Mexico just elected a new President. You spent some time in Mexico recently. What are your impressions of what’s happening there?

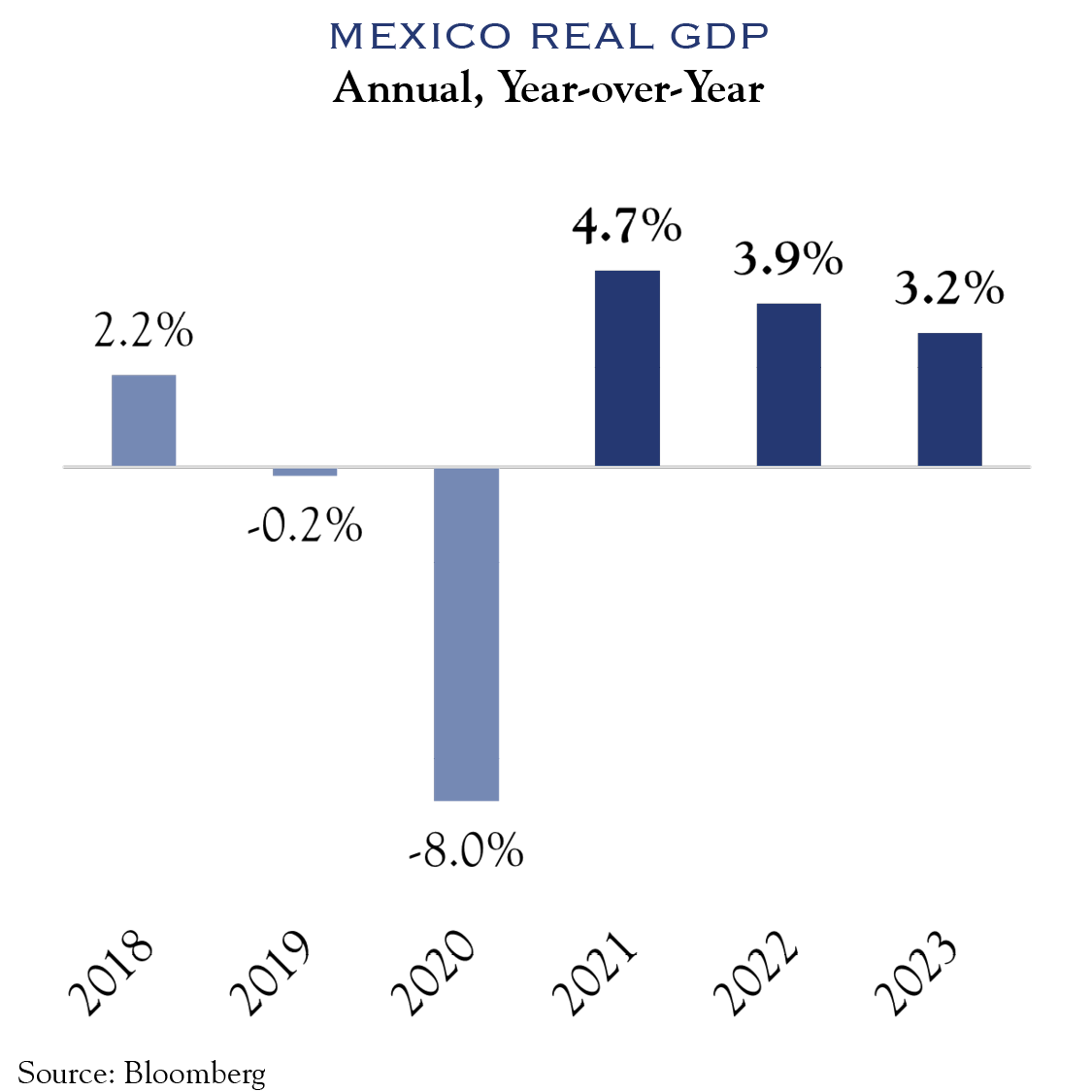

I was reminded of the line from Dickens: “It was the best of times, it was the worst of times.” Obviously, when we watch TV here in the U.S., we’re aware of the problems along the border in terms of migrants and drug cartels. The cartel violence in Mexico is very bad, with thousands of people “missing” and presumed killed. The impression is that Mexico is on the verge of becoming a “failed state”. But if you look at Mexico’s economy, it’s doing really well. GDP growth is over 3% for the past three years, in large part due to booming trade with the U.S., across that same border. That’s a big reason why the current President of Mexico, Andrés Manuel López Obrador (known as AMLO), is extremely popular.

So what happened in the recent elections?

AMLO has to retire, but his popularity carried over to his hand-picked successor, Claudia Sheinbaum, who won the election to succeed him, becoming Mexico’s first woman president.

Mexico’s presidents serve a single six-year term and can’t run for reelection. AMLO has to retire, but his popularity carried over to his hand-picked successor, Claudia Sheinbaum, who won the election to succeed him, becoming Mexico’s first woman president. It was a landslide: Sheinbaum won over 58% of the vote, with her nearest opponent (also a woman) getting just 28%. Despite the victor’s celebrations, it was an election season marred by serious violence: 37 candidates for local positions were assassinated during the campaign, making it the bloodiest election in modern Mexican history.

Why is AMLO so popular?

It may seem surprising because he’s been a very controversial figure in the past, with a reputation as a fiery left-wing populist. When he ran for president before and lost, he claimed the election was stolen. So, when he won in 2018, a lot of people, including the business community in Mexico and foreign investors, were very worried about what he might do. They expected him to raise taxes and go on a populist spending binge.

That’s not what happened. Rather than raising taxes overall, he went after Mexican companies for not paying what he said they owed. And on the spending front, he turned out to be very frugal, cutting spending and getting Mexico’s debt under control. In fact, some of his critics, including The Economist magazine, have actually argued that his austerity measures have gone too far, short-changing necessary investments in education, for instance. That may be a valid critique, but it’s certainly not what people expected, and it’s blunted a lot of other criticism.

And at the same time, the economy is doing well?

Yes, and that’s mainly due to trade with the U.S. When President Trump came into office, you could say that Mexico was one of his favorite punching bags. Tempers were raised on both sides of the border, and relations might have gone downhill. But the Mexicans very quickly and quietly renegotiated NAFTA. At the time, I asked some of my friends in Mexico why there wasn’t more resistance to Trump’s demands. They told me that if Mexico made some concessions and gave Trump an apparent win, his attention would shift to China, making Mexico the prime beneficiary of growing trade tensions between the U.S. and China.

Compared to most of the world, the U.S. has seen one of the strongest post-COVID economic recoveries, and Mexico has been able to ride that once it took NAFTA off the table.

They were right. As U.S.-China tensions heated up, Mexico began to look more and more attractive as an alternative supply source. The fact that wages in China have been rising was already making Mexico more competitive. COVID only reinforced the perception that distant supply chains, especially to China, could be risky. The result has been a boom in so-called “friendshoring,” which has driven increased investment and growth in Mexico. Even Chinese companies are relocating factories there. We’ve seen freight data that clearly shows a huge increase in traffic across the U.S.-Mexico border along the major delivery corridors. Compared to most of the world, the U.S. has seen one of the strongest post-COVID economic recoveries, and Mexico has been able to ride that once it took NAFTA off the table.

But there are still plenty of tensions between the U.S. and Mexico over the border, right?

Absolutely. First of all, there’s the migrant crisis. Many of the migrants aren’t coming from Mexico; they’re coming from other countries—Venezuela, Central America, even China—through Mexico. If the U.S. doesn’t accept them, Mexico doesn’t want them either and doesn’t feel responsible for taking them. In fact, AMLO has been able to use cooperation (or the threat of withholding cooperation) as a big leverage point with both Trump and Biden.

There are also the drug cartels which have become prime channels for smuggling Chinese-made fentanyl into the U.S. During the Republican primaries, several candidates floated the idea of using the U.S. military to hit the cartels inside Mexico directly. Those comments drew a very sharp, angry response from AMLO. At the same time, the violence inside Mexico has gotten so bad that AMLO has even talked about negotiating a “ceasefire” with the cartels. That might solve some of Mexico’s immediate problems, but it obviously wouldn’t stop the flow of increasingly deadly drugs across the border.

How has AMLO been handling the “law and order” issue in Mexico?

He’s relied a lot more on the military. He created a new National Guard to police the streets and put it under the army’s control. During my visit, I definitely noticed a more visible armed military presence throughout the countryside.

He’s also given the military more economic power as part of his cost-cutting policies. For example, he’s turned over a lot of infrastructure projects to the armed forces to build, figuring it will save money. He’s also turned over management of several of the country’s airports to the military. This gives Mexico’s armed forces an economic base they never had before.

These moves have some of his critics very concerned, at least long-term. Traditionally, Mexico’s military has been kept very weak and underfunded, so it wouldn’t threaten the ruling party. And at least since the Mexican Revolution in the 1910s, Mexico hasn’t seen the kind of military coups that were common across Latin America.

Those same critics point out that AMLO has targeted the nation’s election watchdog commission, which he accused of rigging past elections against him, by gutting its funding. They worry that his moves to strengthen the military and weaken election oversight could undermine democracy.

But none of this has undermined his popularity?

There have been some large protests, especially over gutting the election commission, but one thing AMLO has going for him: the opposition is divided. When he ran (and won) in 2018, he formed his own political party, Morena. The other traditional parties, right and left, formed a coalition against him, but the only thing they really have in common is that they don’t like AMLO.

For some people, that’s enough, but with the economy doing so well, they’re clearly a minority. And AMLO himself, of course, is leaving the stage—at least officially.

What can we expect from Sheinbaum as AMLO’s successor?

Claudia, as everyone refers to her, is a former mayor (or, more accurately, governor) of Mexico City. She is more of a technocrat and less of a firebrand populist than AMLO. During COVID, when AMLO dabbled in some of the more “contrarian” takes, Claudia took a far more conventional line in favor of pandemic restrictions and vaccines. So, she may bring a different style, at least, to the office than her predecessor.

Mexico’s presidency is a very powerful office, and most of the country’s presidents have been able to leave their own imprint on the country. Claudia’s challenge, however, is that she doesn’t really have her own political base. Morena is AMLO’s party, and many believe that he will continue to control it, like a puppet master behind the scenes. It remains to be seen if Claudia, as his successor, will be able to call the shots.

What does all this mean for investors?

There is a broad consensus in Mexico, across the political spectrum, that its fate is linked to the U.S. economy—very few seriously question or want to change that.

It’s easy to get thrown off by all the negative headlines on the very real challenges Mexico faces, as well as tensions with the U.S. The fact is Mexico’s economy is booming because of trade links with the U.S. that are only growing stronger, not weaker. One thing I’ve noticed that’s very interesting: you hear a lot about the BRICS nations (Brazil, Russia, India, China, and South Africa) hoping to eclipse the U.S. and the G-7 as a leading force in the global economy. You might expect AMLO, as a left-wing populist, to join Brazil’s Lula in calling for an end to the dominance of the U.S. Dollar or aligning with China. In fact, you haven’t heard any of that from AMLO. There is a broad consensus in Mexico, across the political spectrum, that its fate is linked to the U.S. economy—very few seriously question or want to change that. So, it’s a very complicated, often troubled partnership, but it is a partnership, and it will continue to be one—especially as the U.S.-China relationship grows more sour.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Chovanec. No part of Mr. Chovanec’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC