Recently the Chief Investment Officer for CALPERS, Ben Meng, was quoted as saying with regard to private equity, “We would like to have as much as we can, as much as our liquidity profile can afford us.”

When an investment strategy has reached such levels of popularity and praise, there is a tendency to want to do it—now. However, it is prudent to pause and think. How does it fit within portfolio goals? A few areas to explore:

- Liquidity

- Time horizon

- Fees

- Complexity

- Range of returns

At Silvercrest, we think about “hurdle rates” for each area, relative to the risk factors at the base of every strategy. Thus, for private equity, we start with a base rate of return assumption on equities. We then add estimated compensation that should be earned relative to each factor. This is where things get interesting. An endowment, with a low spend rate and a long-term time horizon may assign relatively low hurdle rates to issues that they are well equipped to manage—such as liquidity and complexity. Whereas an individual investor with estate planning needs requiring more liquidity and lacking an investment office to manage complexity may do well to assign a much higher hurdle rate to these factors. Take venture capital, for example. This is a strategy that has had very strong returns and may well continue to do so. However, the distribution of returns over time can be spotty and often occurs over a long time horizon. The life span of a typical venture fund is 10–15 years. For an institution with an indefinite time horizon seeking to maximize returns over the very long term, this might be a great fit. For an individual investor seeking to generate returns for generational transfer or retirement planning, this time horizon may be situationally dependent. In other words, the same investment can have differing degrees of value to investors with varying objectives.

In other words, the same investment can have differing degrees of value to investors with varying objectives.

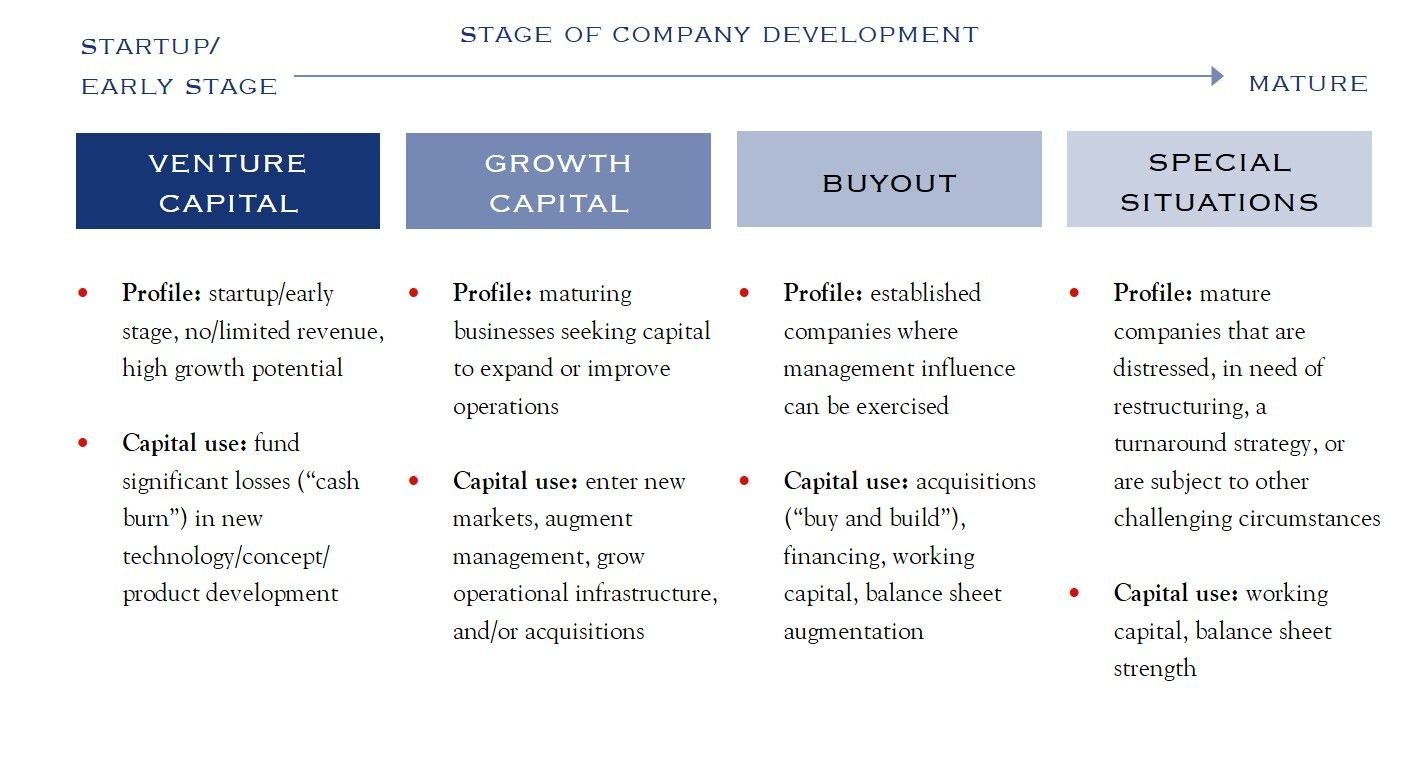

As with other over-simplified terms such as “mutual fund” or “hedge fund”, a private equity fund can mean many things. The next page shows a simple overview of common strategies. In weighing the risk vs. opportunity of each type of private investing, we use a fundamental framework, with a key input being valuation. While historically private investments have had a valuation discount, Pitchbook notes that “the longer-term trend of multiples converging looks to continue”. This is not true in all areas, yet is reason for increased diligence and careful selection. In addition, the wide range of realized results in private funds places an extra burden on the selection process. In other words, the range between the best and worst is quite wide.

It is essential to identify portfolio goals and then work to find investments that are additive to those goals.

Another criticism of private investing is that leverage is involved. In some segments, such as buyout, this is certainly the case. Though in some sense it is no different than leverage on a public company. In other words, it is similar to buying a basket of companies with financial leverage—that leverage cuts both ways and success is dependent on the appropriate deployment of the leverage and the management team in place. While leverage is typical in buyouts, it is not as prevalent in other private investing strategies.

Source: Silvercrest

Despite those concerns, certain unique skills add value and create long-term returns for investors. Things like identifying startups that turn into stars, or the ability to provide financial, managerial and operational expertise to growing companies who need those skills for their business to succeed.

Thus, not quite caveat emptor—rather: buy, but beware.

At Silvercrest, we do believe that certain segments of private investing are capable of producing returns above and beyond these hurdle rates. In our model portfolios, we maintain modest amounts of private exposure, particularly for more aggressive and longer time horizon portfolios. However, given the complexities involved, not to mention the difficult task of finding a talented manager, it is most definitely not a one size fits all approach. Thus, not quite caveat emptor—rather: buy, but beware. It is essential to identify portfolio goals and then work to find investments that are additive to those goals.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC