“To strive, to seek, to find, and not to yield.” Those famous words of Tennyson, indeed the whole of Ulysses, seem an apt description of the stock market throughout the course of 2019. With a double black diamond decline late in 2018, followed by a belated Santa Claus rally, it was not yet obvious in the early days of 2019 that the stage was set for what would shape up to be an incredibly rewarding year for equity investors. The words of Tennyson are especially true as we consider the seeking and finding that takes place non-stop, but especially so in 2019 against the backdrop of Brexit, tariff wars, loud tweets, impeachment, and that’s not even counting the endless humdrum events bandied about on the news channels day after day. And yet, while this bull market rally has aged, it did not yield.

Looking back, it was hard to add value as an asset allocator, at least within asset classes, as large cap growth dominated returns during the calendar year. Winds of change were blowing in late 2019, and market strength may broaden in 2020.

The words of Tennyson are especially true as we consider the seeking and finding that takes place nonstop, but especially so in 2019 against the backdrop of Brexit, tariff wars, loud tweets, impeachment, and that’s not even counting the endless humdrum events bandied about on the news channels day after day.

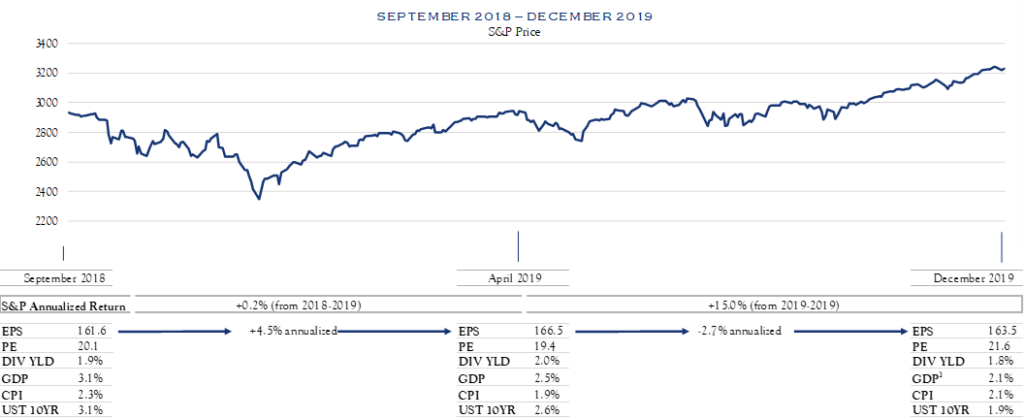

Considering the 29% return for the S&P 500 in 2019, we note that 17% of the gain merely advanced values to their level as of September/October 2018, while the remaining 12% represented primarily an advance in valuation as measured by PE, perhaps in anticipation of an improving economy and earnings picture. Alternately, one could make the case that the mere lowering of volume on numerous macro issues—Fed rate posture, tariffs, etc.—improves the valuation picture. The whole episode highlights the somewhat arbitrary nature of the calendar year as a yardstick for how stocks have performed. While many hew to the calendar year with annual market predications or avoid the exercise entirely by forecasting over 7–10 years, we stick with a three-year time horizon—splitting the difference between tactical and strategic outlooks. We note that each year seems to bring information that is more readily and travels more quickly than ever before. 2019 was no exception. 2020 is likely to be even more emblematic of this issue, particularly as the U.S. presidential campaign gets in full swing.

We note that each year seems to bring information that is more readily and travels more quickly than ever before. 2019 was no exception.

Stocks enter 2020 with elevated valuations and a murky earnings outlook. Yet, we have a relatively constructive outlook. This has manifest itself in our equity risk posture, which sits at +5% above the mid-point of range for exposure in balanced accounts. It can be characterized as a positive, but not aggressive, posture. In fact, this has been our target exposure for several years. We believe the high noise level on the geopolitical front, along with modestly elevated valuations, calls for tempered optimism.

Our target exposure is based on several favorable factors balanced against a noisy backdrop. Low inflation looks to continue as far as the eye can see—though we closely monitor signs of wage push inflation. Likewise, Fed posture and globally sluggish growth are likely to keep a lid on interest rates. Thus, these valuation levels are well supported. Regarding pure fundamentals, while earnings growth has been modest, there are reasons for possible improvement. First, dividends and buybacks combined create a natural starting point of a 4–5% shareholder total yield. A strong employment market and low interest rates are benefiting consumer spending and housing. Further, earnings can benefit directly from two possible changes. If trade tension continues to subside, it is likely to improve corporate confidence which in turn may improve the capital expenditures situation. Lastly, dollar dominance may dissipate, and this tends to have a favorable effect on earnings for large, global companies within the S&P 500.

Presently, we see no signs of imminent inflation, recession or financial crisis.

Our work on economic factors and market performance has shown that absent inflation, recession, or financial crisis, stock declines tend to be rather modest. Presently, we see no signs of imminent inflation, recession or financial crisis. Thus, we expect market declines to be in the “normal” category of 15% or so. Our posture allows benefit to accrue from rising markets, yet does not dramatically alter risk posture so as to induce nervous reactions at every dip along the way. For now, low and slow growth and staying the course are appropriate catchphrases. If trade tension continues to subside, it is likely to improve corporate confidence which in turn may improve the capital expenditures situation.

As shown below, Fed policy has supported lower interest rates which in turn have provided support for higher multiples, in spite of a declining rate of earnings growth. Current consensus calls for modest improvement in the earnings picture, particularly if global macroeconomic and geopolitical issues turn more neutral or positive. Taken together with dividends and buybacks, equity returns look reasonable over our three-year time horizon.

Source: Bloomberg

1 GDP as of September 30, 2019

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC