A key tenet of summer is the languid pace owing to warm weather and days where sunlight lingers.

While summer has a reputation for lazy days, a pause for thought is anything but.

Robert R. Teeter

Managing Director, Chief Investment StrategistEconomic & market overview

In fact, The Economist notes in a book review that “Deep work is the killer app of the knowledge economy: it is only by concentrating intensely that you can master a difficult discipline or solve a demanding problem.” In a fast-paced world stocked with ample data, the motto of IBM founder Thomas Watson—Think—is instructive. In our work with this publication, we aim to slow down, ponder, think and provide insight.

Why do smart people continuously fall for financial frauds?

While seeking compelling risk-adjusted returns is a worthwhile objective, the true foundation of any investment begins with avoiding fraudulent situations. Our team shares insights drawn from the experience of performing this critical work.

What to make of private equity

Private Equity—Portfolio savior or flavor du jour? We review this important investment area and conclude—buy, but beware. In other words, there is opportunity to be had but choices must be made carefully.

Five good reasons to invest internationally

Silvercrest’s international value equity team discusses the benefits and risks inherent in venturing abroad to seek investment opportunity.

It wasn’t that volatile, was it?

Volatility is a word that is prone to being misinterpreted or misused. Within the framework of our risk analytic tools, we take a look at the true meaning(s) of volatility.

The importance of independent directors & good corporate governance for family businesses

Seán O’Dowd applies his vast experience in working with families towards a review of best practices in governance for family owned businesses.

Fed policy and inflation

Inflation, and sometimes the lack thereof, remains at the forefront of investing conversations. Here we examine some particulars around inflation measurement and possible implications.

Manager selection: follow the asset allocation

As we often say at Silvercrest, manager selection is an art and a science. However, step one is goal identification. Our team provides thoughts on how to find the right tool for the job and avoid having a portfolio full of mismatched, useless funds.

Economic & Market Overview

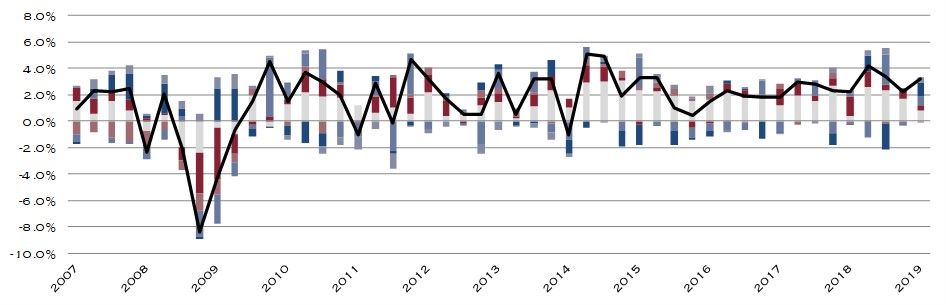

GDP Contributions: Quarterly

Source: BEA, as of March 31, 2019

The U.S. economy grew by +3.1% in the first quarter of 2019, surpassing expectations. Much of the outperformance, however, was due to a continued inventory build-up and a smaller trade deficit driven in part by falling imports. The domestic demand drivers of economic growth slowed to just +1.5%, down from +4.1% in the second quarter of 2018.

Joseph R. Agnello

Head of Due Diligence, OCIO Client Relations

Liliana V. Capatori, CFA, CPA

Senior AnalystWhy Intelligent Individuals Can Still Fall for Financial Frauds: A Comprehensive Analysis

The renowned father of value investing, Benjamin Graham, once said, “The investor’s chief problem—and even his worst enemy—is likely to be himself.” There is a distinction between being intelligent and being rational. Our own experience tells us that we often make important decisions driven by emotion and based on intuition or impulse rather than through methodical in-depth analysis. It is much more exciting to invest in an “exclusive” deal or one that reportedly has made family, friends or people we admire, wealthy. The urge to “get in” takes precedence over prudence and due diligence.

read the insight

Robert R. Teeter

Managing Director, Chief Investment StrategistWhat to Make of Private Equity

Recently the Chief Investment Officer for CALPERS, Ben Meng, was quoted as saying with regard to private equity, “We would like to have as much as we can, as much as our liquidity profile can afford us.”

read the insight

Christopher K. Richey, CFA

Managing Director, Portfolio ManagerFive Compelling Reasons to Include International Investments in Your Portfolio

The expansion of global equity investing over the past four decades is nothing short of remarkable. The 30x growth from $2.5 trillion in global market capitalization to over $75 trillion correlates with the rise in the number of listed companies from 17,273 to 43,036 today.

read the insight

Mark Morris

Senior AdvisorIt Wasn’t That Volatile, Was It?

“Markets were really volatile!” Headlines like this were common in the fourth quarter of 2018, especially in December. They highlight the need to revisit the idea of volatility, to ask what it means to say the markets were volatile, to assess whether they were, and to see how it matters.

read the insight

Seán O'Dowd, CFA

Managing Director, Family Business AdvisoryThe Importance of Independent Directors & Good Corporate Governance for Family Businesses

When many people think of a business having a professional board of directors, they envision a large Fortune 500 corporation. But as many successful owners and leaders of family businesses already know, a business of any size can benefit from a board of directors with independent directors

read the insight

Patrick Chovanec, CPA

Economic AdvisorFed Policy and Inflation

In response to shaky economic data at home and abroad, the Fed has signaled that it does not plan to raise interest rates for the rest of this year. In fact, the shape of the yield curve indicates that the market expects the Fed to cut rates by at least 50 basis points in coming months.

read the insight

Martin Loeser

Head of Manager Research, Portfolio Manager

Elinor Ouyang, CFA, FRM

Head of Portfolio Analytics, Portfolio ManagerManager Selection: Follow the Asset Allocation

Complicated tasks are often described as requiring a mix of artistic and scientific sensibility. That is certainly true for the process of selecting an investment manager for inclusion in a client’s portfolio.

read the insightInvestment Outlook Summary

The Investment Policy & Strategy Group (“IPSG”) met on Tuesday, April 9th, 2019 to review asset allocation.

The near bear market of late 2018 was essentially reversed with abundant alacrity, fully demonstrating the challenge facing any short-term market timing strategies. As a result, prices and fundamentals returned to familiar territory, with valuations somewhat elevated versus history, yet supported by an absence of inflation and low bond yields.

As in prior quarters, there remains a nearly weekly addition to the bricks in the wall of worry. However, two of the most typical negative influences on equities prices, recession and inflation, remain at bay and warning signs do not appear to be flashing red. As a result, the outlook for earnings and dividends growth remains positive, albeit at a reduced rate due to more difficult comparisons. While recent volatility has been of the upside variety, it is prudent to remember that volatility in prices is common and is a measure of both upside and downside travel. Thus, re-balancing continues as a very simple and rewarding exercise.

While recent volatility has been of the upside variety, it is prudent to remember that volatility in prices is common and is a measure of both upside and downside travel.

The guidance of the IPSG remains at a level of equity exposure that sits just above the midpoint range. This suggested equity allocation reflects both opportunity and risk and assumes a reasonable time horizon. We believe that slow and steady progress in fundamentals, such as earnings and dividend payouts, will outweigh negative sentiment over time, so we maintain our modestly positive tilt.

Within fixed income, we have updated our expected returns to be more consistent with current yields available in fixed income instruments, continuing to expect no major moves in rates, but rather earning yield to maturity. We continue to believe that the most important objective of a fixed income allocation is a well-constructed bond portfolio built towards providing capital preservation and liquidity. Our guidance is for conservatism, emphasizing the capital protective elements of a bond portfolio.

Allocations across geography, market cap and investment style were maintained. While non-U.S. equities continue to offer a slightly better valuation profile (yet close to the long-term discount), economic growth in many regions has occurred in a sputtering fashion. Emerging markets offer the potential for higher growth (and risk) as well as opportunity for good stock selection as the number of listed securities is vast and coverage is less dense. Depending on investor objectives and risk tolerances, non-U.S. investments can offer some degree of diversification and potential. We maintain a balance between growth and value within U.S. equities. When adjusting for the differing rate of change of earnings, growth stocks valuations do not appear to be excessive, though they are far from “cheap” vs. history and vs. value stocks. Thus, we maintain a balance of both growth and value styles for the moderate risk profile model. The small cap area presents some potentially interesting valuation. However, at the index level, there remain divergences of quality. Thus, there is opportunity for skilled active management.

Depending on investor objectives and risk tolerances, non-U.S. investments can offer some degree of diversification and potential.

Alternative investments, such as hedge funds and private investments, offer a wide range of strategies and risk profiles. Private investments can selectively offer an opportunity for the more aggressive investor to seek higher returns either through equity-related strategies, such as venture capital or growth equity, or as a higher risk return alternative to traditional fixed income, such as private credit or private real estate offerings. While hedge funds have been maligned, when they are chosen appropriately, they can play an important role in managing overall portfolio risk.

While hedge funds have been maligned, when they are chosen appropriately, they can play an important role in managing overall portfolio risk.

As an important reminder, continued attention to rebalancing can add significant value. Further, the establishment of a reasonable timeframe as an offset to a very noisy investment environment continues to be additive.

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.

Source: Bloomberg, data as of 3/31/2019