Gains in equities this year, with the S&P 500 up around 15%, reflect declines in inflation and improvements in the outlook for the U.S. economy. The recent sell-off in stocks is a recognition that elevated rates and resolute Fed policy remain in force. The yield on the U.S. Ten Year Note remains above 4.0% at 4.18%, up from 3.8% on July 17. Some of this movement reflects concerns over debt levels in the United States. Perhaps more directly and immediately problematic is the outlook for Fed policy. Current expectations show a possibility for one more increase and no chance of a decrease until mid-2024. Those persistently elevated rates—higher for longer—mean that valuations are likely capped in the short term. With further progress on inflation likely to be slow and the economy slowing down, there simply isn’t much fuel for further stock gains in the short term.

The longer-term picture is more encouraging. Wall Street tradition is to focus on the upcoming year after returning from the Labor Day weekend holiday. There is a lot to like about the 2024 outlook.

Economy

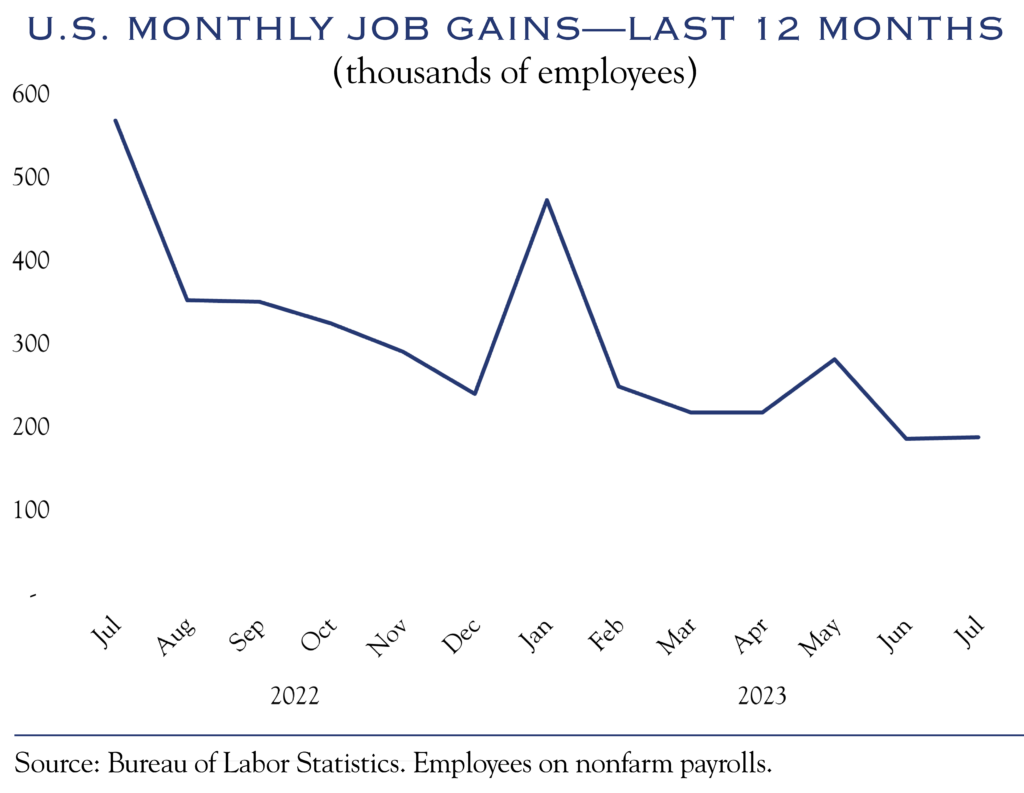

While job gains have slowed down a bit, they remain expansionary. The addition of new jobs creates more income, adding to growth. Recent survey data from the National Federation of Independent Businesses point to an improved outlook for capital expenditure. Funding from prior policy initiatives is also flowing through the economy—the jury is still out on whether this will produce long-lasting gains or merely a short-term blip. Either way, those increased expenditures are additive to economic activity. According to the Bureau of Labor Statistics JOLTS survey, jobs being offered have declined a bit. Companies are adding employees and planning to invest more in their businesses. Though the economy is losing some momentum, we don’t see an imminent recession.

Earnings

Earnings have been better than expected in 2023. In fact, current estimates show a slight gain expected for the full calendar year, an improvement from the losses foreseen at the start of the year. Notably, following all of the information provided by earnings reports for Q2, estimates increased further, though only slightly. We expect the outlook for 2024 to be favorable. A backdrop of slow economic growth will provide some revenue gains. Earnings are likely to be driven more by productivity improvements and cost structure management. The situation remains very company-specific. Throughout the turbulent pandemic economy, those companies that deployed technology to do more with less and that were flexible in adapting to changing preferences will be the same ones that will continue to deliver earnings through improved profit margins.

Inflation

Wage gains, a strong services sector, and ongoing higher energy costs are conspiring to halt the rapid progress of inflation. Working against that stickiness, recent research from the San Francisco Fed illuminates the sizeable effect that reduced shelter costs are likely to play in bringing down inflation. Progress from here onwards will be slow, but mostly in the right direction, trending towards the Fed’s 2.0% target by mid-2024.

Rates

For now, the Fed’s resolute policy stance has market participants expecting the Fed Funds Rate to remain at current levels (or slightly higher) through June 2024. Even then, the expected path to lower rates remains slow. Consider that current expectations (via Bloomberg’s WIRP tool) are for the Fed Funds Rate to not dip below 4.5% until the very end of 2024.

Valuation

The higher-for-longer policy stance of the Fed has put a ceiling on valuations. The S&P 500 is currently trading at 20.1x 2023 earnings and 18.3x 2024 earnings. This year’s move to higher valuations reflects improved inflation, a stable domestic and global political backdrop, and slightly improved sentiment. Further gains will require more clarity on Fed policy, which should help rally bonds, reduce rates, and boost valuation metrics like PE ratios.

Outlook

Our short-term outlook is for a stalemate in the standoff between valuation and Fed Policy. We expect rates to stay a bit above 4.0% until further clarity emerges on the timeline and decision-making factors for the Fed Funds Rate. With that backdrop, it makes sense to follow the earnings. The U.S. economy is still growing and creating pockets of earnings strength. Further, the focus on boosting domestic activity provides a tailwind for some sectors, as well as small caps. Small cap investing can be a harrowing activity, with nearly 40% of the Russell 2000 producing negative earnings and balance sheet concerns always staying on the front burner. However, active management focusing on quality can unearth some

compelling opportunities in the small cap space.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC