A Shift from Effectiveness to Efficiency

In 1858, Queen Victoria sent the first transatlantic telegraph from England to rural Bedford Springs, Pennsylvania, where President James Buchanan was stationed at his “Summer White House.” Her message and President Buchanan’s reply took over 24 hours to make the round-trip. This marked an exponential improvement over prior transatlantic communications, which took about 25 days for round-trip communication. A century later, NASA launched the spacecraft of the Voyager program. These spacecraft are in the final phase of their journey and looking to eke out every possible mile before failure—a story told in the documentary “It’s Quieter in the Twilight.” Today, Voyager 1 is located over 15 billion miles from Earth, the greatest distance any human-produced object has traveled from our planet.

For much of its history, the U.S. economy prioritized effectiveness—creating new things. Much has been accomplished with innovations such as the railway, telegraph, rocket, personal computer, internet, and the mobile phone. Going forward, efficiency is likely to be the defining element of the economy, driven by new technology and supply chain problems encountered during the pandemic.

A new wave of rockets, autos, robots, and medical devices are being built in pursuit of higher levels of efficiency. Advances in software now focus on data analytics, machine learning, and artificial intelligence to better process the voluminous information available in the modern economy. Each of these technologies target improved efficiency metrics such as processing speed, or success rates.

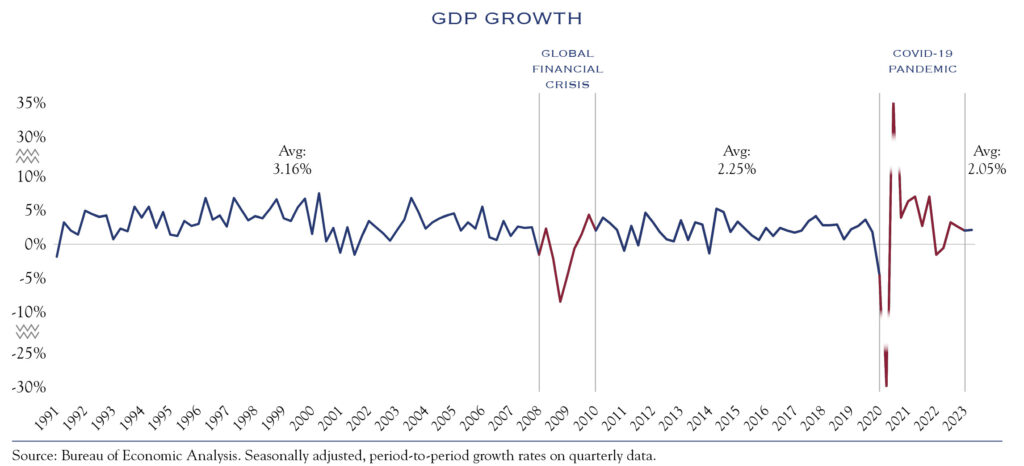

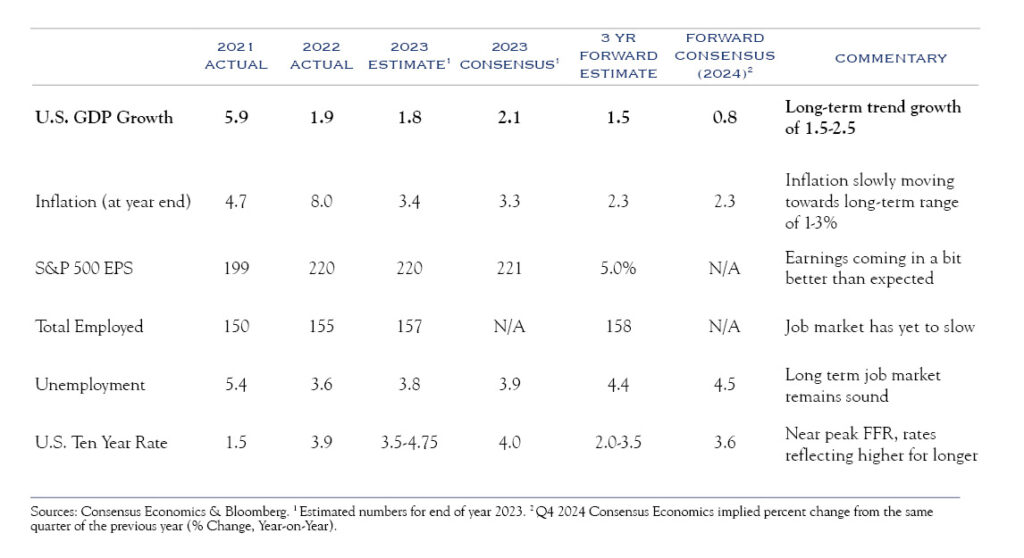

The pivot towards efficiency comes at a critical juncture for the economy. Slower population growth, higher interest rates, and depressed productivity gains have conspired to constrain economic growth. As shown below, economic growth has been fairly muted.

The Economy

Recent economic data sets have been especially challenging to interpret. For example, the below three economic metrics provide inconsistent signals:

- Recessionary Signal: The yield curve has been pointing to recession since inverting in July 2022.

- Slow Growth Signal: The Weekly Economic Index (“WEI”) produced by the New York Fed is showing an estimate of +1.86%

- Fast Growth Signal: Atlanta Fed’s GDP Now indicator shows growth of +4.9%

In addition to those readings, our outlook for the economy is informed by “real-time” indicators of spending, mobility, revenues, and countless other metrics. Across this wide swath of data, we see signs of slowing momentum, though not recession. This growth of around 2.0% will be weighed on by elevated interest rates and pockets of financial stress. We anticipate GDP growth below 2.0% over the next few quarters, gradually leading back to the long-term trendline.

Recently, the yield on the benchmark U.S. 10-year Note hit 4.5%, marking the first time above 4.0% since before the financial crisis. Rates on the 10-year averaged 2.4% from 2010 to 2020, and from 1997 to 2007 (just prior to the financial crisis), rates averaged 5.0%. Nonetheless, the swift move in Fed Funds from zero (during the pandemic) to 5.5% currently and the advance in the 10-year over 4.0% will drag growth. The longer rates stay elevated, the larger the economic drag will be, as more and more activity will be subject to higher rates. A related detriment to economic growth is continued scattered stress in the banking sector, and while not prevalent throughout all of banking, it is an issue that is reducing economic activity at the margin.

Recession? Not with continued job growth.

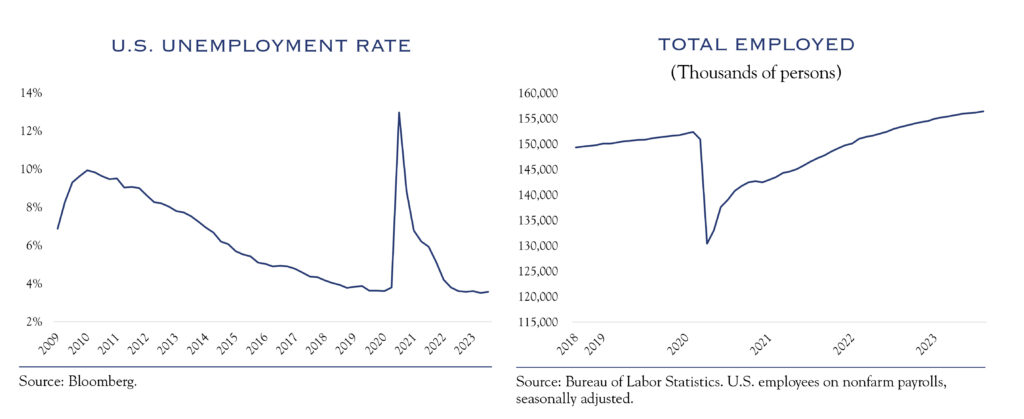

Despite slow growth and a loss of positive momentum, the economy is unlikely to encounter an imminent recession, mainly due to a strong and stable job market.

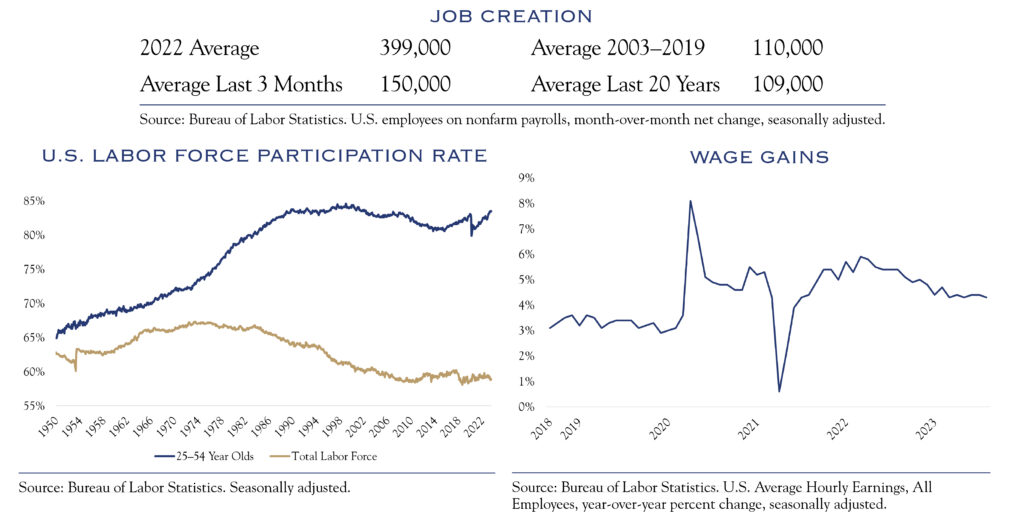

Below are charts showing key indicators on the labor market: job creation, participation, the unemployment rate, wage gains, and our favorite: total employed. A simple mantra from a former colleague states, “More employment creates more income which creates more spending and leads to a growing economy.”

Momentum is slowing. Job creation remains above long-term averages but below levels seen in 2022. Participation rates have improved overall, mostly driven by those in the prime-age range of 25-54, but remain below the peak for older workers and women, indicating that some of the challenges created by the pandemic have not been solved. The unemployment rate remains low, signaling that the economy is operating at or near potential growth. Wage gains remain solid, though they have cooled—this is an encouraging configuration. Ideally, wages grow enough to keep the economy moving forward, but not so much as to create inflation. While the members of the Federal Reserve Open Market Committee have expressed serious concern over the potential for wages to create, or sustain, inflation, we expect wage gains to continue to cool as economic growth has moderated, and supply chain problems have improved. The total number employed in the United States continues to rise and is a key reason we do not see an imminent recession.

Inflation is still a problem

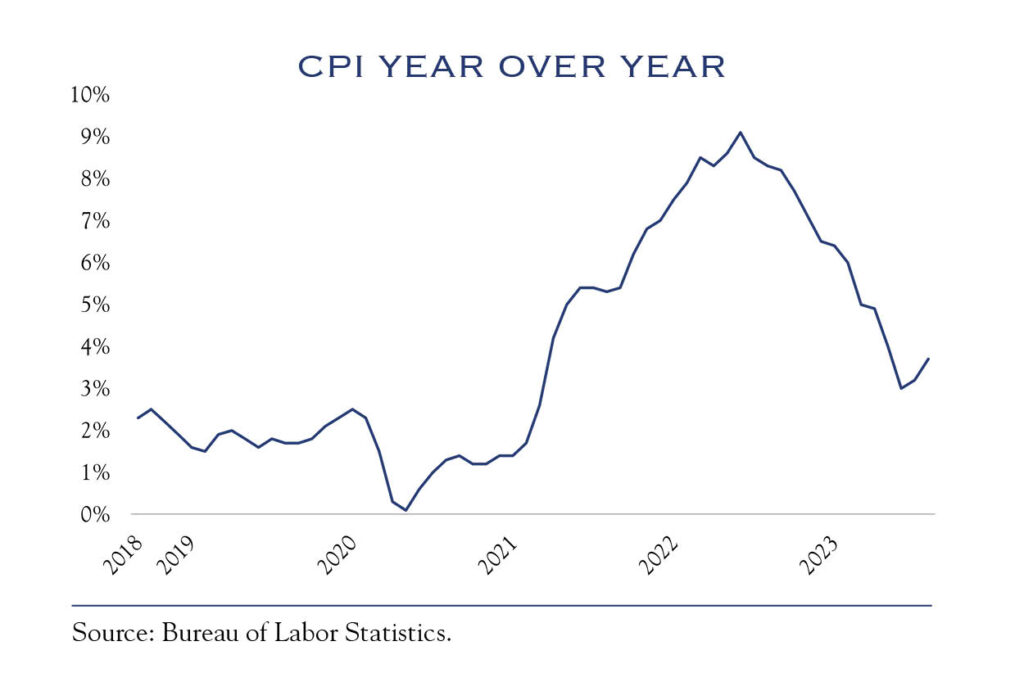

While the economy remains on solid ground, mainly due to employment, inflation is a lingering concern. There has been a lot of progress: at one point, the Consumer Price Index (“CPI”) was as high as 9.1%, and the most recent reading was 3.7%.

Several inflation metrics, such as the Personal Consumption Expenditures indicator, the “core” versions of inflation measures, and real-time metrics like Truflation show inflation moving lower, but not yet within reach of the 2.0% target set by the Fed. This creates a conundrum for investors as inflation is at a level that is not especially damaging to economic activity or profits but is at a level that merits elevated interest rates in the form of a 5.5% Federal Funds Rate. The bond market has taken the posture that rates will remain elevated for some time. Projections using the futures market and derived with Bloomberg’s WIRP tool show expectations for a first rate cut not appearing until the Summer of 2024. Equities seem to be incorporating a similar outlook, as the S&P 500 has declined about -7% from its peak and is back to levels seen in June of this year.

Looking ahead, we see no major changes in inflation levels or interest rate policy over the next two quarters. As such, we expect valuations will remain capped at these levels and to respond primarily around inflation readings. While we anticipate inflation readings to improve, it will be a slow and uneven process. Behavioral changes are often slow to unwind and it is going to take some time to get back to 2.0% inflation. However, there has been no new fuel for inflation. Drivers of inflation such as money supply, supply chain issues, wage gains, changing demand patterns, and other challenges have largely abated. Recent increases in oil prices and labor actions will exert some upward pressure, while mostly flat prices in housing will exert downward pressure.

Inflation has become much less of a problem for the economy, but remains a significant concern for The Fed and investors. Throughout 2024, the focus will shift from the absolute level of Fed Funds Rate to the “real” level, which represents the difference between rates and inflation. For example, one version of the “real rate” can be calculated by taking the current Fed Funds rate of 5.5% minus the current CPI reading of 3.7%, resulting in a 1.8% “real rate.” If inflation declines, the “real rate” will increase, leading to increasingly restrictive conditions and robust debate within the Fed regarding the appropriate level for the Fed Funds Rate. This dynamic will likely be a catalyst for initial, modest, decreases in the Fed Funds Rate at some point next year. As that happens and more clarity emerges on the path ahead for inflation and Fed policy, we anticipate valuations will improve. For now, valuations are likely stuck.

A Narrow Path

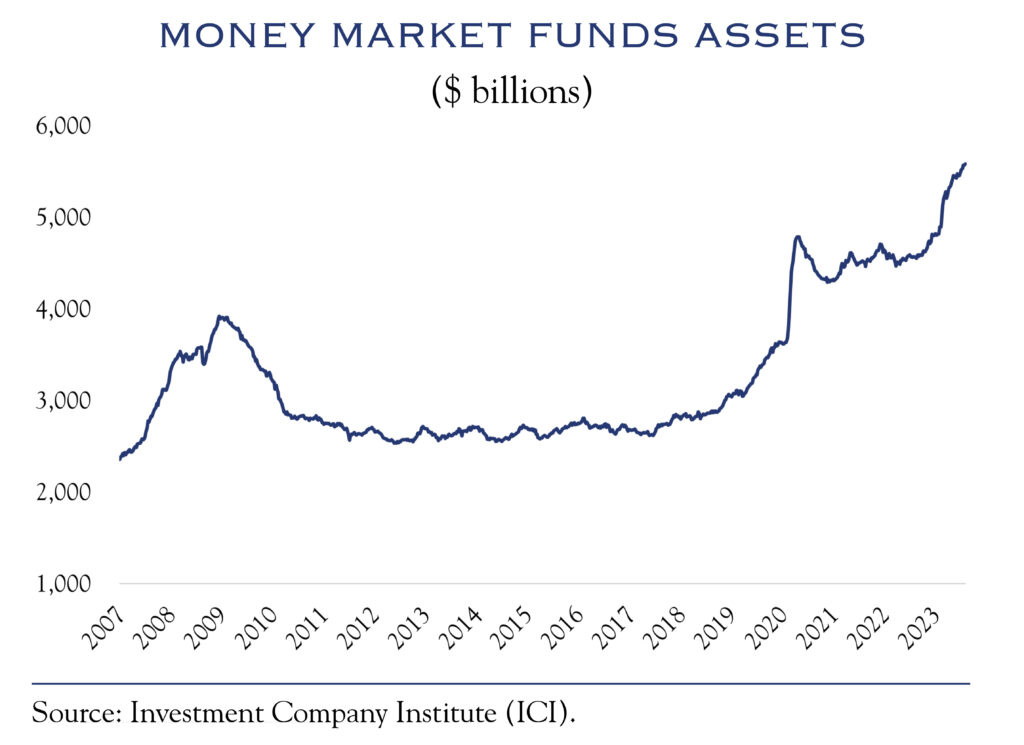

One challenging dynamic for investors in 2023 has been the narrow nature of gains in equities. While the S&P 500 Index is up 11.68%, the Russell 2000 Index’s reading for small cap stocks is weak at 1.35%, respectively. This indicates that investors are anticipating a challenging road ahead. One challenge could come from a slower economy. Another could be related to financing, as bigger companies are often assumed to have an easier time meeting their borrowing needs. Both challenges are likely to persist until the focus shifts to the longer-term path ahead, especially as it relates to Fed policy. Often, the fourth quarter is a time when investor focus moves to the year ahead, though in the current situation, the timing will be more likely linked to hints of changing Fed policy. As clues emerge on the path for the Fed Funds Rate, look for the market to broaden, with gains coming from a larger segment of stocks, including smaller-cap companies. Given high levels of “cash on the sidelines”, the move could be robust.

Earnings

An important theme for the quarters ahead will be to “follow the earnings.” We expect large divergences across companies as they navigate a slowing economy and work to incorporate new technology to preserve profit margins. Efficiency will be the name of the game.

Current concensus estimates for 2024 S&P 500 earnings are $246, an advance of 11%. We expect a bit more modest gain of +8% to $238. Major clues will arrive in the form of third-quarter earnings, and guidance provided on company earnings calls beginning in October.

Our analysis of earnings calls’ transcripts reveals increasing efficiency gains from recently deployed technologies. The supply chain disruptions from the pandemic contributed to this trend. The quest for earnings in a slow-growth world will drive further implementation.

What follows are quotes from our review of S&P 500 earnings calls transcripts from June through September. The quotes have been lightly edited and condensed, and company names removed, so as to keep the focus on the trends relevant to the economy, rather than any individual company.

Outlook

The recent, sharp rise in yields has created a challenging investment backdrop. Most of the move in the 10-year from below 4.0% to above 4.5% was overdue. With Fed Funds at 5.5% and projected to stay above 5.0% through the fall of 2024, it makes sense that bond investors are now taking seriously the Fed’s pledge to remain vigilant. These higher rates serve as a ceiling on equity valuations and likely keep markets in a choppy holding pattern in coming quarters. Once the focus looks to 2024 and beyond, the outlook is a bit brighter. Inflation is declining and will continue to do so, albeit slowly and sporadically. Interest rates are likely to be lower one year from now, and even lower three years from now. That means that valuations can recover some lost ground. Similarly, a slow-growing economy often sets the stage for decent earnings gains. The move towards efficiency in the economy means that profit margins and earnings gains have not yet peaked. Our forecast time horizon is three years, deliberately chosen so that underlying fundamentals, rather than sentiment, dominate the outcome. On a fundamental basis, the next three years look likely to be modestly favorable.

Equities

We look for equities to generate returns around 6-8% annualized over the next three years, driven by continued progress on earnings (via efficiency gains), and a recovery in valuations beginning sometime in 2024.

Growth & Value

We recommend a balance between the growth & value investing styles. Similar to the last few years, individual company activity is far more likely to drive results. We expect continued rotation between growth and value and prefer to focus on stock selection.

Small Cap & Large Cap

While large cap returns have dominated 2023 results, we anticipate that an eventual easing of interest rate stress will accrue to the benefit of small caps. Small caps have compelling valuations, though quality considerations are important. We continue to recommend a modest allocation to small caps, above benchmark/policy targets.

U.S. & Non-U.S.

While many great companies based outside the U.S. have compelling valuations, we remain cautious about the global outlook. The interaction between a slowing China and a slow-growing Europe presents macro headwinds. We continue to advocate for exposure to non-U.S. equities through active management focused on identified compelling individual companies.

Fixed Income

While rates are likely to remain elevated in the near term, an eventual shift in language from the Federal Reserve will ultimately bring relief to interest rates. Current yields are compelling, and the long-term outlook for bonds is favorable. Within credit, we continue to advocate for careful active management, as higher rates will require diligent navigation of the financing environment.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC