Sir David Attenborough has said “There are some four million different kinds of animals and plants in the world. Four million different solutions to the problems of staying alive.”

Investing can feel the same way—endless permutations of investment ideas

Robert R. Teeter

Managing Director, Chief Investment StrategistOne famous episode of Attenborough’s show Planet Earth had him narrating a suspenseful chase scene in which a baby ibex was pursued by a red fox on a nearly vertical cliff. The ibex survived and avoided capture due to its superior mobility at the cliff edge. At times, investing may also feel like a dance for survival along a cliff edge—or so we’re told from the countless doomsayers who purport to see what the future holds.

Similarly, elements of successful investing include the ability to skillfully navigate the countless options for survival, along with a humble understanding that while bull and bear markets will come and go, survival of the fittest—portfolio—marches on indefinitely.

While bull and bear markets will come and go, survival of the fittest—portfolio—marches on indefinitely.

There are more ways to invest than ever before. In this issue, we address how something seemingly so simple, the ETF, became so complex. We’ll also look at how to invest for persistent growth, take a look at the longer-term issues surrounding trade and take a look back and ahead; hoping to share insights that are beneficial to the survival of your portfolio.

Economic & Market Overview

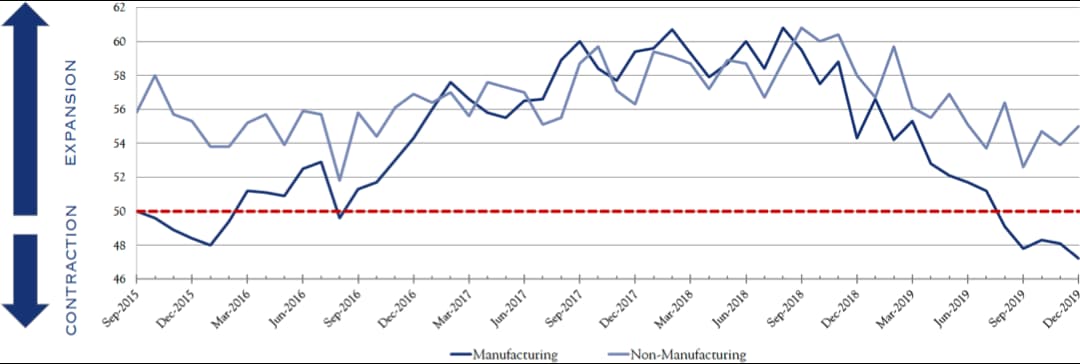

ISM INDICES

(>50 is expansion, <50 is contraction)

The U.S. manufacturing sector, which comprises about 12% of GDP, has been in contraction for the past five months, according to the ISM purchasing manager survey. This is enough to slow the economy, as it did in late 2015 and early 2016, but not pull it into recession. That depends on the much larger Non-Manufacturing sector, which though it has weakened, somewhat, for now remains in solid expansion territory.

Source Institute for Supply Management, as of December 2019

Robert R. Teeter

Managing Director, Chief Investment StrategistLooking Back & Looking Ahead

"To strive, to seek, to find, and not to yield." Those famous words of Tennyson, indeed the whole of Ulysses, seem an apt description of the stock market throughout the course of 2019. With a double black diamond decline late in 2018, followed by a belated Santa Claus rally, it was not yet…

read the insight

John Potter, CFA

Managing Director, Portfolio Manager

Tom Eck, CFA

Managing Director, Portfolio ManagerThe Case For Growth Investing

Today’s economic environment in the United States presents challenges to many investors. The United States economy has expanded at a 2.3% annual rate since the Great Recession, as compared to the typical non-recessionary pace of 4.2% since 1946.

read the insight

Mark Morris

Senior Advisor

Martin Loeser

Head of Manager Research, Portfolio ManagerBuyer Beware

"Value” has a nice ring to it. It appeals at a visceral level. Investing in value seems like a reasonable thing to do.

read the insight

Patrick Chovanec, CPA

Economic AdvisorTrade War

There’s a widespread belief that the signing of a U.S.-China trade deal, and expected ratification of the revised NAFTA agreement, means that trade tensions—which hung like a cloud over markets for much of 2019—have gone away. I think they will continue. Corporate surveys seem to suggest that U.S. businesses aren’t dropping their concerns over trade so easily either.

read the insight

John (Buck) Stevenson

Managing Director, Portfolio ManagerInvesting with a Purpose: Uncovering Hidden Opportunities for Positive Impact

Investors who seek to complement a financial return with social impact often are unaware that highly impactful investments exist in full view (and sometimes right around the corner) in many U.S. communities.

read the insightInvestment Outlook Summary

The Investment Policy & Strategy Group (“IPSG”) met on Wednesday, January 15th, 2020 to review asset allocation.

Investment returns in 2019 were almost universally extraordinary. As a result, portfolio rebalancing is an essential activity. A typical 60/40 stock/bond portfolio would have seen an increase in equity exposure of approximately 5%. Thus, rebalancing is an important exercise to maintain appropriate risk levels.

There is no change to our base case scenario which calls for modest economic growth, slow earnings growth, robust employment, and continued low rates of inflation and interest rates. Election rhetoric will no doubt heat up, with plenty of airtime and ink devoted to how great or terrible things seem. For this reason, modest changes for the better or worse are likely to have an outsized impact on volatility. That potential volatility was a main reason behind the reduction in equity exposure several years back. At the time, the source of volatility was geopolitical events. While those events continue to flare up, they have receded somewhat in the aggregate. Trade war noise has subsided a bit, at present, with improvements on both the USMCA agreement as well as Phase I between the U.S. and China. Brexit remains as a potential disruptor, albeit with more clarity than previously.

There is no change to our base case scenario which calls for modest economic growth, slow earnings growth, robust employment and continued low rates of inflation and interest rates.

Taking this all into consideration, the guidance of the IPSG remains at a level of equity exposure that sits just above the midpoint range. We believe slow and steady progress in fundamentals, such as earnings and dividend payouts, will outweigh negative sentiment over time. In fact, several sources cite dividend yield and expected buybacks as providing a 4–5% return to equity investors, even in the absence of real earnings and/or changes in valuation. Policy actions from the Federal Reserve are keeping a lid on interest rates, which is reasonable given the lack of meaningful inflation. In turn, low rates have been a key support for equity valuations. So long as inflation remains muted, this balance should remain in place.

We believe the most important objective of a fixed income allocation is a well-constructed bond portfolio to provide capital preservation and liquidity. Our guidance is for conservatism, emphasizing the capital protective elements of a bond portfolio. The rather minimal rewards of additional return in fixed income are simply not worth the additional risk required in many cases. Further, higher credit risk tends to correlate with equities, while more conservative forms of fixed income tend to benefit from flights to quality during equity declines. Thus, simple and conservative is the guiding principle in fixed income.

We believe slow and steady progress in fundamentals, such as earnings and dividend payouts, will outweigh negative sentiment over time.

Allocations across geography, market cap and investment style were maintained. While non-U.S. equities continue to offer a slightly better valuation profile, economic growth in many regions in the developed markets has remained sluggish. Emerging markets present the prospect of higher growth potential but with other challenges. We note that some markets outside the U.S. offer less crowded areas for stock selection to add value. We maintain a balance between growth and value within U.S. equities. When adjusting for the differing rate of change of earnings, growth stock valuations do not appear excessive, though they are far from “cheap” vs. history and relative to value stocks. The small cap area presents some potentially interesting valuation. However, at the index level, there remain divergences of quality. Thus, there is opportunity for skilled active management.

Alternative investments, such as hedge funds and private investments, offer a wide range of strategies and risk profiles. Private investments can selectively offer an opportunity for the more aggressive investor to seek higher returns either through equity-related strategies, such as venture capital or growth equity, or as a higher risk return alternative to traditional fixed income, such as private credit or private real estate offerings. While hedge funds have been maligned, when they are chosen appropriately, they can play an important role in managing overall portfolio risk.

In conclusion, rebalance, set a modest time frame, and expect noise against a quietly positive fundamental backdrop.

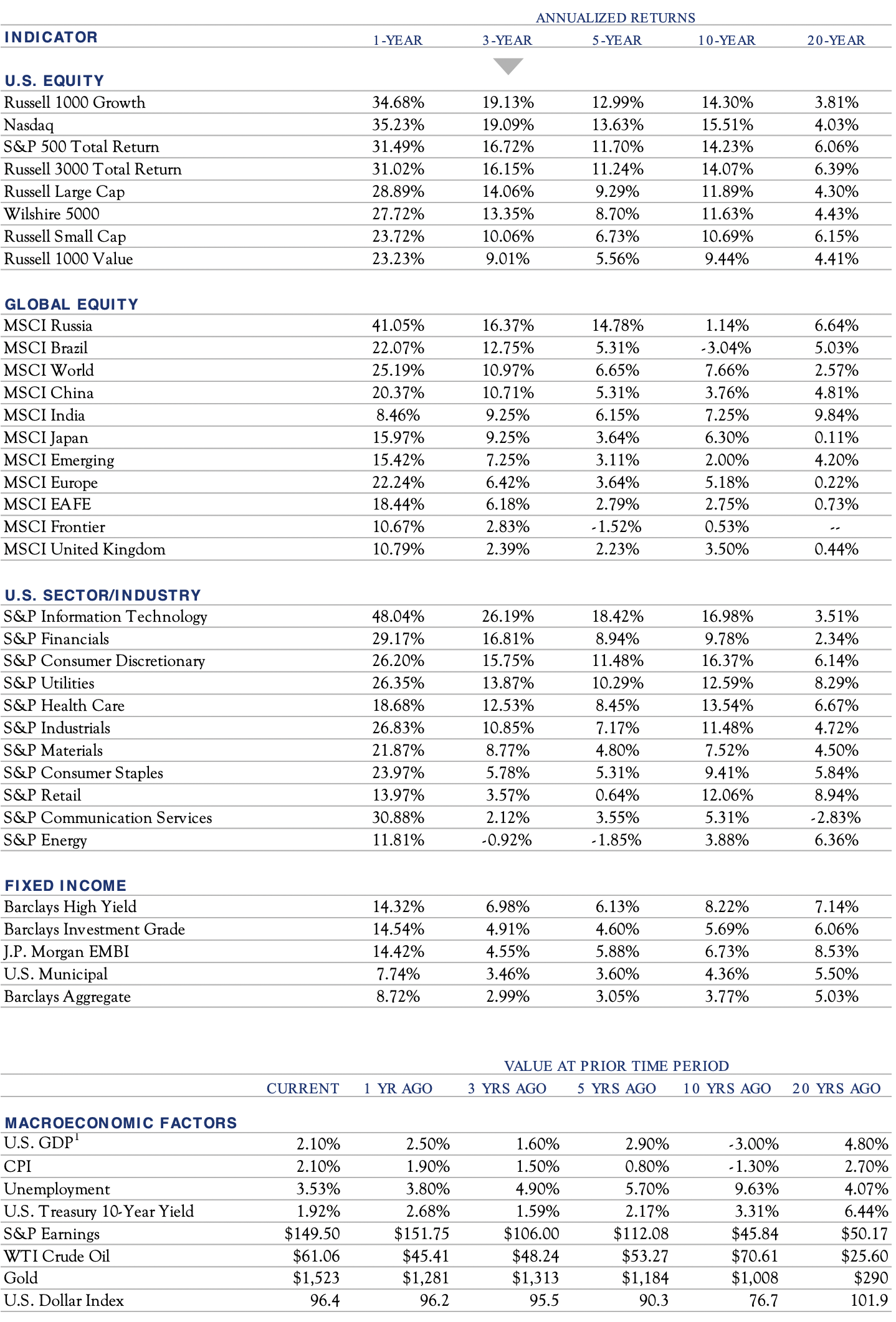

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.

Source: Bloomberg, data as of 12/31/2019

1 U.S. GDP as of 9/30/19