energy impact, revisit essential financial planning principles for every life stage, evaluate Mexico's economy amidst political shifts, integrate next-generation enthusiasm with prudent investment strategies, and uncover the power of thematic investing for a strategic edge.

Introduction

Richard R. Hough III

Chairman and CEOOur latest issue of Insights explores the nuances of modern investing, financial planning, and global economic dynamics.

“Thematic Investing—A Stock Picker’s Secret Weapon” delves into the methodology behind identifying influential market trends. Brian Bies and Steve Lilly, our Small Cap Growth and SMID Growth portfolio managers, outline how thematic investing can uncover hidden gems by focusing on undeniable, secular trends that span across various industries, providing a strategic edge in building portfolios.

In “Bitcoin, Energy Consumption, and Context—Are We Asking the Wrong Question?”, research analyst Alex Waldorf examines Bitcoin’s relationship with energy. Bitcoin mining, often criticized for high energy use, can play a crucial role to stabilize modern energy grids and utilize otherwise wasted electricity. Alex’s piece offers a fresh perspective on the interplay between digital currencies and sustainable energy solutions.

Carolin Newland, a Silvercrest portfolio manager, explores the critical role of strategic foresight at each stage of life in her piece, “The Importance of Financial Planning—Guiding Principles for Every Stage of Life.” From early-career individuals to retirees, comprehensive financial planning ensures that short-term desires and long-term objectives are well-aligned, safeguarding financial security and enhancing wealth management.

In “Not Your Grandma’s Portfolio—Integrating Next-Generation Enthusiasm With Prudent Investment Strategies,” portfolio manager Judy Morrill highlights the importance of engaging young inheritors in portfolio management. By balancing their enthusiasm for high-growth stocks with the principles of due diligence and diversification, managers can create resilient investment strategies that cater to their unique values and goals.

Finally, Patrick Chovanec, our economic advisor, sheds light on Mexico’s economic and political landscape in “Navigating Mexico’s Economic Boom Amidst Political Shifts.” Mexico, the United States’ largest trade partner, deserves more attention. Patrick discusses the paradox of Mexico’s thriving economy amid severe cartel violence and how their recent presidential election could shape the country’s future, especially for trade and migration.

We hope you find this issue of Insights both informative and thought-provoking.

Economic & Market Overview

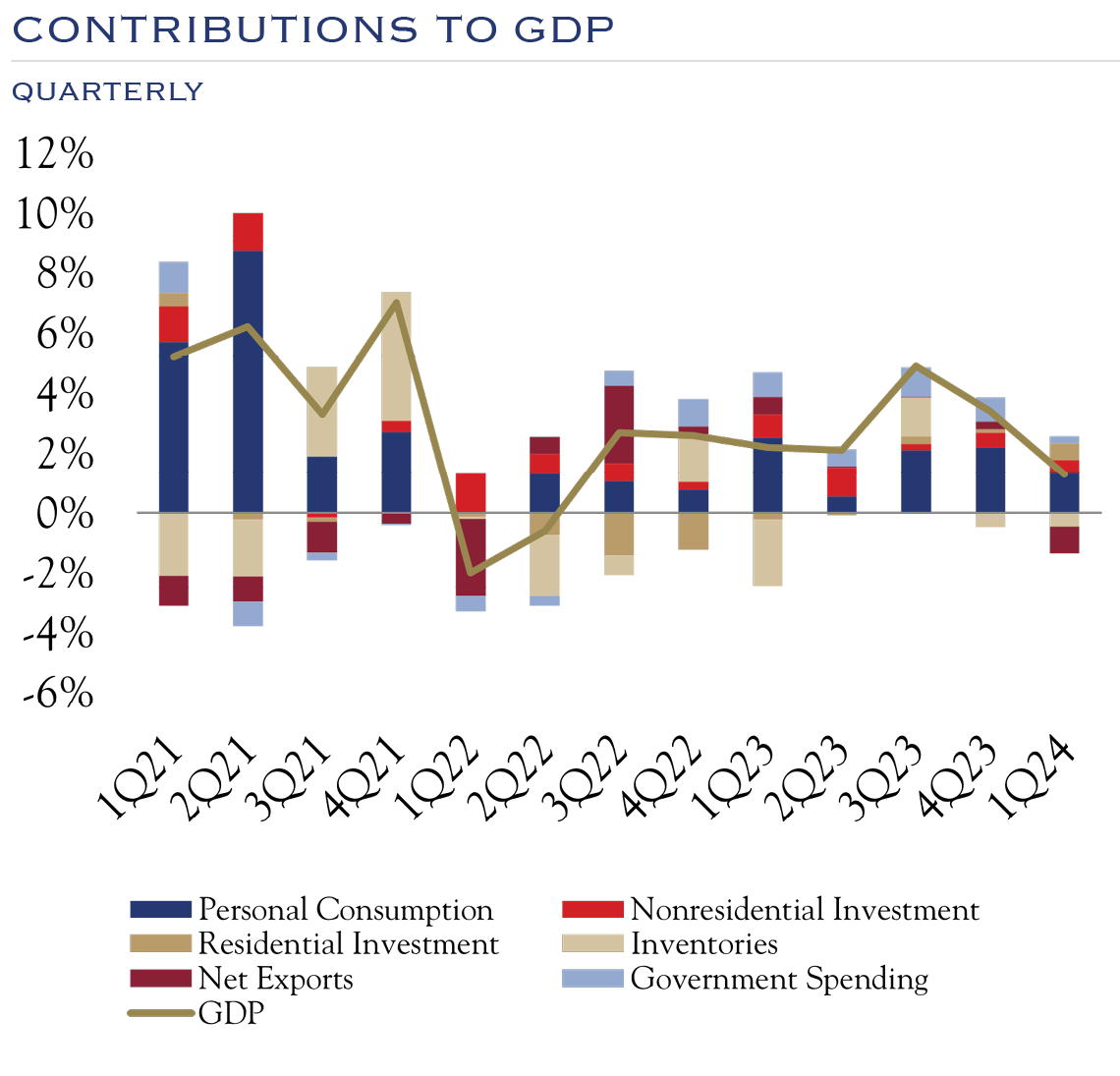

Sources: Bureau of Economic Analysis & Federal Reserve Bank of St. Louis

- Growth conditions have normalized to those seen in prepandemic conditions. Since 1Q 2021, growth has averaged 2.95%.

- Personal Consumption remains the most prominent driver of economic growth followed by Government Spending, Non-Residential (business) and Residential (housing) investment.

- Inventories and Net Exports, which helped drive growth in previous quarters, have fluctuated since 2021 and now have become laggards to economic growth in 1Q2024.

- We continue to expect growth around long-term trends of 2%, being driven by the consumer, nonresidential investments, residential investments, and government.

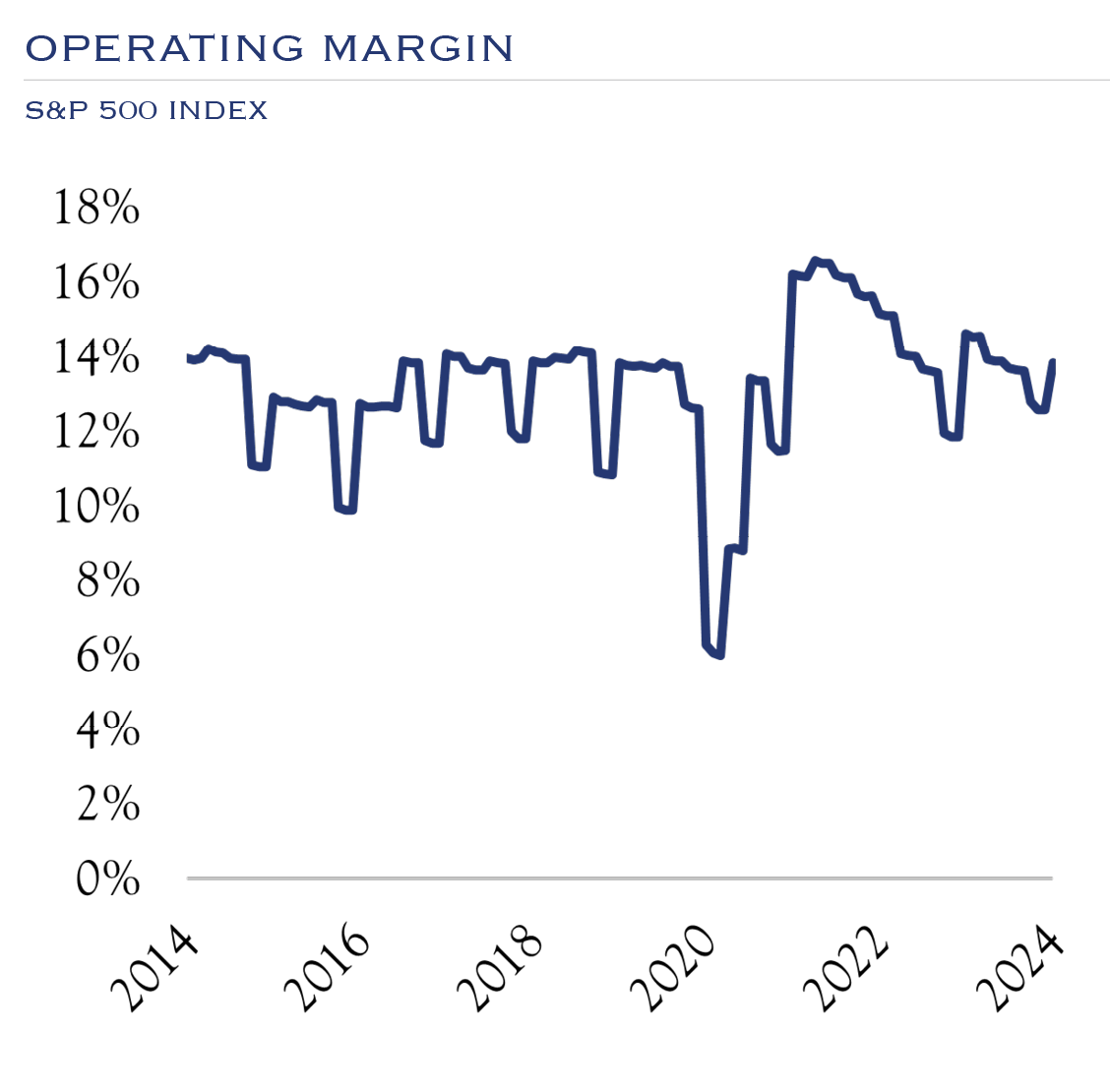

Source: Bloomberg.

- The data over the past 20 years shows that companies have been efficient in converting revenue into profit.

- While margins have come down slightly since their 2021 high, they have stayed consistent between 10-15%, averaging 13.1% in the past 20 years.

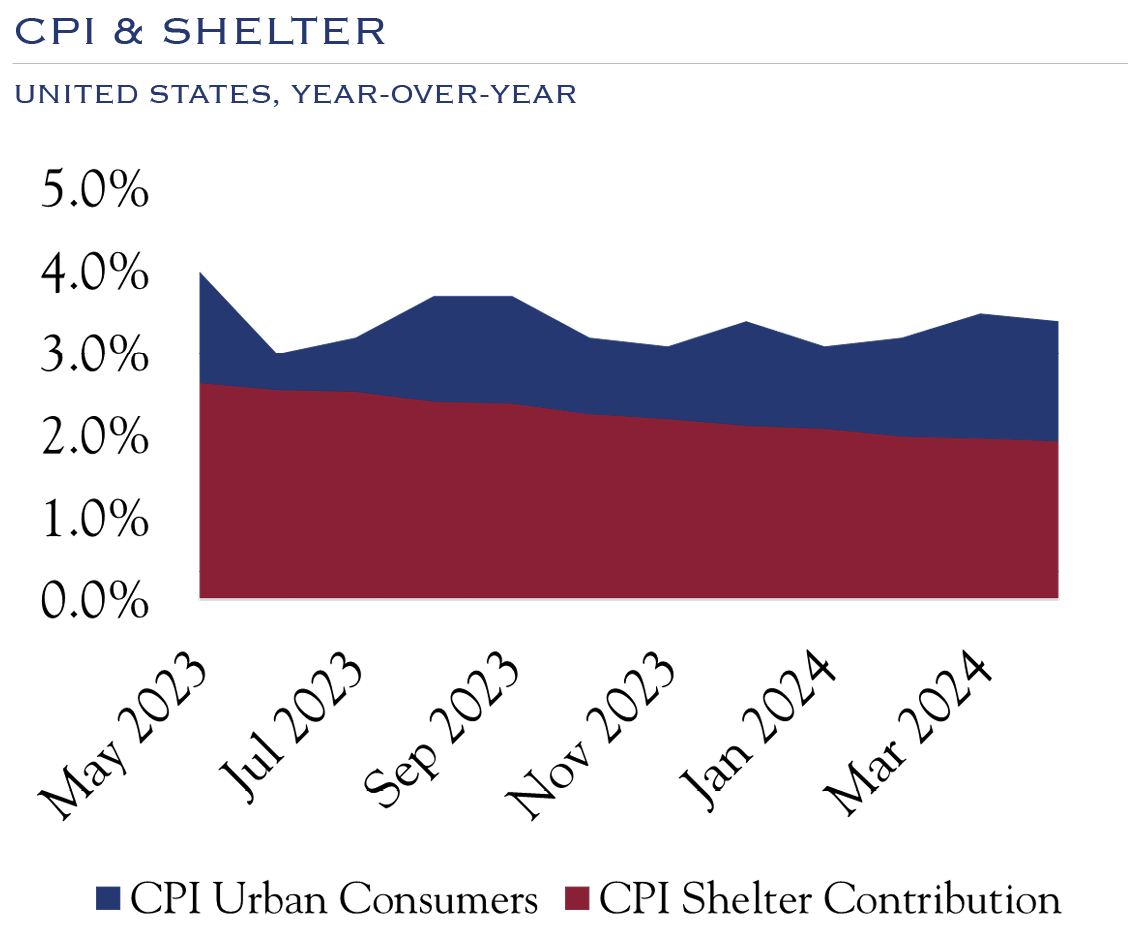

Source: Bureau of Labor Statistics.

- CPI is presently at 3.4%. Shelter, a 34.56% weighting, has been a primary driver of inflation over the last 12 months.

- The Shelter component of CPI is made up of two items. First, Rent of Primary Residence, which, simply put, is the cost of renting a residence. This metric accounts for around 7.5% of Shelter’s 34.56% weighting in CPI. The second is Owners Equivalent Rent, which refers to the amount of rent that a homeowner would be paid if they were renting out their own home in the market. This metric accounts for 25.4% of Shelter’s weight.

- With both homeowners and renters staying put for various reasons and the specific methodology of CPI, the effect from Shelter has worked against inflation.

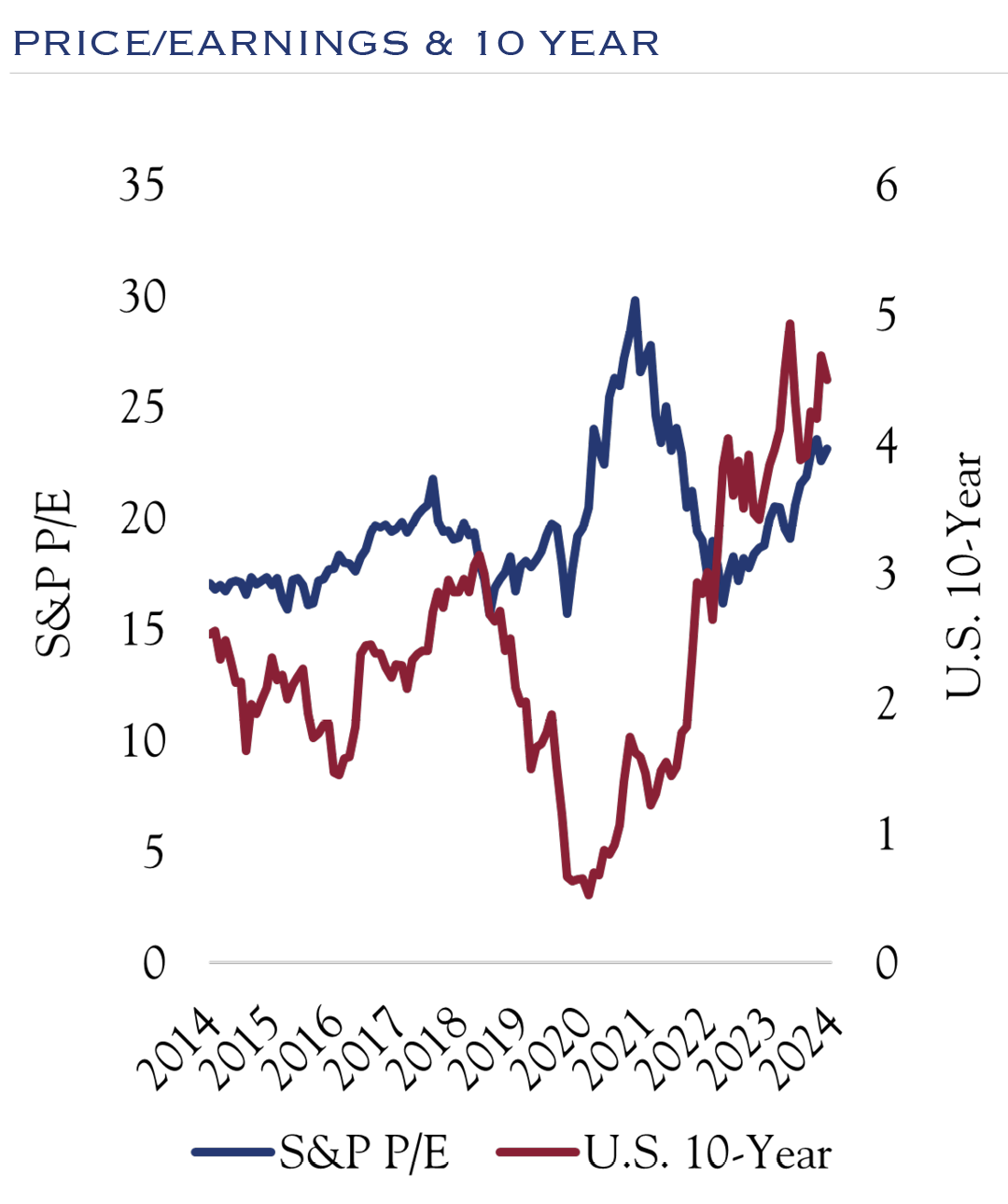

Sources: S&P Global, Bloomberg.

- Equity investors and the Fed have different opinions on inflation, allowing valuations to remain elevated in the face of persistent inflation. Earnings have been solid, but trailing price-to-earnings (P/E) ratios entered the year at 22x and now reside at an even loftier 23x.

- U.S. 10-Year interest rates are working against valuations, as yields on the benchmark U.S. 10-Year Note have increased from 3.9% to 4.5% in 2024.

- Furthermore, Fed Funds Rate Expectations for rate cuts have evaporated and should also be weighing on valuations. Entering the year, expectations were for six cuts (via Bloomberg WIRP); expectations are now for just over one cut in 2024. The Fed is on a “hard pause” and will need to see either a downside surprise on inflation or convincingly weak employment data. Absent those factors, the only path to a cut is through outlining a case for reducing real rates.

- We expect valuations to remain stable and future equity gains to come from earnings.

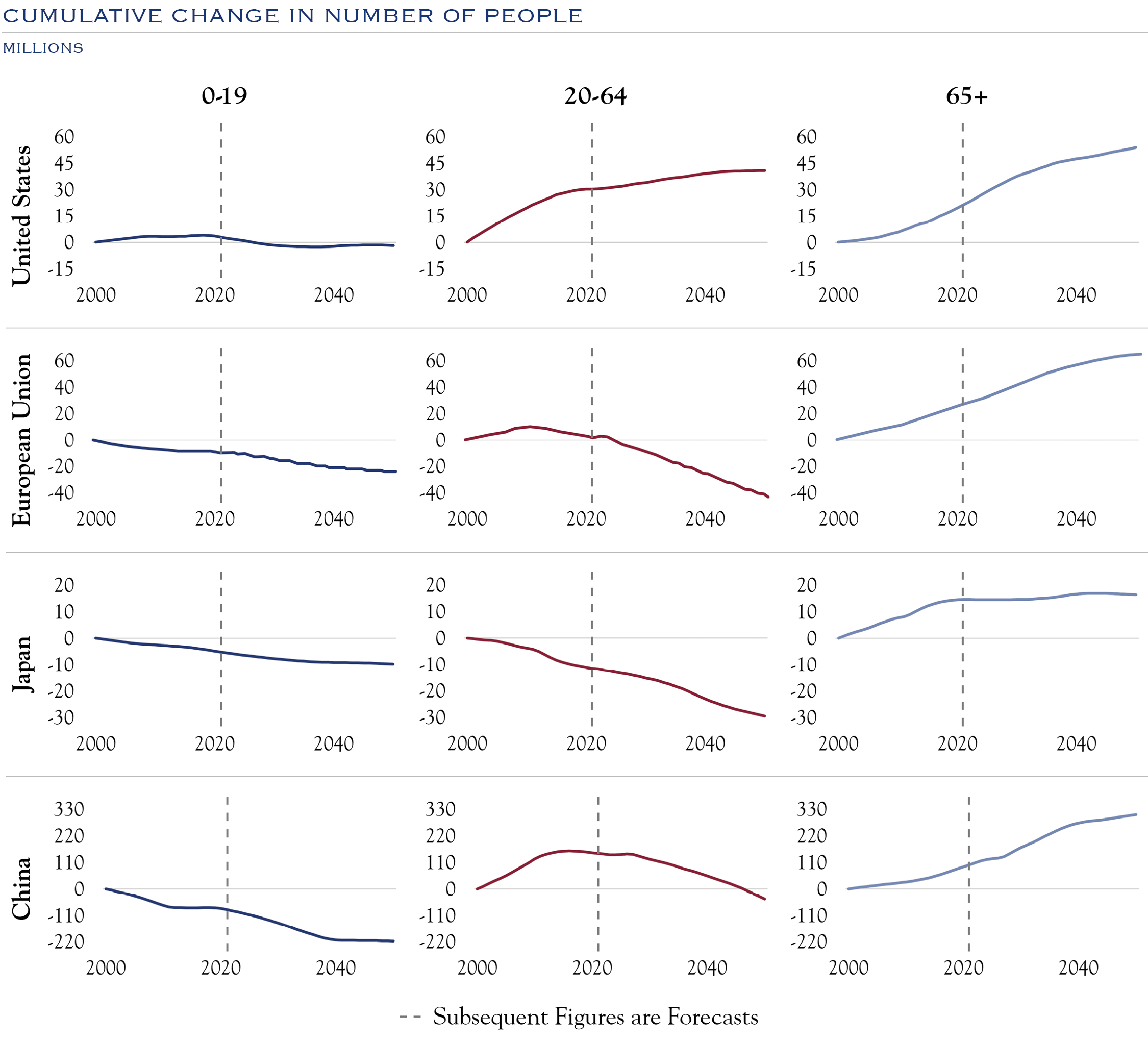

Sources: Financial Times, United Nations Population Division, Department of Economic and Social Affairs

- Demographics have a potent influence on the rate of economic expansion. It is much easier for companies to generate earnings growth and returns of capital in the form of dividends and share repurchases in a growing economy. The stark divergence in demographics is one reason we favor allocations to non-U.S. investments at levels modestly below those of the MSCI All-Country World Index. However, some countries and regions offer a stable economic and demographic backdrop, as well as the potential for interest rate cuts ahead of the U.S. In addition, U.S. equities are more expensive on a relative valuation basis, meaning that great companies outside the U.S. represent an important opportunity set.

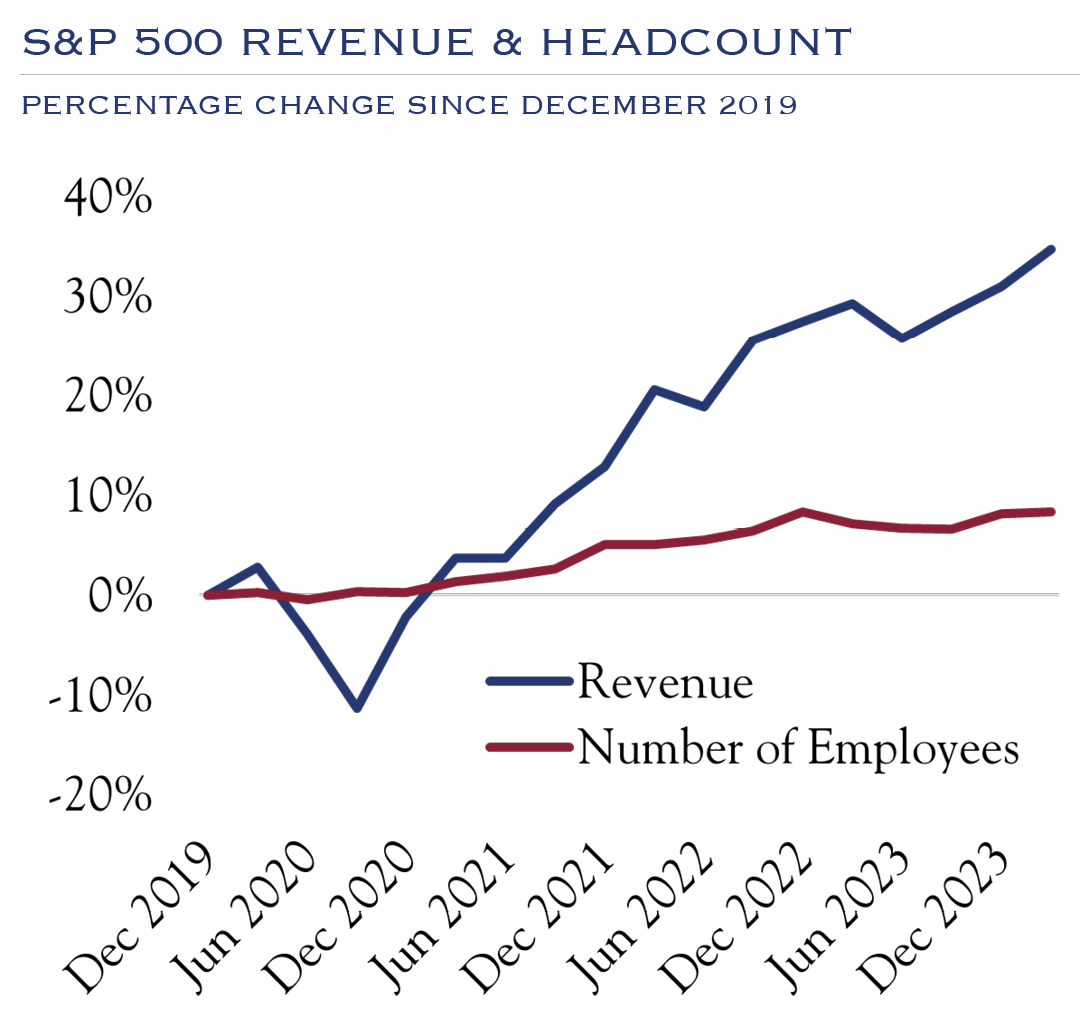

Sources: S&P Global, Bloomberg.

- Productivity is notoriously difficult to manage; however one indicator comes from evaluating Revenue vs. Headcount.

- On this metric, within the S&P 500, revenue has expanded +34.7% since the pre-pandemic base level of December 2019. Over the same span, headcount has increased just +8.3%.

- We expect positive trends in production to manifest in a similar manner going forward. In other words, we do not foresee layoffs caused by the adoption of technology. Rather, with the backdrop of a slowly growing economy, we expect revenue to expand and headcount to grow at a slower pace. This will boost profits margins and earnings.

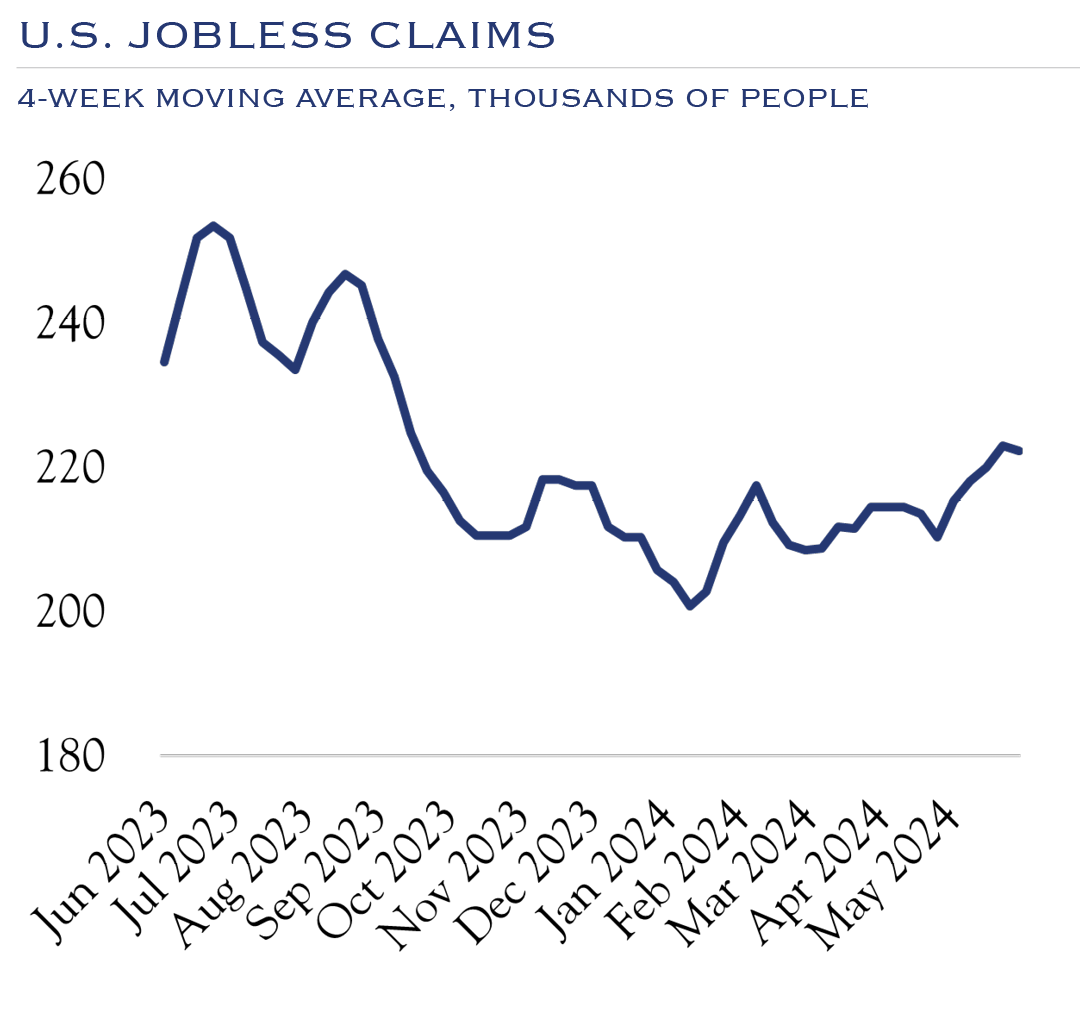

Source: Department of Labor

- Since this time last year, Jobless Claims have ranged from 200.8K to 253.5K averaging 221.4K.

- Claims have virtually flattened YTD and on a year-over-year basis have declined 10%.

- We are monitoring the recent uptick in claims.

Brian Bies, CFA

Managing Director, Portfolio Manager

Steve Lilly, CFA

Managing Director, Portfolio ManagerThematic Investing—A Stock Picker’s Secret Weapon

Discovering tomorrow’s great growth companies is like fishing—landing one can take many casts. However, we consider a thematic overlay as just one tool to help us find where the real trophy catches might be hiding, even if no other boats are there yet.

read the insight

Alexander I. Waldorf, CFA

Director, Portfolio ManagerBitcoin, Energy Consumption, and Context—Are We Asking the Wrong Question?

Much of the media discussion focuses solely on how much electricity is being used by the network. However, energy systems are diverse and complex, and a deeper look offers clarifying nuances about Bitcoin and its relationship to energy.

read the insight

Carolin M. Newland, CFA

Director, Portfolio ManagerThe Importance of Financial Planning—Guiding Principles for Every Stage of Life

Financial security at all levels of wealth involves prudent decisions and foresight. Whether tailoring an investment portfolio to fit your goals or preparing to bequeath generational wealth, the path to financial success begins with a clear vision and a well-crafted plan.

read the insight

Judy B. Morrill

Managing Director, Portfolio ManagerNot Your Grandma’s Portfolio—Integrating Next-Generation Enthusiasm With Prudent Investment Strategies

Advisors to multi-generational families should make it a point to acknowledge and respect the younger generation’s different perspectives, experiences, and values. The wealth transition between generations is an opportunity to further engage and educate them about the importance of due diligence, diversification, the pitfalls of market timing and speculation, and the history of hot trends and market bubbles.

read the insight

Patrick Chovanec, CPA

Economic AdvisorNavigating Mexico’s Economic Boom Amidst Political Shifts

There is a broad consensus in Mexico, across the political spectrum, that its fate is linked to the U.S. economy—very few seriously question or want to change that.

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Equities

While valuation levels are elevated, we look for equities to generate returns of 6–8% annualized over the next three years, driven by continued progress on earnings. A slow-growth economy and continued productivity gains will deliver expanded margins, earnings growth, and equity gains.

Growth & Value

We recommend a balance between the growth and value investing styles. Similar to the last few years, individual company activity is far more likely to drive results. This dynamic will be further heightened by individual company adaptations to artificial intelligence tools. We expect continued rotation between growth and value and prefer to focus on stock selection.

Small Cap & Large Cap

While large cap returns continue to exceed those of smaller companies, we see a two-part catalyst for a broadening of the market to small caps. First, we anticipate that an eventual easing of interest rate stress will accrue to the benefit of small caps. Second, the cost of access to productivity-enhancing technologies will spread to smaller companies. Small caps have compelling valuations, though quality considerations are important. We continue to recommend a modest allocation to small caps, above benchmark/policy targets.

U.S. & Non-U.S.

While many great companies based outside the U.S. have compelling valuations, we remain cautious about the global outlook. The interaction between a slowing China and a slow-growing Europe presents macro headwinds. We continue to advocate for exposure to non-U.S. equities through active management focused on identified compelling individual companies.

Fixed Income

While rates are likely to remain elevated in the near term, an eventual shift in language from the Federal Reserve will ultimately bring relief to interest rates. Current yields are compelling, and the long-term outlook for bonds is favorable. Within credit, we continue to advocate for careful active management, as higher rates will require diligent navigation of the financing environment.

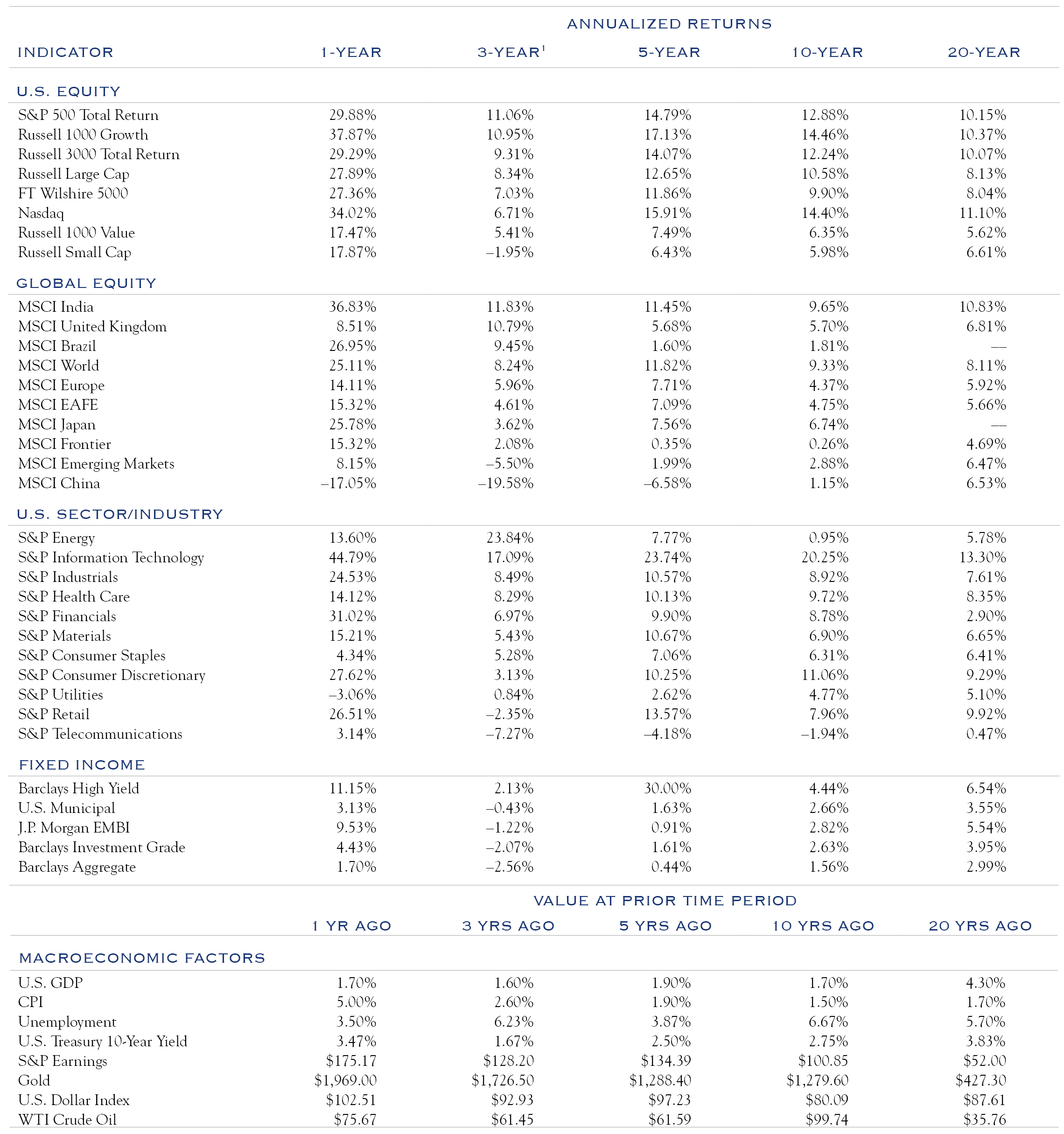

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 3/31/2024.